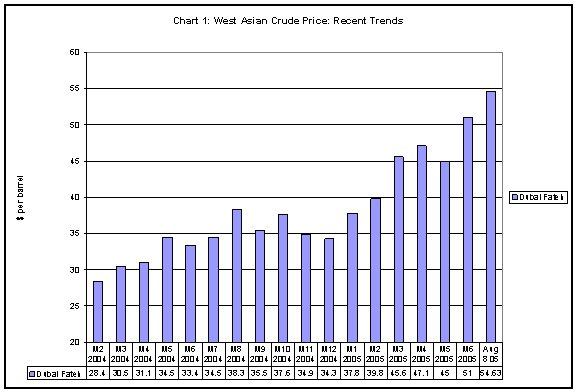

Nothing

seems to hold back world oil prices. Taking one of

many internationally traded varieties of relevance

to developing Asia, the price per barrel of Dubai

Fateh crude averaged $28 in February 2004, around

$35 between May and December 2004, nearly $40 in February

2005, crossed $45 in March and $50 in June and stood

at $55 in mid-August. Other varieties like American

light crude have crossed the $65-per-barrel mark in

international markets in recent weeks.

Chart

1 >> Click

to Enlarge

The fundamental

reason why prices have risen so dramatically is that

demand-especially driven by growth in the US, China

and India-has outstripped the capacity of the industry

to pump out crude and refine it. Global demand is

estimated to have risen by 2.7 million barrels per

day in 2004, the highest since 1976. Nearly a third

of that growth came from China, where oil consumption

soared by around 16 percent in 2004. On the other

hand capacity has not been expanding to meet this

growing demand. As a result, surplus capacity in the

oil producing system is limited. Spare capacity in

2004 is estimated to have fallen to 1 million barrels

per day (b/d), its lowest level in 20 years. Saudi

Arabia, the country which sits on the largest share

of global reserves and which was responsible for increasing

availability when supplies were tight in the past,

is also nearing its limits. Given the nature of the

industry, supply can adjust only with a considerable

lag, since investment requirements are large and involve

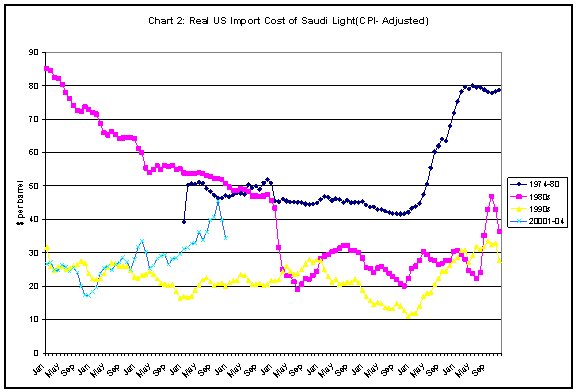

substantial gestation lags. Investment has not kept

pace with demand partly because of the low oil prices

of the 1990s, when the average real price of oil was

half that in the 1980s (Chart 2).

The other reason why supply is inelastic is that much

of the oil that was discovered in non-traditional

locations after the oil shocks, as in the Arctic and

offshore in many countries, has already been exploited.

Thus the world’s dependence on traditional sources

of "easy oil" has increased.

The effects of medium term excess demand on prices

have been aggravated by a number of factors that have

increased uncertainty. The most important is, of course,

the continued occupation of Iraq by the US and its

allies and the strong resistance of the Iraqi people

to that occupation. The inability thus far of the

US army to contain the armed struggle, despite the

use of violence even when it endangers civilians,

has reduced exports and led to expectations of uncertain

future supplies from Iraq. In addition, the war has

precipitated terrorist attacks in the world's largest

oil producer, Saudi Arabia, which have affected oil

supplies, even if temporarily. So long as the threat

of such attacks remains, supplies are uncertain and

prices are buoyant.

The net result has been that any development that

affects or could affect supplies from any other country

triggers a price increase. This could be political

uncertainty in Nigeria, the battle for control of

Yukos in Russia, civil strife and oil industry strikes

in Venezuela or fears of the impact of Hurricane Dennis

on US oil supplies. All of these have in the recent

past substantially affected prices at the margin and

even led to a spike in prices.

The upward pressure on prices that result from these

developments has been further exaggerated by speculative

investments by financial investors in oil markets.

It is known that price trends in energy markets have

substantially increased financial investor interest

during 2004. This has also affected the relative price

of oil. It is widely known that capacity shortfalls

in both extraction and refining are greater in the

case of light sweet crude oil. For example, the little

excess capacity available with Saudi Arabia is in

heavy crude that is harder to refine into the cleaner

fuels demanded by rich countries. This places a premium

on light (low specific gravity) sweet (low sulphur)

grades, whose supplies are relatively inelastic.

Chart

2 >> Click

to Enlarge

With investor interest focused for this reason on

the light sweet grades during 2004 the spread between

light and heavy grades rose during 2004. According

to the Financial Times, in the first 10 months of

2004 West Texas Intermediate (WTI) rose 65 per cent,

but heavier sour oil blends rose by less than half

as much. But as investors have discovered that excess

demand is more generalised this spread has tended

to decline more recently. The discount for Saudi Arabian

oil relative to WTI rose from below $6 a barrel to

almost $20 in October 2004. This year the situation

has reversed. Saudi grades have gained by more than

twice as much as WTI and the spread is back down near

$6.

The base for speculation seems even greater since

the sharp price increases of recent times have not

spurred inflation, curbed growth and forced a cutback

in demand. The dissociation between the level of oil

prices and the rate of global expansion only strengthens

expectations of further price increases.

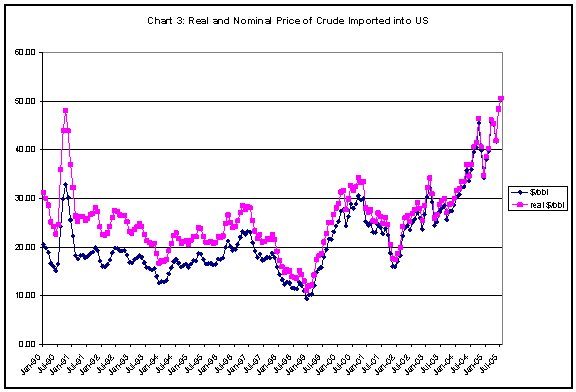

One explanation advanced for this lack of association

between oil prices and growth is the fact that the

real price of oil, which adjusts the nominal price

increase to take account of changes in the prices

of commodities other than oil, is by no means at a

peak. Thus, in terms of 2005 dollars, the 1980 price

of Arabian Light, which was $35.69 in nominal terms,

amounted to $84.29. That is $25 per barrel or 40 percent

higher than today’s price in real terms.

However, the fact that in absolute terms today’s real

price of oil is far short of its historic peak does

not detract from the fact that recent increases in

that price have been dramatic and that the real price

of oil is at a 15-year high (Chart 3). So the persistence

of growth and demand for oil is indeed puzzling. It

suggests that the expectation that rising nominal

oil prices would trigger contraction in government

spending to smother inflation, as happened at the

time of the second oil shock at the end of the 1970s,

has not been realised. One reason for this could be

that the impact of oil price increases on the balance

of payments is immediately debilitating because of

the greater access to foreign exchange of the big

spenders. Many countries have been able to finance

a rising oil import bill without much difficulty.

For example, China keeps sucking in oil despite higher

prices because of the consistently high increase in

its export earnings; India manages because of large

IT-related revenues and capital inflows; some other

developing countries are able to stay afloat because

of remittances from migrant workers; and the US pulls

through because of capital flows that finance its

burgeoning trade deficit and make it the world’s largest

debtor nation.

Chart

3 >> Click

to Enlarge

Thus the fact that the world is awash with liquidity

that can be accessed in the form of foreign revenues,

debt, portfolio investments or foreign direct investment

by countries that are better off has helped ensure

that a sharp contraction of the kind triggered by

the second oil shock has not occurred. The resulting

persistence in strong demand for oil has contributed

to buoyancy in prices because supply too has not been

responsive to price increases.

These features of the global oil scenario have two

implications. First, it is likely that prices are

likely to remain high for some time to come even if

the era of cheap oil is not altogether over. Second,

as and when specific developments threaten to affect

or actually do affect oil supplies from any existing

location, a further spike in oil prices is a real

possibility.

But already there are signs that things may change.

To start with, not all countries are in a position

to cope with the current price of oil. Many poor countries

cannot access foreign credits with the ease that characterizes

the more developed even among the developing. But

that is not all. Even some of the more developed countries

in developing Asia have been badly affected in 2005,

when prices have continued to rise and the discount

on the West Asian varieties they import has fallen

sharply. Asia, which imports 70 per cent of its oil

from the Middle East, has received a larger oil shock

this year than last. Countries are finding it increasingly

difficult to maintain retail fuel subsidies. Thailand

abandoned subsidies in August, while other governments,

such as India’s, have raised prices despite opposition.

In the event growth and oil demand are likely to fall.

Thus the hike in oil prices is bound to have an adverse

effect on the global system soon. What is not certain

is the nature and location of that adverse effect.

Fears of a global recession arise because the already

high US trade deficit is widening sharply. Clearly,

if prices rise further, global growth could indeed

stall. Even the otherwise optimistic IMF believes

it would. To quote the World Economic Outlook

released in April: ''In the past, a permanent $5 a

barrel increase in oil prices has been expected to

lower global GDP growth by up to 0.3 percentage point;

in practice, the impact over the last year has been

less than feared, partly because higher prices have

in part been a consequence of strong global growth,

and partly reflecting the greater credibility of monetary

policies (so that interest rates have not had to be

raised to ward off second-round inflationary effects).

The impact of further sharp increases, however, could

be more marked, especially if they were to adversely

affect confidence or inflationary expectations; there

would also be a greater danger of negative supply-side

effects over the longer run.''

However, that projection hinges on the perceived trade-off

between growth and inflation, and is predicated on

the assumption that oil price increases will lead

to more general inflation. Governments attempting

to combat inflation will then embark upon contractionary

fiscal and monetary policies, which will bring down

inflation but also imply lower rates of aggregate

economic growth.

It is correct to assume that governments across the

world remain obsessed with inflation control, because

the political economy configurations that have led

to the domination of finance still persist. However,

the prior assumption, that oil price hikes necessarily

lead to higher inflation, may not be so valid any

more.

Certainly it is true that for a very long period-in

fact almost the whole of the second half of the 20th

century- oil prices showed a strong relationship to

aggregate inflation rates in the world economy. Between

1970 and 2000, for example, world trade prices and

oil prices were strongly positively correlated and

in the largest economy, the US, the Consumer Price

Index inflation tracked movements in world oil prices.

But, there is evidence that this relationship may

have changed. Though oil prices have been exceptionally

volatile recently, such fluctuations appear to have

had little impact on aggregate inflation rates in

either developed or developing countries. Rather,

such inflation rates have been relatively stable and

even fallen slightly compared to the earlier decade.

So what has changed in the world economy to cause

such an apparently established relationship to break

down? The first important factor is the reduced dependence

of the industrial economies upon oil imports, at least

in quantitative terms. For the group of industrial

countries in the OECD, net oil imports accounted for

2.4 per cent of GDP in 1978, but have since fallen

continuously, to amount to only one per cent of GDP.

But the second factor may be even more significant.

This is a distributional shift, whereby the burden

of adjustment to higher oil prices is essentially

borne by workers across the world and non-oil primary

commodity producers in the developing countries. These

prices do not rise in tandem with oil prices and in

some cases have declined. This means that even though

energy is a universal intermediate good, its price

rise does not cause prices of many other commodities

to increase anywhere near proportionately. This in

turn enables aggregate inflation levels to remain

low even though oil prices may be increasing.

It is well-known that the period since the early 1990s

has been once of a substantial decline in the bargaining

power of workers vis-à-vis capital in most

of the world, and this has been reflected in declining

wage shares of national income and real wages that

are either stagnant or growing well below productivity

increases. This provides a significant amount of slack

in terms of the ability of employers to bear other

input cost increases. In addition, this disempowerment

of workers also means that such input cost increases

can be passed on without attracting demands for commensurate

increases in money wages in the current period.

Along with workers, agriculturalists and other non-oil

primary commodity producers have also been adversely

affected and been forced to take on some of the burden

of adjustment. Indeed, even manufacturing producers

from developing countries have been adversely affected

in a situation where intense competitive pressure

has ensured that they cannot pass on all their input

cost increases.

Thus, even if growth persists despite rising oil prices,

the distribution of the benefits of that growth is

likely to be extremely unequal. But even growth is

likely to be unequally distributed. In the case of

the poorer, oil importing developing countries, the

effects of higher oil prices are already adverse and

can get worse. These countries have much smaller volumes

of remittance incomes from abroad and cannot access

large capital inflows. Thus the have to adjust to

rising oil prices by squeezing demand through contractionary

policies that reduce domestic incomes and increase

unemployment. This is the only way they can deal with

their balance of payments difficulties.

So long as these sections are forced to bear a disproportionate

share of the burden, the current oil shock may not

seem a big problem. But if for some reason they cannot

be called upon to do so, a global recession may be

inevitable.