The

predicament in Europe has thus far diverted attention

from another crisis that has been brewing for some

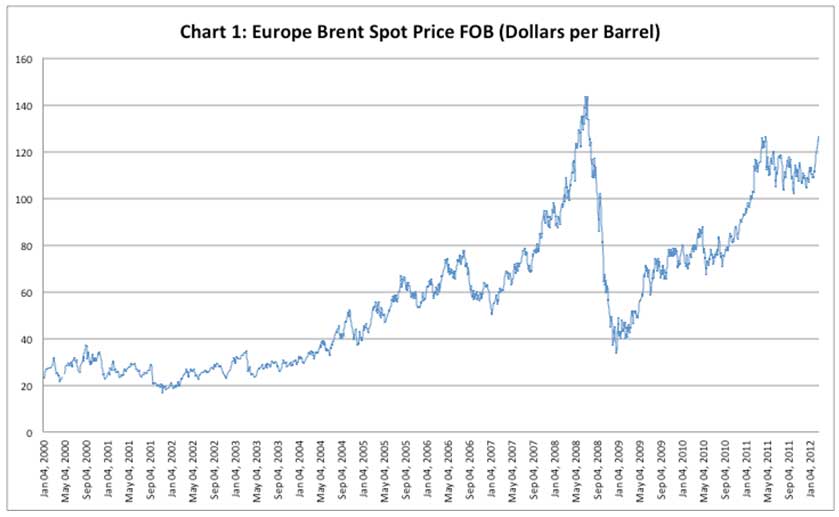

time now: a spike in global oil prices. The price

of oil has risen by close to 20 per cent since the

beginning of this year, raising the prospect of it

touching the peak levels it had reached in July 2008.

Brent Crude was selling at $128 a barrel at the beginning

of March, as compared with its less-than-$110-a-barrel

price at the end of December (Chart 1). This spike

occurred on top of the continuous increase in prices

recorded since December 2008, when oil prices touched

a low influenced by the global crisis. Prior to that

the free-on-board (FOB) price of Brent crude had collapsed

from more than $140 per barrel in July 2008 to less

than $35 a barrel by the end of that year. But though

the recession has persisted even after that, the price

trend has reversed itself to reach its current high

levels even by historical standards. In fact, if Europe

was not experiencing the stagnation it is struggling

to address, oil prices could possibly have been at

another record high.

Chart

1 >>

(Click to Enlarge)

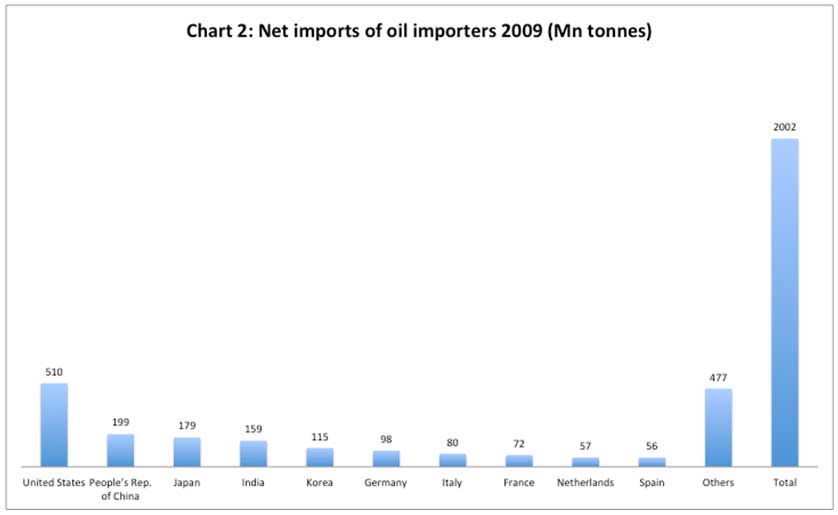

From a purely demand-supply point of view, the rise

is indeed surprising. The US, the world's largest

importer (Chart 2), has seen its import levels drop

significantly. One reason is that the combination

of a recession and higher oil prices has restrained

oil demand. According to official sources, the demand

for oil in the US was down by 2 per cent last year.

In addition domestic supply has improved, partly because

of increased domestic production and partly because

of the availability of alternative fuels such as ethanol.

As a result the share of imports in US oil consumption

was down to 45 per cent from 60 per cent in 2005.

Aggregate US imports of crude oil are placed at 8.91

million barrels a day in 2011, which was the lowest

it has reached after 1999. All this should have worked

to moderate international oil prices.

It could be argued that the fallout of these trends

in the US has been partially countered by the increase

in Asian demand. China and India are the second and

fourth largest net importers of oil. But in their

case too growth, though higher than in Europe, the

US and Japan, has slowed after the crisis. So demand

from those sources too would have been lower than

would have otherwise been the case.

Chart

2 >>

(Click to Enlarge)

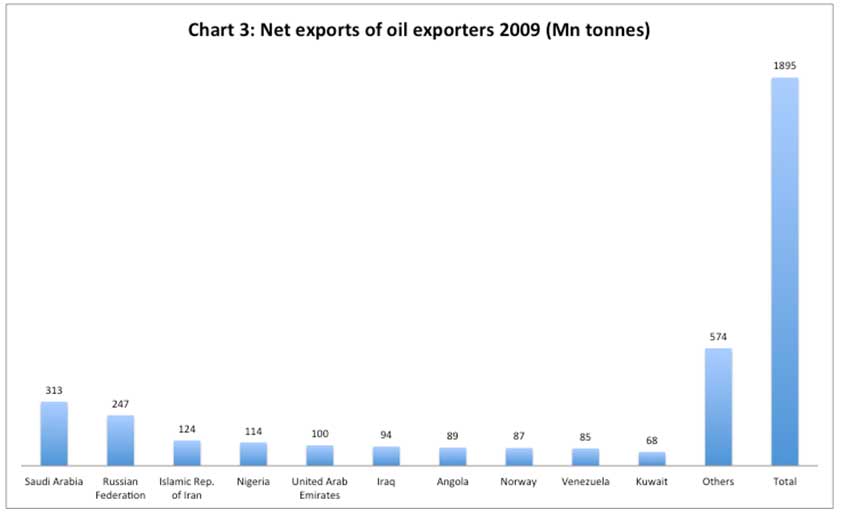

If prices have risen sharply despite these trends,

it is principally because of the uncertainty resulting

from political developments in the region. Ever since

the outbreak of diverse oppositional movements in

West Asia and North Africa, uncertainty with regard

to supplies has been on the rise. The political disruption

in Libya in particular was seen as having had an adverse

effect on supplies. But the factor that seems to have

provided a fillip to the price rise was the standoff

between Iran and the West, ostensibly over the former's

nuclear programme. Iran, which is third largest net

exporter of oil (Chart 3), is already subject to US

sanctions that are targeted at limiting its oil exports.

In fact, in recent times, the US has intensified its

efforts to discourage global consumption of Iranian

oil. To add, Europe announced that it would also impose

an embargo on oil imports from Iran starting from

July this year, and Iran responded by threatening

to immediately cut supplies to six European countries.

The price spike, however, was not because of any immediate

shift in the supply-demand balance and shortfall in

oil availability resulting from these factors. To

start with, the announced European embargo and Iran's

response to it have yet to be implemented. Secondly,

the US has not been able to persuade all countries

to stop oil imports from Iran, which would have effectively

cut off its supplies to world markets. A typical case

here is India. India imports around 300,000 barrels

of oil a day from Iran, which amounts to a significant

share of its oil consumption. Yet India seemed to

be succumbing to pressure from the US, first with

respect to a transnational pipeline project involving

Iran and subsequently with regard to foreign currency

payments arrangements for Iranian oil. But finally,

India has worked out a rupee payment deal, which secures

its supplies from Iran as well as opens up opportunities

for trade reminiscent of India's relationship with

the erstwhile Soviet Union. Besides India's action,

Iran's supplies to the world market are likely to

remain untouched because of the importance of Asia

in its total exports. China, India, Japan and South

Korea account for more than 60 per cent of world imports

of Iranian oil. So long as these countries protect

their own energy security by not cutting off their

relationship with Iran, a chunk of supplies involved

in the global trade in oil would not get cutoff.

Chart

3 >>

(Click to Enlarge)

Finally, as in the past Saudi Arabia has helped cool

oil markets with its spare capacity and its willingness

to ramp up production to cover any unmet demand. Saudi

Arabia had made an important contribution to reining

in oil prices during the Venezuelan oil strike in

2003, the invasion of Iraq in 2003 and the Libyan

crisis last year, and promises to continue to do so.

If despite all these factors that keep the supply-demand

balance in control, prices have risen, it is because

of the speculation engaged in by global finance by

exploiting the prevailing political uncertainty. It

is known that energy markets have attracted substantial

financial investor interest since 2004, especially

after the decline in stock markets and in the value

of the dollar. Investors in search of new investment

targets have moved into speculative investments in

commodities in general and oil in particular. Hedge

funds and other investors have been buying into the

commodity, fuelling the price increase even further.

The problem is that this consequence of speculation

is not just a short-term price spike. If speculation

feeds on political uncertainty, then we could be looking

at a long-term problem in oil markets. As noted earlier

(Chart 1), looking back it emerges that nominal oil

prices were rising gradually from 2003 till the middle

of 2006 and sharply from early 2007 till the middle

of 2008, after which we have witnessed the dip and

revival since 2008. That is, the last decade, when

political turmoil intensified in the West Asian region,

has been a period of an almost continuous increase

in oil prices, irrespective of the state of global

demand.

Chart

4 >>

(Click to Enlarge)

This is by no means a normal inflationary trend, since

even the real, consumer price inflation-adjusted price

of oil has been at high levels in recent years. Consider,

for example, the price of oil imported into the US,

measured in inflation-adjusted terms or in ''2012

dollars'' (Chart 4). The chart shows that the real

price of oil has been on the rise since 1999 and especially

since September 2001, when the US responded aggressively

to the twin towers attack. What is more, the peak

2008 price in 2012 dollars was above the high prices

recorded in the 1970s, which was when the world experienced

the effects of the formation of OPEC, the Iranian

revolution and the Iran-Iraq war. In sum, ever since

''9/11'', oil prices have not just been on the rise

but seem to have found a higher average level when

compared with trends since the formation of the OPEC

cartel.

It has been known for sometime that this long-term

trend was not really the result of fundamental demand-supply

imbalances but driven by financial speculators exploiting

political uncertainty. In April 29, 2006 the New York

Times had reported that: ''In the latest round of

furious buying, hedge funds and other investors have

helped propel crude oil prices from around $50 a barrel

at the end of 2005 to a record of $75.17 on the New

York Mercantile Exchange.'' According to that report,

oil contracts held mostly by hedge funds had risen

to twice the amount held five years ago. To this had

to be added trades outside official exchanges, such

as over-the-counter trades conducted by oil companies,

commercial oil brokers or funds held by investment

banks. And price increases had also attracted new

investors such as pension funds and mutual funds seeking

to diversify their holdings. In fact, in November

2007, when Royal Dutch Shell, Europe's biggest oil

company, presented its third quarter results, Chief

Financial Officer Peter Voser argued that: "The

price (of oil) seems to be driven by some speculation

and also has a political premium in it rather than

actually some of the fundamental drivers." These

trends have only intensified since.

Not surprisingly, in 2008 the Organisation of the

Petroleum Exporting Countries (OPEC), which is normally

held responsible for all oil price increases had asserted

that oil has crossed the $100-a-barrel mark, not because

of a shortage of supply but because of financial speculation.

OPEC's contribution was indirect and unintended if

at all. As A.F. Alhajji, Energy Economist and Associate

Professor at Ohio Northern University had argued in

the Financial Times, even when some OPEC countries

are to blame it is because: ''As oil prices have increased,

so have their (OPEC countries') revenues. Some of

these revenues found their way into funds that speculate

in oil futures.'' In his view, it was in this way,

ironically, that ''petrodollars'' have helped drive

oil prices to record levels.

In sum, a combination of political uncertainty, partly

generated and sustained by US and European foreign

policy, and the operations of global finance, has

taken the world into a higher oil price regime. Such

uncertainty and the accompanying speculation hold

out the threat of an age of ''high oil''. We seem

to have forgotten that. But recent developments are

once again bringing that truth to the forefront.

*This

article was originally published in the Business Line

on 5 March 2012.