The

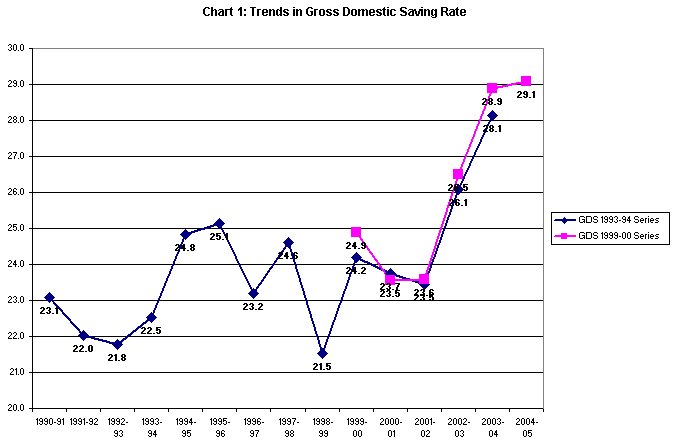

domestic savings rate or the ratio of gross savings

to GDP is estimated by the CSO to have touched a record

level of 29.1 per cent in 2004-05. This implies an

increase of 5.5 percentage points since 2001-02, before

which the rate had remained stagnant and even declined

since the mid-1990s. The recent revision of the weighting

system and revision of the base year from 1993-94

to 1999-00 has made a difference to the savings rate

estimates for individual years for which estimates

for both series are available. But the trend remains

broadly the same. The initial rise in the savings

rate was captured by the old series. And provisional

estimates for 2004-05 from the new series suggest

that the trend has continued. Overall, the rise in

the savings rate has coincided with an increase in

the rate of growth of GDP over the last three years,

suggesting that the economy is transiting to a sustainable,

higher growth trajectory.

The question naturally arises as to the factors that

are responsible for the rise in savings. In particular,

given the necessarily complex way in which savings

and investment are estimated in an economy like India

with a large household sector, including unincorporated

enterprises, the question arises as to whether the

sudden increase is more statistical than actual. In

fact, since the current savings surge coincides with

a massive increase in the inflow of portfolio FII

investment in India’s stock and debt markets, it had

been argued (see S.L. Shetty in Economic and Political

Weekly, February 12, 2005, for example) that some

of this capital may have been lodged with the banks

and got erroneously recorded as constituting household

savings invested in financial assets.

Chart

1 >> Click

to Enlarge

A priori this is indeed a possibility. Savings are

estimated by dividing the universe of savers into

the public sector, the private corporate sector and

the household sector (including unincorporated enterprises).

Public sector saving is computed from budgetary data,

and captures the excess of government expenditure

at the central and state levels over revenue; and

private corporate sector savings in the form of retained

earnings are obtained from company balance sheet data.

Household savings are estimated in two parts. First,

household financial savings, estimated using data

on the assets and liabilities of the financial sector,

adjusted for its outstanding positions with the public

and private corporate sector. Second, household savings

in physical assets which is the excess of aggregate

capital formation estimated by the product flow method

(or the availability of items like machinery, equipment

and construction material that enter into capital

formation) over the estimated capital formation in

the public and private corporate sectors based on

budgetary data and company balance sheets.

It should be clear from the above that household saving

is derived as a residual category in the case of both

household financial saving and household savings in

physical assets (or household capital formation).

It should be clear that if funds transferred by FIIs

for investment purposes are parked in bank deposits

or other financial instruments before being invested

in corporate equity and bonds, there is a possibility

that they could be attributed to the household sector.

Similarly if aggregate capital formation derived through

the product flow method is overestimated, then assuming

that estimates of capital formation in the public

and private sectors are correct, there would be an

overestimation of ''physical savings'' in the household

sector.

Chart

2 >> Click

to Enlarge

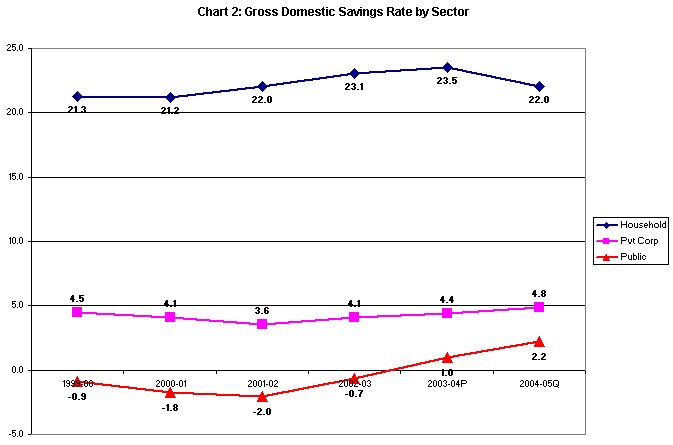

These issues are of relevance because the gross savings

rate in the household sector had indeed risen between

2000-01 and 2003-04 (provisional) (Chart 2). However,

there are two features of movements in the sectoral

savings rate that need to be noted. First, while the

increase in the economy-wide gross savings rate between

these two years amounted to 5.4 percentage points,

that in the case of the household sector totaled 2.3

percentage points. That is, movements in household

sector savings account for much less than half of

the increase in the aggregate savings rate between

these two years. Second, if we consider the quick

estimates for 2004-05, we find that the savings rate

in the household sector fell by 1.5 percentage points,

whereas the aggregate savings rate rose by a further

0.2 of a percentage point. Overall, between 2001-02

and 2004-05 while the aggregate savings rate rose

by 5.5 percentage points the household savings rate

was stagnant.

Chart

3 >> Click

to Enlarge

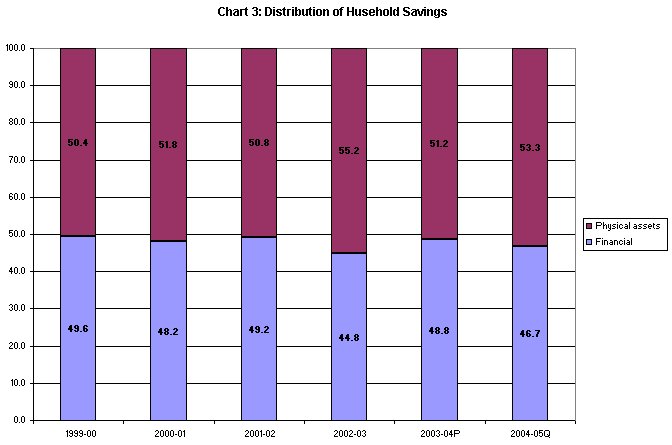

Another point to note is that the composition of the

household savings rate (Chart 3) has not changed significantly

in favour of financial instruments. In fact the share

of financial savings has been more or less stagnant,

falling in individual years like 2002-03 and 2004-05.

This weakens the argument that the rise of in the

aggregate savings rate could have been the result

of a mis-categorisation of float FII funds as household

savings.

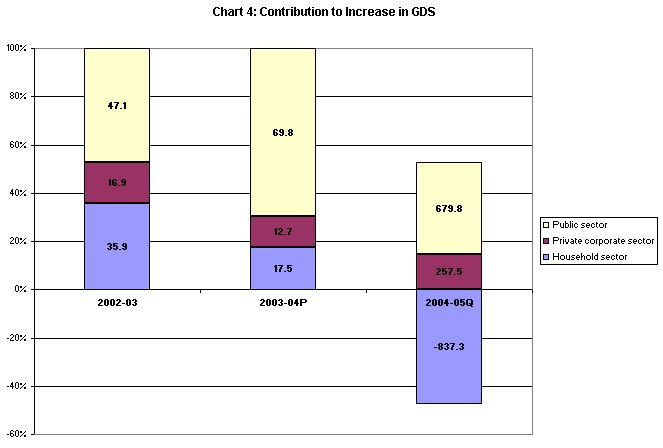

In fact, a close examination of sectoral savings trends

(Chart 2) suggests that the sector responsible for

the rise in the savings rate is the public sector,

which has seen a sharp transformation of its dissaving

into saving in the years since 2001-02 and 2004-05.

During this period, the public sector saving rate

rose from a negative 2.0 per cent to a positive 2.2

per cent, contributing a remarkable 4.2 percentage

points increase to the savings rate. Together with

a small contribution from the private corporate sector,

this been primarily responsible for the statistically

recorded savings surge. This comes through from Chart

4 which shows the major role played by reduced public

sector dissaving or increased public saving to the

increase in the aggregate savings rate between 2002-03

and 2004-05.

Chart

4 >> Click

to Enlarge

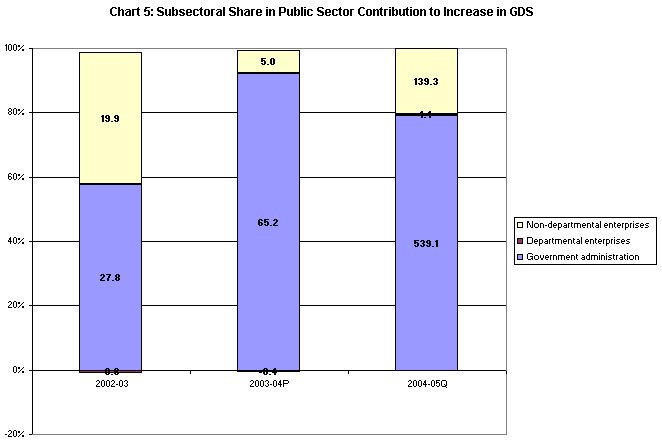

The public sector itself consists of three sub-sectors:

government administration, departmental enterprises

and non-departmental enterprises. An interesting question

to ask is which of these contributed to reduced dissaving

or the increase in saving. There is a common perception

that some of the non-departmental public enterprises,

in the wake of liberalization of public sector pricing

practices, have been able to accumulate large surpluses

that are accumulated in the form of reserves. While

this is indeed true, it does not seem to be the case

that this substantially explains the improvement in

public saving. Rather, as Chart 5 shows, while the

savings of non-departmental enterprises have contributed

to improved savings, especially in 2004-05, it is

the reduced dissaving in government administration

that substantially accounts for the estimated improvement

in the savings rate. This sub-sector accounted for

approximately 60, 90 and 80 per cent respectively

of the contribution of the public sector to increases

in the savings rate in 2002-03, 2003-04 and 2004-05.

Chart

5 >> Click

to Enlarge

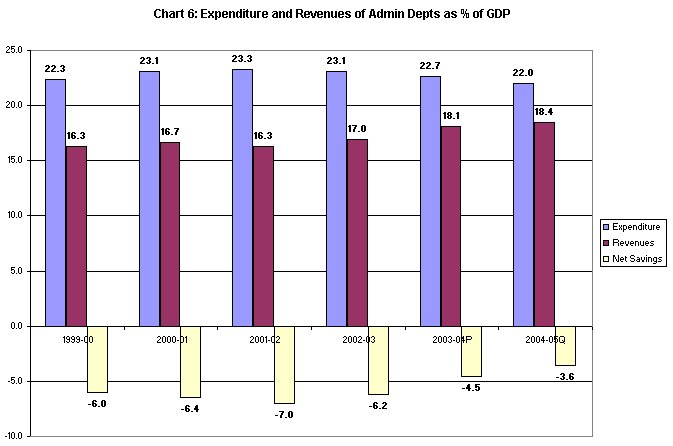

The final question to ask then relates to the factors

that contributed to the improvement in public savings.

As Chart 6 shows both stagnation and decline in government

expenditures and a significant improvement in government

revenues seem to have delivered the reduction in net

dissaving of the administrative departments of government.

Chart

6 >> Click

to Enlarge

This is indeed a puzzle inasmuch as the liberalization

years have seen a sharp reduction in customs tariffs

and that while the deficit at the central level has

come down relative to GDP, no sharp reduction has been

recorded. There could thus be three factors that could

have played a role here. First, a growing curtailment

of public employment, which is by no means positive

given the massive deficit in public services, especially

in rural areas.. Second, improved customs duty collections

despite reduced tariffs, because of an increase in the

quantum of imports and the sharp increases in oil prices.

Third, the contribution of special dividends from to-be-privatised

entities and receipts from disinvestment and privatization

to government ''revenues''.

However, as we noted, the

adjustment in the deficit of government administration

must have in significant measure occurred at the state

level. And states could not have benefited much from

customs tariffs and privatization. In all likelihood

then, the cutback in the size of government administration

must have occurred in large measure at the state level,

which cannot but have adverse implications for development

and the provision of public services.

Needless to say, all this is predicated on the numbers

being reliable. Two features of the savings and investment

estimates released in recent times give cause for concern

on this front. First, the rather sharp revisions made

to the estimates as we move from the quick to the provisional,

revised and final estimates. Second, the huge statistical

discrepancy between savings and investment recorded

in the ''errors and omissions'' category. To the extent

that the capital formation estimate falls short of the

sum total of public, private corporate, household and

foreign savings, the discrepancy is recorded under ''errors

and omissions''. This practice has been controversial

for some time and was to be given up and substituted

with an honest admission of a ''statistical discrepancy''

between savings and investment estimates. But neither

has this been done nor has the discrepancy come down

significantly. In the circumstance we may be debating

an issue which itself is only a statistical mirage.