When

Dubai World decided to suspend payments on its $26

billion debt, among the loans involved was a $4.05

billion repayment on a $3.52 billion sukuk or Islamic

bond issue. This presence of an instrument that has

gained some prominence in recent times has questioned

the credibility of the rapidly expanding field of

Islamic commercial and investment banking. The distinguishing

feature of this sector of finance is the generation

of assets which are structured to be Islamic law or

sharia-compliant. The sharia bans usury or the charging

of interest (riba) on money lent to others. The issue

then is to find alternative routes to ensuring a margin

between the cost of funds and the return they earn

to cover intermediation costs and make a profit.

One obvious way in which this can be done is for the

provider of funds to acquire an asset required by

a potential borrower and then to ''lease'' the asset

to her. Through periodic lease payments, the lessee

compensates the lessor for an amount equal to the

capital outlayed and an interest-margin equivalent.

At the end of the required period the asset is transferred

to the lessee. Another possibility is the sale of

an asset on a deferred payment basis by the lender

who then buys it back immediately for a discount.

That is, the client buys an asset from a financial

institution at a marked-up price that is to be paid

at a later date, and then sells the asset to the bank

at a lower price to raise finance. The transfer of

ownership of an asset in both transactions ostensibly

serves to establish that the arrangement does not

amount to lending money to earn interest.

Islamic bonds or sukuks are also structured along

these lines. As opposed to a normal bond which is

a promise to repay a loan, the sukuk confers partial

ownership in an asset or business. This kind of transaction

normally involves a real asset that backs the provision

of funds, and is therefore considered safer, even

if not completely safe. In fact, when the crisis of

2008 broke and the world was experiencing a credit

crunch, the small Islamic finance segment was seen

as having weathered the storm because of its very

different practices. That judgment, however, has been

questioned in the wake of the Dubai World payments

suspension.

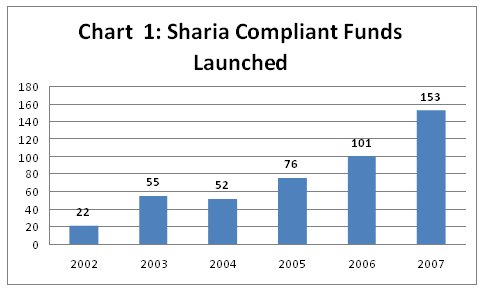

Chart

1 >> Click

to Enlarge

Methods

such as these to earn a return on money without formally

charging ''interest'' amount to circumventing the

sharia rather than adhering to it. This is easier

because of variations of interpretations of the law

between a more liberal Islamic country like Malaysia

and a more orthodox one like Saudi Arabia—a difference

that is not neutralised by the existence of industry

bodies like the Islamic Financial Services Board that

is expected to evolve and set standards for these

products. However, the process of identifying certain

products as sharia-compliant is rendered credible

by having a select group of scholars with the necessary

knowledge of Islamic law to vet the instruments created

as part of the burgeoning field of Islamic finance.

Assets cleared by this elite group can then be bought

by investors wanting to make sharia-compliant investments.

Islamic finance has a long history, but burgeoned

in the 1970s when the oil shocks increased surpluses

held by governments and corporations in the West Asian

region with religiously inclined states and investors.

Moreover, realizing that investors from this region

would prefer to invest in such religiously rated bonds,

the world's financial firms decided to enter this

field. And in periods when credit in normal markets

was stretched, even otherwise staid borrowers chose

to enter Islamic financial markets to raise funds.

In the process Islamic finance got integrated with

modern finance. According to The Banker's 2009 survey

of the top 500 Islamic financial institutions, ''The

volume of sharia-compliant assets of the Top 500 grew

by an extremely healthy 28.6%, rising to $822bn from

$639bn in 2008. At a time when asset growth in the

Top 1000 World Banks slumped to 6.8% from 21.6% the

previous year, Islamic institutions were able to maintain

the 28% annual compound growth achieved in the past

three years.'' Underlying this growth was a certain

distribution of the world's surpluses and an assessment

of the relative safety of instruments generated by

Islamic finance.

It is true that this sector is still a small segment

of current finance and is still substantially confined

to dominantly Muslim countries. Iran, Saudi Arabia

and Malaysia are the three leading countries in terms

of sharia-compliant banking assets and Bahrain, Kuwait

and Malaysia are the leaders in terms of Islamic finance

institutions. But the rapid growth in this sector

has seen the entry of unusual players both in terms

of financial engagement and in terms of borrowing.

Most banks and non-bank financial institutions have

Islamic banking divisions. These players from the

world of conventional finance come armed with the

ability to generate unusual (and risky) derivative

assets, which they then apply to generating sharia-compliant

instruments. In the event, even though West Asia remains

the centre of Islamic banking, investors and borrowers

from that region are increasingly turning to the City

of London to exploit its ability to develop opaque

products. Even the US is now host to a large number

of institutions involved in activities linked to Islamic

finance.

Once the metropolitan centres of finance also establish

themselves as centres of Islamic finance, borrowers

from the rest of the world who would normally abjure

these kinds of instruments and transactions choose

to both invest and borrow in these markets. The attraction

is strong for those seeking to tap the surplus funds

of oil-rich Muslim nations. But the opportunities

are not restricted to West Asia, since well-to-do

Muslims with investible surpluses are geographically

widely distributed. General Electric was the first

western conglomerate to exploit this opportunity by

issuing Islamic bonds. It has been followed by Tesco

of the UK and Toyota of Japan among others. Governments

too—such as those of Thailand and South Korea—have

expressed interest in mobilising money using such

instruments.

It was this asymmetry wherein conventional finance

cannot service the demand for sharia-compliant investments,

but conventional borrowers can issue sharia-compliant

bonds and conventional investors can choose to park

their money in such instruments that led to the belief

that Islamic finance had a great future. Moreover,

in terms of stock, Islamic finance accounts for less

than 1 per cent of all extant financial instruments.

Finally, the rapidly growing emerging markets are

the regions where a majority of the world's Muslim

population lives. Their demand for assets to invest

in is likely to increase if emerging market growth

returns to pre-crisis levels. The potential for growth

therefore seems immense. And recent rates of increase

in the volume of such instruments validate these expectations.

However, here were adequate grounds to be sceptical.

One factor that constrains the growth of this sector

is higher cost resulting from the multiple transactions

that typically have to be executed to make an arrangement

sharia-compliant. Instruments constituted on that

basis involve higher transaction costs and higher

interest rates, making them uncompetitive. Moreover,

if transactions have to be linked to assets to keep

them within the bounds of Islamic law, the proliferation

characteristic of derivative financial instruments

that feed on themselves is not possible. In addition

to this, there is the problem that sharia-compliant

investors are expected to avoid patronising institutions

that have borrowed too much, as is the case with most

highly leveraged modern financial firms. However,

the sheer need for an adequate volume of assets to

meet the investment needs of those wishing to be sharia-compliant

may have encouraged dilution of character to permit

expansion of the volume of these assets.

Such dilution may be facilitated by the shift of Islamic

banking at the margin away from more orthodox Muslim

countries to more liberal ones. According to a Standard

& Poor's estimate quoted by the Financial Times,

about 45 per cent of all Islamic bond issues between

January and July of 2009 took place in Kuala Lumpur,

way above Saudi Arabia's 22 per cent. They helped

raise $9.3bn and put Malaysia on top of the global

league table for issuance.

The ''capture'' of Islamic banking by the now-discredited

world of modern finance with its abstruse products,

speculative practices and unwarranted bonuses has

meant that Islamic finance merely mimics conventional

finance. Products existing in not-so-ordinary financial

markets are dressed up to be sharia-compliant. The

industry has in the process courted controversy. One

example quoted by the Financial Times (December 7,

2009) was a statement by Sheikh Taqi Usmani, a respected

member of the group of scholars accepted as certifiers

of sharia-compliant instruments that ''many Islamic

bonds went too far in mimicking conventional, interest-paying

bonds, which are banned by Islam.'' So influential

was this remark that it triggered a downturn in the

Islamic debt market, possibly because of fears about

redemption of investments that get identified as non-Islamic.

But it is not just the degree of adherence to Islamic

tenets that is a problem with these assets. An additional

problem is that with the industry mimicking conventional

finance it has imported all of the problems typical

of modern finance. This tendency has been aggravated

by the requirement that Islamic banking transaction

must be based on assets. Players with oil to sell

are unlikely to borrow on the basis of that commodity.

But accumulated capital assets are limited in many

countries where Islamic banking is popular. Thus often

the assets that commonly underlie Islamic financial

instruments are real estate and equity, which can

display volatile movements in value. This increases

the probability of default because of speculative

decisions. Dubai World would by no means be the first

instance of default, if that occurs. Others like US-based

East Cameron Partners, the Kuwaiti company Investment

Dar, and the Saudi Arabian Saad Group have defaulted

in the past, on debts which include those raised through

issues of sukuks. In fact, three among the largest

issues of Islamic bonds in countries belonging to

the Gulf Cooperation Council are in various stages

of default.

This implies that the presumption that these Islamic

bonds are safer because they have to be backed by

assets is not really true. One problem is that even

when assets are involved, they may have been just

accommodated to meet sharia requirements, in ways

that leave investors little recourse to the assets.

Another can be that the assets involved may prove

worthless when sought to be liquidated. This is what

seems to be happening in the case of Dubai World,

and its developer arm Nakheel, where the assets concerned

are reclaimed shorelines or strips of desert which

were to be transformed into some version of Paradise

on Earth to satisfy the whims of the wealthy. When

the crisis shrank the surpluses of the wealthy, there

were no takers for the part constructed real estate

assets, rendering them almost worthless. The resulting

losses forced Dubai World to declare that it was not

in a position to redeem its promises to pay. That

not only hurt investors. It also questioned the credibility

of the recent and rapidly growing versions of what

has been presented as Islamic finance.