|

In

the post WTO era, ever since agriculture was opened

up to free global trade, world prices of cotton have

witnessed a sharp and steady decline. Despite the

avowal to cut protection in agriculture, the post WTO era has not seen any reduction in protection that

is being given to farmers in rich developed countries

like the US and the European Union. The subsidies

given by the US to its cotton farmers have largely

been accepted to be the reason for the spectacular

decline in cotton prices at a global level.

The reason for this is that since the government provides

a large range of domestic support, US cotton farmers

increase their production unlimitedly and in much

excess of domestic demand. This excess is then dumped

in the international market, which makes the world

cotton supply much larger than demand and brings down

cotton prices. This is possible since the US has various

export promotion programmes like credit promotion

and other direct payments for making US cotton globally

competitive, which, though disguised as non-subsidies,

actually help to dump this surplus in the international

market. Some of it is given as compensation to US

farmers if their actual price is higher than the world

price (See step 2 payments in

the box below). This obviously encourages the

US producer to dump a huge supply on the international

market. Not surprisingly, world prices have declined

steadily since 1995 and reached a 29 year low in 2001.

While Cotton prices have declined by more than 60

percent since 1995, U.S. subsidies to its 25,000 cotton

farmers reached 3.9 billion dollars in 2001-02, double

the level of subsidies in 1992. Interestingly, the

value of subsidies provided by American taxpayers

to the cotton barons of Texas and elsewhere in 2001

exceeded the market value of output of cotton by around

30 per cent. In addition, this subsidy is provided

to only the richest 10% of US farmers who get 73%

of the total cotton subsidies. The rest of the cotton

farmers in America hardly benefit from these subsidies.

This actually shows that US subsidies, though largely

domestic, is actually for the benefit of the export

market.

|

Cotton

Competitiveness: Provisions

in US Law

These

are "provisions added

by the Food, Agriculture,

Conservation, and Trade

Act of 1990 to the cotton

program designed to keep

U.S. cotton price competitive

in domestic and export markets.

Sometimes referred to as

the "three-step competitiveness"

provisions. Step 1 is the

discretionary authority

for USDA

to reduce the adjusted

world price (used

in the cotton marketing

assistance loan program)

when world prices are declining

to near the adjusted world

price, but U.S. prices are

higher than world prices.

Though rarely used, the

Step 1 adjustment is intended

to make marketing loans

more effective in keeping

U.S. cotton globally competitive.

Step

2 payments,

sometimes referred to as

the "user marketing

certificate program,"

are made to U.S. cotton

users and exporters when

U.S. prices are higher than

world prices. Step 2 payments

are intended to bridge price

gap and keep U.S. cotton

competitive. Step 3 mandates

the opening of a "special

import quota" when

the differential between

the higher U.S. price for

cotton and the lower price

for foreign cotton extends

for a specified length of

time. Its purpose is to

allow imports to enter,

acting to lower U.S. prices

to bring them more in line

with world prices. Step

3 quotas were in effect

in April-May 1995, from

late October 1995 through

early May 1997, and were

triggered in late February

1999. A step 3 quota cannot

be established if a limited

global quota for upland

cotton

is in effect, which operates

differently and is triggered

when other price conditions

are met."

Source:

http://www.webref.org/agriculture/c/

cotton_competitiveness_provision.htm |

|

|

World Production of Cotton

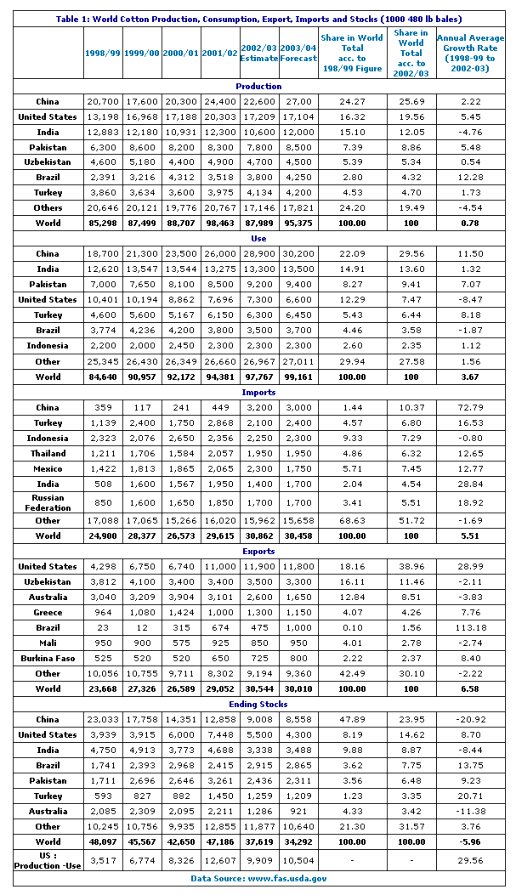

Between 1998-99 and 2002-03 the US has increased its

production at an annual rate of 5.45% (Table 1). It

reached its peak in 2001-02, producing a staggering

20, 303 thousand bales of cotton. Interestingly, its

surplus of production over domestic demand has also

increased steadily from 3,517 thousand bales in 1998-99

to 9,909 thousand bales in 2002-03. This is close to

a three-fold increase in surplus levels over a span

of just 4 years and represents a 29.56 % annual growth

rate. Stocks show a much lower growth rate of 8.70%

per annum. This is not surprising since the huge production

is dumped into the export market. World production also

shows a huge increase between 1998-99, and 2001-02 when

it reached peak levels. From a figure of 85, 298 thousand

bales in 1998-99, it went up to 98,463 bales in 2001-02.

Table

1 >> Click

to Enlarge

A look at table 1 shows that the US has increased its

export market share drastically between 1998-99 and

2002-03. From a share of 18.16% in 1998-99, America’s

share in world exports jumped to 38.96 % in 2002-03.

This represents a huge annual average growth rate of

28.99% between these two years. Obviously, nudged on

by its subsidy programme, US exports have been able

to keep pace with its surplus growth rate.

Only in the last two years does the US show a decline

in production and a subsequent decline in World production

has generated a surplus of use over production, resulting

in an increase in world prices.

Global

Prices of cotton and the US

In 2001-02, global prices were around 42 cents per pound,

the fourth year in succession that they were below the

long-term average of 72 cents per pound (Table 2). Even

the most efficient producers are now operating at a

loss, unable to cover the costs of production. Marketing

projections by the International Cotton Advisory Committee

(ICAC) suggest that prices will remain chronically depressed

in the foreseeable future. Forecasts point to a modest

recovery in 2003, but prices look likely to remain at

between 50-60 cents per pound until 2015 if present

conditions continue.

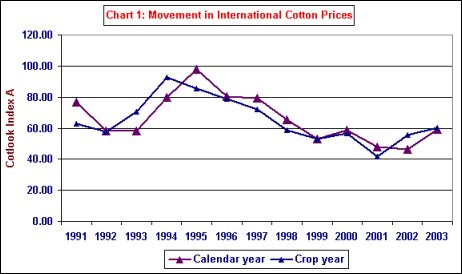

Table 2 and Chart 1 show the spectacular decline in

the Cotlook Index A, the indicator for the global prices

of cotton. The annual indices according to both calendar

and crop year (the latter is the more relevant timeframe)

reflect this pattern. However, only in the last one-two

years have there been some improvement in the global

prices of cotton. That is largely because of the fact

that due to the rock-bottom price in 2001-02, global

stocks had been drawn down subsequently. But unless

the subsidies are cut soon, the imbalance in the world

market will continue.

Table

2 >> Click

to Enlarge

Chart

1 >> Click

to Enlarge

Since it has managed to bring in such a large supply,

the subsidies given by the US government has brought

down international prices considerably. Consequently,

after 1995 when the Agreement on Agriculture came into

effect, global prices continued to fall reaching the

lowest ever level in 29 years in 2001. It is not surprising,

and only goes to prove the trade distorting nature of

US subsidies, that this all-time-low in global prices

coincide with the highest level of US subsidies in 2001-02.

The subsidies managed to bring the largest ever supply

of cotton by US farmers to the export market around

2001 and 2002.

This price pattern is ironical considering agricultural

prices were supposed to increase after the Agreement

on Agriculture. A less protected international agricultural

market and the removal of subsidies by the developed

countries were supposed to improve cotton prices and

therefore improve the lot of poor farmers in poorer

countries. However, the reality turned out to be rather

different.

The

Developing World

Estimates by the International Cotton Advisory Committee

(ICAC), using its World Textile Demand Model, indicate

that the withdrawal of American cotton subsidies would

raise cotton prices by 11 cents per pound, or by 26

per cent.

The refusal to cut cotton subsidies by the US has adversely

affected the condition in many developing or least developed

countries, which are exporters of cotton. The government

of India puts its losses at $1.3 billion, Argentina

at over $ 1 billion, and Brazil at $ 640 million in

2001-02. However, countries located in Africa, especially

Benin, Burkina Faso, Chad and Mali, who depend heavily

on cotton exports for their economic conditions, have

been hit the hardest by the secular decline in prices.

In 11 countries in Africa, cotton export earnings bring

in one fourth of all export revenue. In the four above-mentioned

African countries, 30 per cent of total export earnings

and over 60 per cent of earnings from agricultural exports

come from cotton. According to Oxfam, U.S. cotton subsidies

are destroying livelihoods in Africa by encouraging

over-production and product dumping.

According to an Oxfam Report (2001), costs of production

for one pound of cotton are three times higher in the

US than in Burkina Faso. Other major producers like

Brazil also have far lower production costs. In spite

of this, the US has expanded production in the midst

of the price slump. Obviously cotton subsidies help

them to increase production unlimitedly, and then dump

that higher production in world markets.

Other countries have consequently suffered as a result

of both lower prices for exports and loss of world market

share. While the US improved its share gradually to

a massive 40% of the world market, other major exporters

who could not subsidies their exports suffered a decline.

Uzbekistan’s share dropped from 16.11% to 11.46%,

and that of Mali from 4.01% to 2.78% between 1998-99

and 2002-03. In fact this decline had started even earlier.

Burkina Faso’s share increased marginally but

it lost out in real terms due to the steady decline

in global prices of cotton.

For India, the subsidies mean a huge loss. Though India

is a net importer at the moment, and therefore Indian

consumers can take advantage of the price decline, Indian

farmers are losing out heavily. Imports are flooding

the Indian market, whereas if subsidies were cut, Indian

cotton could have become much more competitive. The

trend of international prices over the last few years

has driven many of the poorer and smaller cotton farmers

to suicide. This phenomenon has taken on alarming proportions

since most of the farmers who have gone into cotton

production have had to take heavy loans in order to

meet production needs. However, regular slumps in international

prices have meant that they were unable to capture enough

of the world market, nor able to recover enough profits

to be able to repay their loan. Simultaneously and more

crucially, they are forced to compete with international

cotton supply even in the domestic market.

|