The

mainstream press was almost unanimous in its hysteria.

''Bloodbath'' and ''carnage'' screamed the front page

headlines in the English language press, while editorials

sermonised disapprovingly of the apparent irresponsibility

of politicians. Was this all fury about mob frenzy

or state-sponsored riots on the scale of the Gujarat

pogrom of two years ago? No, it was simply that the

stock market indices had fallen sharply for the third

day, after it became clear that a Congress-led formation,

supported by the Left parties, would constitute the

government at the Centre.

So

much of the presentation of economic news, especially

in the financial press, is oriented around the behaviour

of stock markets, that the uninitiated can be forgiven

for thinking that their movements actually reflect

real economic performance. Such an interpretation

is not exclusive to India. Across the world, ordinary

citizens have been conned by the media into believing

that the relatively small set of players in international

stock markets really do comprehend and correctly assess

the patterns of growth in an economy, and that their

interests are broadly in conformity with the economic

interests of the masses of people in those countries.

This is not simply a deeply undemocratic position

(as shown by C.P. Chandrasekhar in his article in

the current issue of Frontline). It is also a completely

false argument, since it has been abundantly clear

for some time now that stock markets are very poor

pointers to real economic performance. Stock market

indices are indicators of the expectations of finance

capital, and they can move up and down for a variety

of reasons, most of which are not related even to

the current profitability of productive enterprises.

They are prone to irrational bubbles and sudden collapses

which reflect all sorts of factors, ranging from international

forces to domestic political changes, and may have

very little relation to economic processes within

the economy.

Consider the latest fall in the Indian stock market.

While it is true that some of it is clearly a reaction

to the uncertainty created by the unexpected and remarkable

defeat of the NDA government at the polls, it also

should be noted that across the world, financial markets

have been in downswing in recent weeks. The New York

Stock Exchange composite index fell by 4 per cent

between 5 May and 14 May, and other markets across

Europe and Asia have shown similar or even larger

falls. Much of this is because of rising oil prices,

the failure of the economically and politically expensive

US military occupation in Iraq, and fears of interest

rate hikes in the US.

It is true that the Bombay Sensex index fell by more

than 10 per cent and the Nifty index by 12 per cent

over the same period, but this is still part of a

more general worldwide trend of decrease in stock

values, and some market analysts have even described

these as necessary ''corrections'' of the earlier

inflated values.

For the past year, Indian stock prices had been pushed

up by large inflows from foreign portfolio investors,

who had recently ''discovered'' India as an attractive

emerging market that has not yet had a financial crisis.

This meant that, despite the fact that very little

had changed in the so-called ''fundamentals'' of the

economy, there were substantial inflows from financial

investors that also caused the rupee to appreciate.

Foreign investors use emerging markets like India

to hedge against changes in other markets; they also

like to focus on particular countries in any one period,

where herd behaviour creates a boom and the countries

concerned become the temporary darlings of international

capital. In India in the recent past, the numerous

concessions provided by the NDA government to such

mobile capital also allowed for large super-profits

to be made through such transactions.

Because the Indian stock market still has relatively

thin trading, these foreign institutional investors

made a big difference at the margin, and were responsible

for pushing up stock values well beyond what would

be ''sensible'' values according to standard international

norms of price-equity ratios. This is typical of the

bubbles that have been created by internationally

mobile finance in various developing countries, especially

since the early 1990s.

It is inevitable that such bubbles must eventually

come to an end, whether through a sharp burst in the

shape of a financial crisis or through a slower and

more managed shrinking of values. When this happens,

it is true that a lot of players who have put their

bets on continuously rising share values will be affected,

but this need not mean that there has been any other

bad news in the economy.

Of course, it is always difficult to attribute causes

to stock market movements, since financial markets

are notoriously prone to ''noise'' and irrational

behaviour. However, more than the actual causes, the

implications of such falls are what matter to most

of us, and this is where the mainstream media have

been the most misleading.

It is usually argued that stock market behaviour is

a reflection of ''investor confidence'' and this in

turn affects important real variables such as productive

investment in the economy, which is critical for growth

and development. This is not really the case, and

has become even less true in the recent period. Especially

since the early 1990s, the stock market has experienced

huge increases and wild swings, while investment has

not shown any such volatility and indeed has barely

increased in real terms.

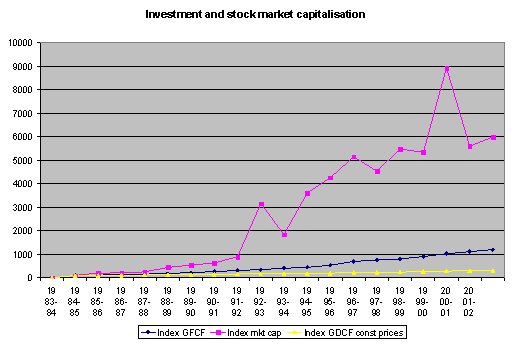

This is evident from the chart below, which shows

the index of stock market capitalisation in India

since the early 1980s. Stock market capitalisation

increased by around 4 times in the decade 1991-92

to 2001-02, with very large fluctuations in between.

By contrast, total gross fixed capital formation in

the economy increased much less even in current prices,

and in constant prices it barely doubled.

Chart

>> Click

to Enlarge

More to the point, the large

swings in market capitalisation were not associated

with any commensurate changes in investment, suggesting

that the financial markets dance to a bizarre tune

that is all their own, and do not have much impact

on real investment in the economy. This is very important

to underline, because the reason that we are all supposed

to be concerned about stock market behaviour is because

of its supposed effect on investment. In fact, it

is really only those agents who are dependent upon

the return from finance capital who are affected,

while real investment depends upon many other factors.

The other impact that movements in the stock market

have nowadays is on the exchange rate, especially

since so much of the change is caused by the behaviour

of foreign institutional investors. Their movements

over the past year have helped to build up the RBIís

foreign exchange reserves to an almost embarrassing

amount, partly because their inflows are not being

used to increase productive investment, and partly

because the RBI kept buying dollars in an effort to

keep the rupee from appreciating even further.

While the large forex reserves may have provided a

macho feeling of false confidence to some, in reality

they were a reflection of huge macroeconomic waste,

since they implied that the capital inflows were not

being productively used. They were also expensive

for the economy to hold, since the interest received

on such reserves by the RBI is typically very low,

whereas the external commercial borrowing by Indian

firms in the current liberalised environment was at

significantly higher interest rates.

In this background, some dilution of the forex reserves

may even be welcome. Of course, if the current outflow

turns into a capital flight which is also joined by

Indian residents, then clearly the situation can become

more serious. Such a possibility is now more open

because of all the recent measures liberalising capital

outflow that the NDA government brought in during

the closing months of its rule. The new government

may have to address some of these measures quite quickly,

to prevent excessive capital outflows which can then

become another means of pressurising the government

on its economic policies.

But otherwise, the current downslide in the stock

markets is really not a matter of serious concern

for most Indians, and it should certainly not be much

of an issue for the new government either. The mainstream

English language media, whose business interests increasingly

coincide with those of finance capital, may continue

to shout itself hoarse about it. But then, as the

recent electoral cataclysm has shown, these media

also do not reflect the interests of the Indian people,

nor do they even understand them.