Price

movements are fundamentally about income distribution.

When prices of certain commodities go up faster than

others, it implies reduced real incomes of those who

sell the latter. The most obvious direct effect is

of course on real wages - because when the price of

labour, or money wages, does not keep pace with the

items that form the consumption basket of workers,

it implies reduced real wages of workers. But other

categories of workers are also affected: when agricultural

crop prices do not go up as much as input costs for

cultivation, or other goods that farmers have to buy,

it affects the real incomes of farmers. Similarly

for non-agricultural petty producers, who can also

be considered as self-employed workers.

That is why prices are also political, or rather,

why inflation can be such a hot political issue especially

before elections. The general perception is that high

inflation is unpopular, for the obvious reason that

it cuts into the real income of most people. Therefore,

in the middle of last year when the increase in prices

had become an issue of widespread concern, it essentially

reflected the concern that this was impacting on the

real incomes of most ordinary people.

The recent decline in inflation rates - on which more

below - has led many to believe that this is no longer

a concern. But in terms of political impact, what

needs to be examined is the extent to which inflation

of the past few years has affected real incomes. In

other words, do people feel better or worse off than

they did five years ago when the UPA government came

to power?

It is important in this regard to be aware of the

difference between inflation and price levels. Inflation

refers to the change in prices, and any positive rate

of inflation, however low, indicates that prices are

rising. So even if the inflation rate is coming down,

that does not mean that prices are coming down, it

only means that prices are increasing at a slower

rate than before. This is a mistake commonly made

by media commentators, who confuse a decline in inflation

rates with a decline in prices. If prices themselves

actually come down, then that is deflation.

Why does this matter? Because even if the inflation

rate slow down or comes down to zero, it simply means

that the price level stays at the level it had reached,

which may be felt to be a very high level by those

whose nominal incomes have not increased. So if prices

had risen very dramatically last year, but have now

slowed down, this may still be experienced as very

high price levels by those whose wages and salaries

have not increased much over the whole period.

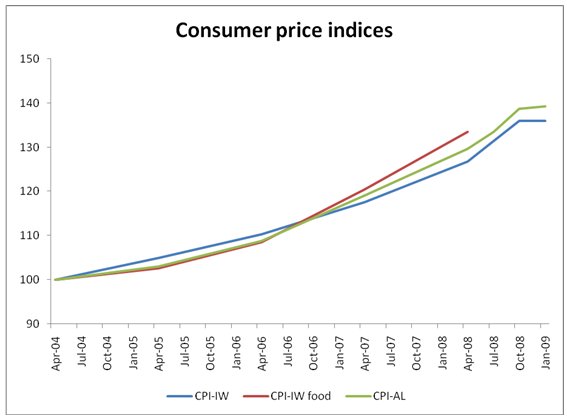

The accompanying chart shows how consumer prices -

the price of the basket of goods estimated to be consumed

by different groups of workers - have moved since

April 2004, just before the last general elections.

Some points of note emerge from this chart. First,

overall inflation has been quite high for both sets

of workers over this period, with consumer prices

increasing by around 40 per cent over this five year

period. It is extremely unlikely that nominal wage

incomes for most workers in urban or rural areas have

increased by that much in this period, although we

will have to wait for large sample survey data before

we can check on this. Certainly the large sample survey

data suggested little change in nominal wage and self

employed incomes between 1999-2000 and 2004-05, especially

in the informal sector. It is likely that this trend

has continued into the past five years as well. For

a significant proportion of self-employed workers

such as home-based workers, micro case studies suggest

that nominal remuneration has even declined in recent

times, suggesting that real incomes have plummeted

quite dramatically.

Chart

1 >> Click

to Enlarge

Second, while the consumer price index for industrial

workers was increasing more rapidly until October

2006, thereafter the index for agricultural labourers

has been moving up more rapidly. The main reason is

probably the faster increase in the price of food,

since the food index even for industrial workers has

moved up more rapidly since October 2006.

But higher inflation need not always be the greater

problem - in fact, sometimes the opposite can be true!

This is not always and inevitably the case - it depends

on what is happening to nominal incomes as well. So

even falling inflation can be of concern, if the nominal

incomes of enough people fall even faster. And deflation,

if is associated with declining economic activity

and employment, can be really bad news.

That is why the news, on 19 March, that the wholesale

price index (WPI) for all commodities had barely increased

on an annual basis, increasing at the historically

low rate of 0.44 per cent, gave rise to mixed reactions.

Some welcomed it, feeling that it reflected an easing

of the inflationary pressures that seemed so marked

just a few months ago, in the middle of last year.

Others (notably the Chairman of the Prime Minister's

Economic Advisory Council) dismissed the lower inflation

rate as nothing but “a base effect” of the earlier

high prices, as the economy stabilises at those price

levels. Others were actually alarmed at this possible

sign that the economy is entering a deflationary phase,

in which output and employment may even shrink.

Yet hardly any commentators dwelt on the income distribution

aspect of the inflation, which is arguably the most

significant consequence, at least politically. To

understand the distributive implications, the overall

inflation rate has to be unpackaged into its component

parts, to understand which sectors and which categories

of producers and consumers are affected in different

ways.

An examination of the disaggregated changes in the

latest WPI numbers throws up some surprising, even

alarming, results. The accompanying table provides

information on year-on-year percentage changes (or

annual inflation rates) for different categories of

goods.

Table

1: Percentage change in prices between 8 March

2008 and 7 March 2009 |

Category

|

Per cent change |

| All

commodities |

0.44 |

|

Food articles |

7.35 |

|

Foodgrains |

10.24 |

|

Cereals |

10.16 |

|

Pulses |

10.97 |

|

Fruits & vegetables |

5.13 |

|

Eggs meat & fish |

3.89 |

|

Edible oils |

-9.78 |

|

Other food articles |

21.60 |

|

Non-food primary articles |

-1.72 |

|

Fibres |

1.73 |

|

Oilseeds |

-5.23 |

|

Minerals |

-1.21 |

|

Fuel, power light &

lubricants |

-0.75 |

|

Manufactured products |

1.32 |

|

Food products |

6.03 |

|

Beverages & tobacco |

8.96 |

|

Drugs & medicines |

4.45 |

|

Textiles |

8.41 |

|

Wood & wood products |

10.05 |

|

Paper & products |

4.77 |

|

Leather & products |

1.82 |

|

Rubber & plastic

products |

2.32 |

|

Chemicals & products |

1.61 |

|

Fertilisers & pesticides |

5.13 |

|

Non-metallic mineral

products |

2.16 |

|

Cement |

1.22 |

|

Metals & metal products |

-11.47 |

|

Iron & steel |

-16.65 |

|

Non-ferrous metals |

-10.49 |

|

Machinery & machine

tools |

2.56 |

|

Transport equipment |

2.69 |

Table

1 >> Click

to Enlarge

SWhile overall inflation has indeed slowed down to

almost no change in the aggregate price level, food

prices have continued to increase. Food grain prices

have gone up the most - by more than 10 per cent -

and this cannot be blamed on higher procurement prices

alone, since the prices of pulses, which are not covered

by public procurement, have also gone up just as much.

The prices of fruits and vegetables and eggs, fish

and meat have also increased, even if not by as much

as for food grains. The only food category for which

prices have fallen is edible oils, which reflects

the decline in oilseed prices as world prices have

crashed. Other food articles' prices have increased

by more than one-fifth in this one year.

So all householders who wonder how inflation could

be falling when they keep facing higher prices when

they go to the market are right in one important respect

- food prices are indeed still rising, despite the

stability of the overall price level. And this will

obviously affect household budgets, especially among

the poor for whom food still accounts for more than

half of total household expenditure. It is worth remembering

that food prices have always been politically sensitive:

there are elections that are supposed to have been

won or lost over the price of onions...

Another major item of essential consumption has also

increased in price: that of drugs and medicines has

gone up by 4.5 per cent, which obviously impacts upon

the entire population, but especially the bottom half

of the population who may find it extremely difficult

if not impossible to meet such expenditures in times

of stringency.

But these are not the only disturbing things about

the disaggregated data. A remarkable feature is how

non-food primary product prices have moved. The prices

of fibres - mainly cotton, jute and silk - have barely

increased at all. Oilseed prices have fallen by more

than 5 per cent. This immediately affects all the

producers of cash crops, who will be getting the same

or less for their products even as they pay significantly

more for food. They are also paying more for fertiliser

and pesticides, whose prices have increased by more

than 5 per cent.

Meanwhile, several manufactured goods have also declined

in price over the past year. Some of the sharpest

price declines have occurred in iron and steel (a

decline of nearly 17 per cent) and non-ferrous metals

(a decline of nearly 11 per cent). This has happened

mostly in the very recent period, as the impact of

the global recession fed into trade prices. Indeed,

the sheer rapidity and extent of the price changes

for traded goods is remarkable.

For example, the price of fibres rose by 12.1 per

cent between 8 March 2008 and 10 January 2009, and

then plummeted by 9.3 per cent in just the past two

months. While some of this can be explained by seasonality

(such as the cotton harvest that comes around December-January)

the decline this year is much sharper than previous

years and reflects international prices as well. Overall,

the price index of manufactured goods increased slightly

by 2 per cent until 10 January, and subsequently fell

by 0.65 per cent to 7 March 2009.

What does all this add up to? What it suggests is

a worrying combination of falling prices faced by

agriculturalists who produce cash crops as well as

petty producers and others who produce manufactured

goods, even as the prices of essential items like

food and medicines continue to rise. These groups

and their families alone account for the majority

of the population in the country. The latest figures

ought to worry the government that is still in power,

for this combination could amount to electoral dynamite.