Stories

abound of India's growing presence as a global player.

Much has been written about the country's success

in the export of software and IT-enabled services,

about the successes of the Indian Diaspora and of

the global expansion, through new investments and

acquisitions, of India's corporations and business

groups. But till recently there has been one disappointing

indicator: the inadequate presence of 'Made in India'

products in the global market for manufactures; in

fact, in the market for goods as opposed to services.

This was a shortcoming in itself, but more so because

an expanding global presence in the market for manufactures

was an explicit objective of the programme of neoliberal

reform launched a decade-and-a-half ago.

Liberalisation was expected to boost commodity exports

in two principal ways, among many. First, exposure

to international competition as a result of trade

liberalisation was expected to restructure economic

activity in ways that would enhance exports. The share

in total production by domestic firms of goods in

which India had a competitive advantage globally was

expected to rise. And goods actually produced would

be delivered through technologies and processes that

were internationally competitive. Second, international

firms were expected to seek out India as a location

for world market production, making India one more

hub for manufactured exports by international firms.

If China could do it, so could India, it was argued,

so long as we were more open. But with a decade-and-a-half

of continuous liberalisation behind us, these expectations

remain largely unrealised. There were individual years

of rapid export growth, but the long-term trend is

disappointing.

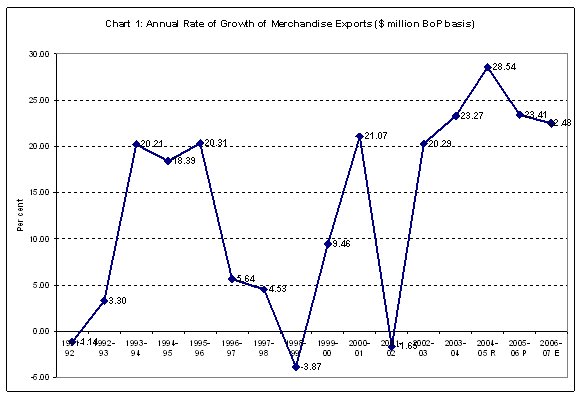

Yet, more recently, there is talk that as an intrepid

explorer of the global economic space, India has begun

to find its place in the global market for manufactures,

as well. Even if belatedly, it is argued, India has

added this too to its list of economic successes.

Such optimism is not without basis, even if occasionally

exaggerated. It stems from the fact that the last

five financial years have been characterised by rates

of growth in the dollar value of merchandise exports

(balance of payments basis) in excess of twenty per

cent per annum (Chart 1). Though there was a short

period in the early 1990s and a single year thereafter

when this had occurred in the past, this is the first

sign of a sustained rate of growth of India's merchandise

exports since the beginning of reform.

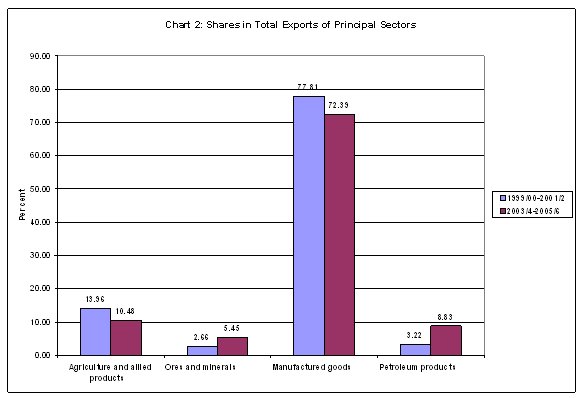

This shift to what appears to be a higher growth trajectory

is also accompanied by a shift in the composition

of overall merchandise trade. But this does not seem

to be in the expected direction. Comparing performance

on average between the three-year period ending financial

year 2000-01 and that ending 2005-06, the shift in

fact seems to be away from manufacturing and agriculture

towards ores and minerals and petroleum products.

The increase in share of ores and minerals is explained

by enhanced demand for commodities like iron ore from

countries such as China. The shift is indicative of

changes in international demand conditions rather

than major changes in India's competitive position.

On the other hand, the exports of petroleum possibly

reflect the volume and structure of India's refinery

capacity, with India remaining a large net importer

of petroleum, oil and lubricants. This is not to say

that the exports of manufactures are not growing.

But changes in the overall composition of India's

exports during the years of export recovery do not

point to a major contribution by manufacturing to

those changes, and therefore to any significant shift

in India's competitive position in manufactured exports.

Chart

1 >> Click

to Enlarge

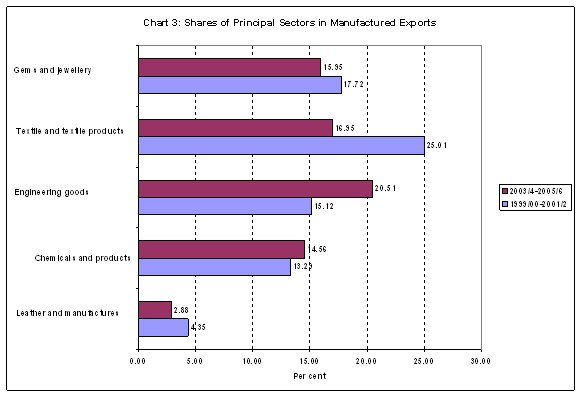

A

more significant change is in the composition of India's

manufactured exports itself (Chart 3). In the short

period under review, the share of India's traditional

manufactured exports such as textiles, gems and jewellery

and leather in the total exports of manufactures has

declined, while that of chemicals has risen modestly

and that of engineering goods quite sharply. This

is the feature that gets captured in anecdotes of

India's success in global markets in areas like automobile

parts and chemicals and pharmaceuticals. It points

to a diversification of manufactured exports into

new areas and markets. But that diversification has

not helped export growth to an extent where it has

become the driving force in India's moderate export

success.

This picture of qualified and limited success is strengthened

if we examine more disaggregated evidence of merchandise

trade available from the Directorate of Commercial

Intelligences and Statistics (DGCIS) for the first

seven months (Aptil-October) of financial year 2006-07

and compare it with the performance during the corresponding

period of the previous year. This data too points

to a creditable 25 per cent annual increase in India's

merchandise exports in dollar terms.

Chart

2 >> Click

to Enlarge

But the growth in exports appears to be extremely

concentrated. If we take the top ten fastest growing

exports between these two periods, we find that they

account for as much as 55 per cent of the increase

in overall merchandise exports. This in itself should

give no cause for concern. Success in a few areas

of competitive advantage is still success. But the

difficulty lies in the nature of this commodity set.

In order of rank in terms of export growth rates,

it consists of sugar, molasses, non-ferrous metals,

raw cotton, man-made staple fibre, groundnut, petroleum

crude, aluminium, dyes and primary and semi-finished

iron and steel.

In some of these cases such as sugar, molasses, raw

cotton and groundnut, they could reflect specific

international conditions and may not be sustainable.

In others, such as non-ferrous metals, aluminium,

staple fibre, dyes and steel they represent India's

competitiveness at the lower end of the global value

chain. But with the global market booming because

of demand from countries like China, exports and profits

are growing.

In sum, there is some success here, but nowhere near

the expectations that had been generated by the advocates

of liberalisation. India is still to encash the competitive

capabilities it built in the commodity producing sectors

during the import substitution years. One consequence

is that after many years of economic reform India

is still plagued with a large deficit in its merchandise

trade account, with imports growing much faster than

exports.

This however has not mattered as much as it should

for two reasons. First, the runaway success the country

has recorded in the new area of trade in services,

especially software and IT-enabled services, has helped

boost foreign exchange earning. Second, the continuing

ability of Indian workers to mine available opportunities

in the global labour market, has delivered large remittances

into the country through the liberalisation years.

Together these flows of foreign exchange have helped

financed a large portion of the deficit in the merchandise

trade account. This has kept the current account deficit

on the balance of payments at reasonable levels and

even delivered surpluses in a couple of years.

Chart

3 >> Click

to Enlarge

But these developments have a downside. Success in

services and high growth without balance of payments

difficulties has made India, with its large domestic

market and overtly favourable policies, an attractive

destination for foreign investors. The net result

has been the large flow of capital into the country

and signs of a growing inability of the Reserve Bank

of India (RBI) to intervene in India's liberalised

foreign exchange markets to limit the appreciation

of the rupee. An appreciating rupee renders India's

exports more expensive and reduces the possibility

that India would improve on its export success at

the lower end of the global commodity value chain.

The possibility that India would enter higher-end

segments with a higher proportion of final value added

being generated within its own geographical boundaries

is weakening.

Bigger Indian firms seem to be seeking a way out of

this conundrum with new strategies involving acquisitions

abroad. Flush with foreign reserves, the RBI has relaxed

regulation of capital account transactions and increased

the access of Indians and Indian firms to foreign

exchange both domestically as well as from abroad.

This has permitted the new experiment. Rather than

wait to built domestic capacities at the top end of

the value chain that are internationally competitive,

firms are seeking to buy into capacities and brands

abroad. This would allow them to do the lower end

processing in India, export the intermediate to acquired

facilities abroad for further processing and then

deliver the output to global markets. This seems to

explain acquisitions such as that of Corus by the

Tata group, which seeks to leverage the latter's access

to quality iron ore and basic steel processing facilities.

These intermediate products would be delivered to

Corus at low cost to be processed for end-product

markets that Corus has access to. India firms are,

it appears, seeking to bypass a phase in development

with the aid of finance that facilitates acquisition.

This is obviously a high risk strategy. When the global

system is flush with liquidity acquisitions are the

norm as the ongoing mergers and acquisitions wave

across the world proves. Firm values are therefore

at their peak making acquisitions costly. Integrating

or synchronising the activities of existing and acquired

units is a problem even within a country and for firms

with experience across vertically integrated segments

of an industry. They could prove a nightmare for firms

without such experience attempting it globally. And

betting on brands available for sale is often a gamble.

The strategy can easily fail.

It is yet to be seen, therefore, if such strategies

are a substitute, however partial, for making India

a manufacturing hub for global markets. It would not

in one obvious sense. The products concerned may be

made by firms controlled by Indians, resident or otherwise,

but they would not be Made in India. And experience

elsewhere has shown that what is good for a country's

corporations need not necessarily be good for the

country. But, pursuing a strategy which makes the

country an export hub of one kind or another may not

be either.