Media reports and assessments

by public and private financial institutions make

clear that India invites and enjoys global attention

as one of the high growth, emerging markets n the

world economy. Along with China, Brazil and Russia,

it is one of the countries captured in the BRIC acronym

coined by international financial firms keen on talking

up these economies so that they attract investors

and deliver large commissions and fees to firms that

broker or mediate such investments. In the resulting

transition from fact, to hype and fable, India is

being presented as an economy that not merely grows

much faster than other global contenders, but is populated

by firms that are aggressively buying into global

assets and workers who are eating into global jobs

by underwriting cheap exports or through real or digital

migration. In the new Asian century, while the erstwhile

tigers of East Asia have lost momentum, India and

China are presented as contenders for supremacy.

This perception of India as an uncaged tiger in the

global system derives whatever strength it has from

developments during the last four years when India,

like other emerging markets, has been the target of

a surge in capital flows from the centres of international

finance. And India has emerged as a leader among these

markets over the last one year or so, when India’s

integration with the global economy has intensified

considerably.

The recent intensification has implied a qualitative

change in India’s relationship with the world system.

Till the late 1990s, India relied on capital flows

to cover a deficit in foreign exchange needed to finance

its current transactions, because foreign exchange

earned through exports or received as remittances

fell short of payments for imports, interest and dividends.

More recently, however, capital inflows are forcing

India to export capital, not just because accumulated

foreign exchange reserves need to be invested, but

because it is seeking alternative ways of absorbing

the excess capital that flows into the country. New

evidence released by the Reserve Bank of India on

different aspects of India’s external payments point

to such a transition.

The most-touted and much-discussed aspect of India’s

external payments is the sharp increase in the rate

of accretion of foreign exchange reserves. During

the first six months (April to September) of financial

year 2007-08, the net addition to India’s stock of

foreign exchange reserves amounted to $40.4 billion

(ignoring the effects of changes in the relative values

of currencies). The comparable figure for the corresponding

period of the previous year was just $8.6 billion.

This surge in the pace of reserve accumulation had

by September 28, 2007 taken India’s foreign exchange

reserves to $248 billion. Being adequate to finance

more than 15 months of imports, these reserves were

clearly excessive when assessed relative to India’s

import requirements. More so because net receipts

from exports of software and other business services

and remittances from Indian’s working abroad had contributed

between $28-29 billion each during 2006-07, financing

much of India merchandise import surplus. Viewed in

terms of the need to finance current transactions,

which had in the past influenced policies regarding

foreign exchange use and allocation, India was now

forex rich and could afford to relax controls on the

use of foreign exchange. In fact, the difficulties

involved in managing the excess inflow of foreign

exchange required either restrictions on new inflows

or measures to increase foreign exchange use by residents.

The government has clearly opted for the latter.

Not surprisingly, the pace of reserve accumulation

has been accompanied by evidence that Indian firms

willing to exploit the opportunity offered by liberalized

rules regarding capital outflows from the country

are resorting to cross-border investments using the

“invasion currency” that India’s reserves provide.

Even though evidence is available only till the end

of June 2007, this trend (that has intensified since)

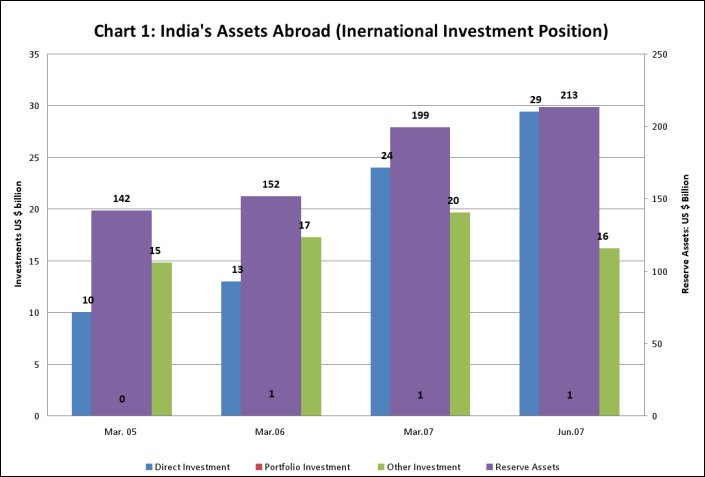

is already clear. Figures on India’s international

investment position as of end-June 2007 indicate that

direct investment abroad by firms resident in India,

which stood at $10.03 billion at the end of March

2005 and $12.96 billion at the end of March 2006,

had risen sharply to $23.97 billion by the end of

March 2007 and $29.39 billion at the end of March

2007 (Chart 1). The acceleration in capital outflows

in the form of direct investments from India to foreign

countries had begun, as suggested by the anecdotal

evidence on the acquisition spree embarked upon by

Indian firms in areas as diverse as information technology,

steel and aluminum.

Chart

1 >> Click

to Enlarge

Does this suggest that using the invasion currency

that India has accumulated, the country (or at least

its elite firms) is heading towards sharing in the

spoils of global dominance? The difficulty with this

argument is that it fails to take account of the kind

of liabilities that India is accumulating in order

to finance its still incipient global expansion. As

has been noted in these columns, unlike China which

earns a significant share of its reserves by exporting

more than it imports, India either borrows or depends

on foreign portfolio and direct investors to accumulate

reserves. China currently records trade and current

account surpluses of around $250 billion in a year.

On the other hand, India incurs a trade deficit of

around $65 billion and a current account deficit of

close to $10 billion. Its surplus foreign exchange

is not earned, but reflects a liability.

To take the most recent period for which data is available,

India had recorded a current account deficit of $10.7

billion on its balance of payments during April-September

2007. Despite earning $15.4 billion from net exports

of software and business services and receiving net

remittances of $18.4 billion during those six months,

India had an overall deficit in its current account

because of a large negative merchandise trade balance.

This deficit had to be financed with capital imports.

But this is where the change in India’s external engagement

is occurring. The $10.7 billion current account deficit

recorded during April-September 2007, was not very

much higher than the $10.3 billion deficit relating

to the corresponding months of 2006. However, while

during April-September 2006 India received capital

flows amounting to just $18.9 billion to finance the

deficit and leave a small capital surplus, it received

a massive $51.1 billion during April-September 2007

resulting in the acceleration of reserve accumulation.

Chart

2 >> Click

to Enlarge

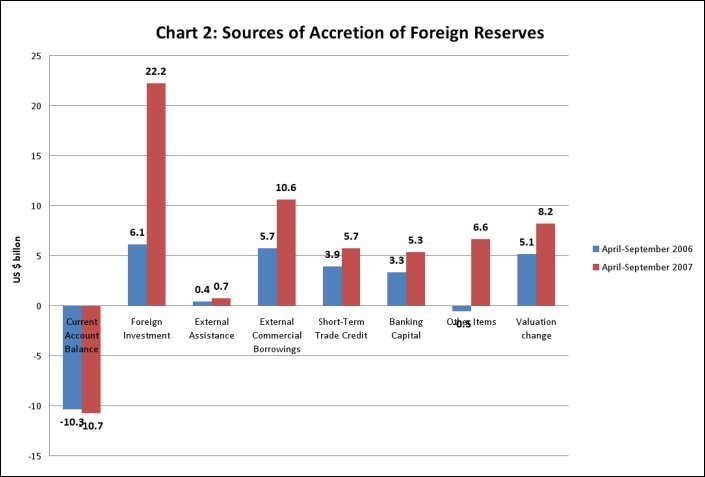

The implication is that excess capital flows account

for all of the accretion of foreign exchange reserves

(excluding valuation changes) in India. The composition

of such accretion needs examining (Chart 2). Of the

$51.1 billion net inflow of capital during April-September

2007, net inward foreign investment ($22.2 billion)

and external commercial borrowing ($10.6 billion)

account for an overwhelming share. What is more, within

foreign investment, it is not direct investment but

portfolio investment that dominates. According to

the Reserve Bank of India’s Balance of Payments statistics,

during the first six months of financial year 2007-08

(April-September), net direct investment by foreigners

in India amounted to $9.86 billion. However, this

was the period when Indian firms were increasing their

investments abroad. As a result, net direct investment

from India to foreign countries amounted to $5.97

billion. This, implies that the net inflow into the

country on account of direct investment amounted to

just $3.89 billion. The bulk of the inflow on the

investment side was on account of portfolio flows.

Net inflows of portfolio investments by foreigners

amounted to $18.3 billion, whereas net outflows on

account of Indian investments abroad were a meagre

35 million. In addition, aiming to benefit from the

much lower interest rates abroad, the Indian corporate

sector has increased its borrowing from abroad. Once

we take account of the resulting large inflows of

external debt being incurred by private players in

India, much of India's foreign exchange reserve accumulation

is explained.

Thus, the acceleration in the pace of reserve accumulation

in India is not due to India’s prowess but to investor

and lender confidence in the country. But the more

that confidence results in capital flows in excess

of India’s current account financing needs, the greater

is the possibility that such confidence can erode.

This could happen for two reasons. First, the build

up of debt and short-term portfolio inflows that imply

interest, dividend and capital outflow commitments,

also implies that the volume of such commitments rises

relative to India's ability to earn foreign exchange

from exports of goods and services and access foreign

exchange through remittances from migrant workers.

As the cost of debt and investment servicing rises

relative to current foreign exchange earnings, concerns

about India's “real” ability to sustain this trajectory

are bound to arise.

Further, there are signs that India’s capacity to

earn foreign exchange from exports may be diminishing

because of the appreciation in the value of the rupee

that capital inflows result in. During April-September

2006, merchandise exports (on a balance of payments

basis) rose by 22.9 per cent relative to the corresponding

months of the previous year and exports of software

and business services by 38.3 per cent. On the other

hand, the corresponding figures for April-September

2007 were 19.9 and 4.6 per cent respectively. In the

case of services, this is a sharp slowdown indeed.

If this continues, India may have to use capital inflows

to meet commitments related to past inflows.

A second reason why investor confidence may wane is

that much of the inflows into India are in the form

of portfolio flows. This implies that, unlike in the

case of China, the contribution of foreign capital

inflows to India’s export earnings is small. It also

means that these flows are more easily repatriated

and the probability of a quick exit is significant.

Therefore, a rising capital liability of this kind

could erode foreign investor confidence, and the reserves

and investments that give India its current "strength"

can shrink.

The difficulty is that the misplaced domestic confidence

that rising reserves create and the difficulties and

costs associated with managing those reserves, is

encouraging the government to favour profligate foreign

exchange use by both firms and individuals. The obsession

with acquisitions abroad, the full benefits of which

for the country are yet to be assessed, is one element

of this new attitude. The decision to allow resident

individuals to transfer sums up to $200,000 a year

for use in any form, is another. That is, capital

import rather than export success is leading to a

resurgence of foreign exchange profligacy in a form

very different from that witnessed during the second

half of the 1980s, when borrowed foreign exchange

was used to finance non-essential imports. The 1980s

episode led to the foreign exchange crisis of 1991.

What this episode would deliver is yet to be seen.