Everybody

learns at their pace. It is not surprising therefore

that it has taken Finance Minister P. Chidambaram

an unduly long time to realize that large capital

inflows into India can adversely affect growth and

the price level. More than three years after India

became the target of an unprecedented surge in foreign

investment inflows, he has finally declared, when

tabling in Parliament the Mid-Year Review of the Indian

economy, that this was a cause for concern.

This admission does point to a major change in the

Finance Minister’s earlier understanding that capital

inflows were not just benign but unquestionably beneficial.

But on that understanding, he has stretched himself

and the nation’s budget to attract such flows. The

most telling instance of such an effort was his decision

in 2004, "to abolish the tax on long term capital

gains from securities transactions". By doing

this he made the tax regime applicable to stock market

investments in India much more favourable than in

most other developing and even developed economies.

Subsequently, when FII inflows were resulting in an

unprecedented boom in capital markets that many observers

felt was not warranted by fundamentals, he sought

to assuage such fears by arguing that better corporate

performance meant that price-earnings ratios in India

were still below acceptable levels. Foreign institutional

investors were coming to India, he argued, because

the economy was doing well under his leadership. Finally,

when the Reserve Bank of India was expressing concern

over these flows and calling for moves to stop inflows

through speculative channels such as participatory

notes (PNs), the ministry he heads not merely disagreed

but sought to silence spokespersons from the central

bank who expressed such views.

Thus, experience seems to have taught the Finance

Minister an important lesson, resulting in a significant

change in his view on the benign and beneficial nature

of capital inflows. But in this case the lesson learnt

may be too little and too late. Too little, because

the Finance Minister does not seems to have fully

understood the problems that the capital surge has

created and is still creating. Too late, because the

Finance Minister looks unwilling to face the consequences

of actions aimed at slowing, let alone arresting,

capital inflows. Foreign capital flows have the quality

that the more you have of them, the more difficult

it is to say that you do not want any more. Choosing

to say no does not just close the tap on new flows

but triggers a drain of capital that has already come

in. The larger is the stock of past inflows, the more

damaging this may be, necessitating stronger action.

And the Finance Minister’s past actions and current

perceptions, do not suggest that this government would

be willing to make the necessary moves. In the event

capital would continue to flow in till such time that

the foreign investors themselves choose to turn their

backs on this country. And if and when they do, the

damage can be severe.

The Mid-Year Review tabled by the Finance Minister

explains why he now sees capital flows as a potential

constraint on macroeconomic management and growth.

The problem is not that India has with a liberal financial

policy allowed itself to be the target of unprecedented

capital inflows that the country does not need to

finance its balance of payments. Rather, to quote

the review, the problem is that: "The economy’s

capacity to absorb capital inflows … has not risen

as fast as the inflows." Needless to say, this

inability to "absorb" in the context of

large inflows, results in an excess supply of foreign

exchange that puts pressure on the rupee in the form

of a tendency to appreciate. In the event, the rupee

has appreciated against the dollar by 15.1 per cent

over the year ended October 2007 and by close to 10

per cent between April 3 and November 20 this year.

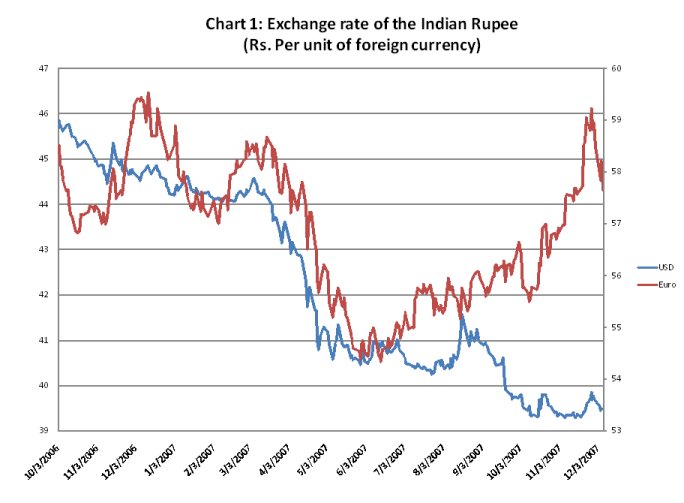

Chart

1 >> Click

to Enlarge

An appreciation of that magnitude, by raising the

dollar value of India’s exports, would adversely affect

exports, since exporters would not be able to reduce

margins and prices to that extent. It gives little

comfort that the rupee has not appreciated as much

vis-à-vis other currencies such as the euro,

since the dollar is the currency in which much of

India’s trade is denominated. Forced by exporters

to recognize the effects that appreciation is having

on the exporting industries, the Review admits that

this could "moderate" growth and lead to

"temporary" job losses in some of India’s

major export industries such as textiles, handicrafts

and leather.

This occurs despite the efforts of the government

and the central bank to stall rupee appreciation through

means that have their own side effects. The Reserve

Bank of India (RBI) has consistently sought to deal

with the problem of an excess supply of foreign exchange

by buying up foreign currency in the market. But this

results in the injection of rupees into the system

and increases money supply by more than what the central

bank has targeted. To mop up the excess rupees the

Finance Ministry has allowed the RBI, under the Market

Stabilization Scheme, to issue government bonds, the

interest on which is paid out of the budget. This

is an additional burden that the Finance Ministry

has to bear. The Budget for 2007-08 had provided for

an outgo of Rs. 3,700 crore on this account. But the

Mid-Year Review estimates that interest payments on

bonds issued for this purpose would amount to Rs.

8,200 crore, necessitating a supplementary demand

of Rs. 4,500 crore. Even more money may have to be

allocated for the purpose before the next financial

year.

Already burdened with a large public debt and a huge

interest burden and committed to meeting the irrational

targets set by the Fiscal Responsibility of Budget

Management Act, this additional commitment reduces

the government’s fiscal maneuverability substantially.

Profit inflation and high growth have no doubt helped

the government, with direct taxes growing by 40 per

cent and indirect taxes by 20 per cent during the

first quarter of this financial year (as compared

with the corresponding quarter of the previous financial

year). But expenditures have also risen rapidly, so

that the revenue deficit during the first quarter

was already near the target for the fiscal year as

a whole.

One consequence of these trends is that the government’s

ability to cover rising petroleum, fertilizer and

food subsidies has been eroded. The subsidies required

in these areas have been rising rapidly because of

the rise in petroleum and food prices in the international

market and India’s traditional dependence on petroleum

imports and more recent dependence on food imports,

especially of wheat. Subsidies rise because the government

cannot politically justify an increase in the prices

of these commodities, and would not dare raise them

in a period when crucial state elections and even

elections to parliament are not far away. On the other

hand, rising subsidies make it increasingly difficult

for the government to meet its FRBM commitments while

maintaining expenditures ate reasonable levels.

One way in which the government has sought to overcome

the problem this creates is through the financial

sleight of hand in which it issues bonds that are

deposited with oil and fertilizer companies, which

are not being permitted to raise prices to cover higher

costs. The value of the bonds covers their losses,

and they can sell the bonds in the secondary market

if they need cash. Since the government receives no

payment for these bonds which it uses to cover its

expenditures, there is no cash outgo. So the sum involved

is kept out of the revenue and fiscal deficit figures.

But these bonds do add to the liabilities of the government,

and would require large capital outflows when the

bonds mature. The government is also required to pay

the interest that is due on them, adding to the interest

burden borne by the government.

This has a number of implications. To start with,

the constraint on government spending is much greater

than is suggested by the aggregate figures on receipts.

This is bound to adversely affect capital outlays

and social expenditures. Second, strapped for funds,

the government would be less willing to compensate

exporters for rupee appreciation with explicit or

implicit subsidies. The Review derides such measures

as a short-term answer and prescribes improvements

in productivity as a lasting solution. Finally, as

the burden of continuing with the so-called "deficit-neutral"

measures to deal with subsidies increases, the government

would, political circumstances permitting, increase

prices to reduce subsidies. This would reveal the

rate of inflation warranted by the government’s policies

and the pace and pattern of growth they generate.

Thus the practice of using bonds that do not mobilize

capital but require interest payments and involve

a liability for the government is only a way postponing

problems that the government does not want to recognize

and address. The same is true of the tendency to see

the problems created by capital flows as being the

result of the inability of the country to absorb them

rather than the fall-out of an excessive inflow of

unwanted capital. A consequence of that perception

would be policies directed at encouraging "absorption"

through profligate foreign exchange use. The decision

to allow every Indian (who has the wherewithal, fo

course) to buy foreign exchange equal to $200,000

every year and use it abroad for any legal purpose

whatsoever is an obvious indication of this tendency

to encourage profligacy to increase absorption.

If successful, measures like this may reduce the excess

supply of foreign exchange in the market. But that

would not mean that the problems created by the surge

in capital flows would go away. Such flows require

payments of a return in foreign exchange. They also

involve a foreign exchange liability for the country.

This may not matter as much for a country like China

which "earns" its surplus foreign exchange.

That country currently records trade and current account

surpluses of around $250 billion in a year. On the

other hand, India incurs a trade deficit of around

$65 billion and a current account deficit of close

to $10 billion. Its surplus foreign exchange is not

earned, but reflects a liability. Opting for a foreign

exchange splurge in such a situation is to create

conditions where when foreigners choose to cash their

investments and move elsewhere, the foreign exchange

needed to meet the country’s commitments may not exist.

That implies a crisis created not because we attracted

the foreign capital that we needed, but because we

did not refuse what we did not need. That would be

the price of having a Finance Minister who is a slow

and poor learner.