Speaking

on the need for more inclusive growth at the recently

held National Development Council meeting to approve

the Approach to the XIth Plan, Prime Minister Manmohan

Singh reportedly said: ''We cannot escape the fact

that the Centre's resources will be stretched in the

immediate future and an increasing share of the responsibility

will have to be shouldered by the States.'' More generally,

his view on resources for the Plan was that much of

the investment needed for rapid growth would come

from the private sector. This, in his opinion, called

for a sound macroeconomic framework, an investor-friendly

environment and a strong and innovative financial

sector capable of responding to the needs of new entrepreneurs.

Implicit in this position are two contentious issues.

The first is the validity of the view that reliance

on the private sector to deliver investment and growth

would not imply an inequalising and less inclusive

path of development, especially if private initiative

is combined with social expenditures financed by the

government. There are indeed many who believe that

the crisis in agriculture (which the Prime Minister

referred to) and the evidence of exclusion (which

he emphasised) are partly the result of the shift

to a private sector-led strategy of growth. In the

event an 8 per cent growth rate notwithstanding, large

sections of the population garner few benefits and

even experience deterioration in their economic position.

The second contentious issue is that in the process

of creating an investor-friendly environment—which

in practice implies substantial tax concessions and

reduced tax rates—the Centre may be engineering an

environment when it finds itself resource-stretched

to finance even crucial capital and social expenditures,

encouraging it to call upon state governments to take

a larger share of the responsibility.

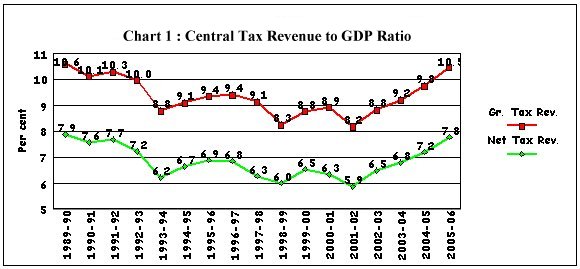

We are here concerned with the second of these propositions.

One striking feature of the period since 1989-90,

which incorporates the years of accelerated economic

reform is that despite evidence of high and accelerating

growth rates and signs of growing inequality, there

has been no improvement in the Centre's ability to

garner a larger share of resources to finance expenditures

it considers crucial. Even when corporate profits

and managerial salaries are reported to be rising

sharply, taxes do not appear as buoyant. The Central

tax-to-GDP ratios in India have been declining for

much of this period. And despite the increase in the

ratio in recent years, their 2005-06 values were at

around the same level they were at in 1989-90 (Chart

1).

Chart

1 >> Click

to Enlarge

This

failure to significantly improve the tax-to-GDP ratio,

in a period when there has also been a widening of

the tax net through various means, is largely due

to the tax concessions provided during the years of

liberalisation. While inequality increases, marginal

tax rates have come down sharply during the liberalization

years. In 1985-86, the marginal rate of taxes on personal

income was brought down from 62 to 50 per cent and

the corporate tax rate from around 60 to 50 per cent.

In the budgets of the early 1990s, especially those

of 1992-93 and 1994-95, the marginal rates were further

reduced to 40 per cent. Today, they stand at around

33 per cent.

As can be seen from Chart 1, the tax-to-GDP ratios

were at their lowest in 2001-02, when they stood at

8.2 per cent in the case of the Centre's Gross Tax

Revenue and 5.9 per cent in the case of Net Tax Revenue,

having fallen from 10.6 and 7.9 per cent respectively

in 1989-90. This decline has occurred despite some

improvement in the collection of Corporation, Income

and Service taxes (relative to GDP) because they could

not cover the loss suffered in customs duty collections

and excise duty revenues as a result of trade liberalisation

and the ostensible ''rationalisation'' of excise duties

(Table 1).

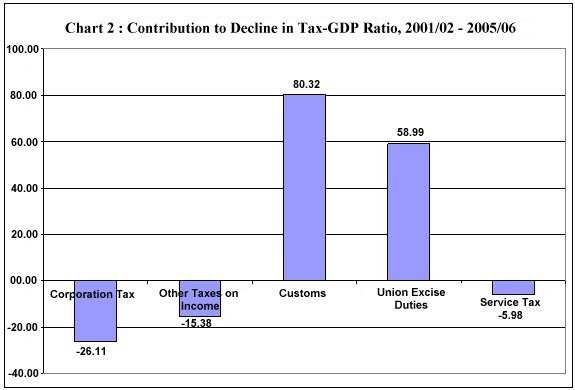

If we decompose the decline in the tax-GDP ratio between

1989-90 and 2001-02, the contribution of the decline

in customs duties relative to GDP amounted to 80 per

cent and that of Excise Duties to 58 per cent. Hence,

despite the neutralising effects of the improved contributions

from Corporation Taxes (26 per cent), Income Taxes

(15.4 per cent) and the newly introduced Service Tax

(6 per cent), the decline in the overall tax-GDP ratio

could not be stalled.

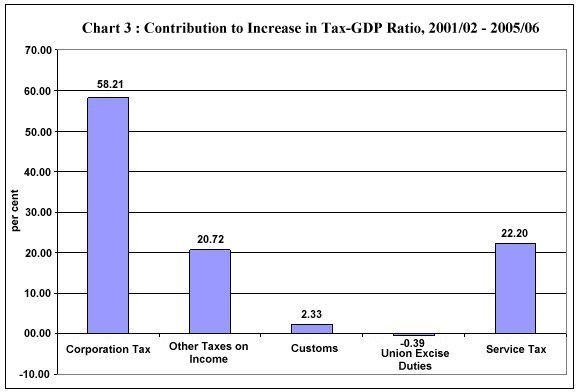

It is indeed true that, subsequently, buoyant corporate

profits, a widened tax base and improved collection

of dues and arrears, have helped raise the tax-GDP

ratio. But despite high growth, improved profitability

and signs of increased inequality (which should improve

tax collection), the increase has just been adequate

to put the tax-GDP ratio back to its immediate pre-liberalisation

levels. This is because, while Corporation, Income

and Service tax revenues (particularly the first)

contributed to the increase, their effect was inadequate

to raise the level above that which prevailed in the

late 1980s.

Chart

2 >> Click to Enlarge

Chart

3 >> Click to Enlarge

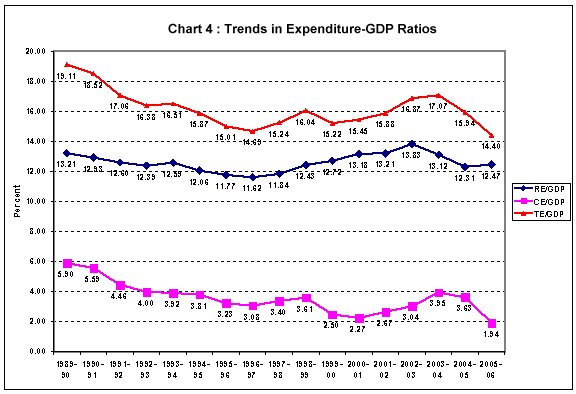

In the event, the Centre has

indeed been strapped for resources to finance its

expenditures. As Chart 4 shows, the ratio of central

budgetary expenditures to GDP fell sharply between

1989-90 and 1996-97. While the ratio regained some

of the lost ground in the latter part of the 1990s

and immediately thereafter, the decline resumed in

2003-04 and was at its lowest level since 1989-90

in 2005-06.

Chart

4 >> Click to Enlarge

Much of this is on account of

curtailment of capital expenditure. Revenue expenditures

as a percentage of GDP, while fluctuating over time,

have more or less retained their level across the

period as a whole. Thus the fall in total expenditure

relative to GDP has been largely on account of cuts

in capital expenditure, which stood at less than 2

per cent of GDP in 2005-06 as compared with 6 per

cent in 1989-90.

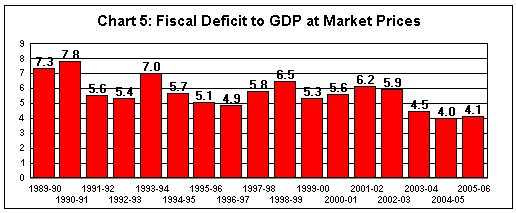

What is noteworthy is that the decline in capital

expenditure has been particularly sharp over the three

years ending 2005-06, when the central tax-GDP ratio

has been on the rise. This was because these where

the years when, armed with the Fiscal Responsibility

and Budget Management (FRBM) Act, the government has

been finally realising its ambition to substantially

curtail the fiscal deficit (Chart 5). With revenues

not rising adequately and the fiscal deficit being

curtailed significantly, expenditures had to be cut

to fulfil the FRBM Act, and the axe fell disproportionately

on capital expenditures. This is the reason why the

Prime Minister has to declare that investment and

growth in the coming years will have to be driven

by the private sector.

Chart

5 >> Click to Enlarge

Does the pattern of movement

of the different components of tax revenue suggest

that the Centre has exhausted the possibilities of

improving it tax revenues relative to GDP? It could

be argued that the decline in customs revenues was

inevitable, since that was an outcome of unavoidable

trade liberalisation. And since corporation, income

and service taxes have increased, it could be said

that the government had made an effort to partially

neutralise the impact of reduced customs tariffs,

but could not completely deal with the problem.

There are a number of difficulties with that argument.

To start with, it does not question whether tariff

reductions that have such a significant impact on

revenues were justified. In fact, when tariff reductions

were being made, one of the arguments was that trade

buoyancy would ensure that revenue losses would be

marginal. This has not really occurred. Second, it

glosses over the fact that what was considered mere

''rationalisation'' of the excise duty structure,

as part of a process of fiscal reform, has amounted

in practice to the provision of significant excise

duty concessions that have had extremely adverse effects.

Third, it does not raise the question, which has been

raised by the Planning Commission itself, whether

there is any rationale for sharply curtailing the

fiscal deficit, despite its extremely adverse impact

on capital and social expenditures.

Finally, it does not answer the criticism that the

Centre has not gone even part of the way in tapping

resources from direct taxes of various kinds, but

in fact has doled out concessions that are unjustifiable.

A striking example is the income earned from equity

investment. There are two principal ways in which

income is garnered through such investment: dividends

and capital gains. Both have them have benefited from

recent tax concessions. To start with, on the grounds

that corporate incomes are already taxed so that taxing

shareholder dividend income would amount to a form

of double taxation, it was decided in 1999-2000, that

dividends paid out to shareholders should be made

tax-free. Being controversial, this decision was reversed

in the budget for 2002-03, only to be reinstated again

in the Budget for 2003-04.

What has been the fall-out of this exemption? An extremely

revealing analysis by B.G. Shirsat (Business Standard,

July 14 and 22/23, 2006) of 1,050 major dividend-paying,

listed companies has found that dividends paid out

during the three years ending 2005-06 amounted to

Rs. 29,532 crores. Since the beneficiaries of these

dividends are likely to be in the highest marginal

tax bracket, if this dividend income had been subject

to tax, the revenue earned by the government over

these three years would have been an additional Rs.10,000

crore (if we assume that the dividend pay out rate

would have been the same even if the tax was effective).

This is by no means a small sum.

What is noteworthy is the inequality in the distribution

of this tax benefit. It is known that a miniscule

proportion of the domestic population invests in equity.

But even among them, the distribution of dividend

and therefore the benefit of the tax exemption is

highly skewed. Of the close to Rs.30,000 crore of

dividends paid out by these companies, Rs.14,000 crore

or around 45 per cent accrued to the promoters of

the companies themselves. In fact, small or so-called

''retail'' shareholders received a relatively small

share of this benefit. Over ninety per cent of the

shareholders holding up to 500 shares each received

just over Rs.4000 crore of dividend income, while

public shareholders with equity holding in excess

of 500 shares garnered Rs.7,575 crore as dividends.

A significant amount of the dividend paid to public

shareholders went to foreign investors. Foreign institutional

investors (FIIs) received Rs.12, 808 crore of dividend

income during this period and investors in GDRs and

ADRs, NRI investors and other overseas bodies received

Rs.4,567 crore. In sum, a combination of promoters,

high net worth domestic investors and foreigners were

the main beneficiaries of the dividend tax hand out.

There remains the argument that the exemption of dividends

from taxes was not a hand out but the redressal of

an unjust scheme of double taxation. Even if this

is accepted, there remains the fact that there is

a high degree of inequality in the distribution of

incomes in the country, which the accrual of record

dividend incomes seems to aggravate substantially.

If the idea was for the government to garner a fair

share of the surplus for social and capital expenditures,

then the removal of the tax on dividends should have

been accompanied by an increase in the marginal corporate

tax rate. The fact that the government has not chosen

to resort to such an increase only strengthens the

perception that it has failed to tax a section of

the rich adequately and effectively.

The evidence on unwarranted benefits to investors

in equity does not end here. It is visible in the

case of the other form of return from equity holding—capital

gains—as well. The budget for 2003-04 also decided

that, ''in order to give a further fillip to the capital

markets'', all listed equities that were acquired

on or after March 1, 2003, and sold after the lapse

of a year, or more, were to be exempted from the incidence

of capital gains tax. Capital gains made on those

assets held by the purchaser for at least 365 days

were defined for taxation purposes as long term gains.

Long term capital gains tax was being levied at the

rate of 10 per cent up to that point of time.

An analysis of share price movements of 28 Sensex

companies found that if we assume that all shares

purchased in 2004 were sold after 365 days in 2005,

the total capital gains that could have been garnered

in 2005 would have amounted to Rs. 78,569 crore. If

these gains had been taxed at the rate of 10 per cent

prevalent earlier, the revenue yielded would have

amounted to Rs. 7,857. That reflects the revenue foregone

by the State and the benefit accruing to the buyers

of these shares. It is indeed true that not all shares

of these companies bought in 2004 would have been

sold a year-and-one-day later. But some shares which

were purchased prior to 2004 would have been sold

during 2005, presumably with a bigger margin of gain.

And this estimate relates to just 28 companies.

In sum, the stock market alone has become the site

for tax-exempt gains of a magnitude which suggest

that a more appropriate tax policy relating to dividends

and capital gains could have yielded substantial revenues

for the government. This is only one area. There are

many more such which the central government should

look to when looking for money to finance crucial

expenditures. But what the instances quoted prove

is that in the effort not just to facilitate but ''induce''

private investment with tax concessions, the government

is engineering a fiscal situation which is by no means

indicative of a macroeconomic framework that is ''sound''

from a growth and equity point of view.