Themes > Features

28.10.2003

Neoliberalism, Investment and Growth in Latin America

Despite the relatively

poor growth record of the era of corporate globalisation, there are many

who continue to believe that corporate globalisation and greater

liberalisation of economic policies do deliver higher investment and more

economic growth, even if there are other less benign effects - such as

greater inequality or inadequate "social sector" expenditure – which then

need to be separately addressed.

But in fact there is little evidence to indicate that the elements of the neoliberal economic policy model actually work to deliver faster economic growth. A good example of this – in fact, almost a laboratory test case – is the region of Latin America, in which the majority of national governments have been implementing this particular economic model with some force, since the early 1980s.

The latest annual report from UNCTAD, the Trade and Development Report 2003, contains a detailed discussion of the Latin American experience with marketist reforms, and the effects on investment, growth, productivity and employment. The results are quite damning for the neoliberal paradigm, and call for a major rethinking of the entire strategy of development which has been so comprehensively adopted on that continent.

In the 1960s and early 1970s, East Asia and Latin America grew at approximately the same rate, and the five largest countries in Latin America had per capita incomes that were above those of the first tier NICS (Newly Industrialising Countries – South Korea, Taiwan, Singapore and Hong Kong). Subsequently the pattern has been very different.

In the 1970s the large Latin American economies grew rapidly on the basis of high accumulation rates financed by external borrowing, a process which culminated in the debt crisis of 1982. Thereafter, there has not only been slower growth but much greater volatility of economic activity in the region.

From the point of view of policy orientation, the debt crisis of the early 1980s brought in a prolonged phase of very extensive market-based reforms, which were urged on and supported by, and usually even enforced by, the international financial institutions. Across the region, there were sweeping changes in trade and industrial policy aimed at removing protection to domestic producers and reducing what were seen as price distortions.

There were reductions in rates of public investment, and continuous and comprehensive privatisation of major state assets, in the major economies of the region. There were cuts in explicit and implicit subsidies to domestic producers and consumers, which also reduced the access of poorer groups to public goods and services. There were attempts to reduce the power of organised labour, through a combination of legislation and the pressure of greater unemployment, in order to make labour markets more "flexible".

These changes in economic strategy actually went further, and were more comprehensive, than in any other region of the developing world. In most of the economies, the change from the earlier import-substituting industrialisation strategy became most pronounced in the aftermath of the debt crisis of the early 1980s, although there were some beginnings in the 1970s.

In Chile, the shift to the neoliberal policy paradigm started much earlier, with the Pinochet dictatorship of the early 1970s, and the subsequent decades in Chile actually witnessed a slight modification of that very extreme form of marketist approach, with greater role for government intervention. Chile is an outlier in the Latin American case in some important ways, but certainly shares some of the more significant structural characteristics with other large economies of the region.

The explicit aim of the neoliberal policy package was, in the first instance, to stabilise the economies by controlling inflation and reducing macroeconomic imbalances. But the more significant medium term purpose was to remove the constraints to growth, increase productive capacity and external trade performance, and therefore reduce both the periodic balance of payments crises and boom-bust cycles of growth. However, the experience suggests that none of these aims has been even partially achieved in most countries of the region.

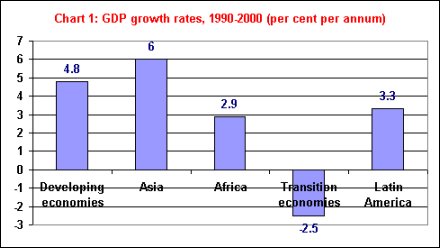

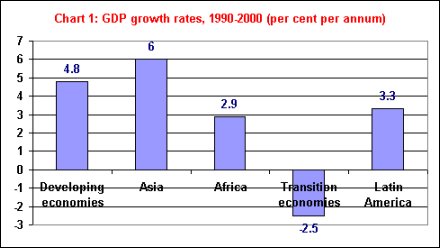

Chart 1 provides evidence of growth rates in the 1990s in the major regions of the developing world. Latina American growth is seen to be definitely less rapid than that of Asia, although superior to that in Africa. However, bear in mind that these average rates of growth in Latin America came after the "lost decade" of the 1980s, which experienced very sharp falls in per capita incomes and in wage incomes in particular. In other words, the growth was from a relatively low base of economic stagnation or decline in the earlier period.

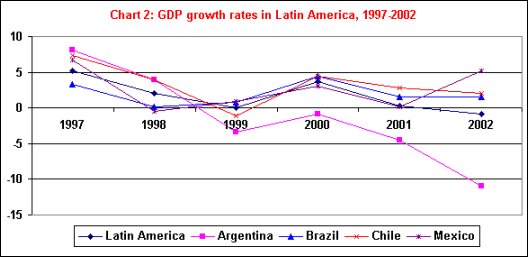

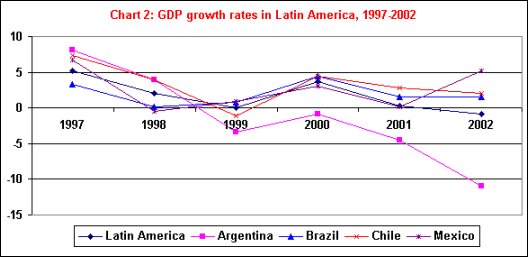

Chart 2 indicates the situation in the more recent period for the four largest economies, Argentina, Brazil, Chile and Mexico. It is clear that even in the latest period, growth has been generally low and highly volatile, even in the so-called "success stories" such as Chile.

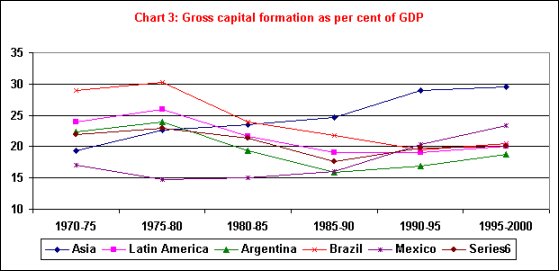

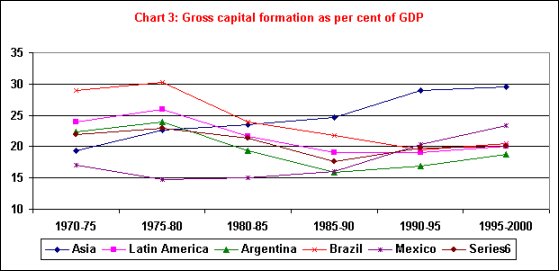

At one level the lower rates of growth in the Latin American region are not surprising, because the region also experienced a fairly substantial drop in investment rates (as share of GDP), among the highest in the developing world. Chart 3 indicates that the comparison with Asia can be instructive in this regard: not only have investment rates in Asia been high, but they have been increasing continuously over the long period from the 1970s to now.

In Latin America, by contrast, there is clear evidence of a trend decline in investment rates, from an average of 25 per cent in the 1970s to only around 20 per cent or less in the recent past. The decline has been most marked in Argentina, but even countries like Mexico which are supposed to have benefited from the effects of closer trade integration with the US through NAFTA, have shown low investment rates. Only Chile (where, as we have already argued, the transition to the neoliberal economic regime occurred already in the early 1970s) have investment rates increased over this period, after initially falling.

This trend of declining investment rates was of course contrary to the neoliberal expectation, that the removal of domestic prices distortions and the freeing of market forces would improve the investment climate and generate rapid increases in private investment. What happened in reality was that there was a continuous decline in public investment, which in turn meant that there were less virtuous linkage effects to encourage more private investment, and so total investment rates declined.

In most countries in the region, aggregate investment rates in the 1990s and after have fallen below the threshold level of 20 per cent of GDP. The Trade and Development Report 2003 also argues that there has also been a broad tendency for a shift in the composition of investment towards less productive activities such as residential house construction, and away from investment in machinery and equipment, in many countries of the region.

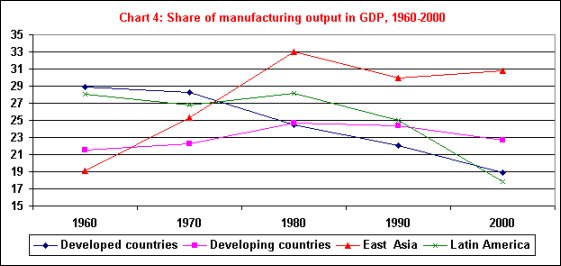

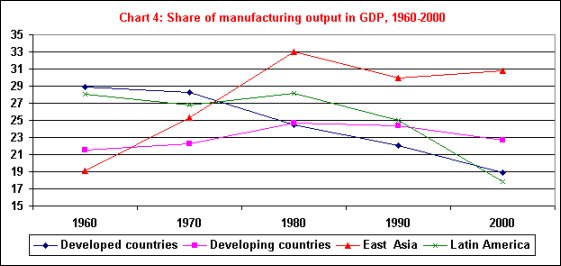

Significantly, the past two decades in Latin America have also been a period of "deindustrialisation", as declining shares of investment and manufacturing valued added in GDP as well as manufacturing employment in total employment have been coterminous with stagnant or falling share of manufactures in total exports. This was the same period in which the much more interventionist policy regimes in East Asia were contributing to a significant expansion in manufacturing activity from that part of the world.

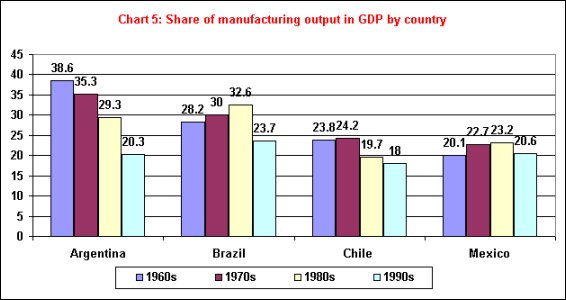

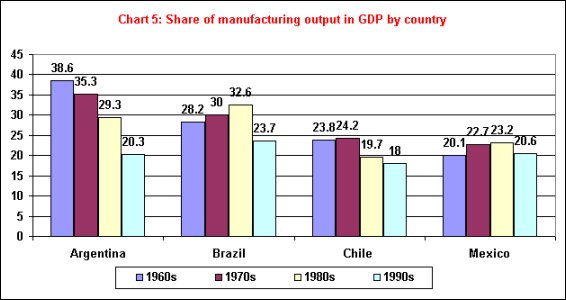

The difference is clearly apparent in Chart 4. The share of manufacturing in gross domestic product in Asia has been rising, and is currently well above 30 per cent. By contrast, Latin America experienced fairly continuous declines in this share, and by 2000 this share had fallen been below that in advanced industrial countries. The point is that the process of deindustrialisation, or reduction in manufacturing shares in GDP and employment, began in Latin America at much lower levels of per capita income than the equivalent and earlier process in the now developed countries. Chart 5 shows how the process has been rapid in the recent decade for at least the three largest countries in the region.

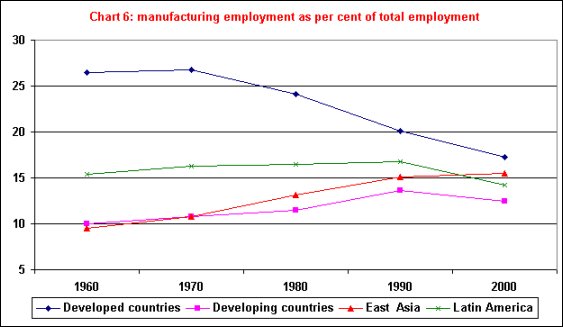

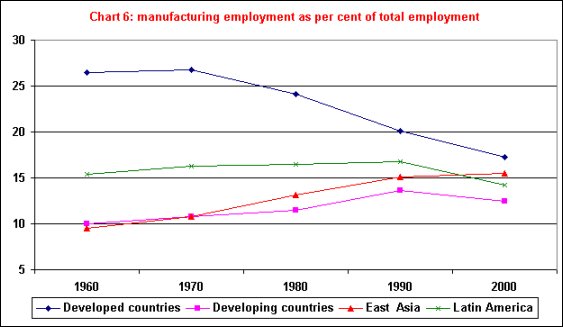

In Chart 6 the employment share of manufacturing is described, with developed countries experiencing a clear decline and Asia exhibiting an increase. In Latin America, the share of manufacturing in total employment rose (although less significantly than in Asia) until 1990, and then declined to less than 15 per cent of the workforce on average.

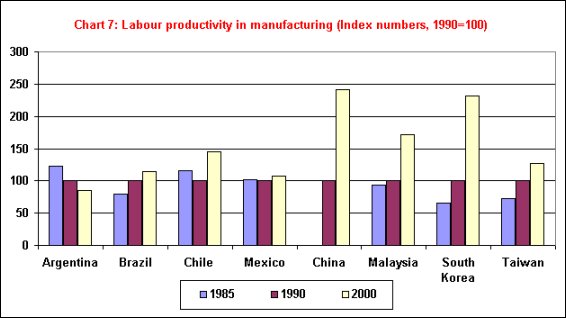

Nor did the neoliberal strategy operate to improve aggregate labour productivity in these economies. In most countries of Latin America, overall productivity in manufacturing actually declined or remained stagnant during the 1990s. In some enclave sectors where labour productivity increased, this was essentially due to the shedding of labour adding to unemployment, rather than greater investment and employment expansion.

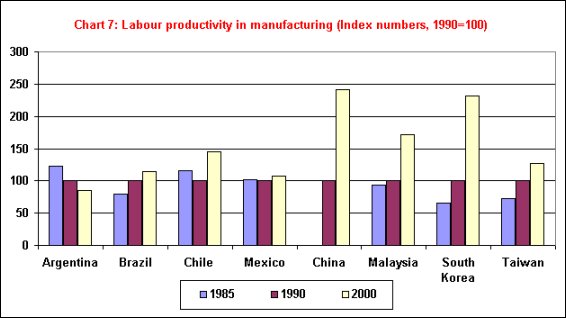

Chart 7 brings out the contrast between Latin America and Asia in this respect. The four Asian countries depicted there – China, Malaysia, South Koreas and Taiwan China – all indicate very rapid and continuous increases in labour productivity in manufacturing over the period 1985-2000. However, the four Latin American economies do not show this positive tendency. Remarkably, manufacturing labour productivity declined quite substantially in Argentina, was volatile and fluctuating in Chile and Mexico, and only seems to have increased, albeit at a gentle pace, in Brazil.

Of course, at one level this is simply a comment on the difficulties associated with measuring and capturing changes in productivity. Too often, the data which actually reflect changes in the state of demand and capacity utilisation are interpreted to denote changes in productivity (which in turn reflects technological change). The falling productivity indicators in Argentina, for example, reflect the worsening macroeconomic situation over the decade, when output was stagnant or falling because of restrictive macroeconomic and exchange rate policies.

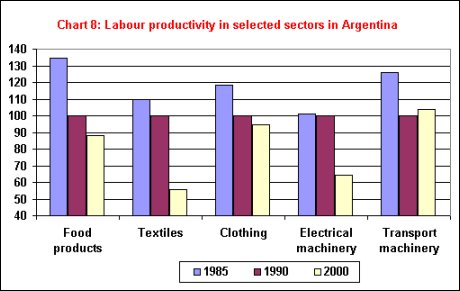

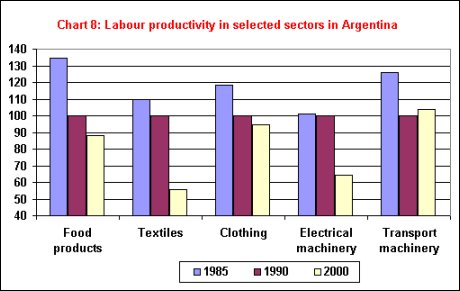

It is also the case that a more disaggregated analysis reveals that there are wide differences across sectors even within aggregate manufacturing in these countries. From Chart 8 it emerges that the sharpest falls in labour productivity in Argentina have been in food, textiles and electrical machinery sectors, while for transport machinery the situation may have improved recently.

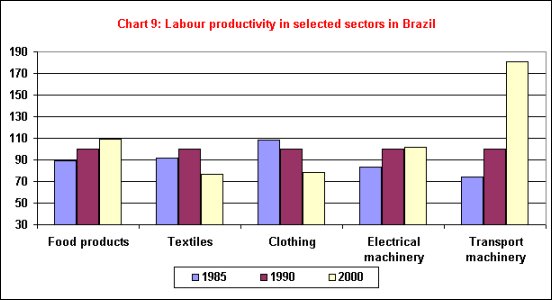

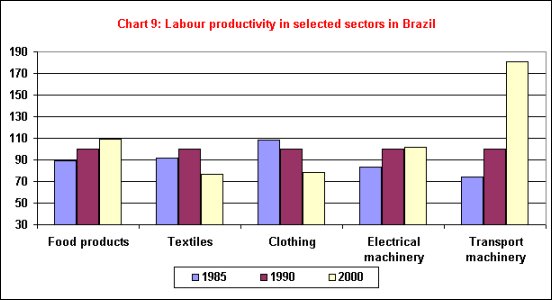

In Brazil (Chart 9) transport machinery has witnessed large improvements in labour productivity (which conversely can be interpreted as greater labour shedding in that sector consequent upon newer more capital intensive technology). Productivity also appears to have improved marginally in food products and electrical machinery, and worsened in the traditional manufacturing export areas of textiles and clothing.

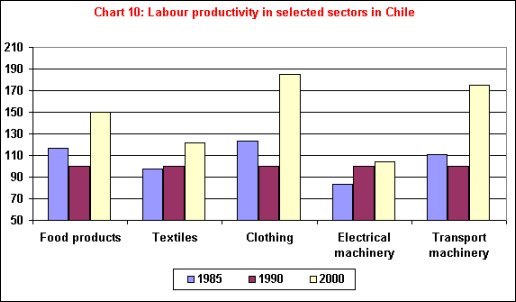

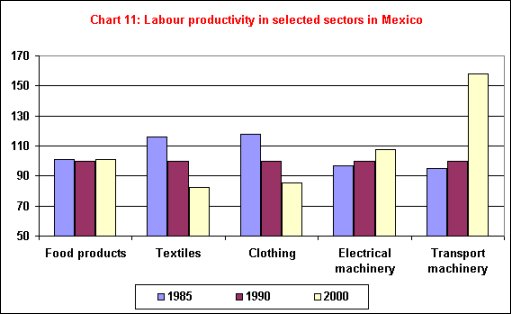

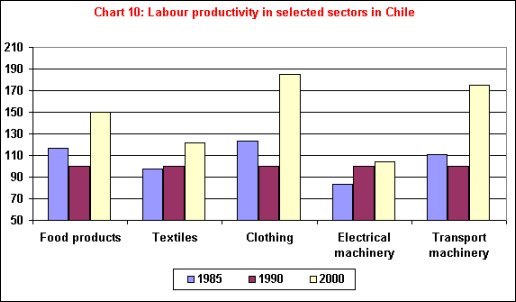

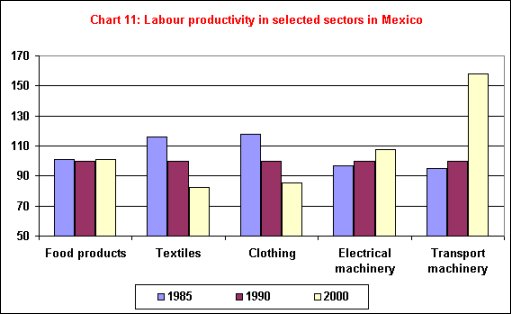

In Chile (Chart 10) in most sectors labour productivity improved by 2000, although the pattern has been one of fluctuation and may be confused by the end year results. In Mexico (Chart 11) as in Brazil, labour productivity has increased mainly in the transport machinery and electrical machinery sectors, and has declined for other manufacturing sectors.

The overall picture seems to be that the weak investment performance in the region tended to stunt productivity growth and upgradation. As a result, international competitiveness has been increasingly based on low wages (which is always an ephemeral advantage at best) rather than on increases in labour productivity.

This has created peculiar results in terms of the behaviour of unit labour costs relative to the US, which provide some basic idea of the competitiveness of particular sectors in different countries. Table 1 shows the change in unit labour costs by sector for the four major Latin American countries and four Asian countries. It is evident that for the Latin American economies, unit labour costs relative to those of the US have actually been rising in the period 1980 to 2000, in most sectors. (Of course, this also depends upon exchange rate policies and other such factors, rather than labour productivity alone.) In consequence, unit labour costs were much higher in Argentina (sometimes nearly double or more than double) compared to the US. Even in the other countries, the gap between unit labour costs between these countries and the US was been rapidly narrowed, which meant that the advantage of cheaper labour may not be available for much longer.

In this context, even the opening up to more foreign direct investment has not been entirely advantageous. A significant part of the FDI inflows into the region have been in the form of acquisition of existing assets, often in non-tradeable infrastructure or service sectors, rather than in greenfield investment in new projects. Even the greenfield FDI has in general been concentrated in sectors producing or processing natural resources, rather than areas with high potential for productivity growth. Meanwhile aggregate employment in productive sectors has suffered because of more capital intensity in resource based industries, accompanied by relative declines in traditional labour-intensive sectors such as textiles and clothing.

Essentially therefore, the neoliberal strategy has mainly been successful only in the very limited aim of inflation control. But this has been achieved at the cost of a much worse record in terms of growth, employment, poverty reduction, and higher volatility. The important point is that the strategy failed not only in terms of social and distributive consequences, but in terms of a much worse performance in investment, growth and productivity. Not only has the transformation of the productive structure through higher investment and technological change failed to materialise, but many of these variables have actually deteriorated in most of the economies of the region.

But in fact there is little evidence to indicate that the elements of the neoliberal economic policy model actually work to deliver faster economic growth. A good example of this – in fact, almost a laboratory test case – is the region of Latin America, in which the majority of national governments have been implementing this particular economic model with some force, since the early 1980s.

The latest annual report from UNCTAD, the Trade and Development Report 2003, contains a detailed discussion of the Latin American experience with marketist reforms, and the effects on investment, growth, productivity and employment. The results are quite damning for the neoliberal paradigm, and call for a major rethinking of the entire strategy of development which has been so comprehensively adopted on that continent.

In the 1960s and early 1970s, East Asia and Latin America grew at approximately the same rate, and the five largest countries in Latin America had per capita incomes that were above those of the first tier NICS (Newly Industrialising Countries – South Korea, Taiwan, Singapore and Hong Kong). Subsequently the pattern has been very different.

In the 1970s the large Latin American economies grew rapidly on the basis of high accumulation rates financed by external borrowing, a process which culminated in the debt crisis of 1982. Thereafter, there has not only been slower growth but much greater volatility of economic activity in the region.

From the point of view of policy orientation, the debt crisis of the early 1980s brought in a prolonged phase of very extensive market-based reforms, which were urged on and supported by, and usually even enforced by, the international financial institutions. Across the region, there were sweeping changes in trade and industrial policy aimed at removing protection to domestic producers and reducing what were seen as price distortions.

There were reductions in rates of public investment, and continuous and comprehensive privatisation of major state assets, in the major economies of the region. There were cuts in explicit and implicit subsidies to domestic producers and consumers, which also reduced the access of poorer groups to public goods and services. There were attempts to reduce the power of organised labour, through a combination of legislation and the pressure of greater unemployment, in order to make labour markets more "flexible".

These changes in economic strategy actually went further, and were more comprehensive, than in any other region of the developing world. In most of the economies, the change from the earlier import-substituting industrialisation strategy became most pronounced in the aftermath of the debt crisis of the early 1980s, although there were some beginnings in the 1970s.

In Chile, the shift to the neoliberal policy paradigm started much earlier, with the Pinochet dictatorship of the early 1970s, and the subsequent decades in Chile actually witnessed a slight modification of that very extreme form of marketist approach, with greater role for government intervention. Chile is an outlier in the Latin American case in some important ways, but certainly shares some of the more significant structural characteristics with other large economies of the region.

The explicit aim of the neoliberal policy package was, in the first instance, to stabilise the economies by controlling inflation and reducing macroeconomic imbalances. But the more significant medium term purpose was to remove the constraints to growth, increase productive capacity and external trade performance, and therefore reduce both the periodic balance of payments crises and boom-bust cycles of growth. However, the experience suggests that none of these aims has been even partially achieved in most countries of the region.

Chart 1 provides evidence of growth rates in the 1990s in the major regions of the developing world. Latina American growth is seen to be definitely less rapid than that of Asia, although superior to that in Africa. However, bear in mind that these average rates of growth in Latin America came after the "lost decade" of the 1980s, which experienced very sharp falls in per capita incomes and in wage incomes in particular. In other words, the growth was from a relatively low base of economic stagnation or decline in the earlier period.

Chart 2 indicates the situation in the more recent period for the four largest economies, Argentina, Brazil, Chile and Mexico. It is clear that even in the latest period, growth has been generally low and highly volatile, even in the so-called "success stories" such as Chile.

At one level the lower rates of growth in the Latin American region are not surprising, because the region also experienced a fairly substantial drop in investment rates (as share of GDP), among the highest in the developing world. Chart 3 indicates that the comparison with Asia can be instructive in this regard: not only have investment rates in Asia been high, but they have been increasing continuously over the long period from the 1970s to now.

In Latin America, by contrast, there is clear evidence of a trend decline in investment rates, from an average of 25 per cent in the 1970s to only around 20 per cent or less in the recent past. The decline has been most marked in Argentina, but even countries like Mexico which are supposed to have benefited from the effects of closer trade integration with the US through NAFTA, have shown low investment rates. Only Chile (where, as we have already argued, the transition to the neoliberal economic regime occurred already in the early 1970s) have investment rates increased over this period, after initially falling.

This trend of declining investment rates was of course contrary to the neoliberal expectation, that the removal of domestic prices distortions and the freeing of market forces would improve the investment climate and generate rapid increases in private investment. What happened in reality was that there was a continuous decline in public investment, which in turn meant that there were less virtuous linkage effects to encourage more private investment, and so total investment rates declined.

In most countries in the region, aggregate investment rates in the 1990s and after have fallen below the threshold level of 20 per cent of GDP. The Trade and Development Report 2003 also argues that there has also been a broad tendency for a shift in the composition of investment towards less productive activities such as residential house construction, and away from investment in machinery and equipment, in many countries of the region.

Significantly, the past two decades in Latin America have also been a period of "deindustrialisation", as declining shares of investment and manufacturing valued added in GDP as well as manufacturing employment in total employment have been coterminous with stagnant or falling share of manufactures in total exports. This was the same period in which the much more interventionist policy regimes in East Asia were contributing to a significant expansion in manufacturing activity from that part of the world.

The difference is clearly apparent in Chart 4. The share of manufacturing in gross domestic product in Asia has been rising, and is currently well above 30 per cent. By contrast, Latin America experienced fairly continuous declines in this share, and by 2000 this share had fallen been below that in advanced industrial countries. The point is that the process of deindustrialisation, or reduction in manufacturing shares in GDP and employment, began in Latin America at much lower levels of per capita income than the equivalent and earlier process in the now developed countries. Chart 5 shows how the process has been rapid in the recent decade for at least the three largest countries in the region.

In Chart 6 the employment share of manufacturing is described, with developed countries experiencing a clear decline and Asia exhibiting an increase. In Latin America, the share of manufacturing in total employment rose (although less significantly than in Asia) until 1990, and then declined to less than 15 per cent of the workforce on average.

Nor did the neoliberal strategy operate to improve aggregate labour productivity in these economies. In most countries of Latin America, overall productivity in manufacturing actually declined or remained stagnant during the 1990s. In some enclave sectors where labour productivity increased, this was essentially due to the shedding of labour adding to unemployment, rather than greater investment and employment expansion.

Chart 7 brings out the contrast between Latin America and Asia in this respect. The four Asian countries depicted there – China, Malaysia, South Koreas and Taiwan China – all indicate very rapid and continuous increases in labour productivity in manufacturing over the period 1985-2000. However, the four Latin American economies do not show this positive tendency. Remarkably, manufacturing labour productivity declined quite substantially in Argentina, was volatile and fluctuating in Chile and Mexico, and only seems to have increased, albeit at a gentle pace, in Brazil.

Of course, at one level this is simply a comment on the difficulties associated with measuring and capturing changes in productivity. Too often, the data which actually reflect changes in the state of demand and capacity utilisation are interpreted to denote changes in productivity (which in turn reflects technological change). The falling productivity indicators in Argentina, for example, reflect the worsening macroeconomic situation over the decade, when output was stagnant or falling because of restrictive macroeconomic and exchange rate policies.

It is also the case that a more disaggregated analysis reveals that there are wide differences across sectors even within aggregate manufacturing in these countries. From Chart 8 it emerges that the sharpest falls in labour productivity in Argentina have been in food, textiles and electrical machinery sectors, while for transport machinery the situation may have improved recently.

In Brazil (Chart 9) transport machinery has witnessed large improvements in labour productivity (which conversely can be interpreted as greater labour shedding in that sector consequent upon newer more capital intensive technology). Productivity also appears to have improved marginally in food products and electrical machinery, and worsened in the traditional manufacturing export areas of textiles and clothing.

In Chile (Chart 10) in most sectors labour productivity improved by 2000, although the pattern has been one of fluctuation and may be confused by the end year results. In Mexico (Chart 11) as in Brazil, labour productivity has increased mainly in the transport machinery and electrical machinery sectors, and has declined for other manufacturing sectors.

The overall picture seems to be that the weak investment performance in the region tended to stunt productivity growth and upgradation. As a result, international competitiveness has been increasingly based on low wages (which is always an ephemeral advantage at best) rather than on increases in labour productivity.

This has created peculiar results in terms of the behaviour of unit labour costs relative to the US, which provide some basic idea of the competitiveness of particular sectors in different countries. Table 1 shows the change in unit labour costs by sector for the four major Latin American countries and four Asian countries. It is evident that for the Latin American economies, unit labour costs relative to those of the US have actually been rising in the period 1980 to 2000, in most sectors. (Of course, this also depends upon exchange rate policies and other such factors, rather than labour productivity alone.) In consequence, unit labour costs were much higher in Argentina (sometimes nearly double or more than double) compared to the US. Even in the other countries, the gap between unit labour costs between these countries and the US was been rapidly narrowed, which meant that the advantage of cheaper labour may not be available for much longer.

In this context, even the opening up to more foreign direct investment has not been entirely advantageous. A significant part of the FDI inflows into the region have been in the form of acquisition of existing assets, often in non-tradeable infrastructure or service sectors, rather than in greenfield investment in new projects. Even the greenfield FDI has in general been concentrated in sectors producing or processing natural resources, rather than areas with high potential for productivity growth. Meanwhile aggregate employment in productive sectors has suffered because of more capital intensity in resource based industries, accompanied by relative declines in traditional labour-intensive sectors such as textiles and clothing.

Essentially therefore, the neoliberal strategy has mainly been successful only in the very limited aim of inflation control. But this has been achieved at the cost of a much worse record in terms of growth, employment, poverty reduction, and higher volatility. The important point is that the strategy failed not only in terms of social and distributive consequences, but in terms of a much worse performance in investment, growth and productivity. Not only has the transformation of the productive structure through higher investment and technological change failed to materialise, but many of these variables have actually deteriorated in most of the economies of the region.

© MACROSCAN

2003