Themes > Features

26.05..2008

A Note on Fiscal Devolution and the Centrally Sponsored Schemes

Under the Constitution, State governments have always had very significant responsibilities (for law and order, infrastructure development, health, education, agriculture – to name just a few). However, at the same time they have not had commensurate powers either to raise resources or to influence broader trends that create the context or enabling conditions for fulfilling these responsibilities. This is why the fundamental fiscal difference between Centre and States – that state governments necessarily face a hard budget constraint unlike the central government – is so important. This obviously puts direct limits upon the capacity of state governments to fulfil even their constitutional responsibilities towards their citizens.

Increasingly,

the powers to raise resources are constrained by the distribution of

revenue-generating powers in the context of the changing composition

of national income. Since the state governments cannot impose service

taxes, and therefore must exclude the fastest growing segment of the

economy from their resource raising efforts, they are at a significant

disadvantage compared to the central government in this regard. So the

pattern of fiscal devolution from Centre to States is of the utmost

significance for most developmental issues as well as basic socio-economic

rights of the citizens in the country as a whole.The basic means of

financial transfer is through the successive Finance Commissions, which

are supposed to ensure a fair and equitable devolution of fiscal resources

from the Centre to States. However, the terms of reference of recent

Finance Commissions have gone beyond the simple allocation of tax revenues

between Centre and different States according to a given formula, to

allowing and even proposing conditional transfers, even if this goes

against the basic principle of federal devolution. Thus, the Eleventh

Finance Commission proposed a system of debt relief to states which

required them to first pass fiscal responsibility legislation according

to parameters laid down by the Centre.For all the talk of decentralisation,

this actually amounts to a greater centralisation of government finances.

Direct central allocations to states are increasingly covered by conditionalities,

even if they are egregious or unsuitable to the state in question. A

case in point is the transfer of funds under the Jawaharlal Nehru National

Urban Renewal Mission (JNNURM), which requires problematic measures

such as the elimination of stamp duty by recipient state governments.

Or they are so rigid as to make it difficult to adjust the funding to

local requirements, as in the case of the Sarva Shiksha Abhiyan (SSA)

where exactly the same norms for expenditure are laid down for all states

regardless of differing contexts.Another attempt to undermine federalism

and the authority of elected state governments comes in the arguments

for fiscal provisions by the Centre directly to panchayats at district

level. With norms for expenditure determined by the Centre, as well

as "capacity building" of panchayat members by the Centre,

this amounts to an extremely centralised notion of decentralisation,

where the real decisions are made at the very top of national government

rather than being delegated to states and then to panchayats.In this

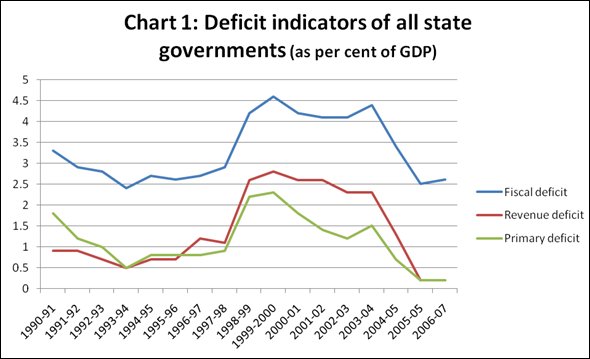

context, what is the current situation with respect to the fiscal health

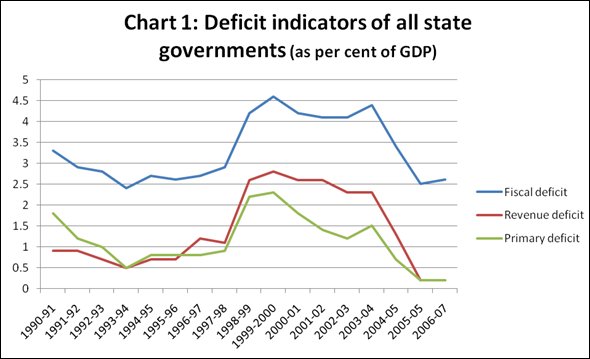

of states and financial devolution? Chart 1 describes the pattern of

deficit among all state governments taken together. It is evident that

the severe fiscal crisis of the states that was so marked in the early

years of this decade is no longer as pervasive. Since 2004 all the major

deficit indicators have been declining, and the revenue and primary

deficits are now close to zero for the states as a whole. Even the fiscal

deficit total is under 3 per cent of GDP.

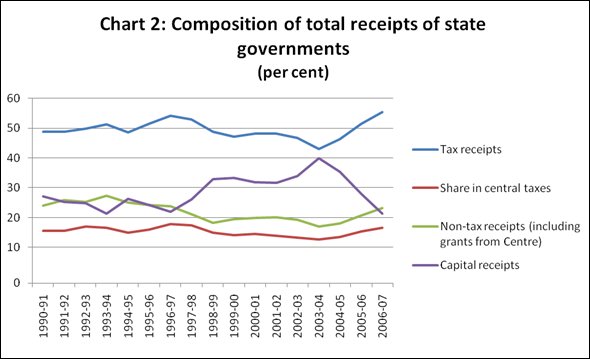

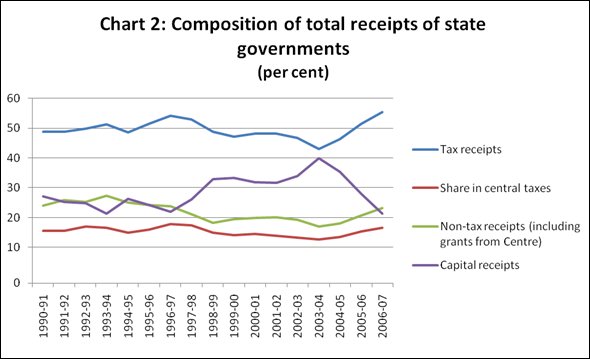

It is generally supposed that this improved fiscal health is the reuslt of the Eleventh Finance Commisison’s award, which is perceived ot have substantially increased grants to states and also allowed some debt write-off to those states that agreed to pass the controversial fiscal responsbility legislation. However, Chart 2 indicates that such a conclusion is not justified. In fact, the significant increase has been in tax receipts of the state governments themselves, which in 2006-07 accounted for more than 55 per cent of their total fiscal resources.

The share in central taxes has remained small and shown hardly any increase as a proportion of total receipts. Even all non-tax receipts (which include grants from the Centre as the biggest chunk) have not increased veyr much and remain at less than a quarter of total receipts. It is worth noting that the share of capital receipts has declined very sharply in recent years.

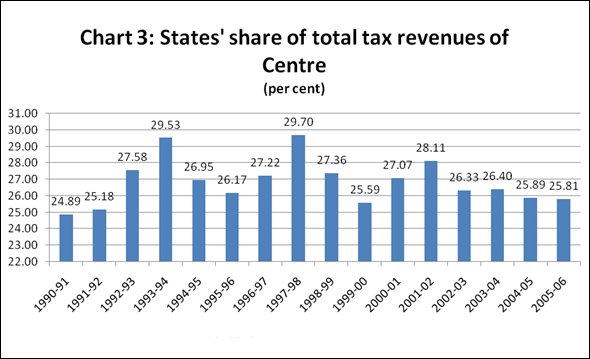

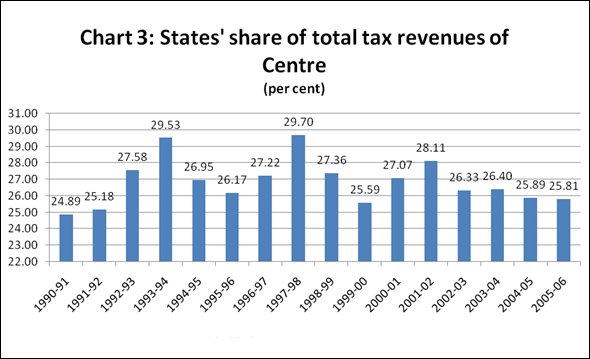

The relatively low and even declining share of central taxes is confimred by the evidence on the states’ share of central taxes as a proportion of the totla central tax collection. Chart 3 shows that this has been declining since the most recent peak of 2001-02, and that the average of the last three years (2004-05 to 2006-07) is well below the average of the three-year period of a decade earlier. All the state government taken together currently receive just around one quarter of central tax revenues, even though they are directly responsible for most of the public service delivery that directly affects the lives of people.

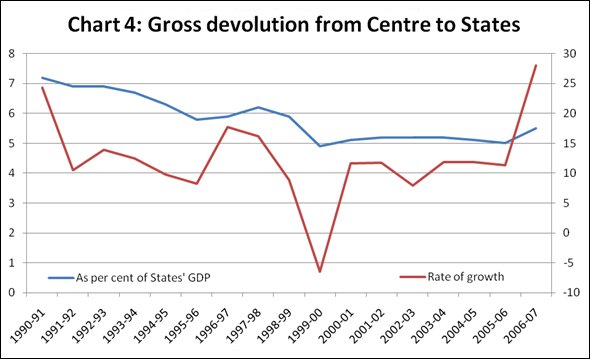

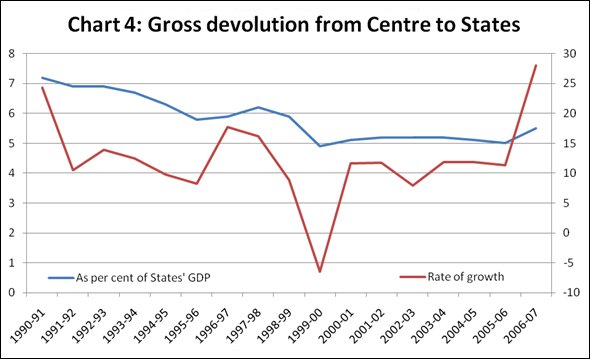

What of the total financial devolution, that is including grants and all other mechanisms? In current nominal terms that has certainly been rising, as indicated by Chart 4 which show the nominal rate of growth on the right hand scale. However, as share of GDP of states they have been mostly stganant in the recent period, and indicate some evidence of medium-term decline compared to the early 1990s.

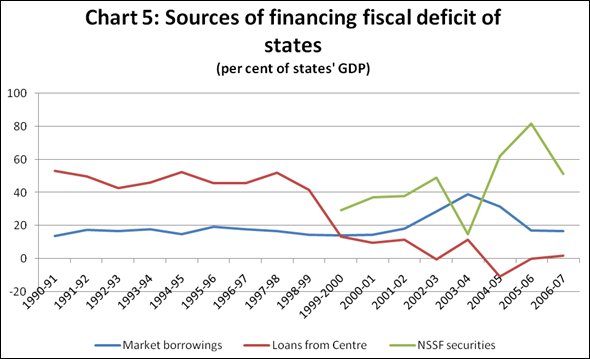

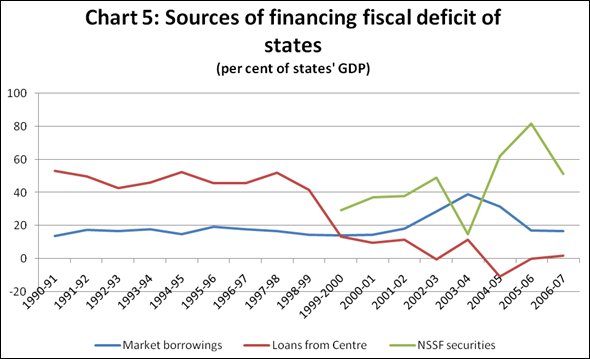

It was noted earlier that capital receipts had been declining as a percentage of total state governments’ receipts, and stood at only 21 per cent in 2006-07. Within this, however, the share of market borrowings increased, as evident from Chart 5 which exmaines the nature of financing the fiscal deficit for all states. In the last three years described here there has also been a sharp increase in use of small svaings (the NSSF or Natioanl Small Savings Fund) which reflects the shift in personal savings away from bank deposits to small savings because of interest rate differentials. This of course means that state governments have had to pay relatively higher rates of interest on borrowing even in the period of lower interest rates on average, but at least they automatically receive most of these funds. Evidence from 2007-08 suggests that this was not forthcoming last year. Meanwhile, loans from the central government have declined to the point of irrelevance.

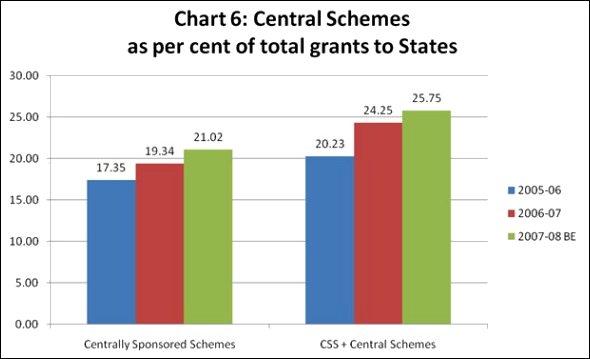

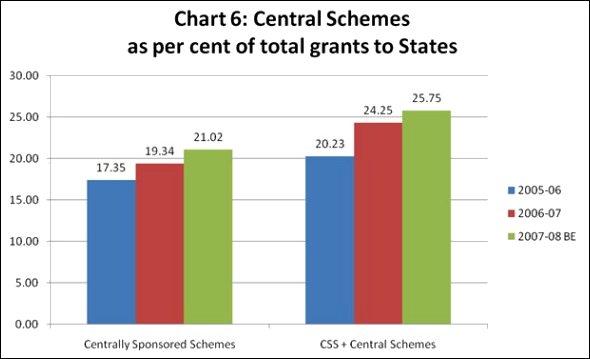

It is sometimes believed that grant funds, which are non-interest bearing and supposedly untied, allow a greater degree of comfort and flexibility to states, and indeed the Eleventh Finance Commission put more emphasis on grants for thosereaosns, as well as because of the perceived decline in aggregate tax-GDP ratios. However, a substantial proportion of the grants provided to the States come in the form of Central Schemes and Centrally Sponsored Schemes.

Chart 6 shows that not only are these significant, but they have also been increasing as a proportion of total grants in the recent period. Strictly speaking, transfers for Central Schemes should not be included in such grants at all or counted as part of devolved resources, since they reflect central government expenditure that is simply administered by states. Centrally Sponsored Scehemes are also problematic since they typically require matching expenditure by states (of varying proportions acording to Scheme) and are in any case completely determined by the Centre, in terms of content, structure, format and process.

So they cannot really be described as devolved funds at all. This is especially the case given the significant increase in different forms of conditionality that now accompany most if not all Centrally Sponsored Schemes. However, it is apparent from Chart 6 that more than one-fourth of all grants to States come in these centralised forms.

All this suggests that fiscal federalism still remains somewhat of an empty promise in India, despite all the protestations to the contrary. If this is indeed the case, and the central government continues to control the bulk of public finances in India, then surely it should also take more responsibility for the eocnomic and social outcomes that are determined by poublic spending.

It is generally supposed that this improved fiscal health is the reuslt of the Eleventh Finance Commisison’s award, which is perceived ot have substantially increased grants to states and also allowed some debt write-off to those states that agreed to pass the controversial fiscal responsbility legislation. However, Chart 2 indicates that such a conclusion is not justified. In fact, the significant increase has been in tax receipts of the state governments themselves, which in 2006-07 accounted for more than 55 per cent of their total fiscal resources.

The share in central taxes has remained small and shown hardly any increase as a proportion of total receipts. Even all non-tax receipts (which include grants from the Centre as the biggest chunk) have not increased veyr much and remain at less than a quarter of total receipts. It is worth noting that the share of capital receipts has declined very sharply in recent years.

The relatively low and even declining share of central taxes is confimred by the evidence on the states’ share of central taxes as a proportion of the totla central tax collection. Chart 3 shows that this has been declining since the most recent peak of 2001-02, and that the average of the last three years (2004-05 to 2006-07) is well below the average of the three-year period of a decade earlier. All the state government taken together currently receive just around one quarter of central tax revenues, even though they are directly responsible for most of the public service delivery that directly affects the lives of people.

What of the total financial devolution, that is including grants and all other mechanisms? In current nominal terms that has certainly been rising, as indicated by Chart 4 which show the nominal rate of growth on the right hand scale. However, as share of GDP of states they have been mostly stganant in the recent period, and indicate some evidence of medium-term decline compared to the early 1990s.

It was noted earlier that capital receipts had been declining as a percentage of total state governments’ receipts, and stood at only 21 per cent in 2006-07. Within this, however, the share of market borrowings increased, as evident from Chart 5 which exmaines the nature of financing the fiscal deficit for all states. In the last three years described here there has also been a sharp increase in use of small svaings (the NSSF or Natioanl Small Savings Fund) which reflects the shift in personal savings away from bank deposits to small savings because of interest rate differentials. This of course means that state governments have had to pay relatively higher rates of interest on borrowing even in the period of lower interest rates on average, but at least they automatically receive most of these funds. Evidence from 2007-08 suggests that this was not forthcoming last year. Meanwhile, loans from the central government have declined to the point of irrelevance.

It is sometimes believed that grant funds, which are non-interest bearing and supposedly untied, allow a greater degree of comfort and flexibility to states, and indeed the Eleventh Finance Commission put more emphasis on grants for thosereaosns, as well as because of the perceived decline in aggregate tax-GDP ratios. However, a substantial proportion of the grants provided to the States come in the form of Central Schemes and Centrally Sponsored Schemes.

Chart 6 shows that not only are these significant, but they have also been increasing as a proportion of total grants in the recent period. Strictly speaking, transfers for Central Schemes should not be included in such grants at all or counted as part of devolved resources, since they reflect central government expenditure that is simply administered by states. Centrally Sponsored Scehemes are also problematic since they typically require matching expenditure by states (of varying proportions acording to Scheme) and are in any case completely determined by the Centre, in terms of content, structure, format and process.

So they cannot really be described as devolved funds at all. This is especially the case given the significant increase in different forms of conditionality that now accompany most if not all Centrally Sponsored Schemes. However, it is apparent from Chart 6 that more than one-fourth of all grants to States come in these centralised forms.

All this suggests that fiscal federalism still remains somewhat of an empty promise in India, despite all the protestations to the contrary. If this is indeed the case, and the central government continues to control the bulk of public finances in India, then surely it should also take more responsibility for the eocnomic and social outcomes that are determined by poublic spending.

©

MACROSCAN 2008