Themes > Features

25.05.2005

The Crisis of State Government Debt

C.P. Chandrasekhar and

Jayati Ghosh

Finance

Commission reports are typically all about the devolution of resources.

The statutory job of the Finance Commissions is usually twofold: to

determine the principles for the distribution of the net proceeds of

shared tax revenues between the Centre and the States; and to provide

for revenue deficit grants from the Centre to those States whose normative

expenditures are likely to exceed normative revenue. However, more recently,

the Central Government has taken it upon itself to extend the terms

of reference of Finance Commissions to cover issues of fiscal sustainability.

Thus,

the terms of reference of the TFC include the following: ''The Commission

shall review the state of finances of the Union and the States and suggest

a plan by which the Governments, collectively and severally, may bring

about a restructuring of the public finances restoring budgetary balance,

achieving macro-economic stability and debt reduction along with equitable

growth.''

The issue of public debt has become a crucial one primarily for the

States in India. It is widely recognized that the large overhang of

debt of almost all state governments has implied such large interest

payments that the States are effectively crippled with respect to the

ability to undertake important socially necessary expenditure. Since

the States are dominantly responsible for most of the types of public

expenditure which affect the day-to-day life of the people, ranging

from law and order and basic infrastructure to health, sanitation and

education, the fiscal crisis of the States has meant that these expenditures

have been very adversely affected in most parts of India.

The need to restructure the debt of the States has been widely accepted,

for several reasons. The first is the adverse impact on expenditure

noted above. The second is the fact that for some years now, the States

have been paying higher interest rates for a variety of reasons discussed

below. The rules imposed by the Reserve Bank of India, which require

case by case permission to States for accessing commercial debt in they

are running revenue deficits, have also operated to make borrowing difficult

and have driven several States to high-conditionality debt from multilateral

agencies such as the World Bank and the Asian Development Bank.

The actual patterns of fiscal imbalances across Centre and States are

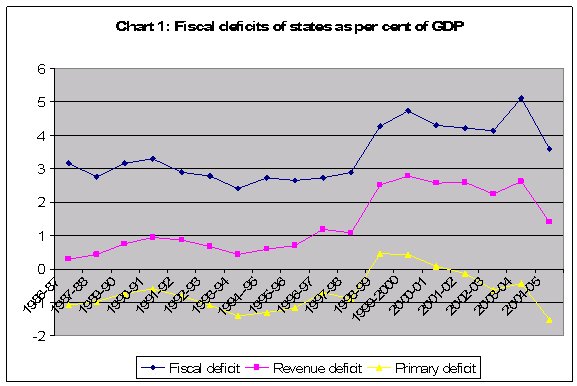

worth noting as background. Chart 1 describes the fiscal indicators

of the States since the late 1980s. It is evident that in the aggregate,

the fiscal deficit of the States as share of GDP was well within sustainable

limits, at around 3 per cent of GDP, until 1997-98. Thereafter there

was a sharp rise, led almost entirely by the rise in revenue deficit,

and this can be traced to Central government measures such as the Pay

Commission hikes.

However, since the turn of the decade, the States' revenue deficit as

a share of GDP has been rising even though they have cut spending and

improved revenue effort. The primary revenue balance has been in surplus,

sometimes quite sharply so, even as the revenue and fiscal deficits

have been increasing, largely because of the effect of the debt overhang

and the unduly high interest rates the States have had to pay.

This

has been further compounded by the decline in central transfers to States

over the years. Such transfers have declined from 40 per cent of the

central tax receipts in the first half of the 1990s to an average of

36 per cent after 1996. Since the Centre's tax revenues have declined

as a share of GDP over this period, this has meant an even sharper decline

as a per cent of GDP. In fact, the States' tax effort has been significantly

better than that of the Centre. So the apparent ''lack of fiscal correction''

by the States in recent years relates entirely to the debt structure

and its implications.

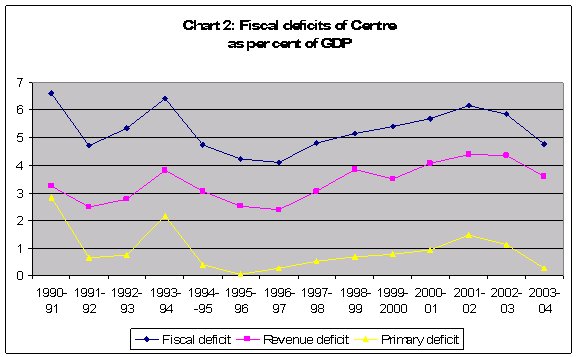

Contrast this with the performance of the Centre, as indicated in Chart

2. While the fiscal deficit declined in the early 1990s, it rose again

quite sharply in 1994-95, after financial liberalisation measures raised

the cost of borrowing by the government and led to increased interest

payments. The subsequent rise in fiscal deficit ratios, post-1997, has

not been only because of interest payments, however, but because of

other expenditures essentially on the revenue account and declining

tax ratios, as revenue deficits and the primary deficits have increased

as share of GDP.

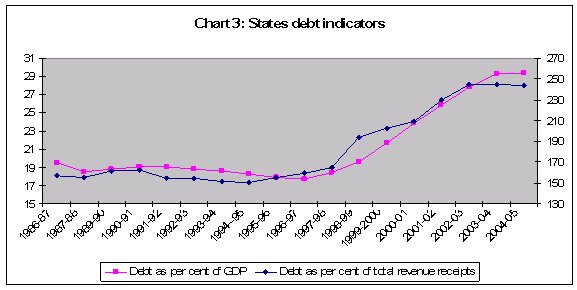

As Chart 3 shows, the total debt of the States was more or less constant as a share of GDP for around a decade until 1997-98, and so was the ratio of debt to total revenue receipts. Thereafter, however, states' debt as a proportion of GDP has ballooned and the ratio of debt to revenue receipts of states has nearly doubled. This is clearly an unsustainable situation, but, as noted earlier, it has not been brought about either by worsening tax generation (which has been broadly stable) or excessive total expenditure, since the primary balance (net of interest payments) generally been in surplus except for only a few years. Rather, this is due to the combination of falling central transfers and related inability to repay the high interest on previously contracted debt.

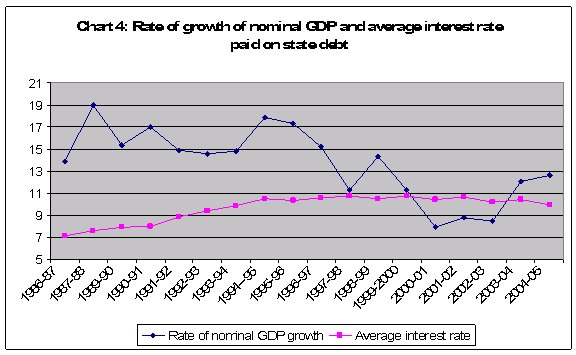

There are various indicators of debt sustainability which are typically estimated, but it is generally accepted that at the very minimum, the growth of nominal GDP must be greater than or at least equal to the rate of growth of interest that has to be paid. It is evident from Chart 4 that until 1997-98, such a condition was more than adequately met. However, since then, not only has the rate of growth of nominal GDP fallen, but interest rates have remained consistently high. As a result, for three critical years since 2000, this condition has not been met, which obviously makes servicing the debt difficult if not impossible. It is this which has then led to further debt accumulation, which obviously makes the trajectory an unsustainable one.

But

why have interest rates remained so high if the general perception of

declining interest rates is valid? This is where the discriminatory

attitude of the Centre towards States in general has had such a negative

impact. Under the Constitution, the Centre has the power to determine

both the extent and the terms of borrowing by the States from all sources,

not only from itself. This power has been used increasingly by the Centre

to restrict States from accessing different types of loans and in effect

dramatically increasing the cost of borrowing for States.

There are several ways in which this has been done. The central government

has been charging the state governments higher rates of interest on

debt which it issues to them, in fact substantially higher than the

Centre has been paying itself. The Centre has also used aggressively

its Constitutional powers to limit the ability of the States to borrow

from the market and from commercial banks. Any state government which

has a revenue deficit therefore has to seek special permission from

the Reserve Bank of India to borrow from commercial banks, permission

which is not necessarily granted. Finally, state governments taking

on debt provided by multilateral institutions or even loans from bilateral

donors have not paid the rate of interest charged by them, but a much

higher rate imposed by the Centre, which is the intermediary for such

transactions.

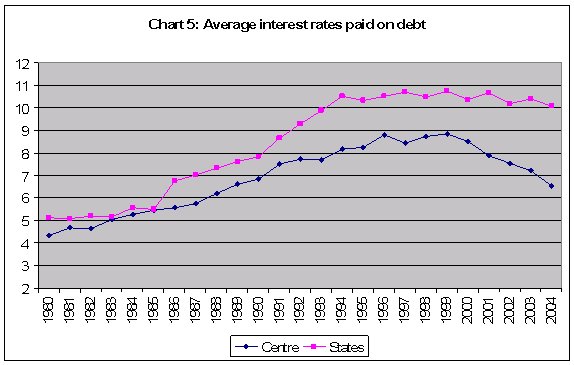

The

consequence of all this is evident in Chart 5, which gives some indication

of the average rates of interest paid on debt contracted by the Centre

and the States. This gives the average, not marginal, rates, but the

shapes of the curves provide an indication of the marginal changes.

From around 1997 onwards, the average rate of interest paid by the Centre

on its own debt has fallen significantly, from 9 per cent to around

6.5 per cent, which suggests a much sharper decline at the margin. By

contrast, the average interest rate paid by the States has remained

broadly stable over this entire period, so marginal rates have not really

come down for them. So the Centre has effectively been reaping usurious

benefits from its lending to state governments, and these have amounted

in recent periods to around 1 per cent of GDP, or around 20 per cent

of the central fiscal deficit.

This is the context in which the TFC's discussion of states' debt restructuring

has to be analysed. The TFC has indeed suggested a formula for reducing

the burden of debt of the states, and also for reducing the interest

rates payable by them. However, the positive effects of such a proposal

have been drastically undermined by the proposed condition sought to

be imposed by the TFC, of forcing states to enact fiscal responsibility

legislation and holding to arbitrary targets for fiscal indicators,

in order to get the benefits of dent reduction.

We will provide a discussion of the debt restructuring package and critically

assess the possible effects of such conditions upon state finances in

the next issue of MacroScan.

© MACROSCAN 2005