Themes > Current Issues

15.04.2008

Neoliberal

Discomfort

C.P.

Chandrasekhar

It

perhaps is a little too early to predict the coming death of "neoliberalism",

or the economic philosophy that governments should facilitate the functioning

of "free" economic agents rather than regulate them. More crudely

put, the idea is that markets should be left free to work so long as they

deliver profits. But globally evidence has been growing that markets are

just not working, precipitating crises that requires bringing the state

back in. Oil prices have risen to levels close to their inflation-adjusted

historic highs and there are no signs of quick adjustment. Governments,

therefore, need to ensure that prices in the areas they govern are not

left to the market. Financial markets that had convinced some policy makers

of their ability to govern themselves are facing their worst crisis. The

sub-prime problem, everybody admits, is merely a symptom of a deeper malaise

which calls for a return to intensive regulation. And the crisis in global

food markets, that has triggered food riots which threaten to spread globally,

has made clear that nations cannot expect markets to deliver crucial public

goods like food security.

These, however, are the starkest and most critical failures of neoliberal policy. But there have for some time now been many areas where outcomes that were initially considered signs of the success of neoliberalism have turned out to be more of a problem that an economic gain. In the Indian case, consider, for example, the increase in foreign exchange reserves because of a more liberal policy with regard to foreign direct and portfolio investment and foreign borrowing. During the 1990s the resulting accumulation of reserves, though gradual, was quoted as evidence of the success of neoliberal policy. In 1991, India had faced a foreign exchange crisis. The change in policy that followed, it is argued, ensured that we have enough and more reserves to prevent the recurrence of any such crisis.

More recently, however, the perspective on reserves has changed. The problem now is that we have too much. Foreign currency assets accumulated by the Reserve Bank of India crossed the $300 billion mark in early April, having risen by more than $100 billion over the previous year. Much has been written about the difficulties this rapid accumulation creates for the central bank in terms of both exchange rate and monetary management. Rising reserves have as their counterpart increases in money supply, which the RBI wants to rein in given the inflationary conditions prevailing in the economy. But, large and persistent inflows of foreign currency imply that unless the RBI mops up these dollars through its purchases, the rupee would appreciate with adverse consequences for India’s already beleaguered exporters. In practice, the RBI has intervened substantially in forex markets, even if it has not been completely successful in stalling rupee appreciation.

Caught in this quandary, the RBI and, more recently, the government, have been contemplating the possibility of limiting inflows. But the efficacy of any measures adopted towards that end would depend on the kind of inflows that predominantly account for such accumulation. Detailed figures on the sources of accretion of foreign exchange reserves over the period April to December 2007 (Table 1), recently released by the RBI, permit an assessment of the room for manoeuvre the government has to adopt policies that can realise its goals. The figures show that, after allowing for valuation changes, foreign currency reserves with the RBI rose by $76.1 billion between the beginning of April and the end of December of 2007.

Among the factors underlying this rise in reserves, are invisible receipts that helped cover a substantial share of the deficit on the merchandise trade account recorded during April to December 2007. According to balance of payments figures from the RBI, gross invisibles receipts comprising current transfers (that include remittances from Indians overseas), revenues from services exports, and income amounted to $100.2 billion during April to December of 2007. The increase in invisibles receipts was mainly led by remittances from overseas Indians ($13.8 billion) and software services ($27.5 billion). After accounting for outflows net invisible receipts stood at $50.5 billion.

The result of these inflows was that while on a BoP basis the merchandise trade deficit had increased from $50.3 billion during April to December 2006 to $66.5 billion during April to December 2007, or by more than $16 billion, the current account deficit had gone up by just $2 billion from $14 billion to $16 billion.

Given its small size, financing that deficit with capital inflows was not a problem. The problem in fact has turned out to be exactly the opposite: capital inflows have been too large. Net capital inflows during the first nine months of financial year 2007-08 amounted to $83.2 billion. The three major items accounting for these inflows were portfolio investments ($33 billion), external commercial borrowings ($16.3 billion) and short term credit ($10.8 billion). To accommodate these and other flows of smaller magnitude, without resulting in a substantial appreciation of the rupee, the central bank had to purchase dollars and increase its s reserve holdings (after adjusting for valuation changes) by as much as $76 billion or by an average of around $8.5 billion every month. This trend has only intensified since then with reserves having risen by $33.8 billion between the end of December 2007 and the end of Mach 2008 or by an average of more than $11 billion a month.

Though inflation is now the focus of policy attention in the country, the government cannot postpone any further dealing with this problem. The first step the government needs to take is to put a stop to borrowing abroad by Indian corporates, much of which is to finance rupee expenditures. This is a clear form of a carry trade in which loans at lower than domestic interest rates in foreign markets is used to finance domestic investments, some of which may even be speculative, in the hope that the investor concerned can not merely benefit from differentials in the rates of return but also from the appreciation of the rupee between the time the loan is contracted and repaid. There is no reason why the government and the central bank should be left with a macroeconomic muddle just because sections of the private sector are looking for quick returns. A return to a more stringent external borrowing regime with lower ceilings is the obvious option for the government.

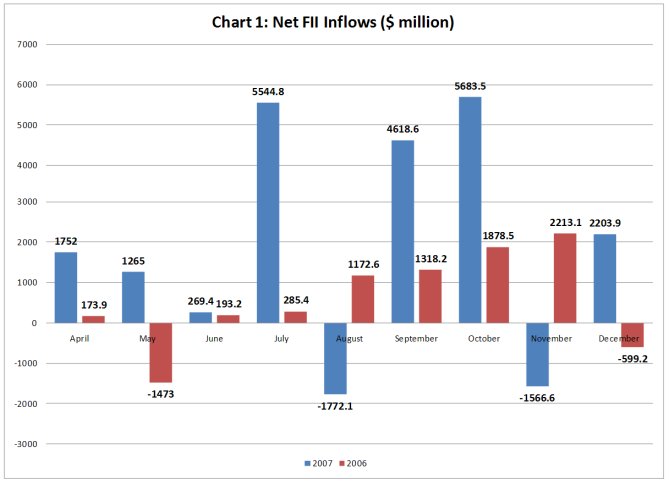

Controlling the second of the flows that are resulting in large accretion of foreign exchange reserves, namely, portfolio investment flows is more difficult. This consists of flows in which the acquisition of shares by a single foreign investor in an Indian company is less than 10 per cent of the aggregate shareholding. This could occur either through the FII route involving purchases of shares in the stock market or the private placement route where share acquisition is ensured through negotiations with the promoters. Acquisitions through private placements now far exceed acquisitions through the stock market. Thus, while the SEBI reports that net FII inflows in the form of equity and debt during April to December 2007 was around $18 billion (Chart 1), the RBI reports that net portfolio investment during the period was $33 billion. Almost as much portfolio investment seems to be coming through the private placement route as is happening through the FII route.

This suits foreign investors, investments by whom would otherwise have been constrained by the volume of free floating shares of listed companies that are available for trading. This is known to be small. Private placements suit Indian promoters as well because they are in a position to sell, at a premium, a small slice of shares, which would not threaten their control over the company. If these are new shares issued for the purpose and if the premium is large enough, the company obtains a relatively large volume of resources to finance expansion. In return for this investment existing shareholders who now own a part of a larger company need to reward the foreign investors with dividends only when profits are made. If the promoters had resorted to borrowing instead, interest and amortisation payments would have to be paid irrespective of the profit performance of the company. It is of course true that foreign investors are resorting to such investments in the hope of selling out these shares at a later date at an appreciated price. If such expectations are realised, the promoters gains because it increases the market valuation of their own shares and therefore their net worth. If these expectations are not realised the promoters anyway benefit from the expansion of the company financed with funds obtained at extremely low cost. Here again, it is the search for significant gains by domestic wealthholders that is partly driving the large inflow.

These, however, are the starkest and most critical failures of neoliberal policy. But there have for some time now been many areas where outcomes that were initially considered signs of the success of neoliberalism have turned out to be more of a problem that an economic gain. In the Indian case, consider, for example, the increase in foreign exchange reserves because of a more liberal policy with regard to foreign direct and portfolio investment and foreign borrowing. During the 1990s the resulting accumulation of reserves, though gradual, was quoted as evidence of the success of neoliberal policy. In 1991, India had faced a foreign exchange crisis. The change in policy that followed, it is argued, ensured that we have enough and more reserves to prevent the recurrence of any such crisis.

More recently, however, the perspective on reserves has changed. The problem now is that we have too much. Foreign currency assets accumulated by the Reserve Bank of India crossed the $300 billion mark in early April, having risen by more than $100 billion over the previous year. Much has been written about the difficulties this rapid accumulation creates for the central bank in terms of both exchange rate and monetary management. Rising reserves have as their counterpart increases in money supply, which the RBI wants to rein in given the inflationary conditions prevailing in the economy. But, large and persistent inflows of foreign currency imply that unless the RBI mops up these dollars through its purchases, the rupee would appreciate with adverse consequences for India’s already beleaguered exporters. In practice, the RBI has intervened substantially in forex markets, even if it has not been completely successful in stalling rupee appreciation.

Caught in this quandary, the RBI and, more recently, the government, have been contemplating the possibility of limiting inflows. But the efficacy of any measures adopted towards that end would depend on the kind of inflows that predominantly account for such accumulation. Detailed figures on the sources of accretion of foreign exchange reserves over the period April to December 2007 (Table 1), recently released by the RBI, permit an assessment of the room for manoeuvre the government has to adopt policies that can realise its goals. The figures show that, after allowing for valuation changes, foreign currency reserves with the RBI rose by $76.1 billion between the beginning of April and the end of December of 2007.

Table

1: Sources of Accretion to Foreign Exchange Reserves |

||||||

April-December

2007 |

April-December

2006 |

|||||

Current

Account Balance |

-16 |

-14 |

||||

Capital

Account (net) (a to f) |

83.2 |

30.2 |

||||

Foreign

Investment (i+ii) |

41.4 |

12.8 |

||||

(i)

Foreign Direct Investment |

8.4 |

7.6 |

||||

(ii) Portfolio Investment |

33 |

5.2 |

||||

Banking

Capital |

5.8 |

0.2 |

||||

of

which: NRI Deposits |

-0.9 |

3.7 |

||||

Short-Term

Credit |

10.8 |

5.7 |

||||

| External Assistance | 1.3 |

1 |

||||

| External Commercial Borrowings | 16.3 |

9.8 |

||||

| Other items in capital account | 7.6 |

0.7 |

||||

| Valuation change | 8.9 |

9.4 |

||||

| Total (I+II+III) | 76.1 |

27.8 |

||||

Source:

Reserve Bank of India. |

||||||

Among the factors underlying this rise in reserves, are invisible receipts that helped cover a substantial share of the deficit on the merchandise trade account recorded during April to December 2007. According to balance of payments figures from the RBI, gross invisibles receipts comprising current transfers (that include remittances from Indians overseas), revenues from services exports, and income amounted to $100.2 billion during April to December of 2007. The increase in invisibles receipts was mainly led by remittances from overseas Indians ($13.8 billion) and software services ($27.5 billion). After accounting for outflows net invisible receipts stood at $50.5 billion.

The result of these inflows was that while on a BoP basis the merchandise trade deficit had increased from $50.3 billion during April to December 2006 to $66.5 billion during April to December 2007, or by more than $16 billion, the current account deficit had gone up by just $2 billion from $14 billion to $16 billion.

Given its small size, financing that deficit with capital inflows was not a problem. The problem in fact has turned out to be exactly the opposite: capital inflows have been too large. Net capital inflows during the first nine months of financial year 2007-08 amounted to $83.2 billion. The three major items accounting for these inflows were portfolio investments ($33 billion), external commercial borrowings ($16.3 billion) and short term credit ($10.8 billion). To accommodate these and other flows of smaller magnitude, without resulting in a substantial appreciation of the rupee, the central bank had to purchase dollars and increase its s reserve holdings (after adjusting for valuation changes) by as much as $76 billion or by an average of around $8.5 billion every month. This trend has only intensified since then with reserves having risen by $33.8 billion between the end of December 2007 and the end of Mach 2008 or by an average of more than $11 billion a month.

Though inflation is now the focus of policy attention in the country, the government cannot postpone any further dealing with this problem. The first step the government needs to take is to put a stop to borrowing abroad by Indian corporates, much of which is to finance rupee expenditures. This is a clear form of a carry trade in which loans at lower than domestic interest rates in foreign markets is used to finance domestic investments, some of which may even be speculative, in the hope that the investor concerned can not merely benefit from differentials in the rates of return but also from the appreciation of the rupee between the time the loan is contracted and repaid. There is no reason why the government and the central bank should be left with a macroeconomic muddle just because sections of the private sector are looking for quick returns. A return to a more stringent external borrowing regime with lower ceilings is the obvious option for the government.

Controlling the second of the flows that are resulting in large accretion of foreign exchange reserves, namely, portfolio investment flows is more difficult. This consists of flows in which the acquisition of shares by a single foreign investor in an Indian company is less than 10 per cent of the aggregate shareholding. This could occur either through the FII route involving purchases of shares in the stock market or the private placement route where share acquisition is ensured through negotiations with the promoters. Acquisitions through private placements now far exceed acquisitions through the stock market. Thus, while the SEBI reports that net FII inflows in the form of equity and debt during April to December 2007 was around $18 billion (Chart 1), the RBI reports that net portfolio investment during the period was $33 billion. Almost as much portfolio investment seems to be coming through the private placement route as is happening through the FII route.

This suits foreign investors, investments by whom would otherwise have been constrained by the volume of free floating shares of listed companies that are available for trading. This is known to be small. Private placements suit Indian promoters as well because they are in a position to sell, at a premium, a small slice of shares, which would not threaten their control over the company. If these are new shares issued for the purpose and if the premium is large enough, the company obtains a relatively large volume of resources to finance expansion. In return for this investment existing shareholders who now own a part of a larger company need to reward the foreign investors with dividends only when profits are made. If the promoters had resorted to borrowing instead, interest and amortisation payments would have to be paid irrespective of the profit performance of the company. It is of course true that foreign investors are resorting to such investments in the hope of selling out these shares at a later date at an appreciated price. If such expectations are realised, the promoters gains because it increases the market valuation of their own shares and therefore their net worth. If these expectations are not realised the promoters anyway benefit from the expansion of the company financed with funds obtained at extremely low cost. Here again, it is the search for significant gains by domestic wealthholders that is partly driving the large inflow.

As is known it is far easier for the government through tax-based or quantitative measures to control capital inflows through the stock market route. Controlling inflows through directly negotiated purchases of equity requires retracting some of the liberalisation of foreign investment rules that has been adopted in recent years. Thus far the government and the nation have borne the costs associated with this form of profit making by foreign and domestic wealth holders. This may be defensible for some time. But with the inflows persisting, exchange rate and macroeconomic management proving increasingly difficult and instability increasing, it is time to rethink at least some of the liberalisation that has led up to this situation. This is one more area where, the dangers of lightly controlled or uncontrolled markets are being driven home. It is better to learn the lessons early rather than be burdened with a crisis whose dimensions are unknown and solutions unclear – as is currently true in the world of finance globally.

© MACROSCAN

2008