Themes > Analysis

04.05.2010

Shrinking Cereals, Growing Food Parks

Rahul

Goswami

The

first release of summary data from the 64th round of the National Sample

Survey Organisation, ‘Household Consumer Expenditure in India, 2007-08’

(NSSO report 530), captures the early impact of the rising trend in

food prices for rural and urban India. This period is significant in

the recent history of food price rise in India, for it signals the strengthening

of the factors that led to the retail food price highs of 2008, which

began to be recorded around two years earlier. Several of the most important

factors have to do with the rapid pace of urbanisation (most visible

in the non-metro tier-1 cities) and the steady growth in the food processing

and food logistics industries, which has taken place alongside the deepening

of the agricultural commodity markets.

In

its comment on India’s growth-malnutrition paradox, the FAO report World

agriculture: towards 2030/2050 had, in 2006, stated: “To judge from

survey data of food intakes, the situation has been getting worse rather

than improving, at least in terms of per capita calories consumed, and

this phenomenon is fairly widespread affecting all classes, rural and

urban and those below and above the poverty threshold”. The report’s

authors had, at the time, commented that matters in India “are getting

worse in the rural areas as people have to pay more than before for

things like fuel and other basic necessities of life”, and that rural

incomes have not improved at anything near the rates implied by the

high overall economic growth rates.

To illustrate the continuing impact of rising cereal prices on rural

households in Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh and Orissa,

district per capita incomes for 2004-05 to 2009-10 are estimated for

five representative districts from these states. These are districts

that record a median per capita income based on data for the 2004-05

year (the last NSSO household consumption survey year) available with

the Planning Commission's district domestic product tables: Bhabua in

Bihar, Dhamtari in Chhattisgarh, Deoghar in Jharkhand, Khandwa in Madhya

Pradesh and Jajpur in Orissa. The per capita income increases in these

districts are recorded up to 2006-07, and taking the national GDP growth

rate for the years following (9.7%, 9.2%, 6.7% and 7.2%) the overall

finding is that statistical per capita income increases are between

36% (for Khandwa) and 47% (for Dhamtari) for the period 2005-06 to 2009-10.

In these five states, the cereals basket occupies a dominant share of

monthly per capita expenditure (MPCE) on food: 42% of MPCE on food and

25% of total MPCE in Bihar; 41% and 21% in Chhattisgarh; 42% and 25%

in Jharkhand; 33% and 17% in Madhya Pradesh; and 42% and 24% in Orissa.

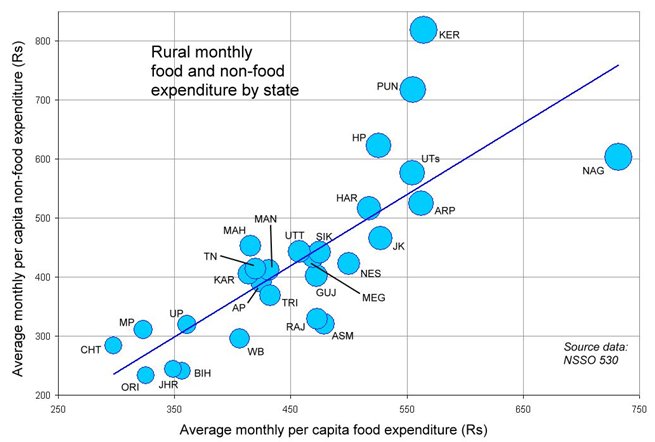

The impact of a steady upward trend in the prices of cereals in these

states - whose rural households spend roughly the same on food as they

do on non-food needs (see Chart 1) - can be gauged from retail price

data on essential food items collected by the Department of Economics

and Statistics, Ministry of Agriculture. This data, although the most

reliable weekly series recorded in a number of centres in the country,

is weakened by deficiencies (gaps in series, numerical mismatches, and

so on). Even so, the patterns they provide are valuable.

From

January 2005 to January 2010, the prices of atta in Sehore and Bhopal

(MP), of desi wheat in Bhopal and of maize in Patna have risen by 200%.

The prices of 'kalyan' wheat (a widespread HYV cultivar) in Bhopal,

Sehore and Patna (Bihar) have risen by 173% to 177%; the prices of maize

in Ranchi (Jharkhand) and common quality rice in Bhubaneshwar (Orissa)

have risen by 171%; the prices of desi wheat in Patna and atta in Ranchi

have risen 170%; and the prices of common rice in Cuttack and in Dhanbad

(Jharkhand) have risen by 169% and 164%. Over this period, the price

of the available basket of cereals has risen by 157% in Cuttack, 162%

in Bhubaneswar, 159% in Sehore, 174% in Bhopal, 176% in Patna, 166%

in Ranchi and 152% in Dhanbad.

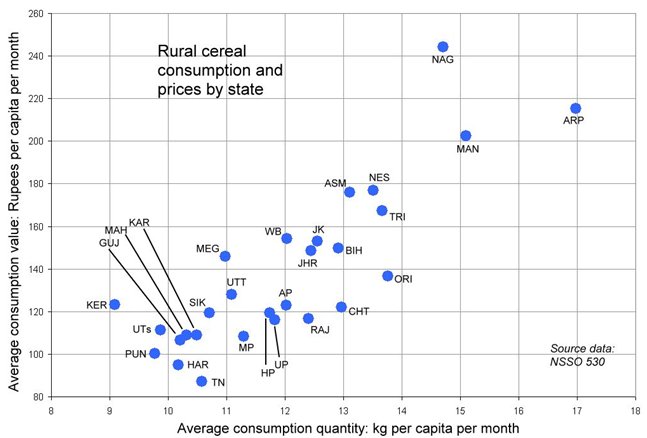

Erratic

data posting (and possibly validation difficulties) have meant that

a better understanding of the food baskets of North-East India is yet

to be achieved. Even so, NSSO 530 shows the heavy reliance by the households

of the North-Eastern states on cereals (rice) with the regional average

consumption greater than that of the states of eastern and central India

in which rice also play a major dietary role: West Bengal, Orissa, Chhattisgarh,

Bihar and Jharkhand. What Chart 2 illustrates is that for those regional

populations dependent on rice, the cost of this dependency is high.

This is not so for wheat in Punjab and Haryana, whose average per capita

consumption quantity of the cereal is both relatively low (as a percentage

of the cereal component of the food basket) and less expensive. For

Gujarat, Maharashtra and Karnataka - all three states affected by rapid

urbanisation and absorbed by the race to build urban and transport infrastructure

- their rural households are far less dependent on a single cereal than

their counterparts in North-East, Eastern or North India. Wheat is the

preferred cereal in Gujarat but accounts for no more than 40% of the

total cereals purchase; rice is the preferred cereal in Karnataka but

accounts for no more than 53% of the total cereals purchase; and wheat

is the preferred cereal in Maharashtra but accounts for no more than

36% of the total cereals purchase.

Food inflation is now a concern for the Reserve Bank of India (RBI) which has begun to make direct causal links between per capita availability of foodgrains and high retail prices. Deepak Mohanty, executive director of RBI, in an address on 'Inflation Dynamics in India: Issues and Concerns' (March 2010) has also drawn a connection between food prices and the minimum support price (MSP) announced by the Government of India for procurement of various commodities. "The high increase in MSP since 2007-08 has given an upward bias to agricultural prices (see Table 1). Reduced availability of foodgrains also tends to keep food prices high. As per the Economic Survey 2009-10, per capita net availability per day of cereals and pulses has been lower than that observed in the previous four decades. The per capita daily availability of foodgrains was 447 grams in the 1960s and 1970s, which successively increased to 459 grams in the 1980s and 478 grams in the 1990s, but came down to 446 grams during 2000-08 and stood still lower at 436 grams in 2008."

Table

1 - Crops: variations in MSP and WPI |

|||||||

Average

annual growth rate % |

|||||||

2003-04

to 2006-07 |

2007-08

to 2009-10 |

||||||

| Paddy | MSP | 2.3 |

18.3 |

||||

| WPI | 2.0 |

10.9 |

|||||

| Wheat | MSP | 5.1 |

14.4 |

||||

| WPI | 5.5 |

6.7 |

|||||

| Tur | MSP | 1.7 |

18.0 |

||||

| WPI | 3.9 |

26.3 |

|||||

| Moong | MSP | 3.4 |

23.2 |

||||

| WPI | 11.3 |

13.2 |

|||||

| Table source: Reserve Bank of India | |||||||

| MSP: Minimum Support Price | |||||||

| WPI for 2009-10 is averaged up to February 2010 | |||||||

| Data source: Ministry of Agriculture and Office of Economic Adviser, Ministry of Commerce and Industry | |||||||

At

the same time, the Government of India has approved proposals for joint

ventures and foreign collaboration (including 100% FDI) in processed

food businesses (including 100% export-oriented units), and "mega

food parks". According to Indian Credit Rating Agency (ICRA), the

processed food market accounts for 32% of the total food market with

the “most promising” sub-sectors listed as soft-drink bottling, confectionery

manufacture, fishing, aquaculture, grain-milling and grain-based products,

meat and poultry processing, alcoholic beverages, milk processing, tomato

paste, fast-food, ready-to-eat breakfast cereals, food processing, food

additives and flavours. From the point of view of the major national

industry associations (CII, FICCI, Assocham) the approximately 7,500

regulated mandis lack critical infrastructure, the provision of which

will cost at least Rs. 12,000 crores at 2009 prices. The potential of

the public-private partnership model in the foods business is seen by

industry as being embodied in ventures such as Safal market in Karnataka

(considered an example of wholesale market modernisation), ITC's e-Chaupal,

Haryali Kisan Bazaar, Mahindra Subh Labh, Cargill Farm Gate Business

and Tata Kisan Sansar.

Removed

from such a view are the recurrent protests since late 2009 in a number

of urban centres over food inflation, urgent signals that the increasing

corporatisation of food production, procurement, movement and distribution

is contributing to household food insecurity, particularly amongst the

rural and urban poor. The Report on the State of Food Insecurity in

Rural India (M.S. Swaminathan Research Foundation) explicitly stated

that "over the longer period of 1993–94 to 2004–05, the states

of Karnataka, Orissa and Madhya Pradesh show significant increase in

the percentage of population suffering acute calorie deprivation. On

the whole, it is clear that, by our measure of food insecurity, the

period of economic reforms and high GDP growth has not seen an improvement

in food security but deterioration for the majority of Indian states."

[The

author is an agricultural livelihoods researcher with the National Agricultural

Innovation Project's (NAIP) Agropedia programme.]

© MACROSCAN 2010