Themes > Special Feature

20.03.2012

The Great Fuel Subsidy Hoax

It

is commonplace to decry the supposedly unsustainable burden of subsidies

on the state exchequer, and to see desirable "reform" as the

removal of such subsidies. In his Budget Speech, Finance Minister Pranab

Mukherjee lived up to this completely, and declared his intention to

bring down the subsidy bill particularly for fuel and fertilizers. The

Budget Estimates for 2012-13 indicate a decline in the fuel subsidy

bill by as much as Rs 25,000 crore. Clearly, if global oil prices continue

to remain high, this is a feat that cannot be achieved without increasing

fuel prices domestically.

It is unfortunate – but not altogether surprising in the prevailing

climate – that hardly any of the commentary around the Budget pointed

not just to the severely inflationary implications of this, but also

the fact that this is unnecessary. Also, there is a remarkable tendency

in India to believe that this particular price – which is after all

the price of the most essential universal intermediate, fuel – should

be equalized to global prices, even while per capita incomes in India

and the incomes of most consumers remain so far below the global average.

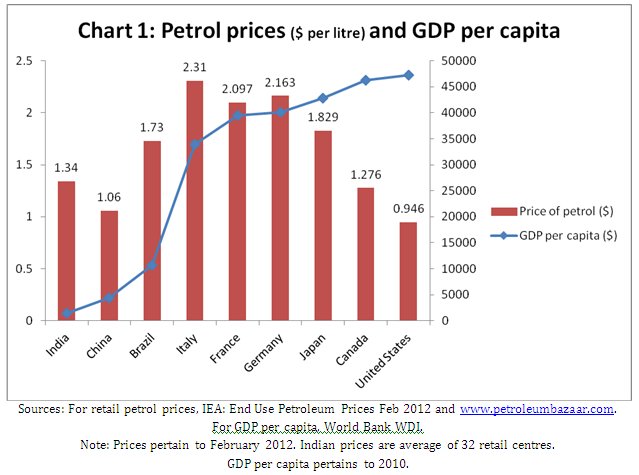

As it happens, retail prices of fuel in India are among the highest

in the world, and significantly higher than in several developed countries

including the United States. Chart 1 shows that relative to per capita

income, Indian retail prices of petrol are already extremely – and unreasonably

– high. For example, in February 2012 the Indian retail price of petrol

(averaged across 32 centres across the country) was 42 per cent higher

than in the US, and 26 per cent higher than in China.

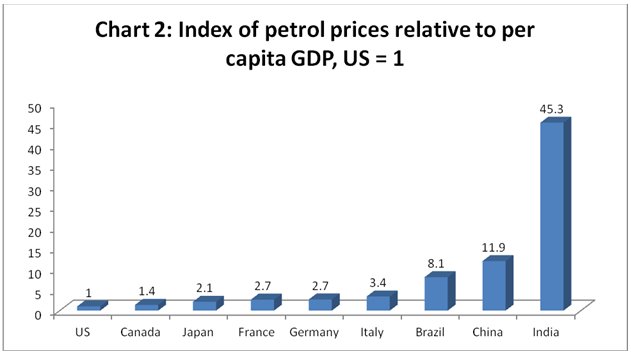

The full extent of this burden is apparent from Chart 2, which plots

the ratio of petrol price to per capita GDP in selected countries, in

index form with the ratio equivalent to 1 in the US (which has the lowest

such ratio among non-oil exporting countries). It is clear that Indian

consumers are being forced to bear an inordinate burden relative to

the average purchasing power. Even compared to other developing countries

like Brazil and China, the burden is extreme. And this does not take

into account the inequalities within the country which make the burden

even more onerous for poorer consumers.

The situation is similar for diesel prices, which is what makes the

matter more extreme. Diesel is close to being a universal intermediate

– entering into costs faced by farmers, the cost incurred in much other

production and obviously the cost of transport. High prices of diesel

therefore feed directly and indirectly into all other prices, including

especially the necessities consumed by the ordinary citizens. Cutting

subsidies that keep this price down is a direct assault on the real

incomes of the poor.

There is a further dishonesty in the government’s approach to the issue,

driven by the tendency to look at the subsidy burden in isolation from

the broader elements of price formation, particularly the tax regime.

In fact, the petroleum sector is not a burden on the government, but

rather a cash cow that yields large revenues in the form of customs

duties and excise duties. Since most of these duties are still specified

as ad valorem rates proportional to the value of the commodity being

taxed, revenues garnered from taxation tend to rise along with the increase

in the international and domestic prices of the commodity. So in that

sense the government is fiscally a substantial gainer from a period

of high global fuel prices, even as it seeks to put more burden on domestic

consumers.

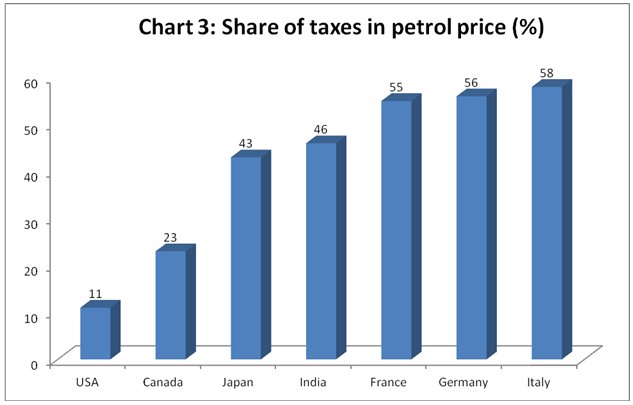

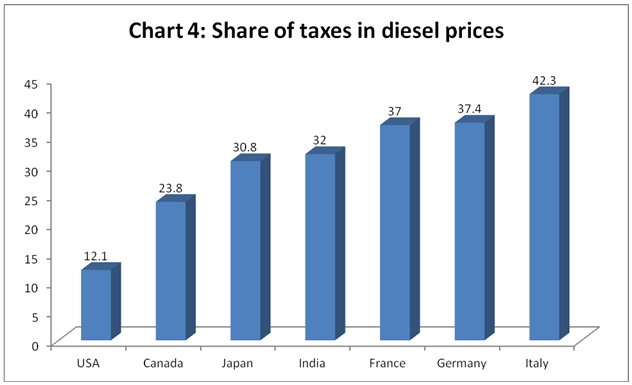

Charts 3 and 4 show the share of taxes in the retail prices of petrol

and diesel in selected countries compared to India. It is evident that

India is somewhat in the middle of this group of developed countries,

which have on average per capita GDP that is nearly thirty times that

of India! In other words, the burden of taxation of this essential good

(which is necessarily inherently regressive in character) is comparable

to countries with massively higher per capita incomes. The contrast

is particularly striking with respect to the USA, since for petrol the

tax burden in India is four times that in the USA, while for diesel

the tax burden in India is nearly three times that in the USA.

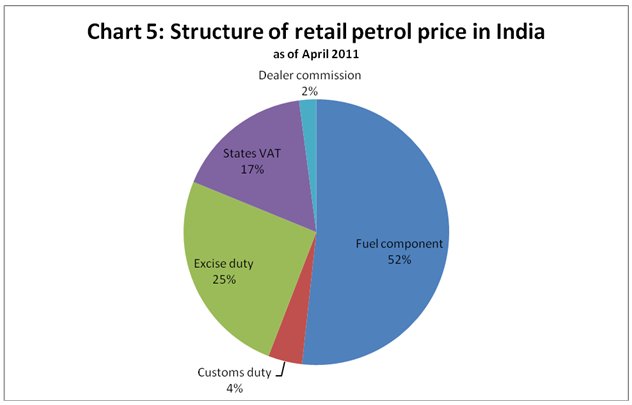

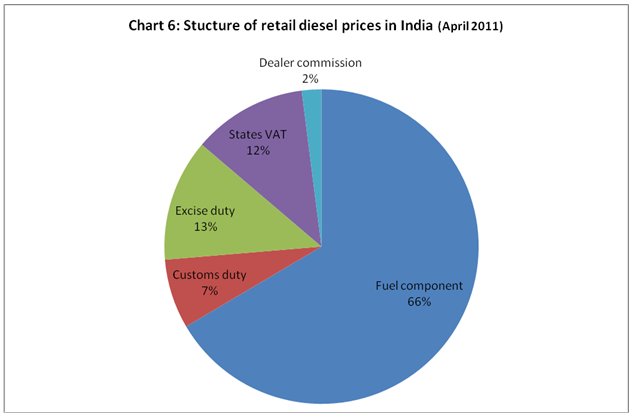

Charts 5 and 6 reveal the structure of components of the retail price in India, based on data for April 2011 presented by the government in response to a question raised in the Lok Sabha in 2011 (as quoted in Rohit, "Economics behind the oil prices in India", www.pragoti.org).

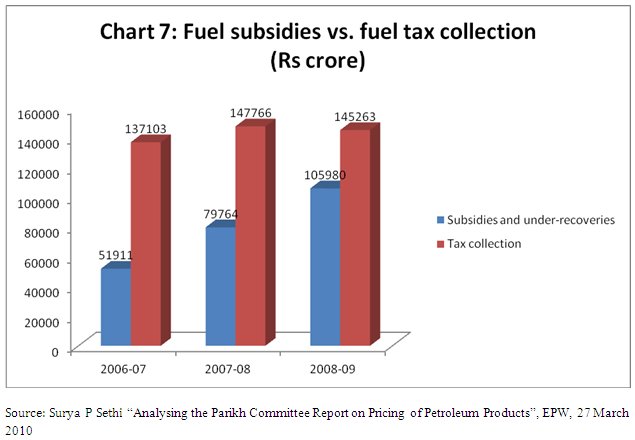

As it happens, the government’s tax collections from petroluem products already far outweigh the subsidies and under-recoveries from oil companies that consitute the drain on the public exchequer. A study by Surya P Sethi, former Energy Advisor to the Planning Commisison, revealed that for the three years at the close of the last decade, tax revenues from oil products had been substantially higher than the outgo on subsidies etc., even in that period of very high global oil prices. Unfortunately more recent data on this are no longer available on the website of the Petroleum Planning and Analysis Cell.

The nature of the Budget Speech was such that the actual measures to

be taken with respect to petroleum pricing were not elaborated. Rather,

statements were made that require action from other Ministries in future,

action that will necessarily involve raising oil prices, with all the

attendant adverse implications.

One point should be clear from this discussion: subsidies in the energy

sector are common across almost all countries, including developed countries,

and are particularly necessary for developing countries like India.

The domestic price of oil cannot be set at levels that recover the costs

of import, since those costs are too volatile and rising. Rather the

domestic price should be set on the premise that it is one element in

a tax-cum-subsidy framework, with the price serving as part tax when

international oil prices are unduly low, and part subsidy when international

oil prices are as high as they are today.

This raises the critical issue of how a subsidy should be viewed. Proponents

of reduced fuel subsidies argue that passing on rising prices and therefore

getting more "realistic" domestic price (that is close to

global market prices) would also encourage more fuel-efficiency and

reduce excess fuel consumption. But this misses the point that the majority

of Indian citizens anyway have very low fuel consumption, and it is

only a small section of the population that can afford to be profligate

in its direct and indirect fuel use.

Higher fuel prices in this context basically raise costs for domestic

producers in both agriculture and non-agriculture, and have cascading

inflationary effects that attack the real incomes of the bulk of people

whose fuel consumption is already low. It is far better to work for

stability and containment of energy prices while taxing the high-fuel

consumption patterns of the rich. So, taxes on luxury cars, air travel,

generators for domestic use or similar expenditure will all contribute

to the desired effect of controlling undesirably excessive fuel consumption

without attacking livelihoods and living standards of all the people.

Avoiding these strategies and causing instead a regressive increase

in fuel prices is not an economic choice – rather it is a choice about

income distribution and deciding to put the burden on the bulk of the

population rather than the privileged few.

©

MACROSCAN 2012