Themes > Features

22.09.2011

The Persistent Global Crisis*

Exactly

a year back, the authoritative Business Cycle Dating Committee of the

US National Bureau of Economic Research declared that the US economy

had experienced a trough in business activity in June 2009. That trough,

in its view, marked the onset of recovery and the end of an 18-month-long

recession that had begun in December 2007.

A year later, as the world's financial leaders gather in Washington

D.C. for the annual meetings of the World Bank and the IMF, that assessment

appears optimistic. The OECD Secretariat suggests that the world is

possibly returning to a period of recession, and that the recovery cited

by the Dating Committee was more a blip than the trend. In its interim

assessment of the outlook for OECD countries released on September 8,

2011, it noted that the recovery had almost come to a halt even by the

second quarter of 2011 in most OECD countries.

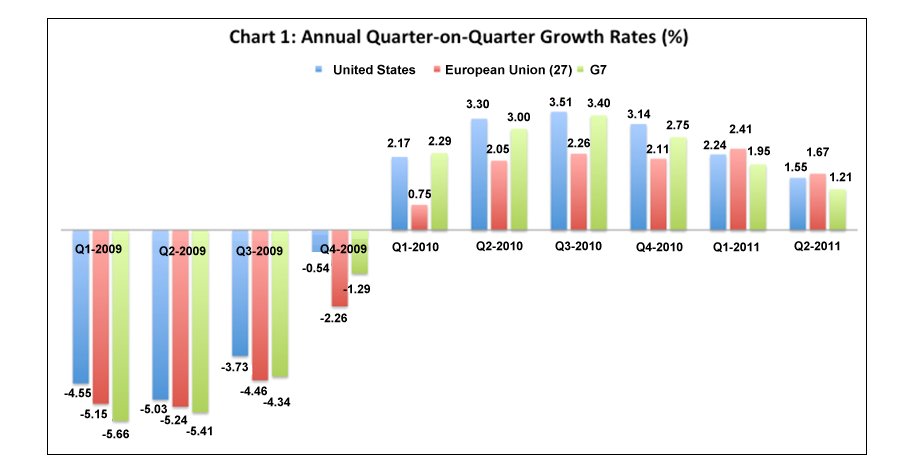

Even though annual quarter-on-quarter growth rates have not returned

to the negative territory they had been in between the third quarter

of 2008 and the fourth quarter of 2009, there are four reasons for gloom.

First, when we compare growth in any quarter relative to the same quarter

of the previous year, there is evidence of a significant decline in

growth rates between the last quarter of 2010 and the second quarter

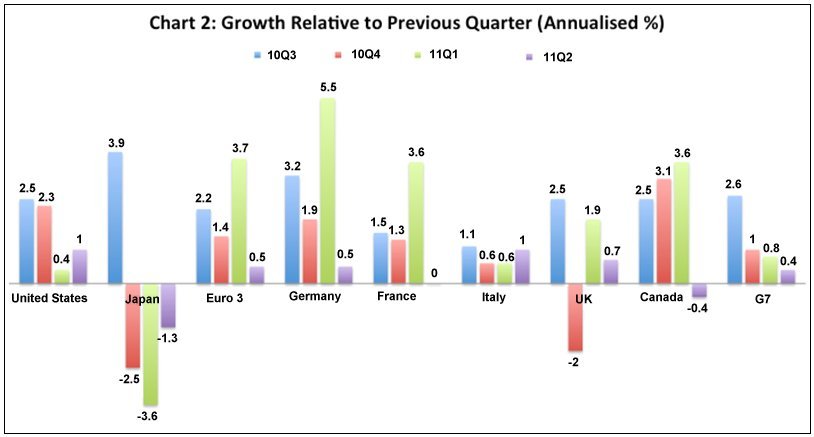

of 2011 (Chart 1). Second, when we examine the annualised growth in

any quarter relative to the immediately preceding quarter, that rate

has fallen significantly in all major OECD countries, including in the

Euro 3 or the core eurozone countries, namely, Germany France and Italy

(Chart 2). Third, there is evidence that this time round emerging market

economies are being impacted quite early. According to the interim assessment,

growth in China eased in the course of the first half of the year and

manufacturing production has weakened. Finally, the OECDs models projecting

growth using lead indicators predict that growth in the G7 economies,

even excluding accident-ravaged Japan, was likely to be less than 1

per cent (annualised), with significantly higher risk of more negative

growth in some major OECD economies.

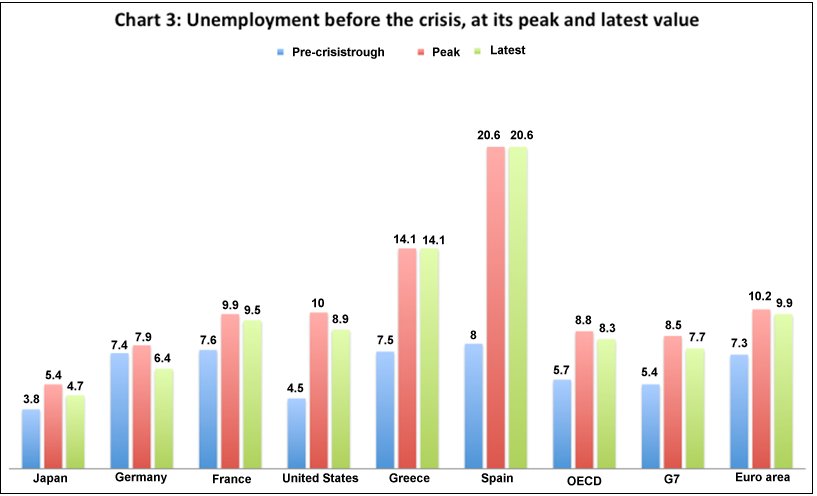

The damage this slide into a second recession would inflict on populations

still reeling under the effects of the Great Recession comes through

from the OECD's recently released Employment Outlook. Unemployment rates

in all leading economies are not very much below the peak levels they

rose to during the recession and are well above the immediate pre-recession

lows they had touched. One in every 12 persons in the workforce is unemployed

in the OECD group of countries. The figure is one in every 10 for the

EU, and as high as one in every five or seven in Spain or Greece (Chart

3). This does not take account of the many who have stopped seeking

work and dropped out of the workforce because of the high levels of

long-term unemployment.

There

are three important reasons why the unemployment problem has persisted

and a real economy growth crisis seems imminent. The first is that the

stimulus adopted in response to the 2008 crisis was grossly inadequate

in most countries and was substantially dissipated in tax cuts and bail-out

packages, which left little for spending that would have strong multiplier

effects, drive long term growth and expand employment. Since governments

did not clearly demarcate the sums allocated for these different kinds

of expenditures in their ''stimulus packages'', the inadequacy of those

packages was not fully recognised. Moreover, those packages could not

ensure that the recovery would lead to the mobilisation of additional

tax revenues that could sustain expenditures. Sustained recovery was

dependent on continuous injections of demand and liquidity.

The second is that having borrowed to finance these insufficient and

inappropriate expenditures, governments have convinced themselves or

been pressured by lenders into believing that they have not just exhausted

their fiscal headroom but borrowed too much and need to retrench substantially.

The fear of ''excess'' public debt and the danger of sovereign default

were used not just to halt the hikes in public borrowing resorted to

in the immediate aftermath of the 2008 crisis, but to require countries

to opt for contraction and austerity. What was and is being forgotten

here are two important facts. The first is that growth driven by stimulus

spending helps to deliver increases in tax revenues that can partly

finance those expenditures. The second is that governments, unlike households,

have the right and the instruments to tax the incomes and wealth of

others to raise resources to meet their debt service commitments.

This kind of blind fiscal conservatism led to the withdrawal of stimulus

measures and a turn to expenditure reduction. The result was not just

slower growth but the forfeiture of the principal remedy for recession

since the Great Depression: enhanced public expenditure. Governments

voluntarily gave up their right to resort to fiscal means to reverse

the deceleration in growth even in countries that were not recording

large fiscal deficits and faced no threat of a public debt crisis. This

not only directly affected growth in individual countries. It also meant

that countries that were dependent on exports to global markets to sustain

much of their dynamism, whether it be Germany in Europe or China in

Asia, also experienced a slow down in growth.

The third reason was the deep flaw in the way the Eurozone had been

constituted. Economic borders between differentially developed countries

were diluted making the less developed easy targets for exports from

the more developed. Yet, the ability of individual countries to opt

for devaluation to enhance national competitiveness was undermined by

the adoption of a common currency. This meant that stronger countries

like Germany could sustain growth based on exports to the rest of the

Eurozone. On the other hand weaker countries inundated with imports

depended on non-tradable activities and government expenditure financed

with borrowing for whatever growth they realised. They could manage

because of the easy access to credit ensured by the strength of the

common currency. Indeed, the capital inflows associated with this credit

operated to push up the real exchange rates (that is the level of domestic

prices) of recipient countries compared to the ''strong'' countries,

and this generated further imbalance.

The risks of such a strategy were underestimated because of the belief

that the more developed Eurozone partners will pull the less developed

ones up the economic ladder. When borrowing reached levels perceived

as excessive and the expected growth supported by the more developed

was not forthcoming, the ability of these countries to meet their debt

service commitments was brought into question. The fear of sovereign

default was the result.

That fear may prove self-fulfilling. Countries like Greece, which that

have indeed borrowed considerably, find that new credit is difficult

to come by and what is available is extremely costly. On the other hand,

their partners in the Eurozone are unwilling to provide them the required

credit or the guarantees that would help them sustain expenditures and

meet their debt service commitments. In the event, countries in crisis

and in danger of defaulting on debt are forced to adopt severe austerity

measures to persuade creditors to roll over and provide new debt. But

such austerity measures not only reduce growth, they squeeze government

revenues as well. Hence, despite and even partly because of the austerity

measures, deficit countries find themselves unable to service the debt

they are burdened with. The fear of default could prove to be a self-fulfilling

prophecy, not despite but because of austerity and slow growth.

That things have come to such a pass is surprising, given the implications

of sovereign default. If the Greek government defaults on its debt,

for example, the banks in Greece that have lent hugely to their government

could face insolvency. If that happens, the problem would not be confined

to Greece alone. After all, perceived excess borrowing is a problem

facing other governments as well, both within and outside Europe. A

banking meltdown in Greece would, at the least, get both rating agencies

and depositors to re-examine their views on the banks they have hitherto

taken to be safe. So contagion is a real danger, since a run on individual

banks or a ratings downgrade that wipes out the backing offered by available

Tier 1 capital can weaken banks elsewhere.

Further, while it is indeed true that much of the government's debt

in a country like Greece is owed to Greek banks, a substantial chunk

is owed to banks outside Greece as well. This is to be expected, since

with a common currency the geographical boundaries between nations are

even less relevant to finance than they would be if such boundaries

also defined economies with separate currencies and distinct currency

risks. So a Greek sovereign default could damage banks outside Greece

as well. This would increase uncertainty, cut off lending and precipitate

a financial collapse and a real economy crisis. Not surprisingly, as

the Greek problem turned intractable, banks' shares (such as those of

Societe Generale and Credit Agricole) took a severe beating. The signal

was clear. For more reasons than one, the rest of the Eurozone or even

the world outside the Eurozone cannot pretend that the problem at hand

is that of a Greece or a Portugal, which must be left to its own devices.

The problem is more general and the solution requires not just European

but global cooperation. That solution must reinvigorate the recovery

and help generate the confidence and the revenues required in countries

where the public debt burden is onerous. This requires a coordinated

effort at enhancing public spending, sharing the losses of reducing

the debt burden with banks also taking a hair cut, and saving banks

faced with the danger of insolvency.

Yet fiscal conservatism and the misplaced belief that the problem is

that of the others seem to be delaying even the effort at such a resolution.

Thus far, the assumption has been that that the stimulus to growth would

come from the private sector, and that the resulting output growth will

enhance revenues to an extent where governments can resolve their public

debt problems. Not surprisingly, IMF Managing Director Christine Lagarde

has expressed disappointment that ''in key advanced economies, the necessary

hand-off from public to private demand is not taking place''. This ignores

the lessons from the run up to the 2008 crisis. The crisis was the culmination

of a trajectory of growth in which debt financed private investment

and consumption provided the demand-side stimulus for growth. That trajectory

required a huge expansion in the universe of borrowers and the volume

of debt. Since leverage of that kind could not be sustained, the financial

and economic crises ensued. It is unlikely that the private sector would

once again be able to increase its borrowing substantially. What is

needed, therefore, is more emphasis on sustainable ways of raising public

demand while adopting policies that share the costs of preventing a

banking sector collapse.

*

The article was originally published in the Business Line, September

20, 2011

©

MACROSCAN 2011