Exactly a year back, the authoritative Business Cycle

Dating Committee of the US National Bureau of Economic

Research declared that the US economy had experienced

a trough in business activity in June 2009. That trough,

in its view, marked the onset of recovery and the

end of an 18-month-long recession that had begun in

December 2007.

A year later, as the world's financial leaders gather

in Washington D.C. for the annual meetings of the

World Bank and the IMF, that assessment appears optimistic.

The OECD Secretariat suggests that the world is possibly

returning to a period of recession, and that the recovery

cited by the Dating Committee was more a blip than

the trend. In its interim assessment of the outlook

for OECD countries released on September 8, 2011,

it noted that the recovery had almost come to a halt

even by the second quarter of 2011 in most OECD countries.

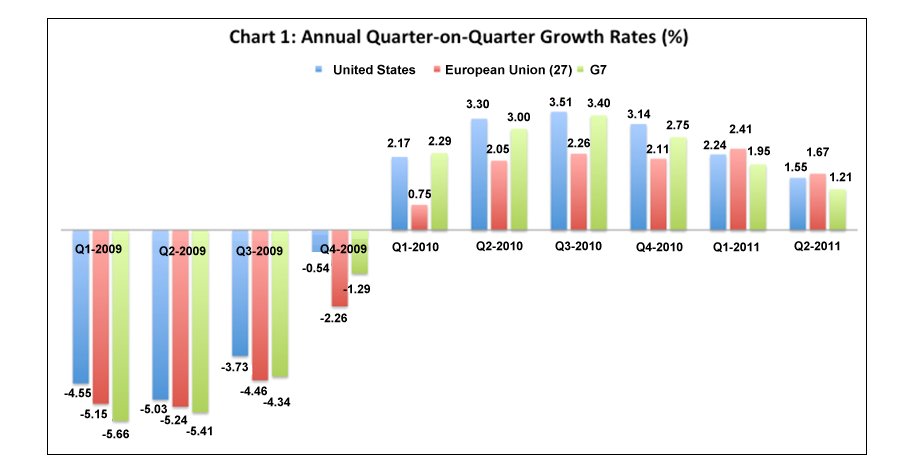

Even though annual quarter-on-quarter growth rates

have not returned to the negative territory they had

been in between the third quarter of 2008 and the

fourth quarter of 2009, there are four reasons for

gloom. First, when we compare growth in any quarter

relative to the same quarter of the previous year,

there is evidence of a significant decline in growth

rates between the last quarter of 2010 and the second

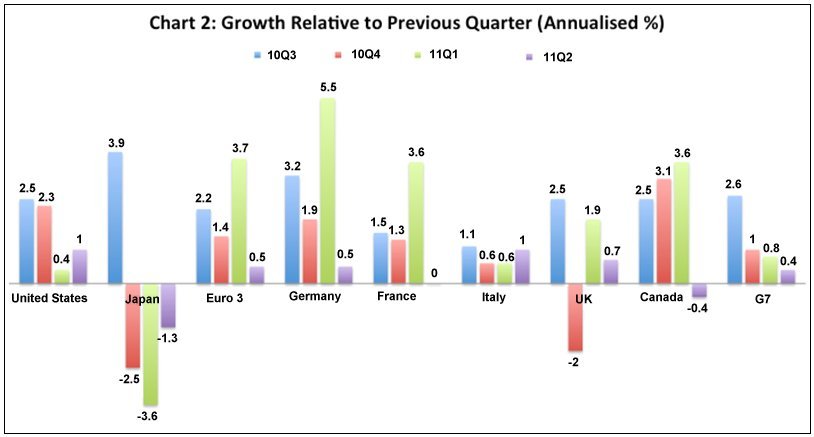

quarter of 2011 (Chart 1). Second, when we examine

the annualised growth in any quarter relative to the

immediately preceding quarter, that rate has fallen

significantly in all major OECD countries, including

in the Euro 3 or the core eurozone countries, namely,

Germany France and Italy (Chart 2). Third, there is

evidence that this time round emerging market economies

are being impacted quite early. According to the interim

assessment, growth in China eased in the course of

the first half of the year and manufacturing production

has weakened. Finally, the OECDs models projecting

growth using lead indicators predict that growth in

the G7 economies, even excluding accident-ravaged

Japan, was likely to be less than 1 per cent (annualised),

with significantly higher risk of more negative growth

in some major OECD economies.

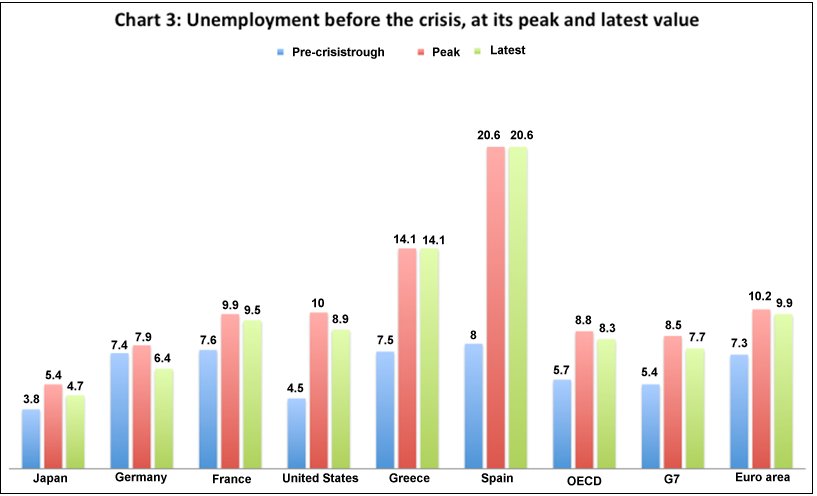

The damage this slide into a second recession would

inflict on populations still reeling under the effects

of the Great Recession comes through from the OECD's

recently released Employment Outlook. Unemployment

rates in all leading economies are not very much below

the peak levels they rose to during the recession

and are well above the immediate pre-recession lows

they had touched. One in every 12 persons in the workforce

is unemployed in the OECD group of countries. The

figure is one in every 10 for the EU, and as high

as one in every five or seven in Spain or Greece (Chart

3). This does not take account of the many who have

stopped seeking work and dropped out of the workforce

because of the high levels of long-term unemployment.

Chart

1 >> Click

to Enlarge

There

are three important reasons why the unemployment problem

has persisted and a real economy growth crisis seems

imminent. The first is that the stimulus adopted in

response to the 2008 crisis was grossly inadequate

in most countries and was substantially dissipated

in tax cuts and bail-out packages, which left little

for spending that would have strong multiplier effects,

drive long term growth and expand employment. Since

governments did not clearly demarcate the sums allocated

for these different kinds of expenditures in their

''stimulus packages'', the inadequacy of those packages

was not fully recognised. Moreover, those packages

could not ensure that the recovery would lead to the

mobilisation of additional tax revenues that could

sustain expenditures. Sustained recovery was dependent

on continuous injections of demand and liquidity.

The second is that having borrowed to finance these

insufficient and inappropriate expenditures, governments

have convinced themselves or been pressured by lenders

into believing that they have not just exhausted their

fiscal headroom but borrowed too much and need to

retrench substantially. The fear of ''excess'' public

debt and the danger of sovereign default were used

not just to halt the hikes in public borrowing resorted

to in the immediate aftermath of the 2008 crisis,

but to require countries to opt for contraction and

austerity. What was and is being forgotten here are

two important facts. The first is that growth driven

by stimulus spending helps to deliver increases in

tax revenues that can partly finance those expenditures.

The second is that governments, unlike households,

have the right and the instruments to tax the incomes

and wealth of others to raise resources to meet their

debt service commitments.

Chart

2 >>

Click

to Enlarge

This kind of blind fiscal conservatism led to the

withdrawal of stimulus measures and a turn to expenditure

reduction. The result was not just slower growth but

the forfeiture of the principal remedy for recession

since the Great Depression: enhanced public expenditure.

Governments voluntarily gave up their right to resort

to fiscal means to reverse the deceleration in growth

even in countries that were not recording large fiscal

deficits and faced no threat of a public debt crisis.

This not only directly affected growth in individual

countries. It also meant that countries that were

dependent on exports to global markets to sustain

much of their dynamism, whether it be Germany in Europe

or China in Asia, also experienced a slow down in

growth.

The third reason was the deep flaw in the way the

Eurozone had been constituted. Economic borders between

differentially developed countries were diluted making

the less developed easy targets for exports from the

more developed. Yet, the ability of individual countries

to opt for devaluation to enhance national competitiveness

was undermined by the adoption of a common currency.

This meant that stronger countries like Germany could

sustain growth based on exports to the rest of the

Eurozone. On the other hand weaker countries inundated

with imports depended on non-tradable activities and

government expenditure financed with borrowing for

whatever growth they realised. They could manage because

of the easy access to credit ensured by the strength

of the common currency. Indeed, the capital inflows

associated with this credit operated to push up the

real exchange rates (that is the level of domestic

prices) of recipient countries compared to the ''strong''

countries, and this generated further imbalance.

The risks of such a strategy were underestimated because

of the belief that the more developed Eurozone partners

will pull the less developed ones up the economic

ladder. When borrowing reached levels perceived as

excessive and the expected growth supported by the

more developed was not forthcoming, the ability of

these countries to meet their debt service commitments

was brought into question. The fear of sovereign default

was the result.

That fear may prove self-fulfilling. Countries like

Greece, which that have indeed borrowed considerably,

find that new credit is difficult to come by and what

is available is extremely costly. On the other hand,

their partners in the Eurozone are unwilling to provide

them the required credit or the guarantees that would

help them sustain expenditures and meet their debt

service commitments. In the event, countries in crisis

and in danger of defaulting on debt are forced to

adopt severe austerity measures to persuade creditors

to roll over and provide new debt. But such austerity

measures not only reduce growth, they squeeze government

revenues as well. Hence, despite and even partly because

of the austerity measures, deficit countries find

themselves unable to service the debt they are burdened

with. The fear of default could prove to be a self-fulfilling

prophecy, not despite but because of austerity and

slow growth.

Chart

3 >>

Click

to Enlarge

That things have come to such a pass is surprising,

given the implications of sovereign default. If the

Greek government defaults on its debt, for example,

the banks in Greece that have lent hugely to their

government could face insolvency. If that happens,

the problem would not be confined to Greece alone.

After all, perceived excess borrowing is a problem

facing other governments as well, both within and

outside Europe. A banking meltdown in Greece would,

at the least, get both rating agencies and depositors

to re-examine their views on the banks they have hitherto

taken to be safe. So contagion is a real danger, since

a run on individual banks or a ratings downgrade that

wipes out the backing offered by available Tier 1

capital can weaken banks elsewhere.

Further, while it is indeed true that much of the

government's debt in a country like Greece is owed

to Greek banks, a substantial chunk is owed to banks

outside Greece as well. This is to be expected, since

with a common currency the geographical boundaries

between nations are even less relevant to finance

than they would be if such boundaries also defined

economies with separate currencies and distinct currency

risks. So a Greek sovereign default could damage banks

outside Greece as well. This would increase uncertainty,

cut off lending and precipitate a financial collapse

and a real economy crisis. Not surprisingly, as the

Greek problem turned intractable, banks' shares (such

as those of Societe Generale and Credit Agricole)

took a severe beating. The signal was clear. For more

reasons than one, the rest of the Eurozone or even

the world outside the Eurozone cannot pretend that

the problem at hand is that of a Greece or a Portugal,

which must be left to its own devices.

The problem is more general and the solution requires

not just European but global cooperation. That solution

must reinvigorate the recovery and help generate the

confidence and the revenues required in countries

where the public debt burden is onerous. This requires

a coordinated effort at enhancing public spending,

sharing the losses of reducing the debt burden with

banks also taking a hair cut, and saving banks faced

with the danger of insolvency.

Yet fiscal conservatism and the misplaced belief that

the problem is that of the others seem to be delaying

even the effort at such a resolution. Thus far, the

assumption has been that that the stimulus to growth

would come from the private sector, and that the resulting

output growth will enhance revenues to an extent where

governments can resolve their public debt problems.

Not surprisingly, IMF Managing Director Christine

Lagarde has expressed disappointment that ''in key

advanced economies, the necessary hand-off from public

to private demand is not taking place''. This ignores

the lessons from the run up to the 2008 crisis. The

crisis was the culmination of a trajectory of growth

in which debt financed private investment and consumption

provided the demand-side stimulus for growth. That

trajectory required a huge expansion in the universe

of borrowers and the volume of debt. Since leverage

of that kind could not be sustained, the financial

and economic crises ensued. It is unlikely that the

private sector would once again be able to increase

its borrowing substantially. What is needed, therefore,

is more emphasis on sustainable ways of raising public

demand while adopting policies that share the costs

of preventing a banking sector collapse.

*

The article was originally published in the Business

Line, September 20, 2011