Themes > Features

29.05.2012

Of Profits and Growth*

As

growth slows, inflation returns and the rupee depreciates, India's growth

story seems at an end. There are two questions being posed. The first

is whether the downturn is the result of international factors, especially

the crisis in Europe, or is partly or largely internally driven. The

second is whether the current downturn is an exception or the high growth

that preceded it an abnormal interlude in India's recent economic history.

It is often argued that the higher growth experienced since the 1980s,

and especially after liberalisation in 1991, had lasted far too long

to be dismissed as an exceptional, short-run phenomenon. But there are

a number of difficulties with that argument. To start with, it does

not take account of the fact that the drivers of growth during the 1980s

were significantly different from that in the 1990s and after. The second

is that even the period after 1991 was by no means one of consistently

high growth. There was a mini-boom during the four years starting 1993-94,

a slowing down of growth after that and then a sharp revival after 2002-03.

The revival was so marked and remarkable that it speaks of a break in

the growth process in the early years of the last decade. For a period

of five years or more after 2002-03, not only was GDP growth in the

8-9 per cent range, savings and investment rates were much higher, the

current balance in the external account was reasonably comfortable,

foreign exchange reserves were high and rising, and manufacturing was

once again a part of the growth process. In sum, the evidence seemed

to point to a new growth paradigm.

Associated with this episode of remarkable growth was one new feature.

These were the years when there was a surge in cross-border capital

flows across the world with the so-called ''emerging market economies''

being major beneficiaries. India too experienced a surge, facilitated

by more liberalised investment rules and encouraged by the abolition

of capital gains taxation on investments held for more than a year.

Foreign investment inflows rose from around $6-8 billion at the turn

of the last century, to $20-30 billion during 2005-07 and $62 billion

in 2007-08. This not only gave the government a degree of manoeuvrability

with regard to its spending, but also infused liquidity into the system

and supported a substantial expansion in retail credit. Lending to individuals

for housing investments, automobile purchases and consumption registered

a spike. The resulting credit-financed investment and consumption helped

expand demand and drive growth, including growth in manufacturing. The

government catalysed that growth with multiple concessions at central

and state levels for private investors, important among which were easy

access to and low taxes on imports of technology, capital equipment

and intermediates and low cost access to land and mineral and other

scarce resources.

The

result was an increase in the private sector's ability to garner higher

profits. Consider trends emerging from the official Annual Survey

of Industries relating to the organised manufacturing sector depicted

in Chart 1. To start with, since the early 1990s, when liberalisation

opened the doors to investment and permitted much freer import of

technology and equipment from abroad, productivity in organised manufacturing

has been almost continuously rising. Net value added (or the excess

of output values over input costs and depreciation) per employed worker

measured in constant 2004-05 prices, rose from a little over Rs. 1

lakh to more than Rs. 5 lakh. That is, productivity as measured by

net product per worker adjusted for inflation registered a close to

five-fold increase over the 30-year period beginning 1981-82. And

more than three-fourths of that increase came after the early 1990s.

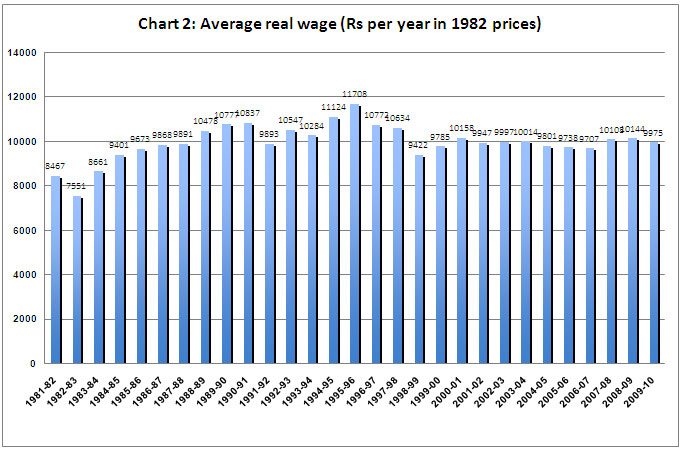

Unfortunately for labour, and fortunately for capital, the benefit

of that productivity increase did not accrue to workers. The average

real wage paid per worker employed in the organised sector, calculated

by adjusting for inflation as measured by the Consumer Price Index

for Industrial Workers [CPI(IW) with 1982 as base], rose from Rs.

8467 a year in 1981-82 to Rs. 10777 in 1989-90 and then fluctuated

around that level till 2009-10 (Chart 2). The net result of this stagnancy

in real wages after liberalisation is that the share of the wage bill

in net value added or net product (Chart 1), which stood at more than

30 per cent through the 1980s, declined subsequently and fell to 11.6

per cent or close to a third of its 1980s level by 2009-10.

A corollary of the decline in the share of wages in net value added

was of course a rise in the share of profits. However, the trend in

the share of profits is far less regular than that of the other components

in net value added. Between 1981-82 and 1992-93, the ratio of profits

to net value added fluctuated between 11.6 per cent and 23.4 per cent.

During much of the next decade (1992-93 to 2002-03) it remained at

a significantly higher level, fluctuating between 20.4 per cent and

34.3 per cent, but showed clear signs of falling during the recession

years 1998-99 to 2001-02.

However, the years after 2001-02 saw the ratio of profit to net value

added soar, from just 24.2 per cent to a peak of 61.8 per cent in

2007-08. Unfortunately for manufacturing capital, the good days seem

to be at an end. There are signs of the profit boom tapering off and

even declining between 2006-07 and 2009-10. But this latter period

being short, we need to wait for more recent ASI figures to arrive

at any firm conclusions.

As of now, what needs explaining is the remarkable boom in profits

at the expense of all other components of net value added. An interesting

feature that emerges from the chart is that the ratio of profits to

value of output, or the margin on sales, tracks closely the irregular

trend in the share of profits in value added described above. Increases

in profit shares have clearly been the result of a rise in the mark

up represented by the profit margin to sales ratio, or the ability

of capital to extract more profit from every unit of output.

Interestingly, the periods in which the ratio of profits to the value

of output has risen, leading to sharp increases in profit shares,

were also the years when the two post-liberalisation booms in manufacturing

occurred. The first of those was the mini-boom of the mid-1990s, starting

in 1993-94 and going on to 1997-98, which was fuelled by the pent-up

demand in the upper income groups for a range of goods that had remained

unsatisfied prior to the liberalisation of imports and foreign investment

rules. The second was the stronger and more prolonged boom after 2002-03,

led by new sources of demand. That boom lasted till the global financial

crisis in 2008-09. The coincidence of the rise in profit margins and

profit shares and the output booms suggests that, in periods of rising

demand, the organised manufacturing sector in India has been able

to exploit liberalisation in two ways. First, it has been able to

expand and modernise using imported technologies, raising labour productivity

significantly in the process. Secondly, it has been able to ensure

that the benefit of that productivity increase accrues almost solely

to profit earners, because of the conditions created by the ''reformed''

economic environment. As a result, the mark up rose significantly

or sharply in these periods and delivered a profit boom.

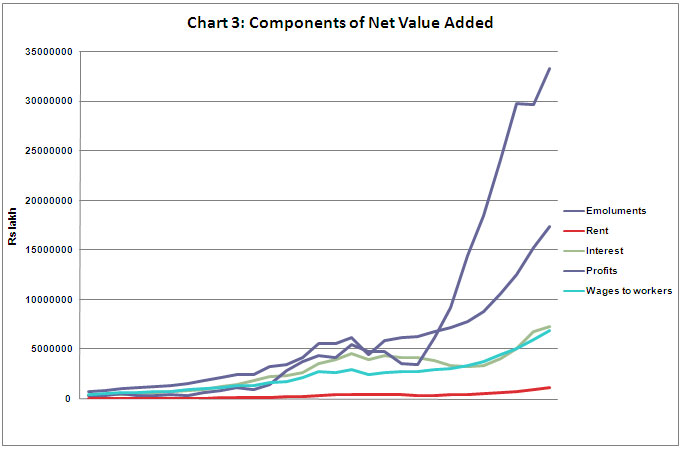

An interesting feature is the way in which this process feeds on itself.

As Chart 3 depicting trends in the different components of net value

added shows, while the nominal value of rent, interest and wages rose

only marginally over a long period, the increase in emoluments, which

include managerial salaries, was substantial. Profits of course soared

as noted earlier. The increase in non-wage salaries and incomes not

only directly drives manufacturing demand, but also provides the basis

for the expansion of credit-financed investment and consumption expenditure.

Thus the boom creates conditions that also help prolong that boom.

Seen in this light, there are reasons to believe that certain recent

developments could be constraining growth in the manufacturing sector.

The first is the reduction and even reversal in foreign capital inflows

into the country as a result of both global and domestic uncertainty.

This is putting pressure on the government to reduce its fiscal deficit

and the level of public debt, which has a deflationary impact. Moreover,

the liquidity crunch resulting from the lower levels of foreign inflows

and the uncertainty arising from increase debt defaults in the retail

market is reducing the volume of credit and hence the volume of debt-financed

investment and consumption.

Finally, there has been an increase in allegations of large scale

corruption. The instances to which such allegations relate are many,

varying from the sale of 2G spectrum and the mobilisation and/or disposal

of land and mining resources to purchases made as part of large and

concentrated public expenditures (as in the case of the Commonwealth

Games). What this has done is increase the reticence and limit the

ability of the government to openly favour private capital with concessions

that deliver high and rising profit margins.

When the effects of such developments combine they could restrict

demand and dampen investment considerably leading to a reduction in

the rate of growth of manufacturing. They are also possibly reducing

profit margins and profitability so that we may well be at the end

of the profit-inflation led growth of manufacturing production.

*

This article was originally published in the Business Line on 28 May

2012.

©

MACROSCAN 2012