Themes > Features

15.03.2005

Budget 2005-06: Stage-managed Humaneness

Spokespersons

for the UPA government have repeatedly declared that it intends to

accelerate the economic reform process the Congress had originally

initiated, even while giving it a human face. However, while imparting

a ''human face'' to reform requires substantial additional allocations,

the reform erodes the revenue base of the government. Since trade

liberalisation requires customs duty reductions and tax reform and

rationalisation inevitably imply a less ‘onerous' tax regime, they

affect revenue buoyancy adversely. This reduces the resources available

for enhanced allocations to the social sectors.

If, simultaneously, deficits have to be curtailed to meet the stringent

and irrational targets set by the Fiscal Responsibility and Budget

Management (FRBM) Act, the formulation of a budget becomes near impossible,

unless the government gives on one or more of its multiple goals.

But such difficulties do not seem to constrain Finance Minister P.

Chidambaram, who claims that he has increased allocations for human

development programmes incorporated in the National Common Minimum

Programme (NCMP), continued with economic reform and, yet, delivered

on his commitment to implement the FRBM Act.

Part A of the budget speech does extend itself to reassure those among

the ruling United Progressive Alliance (UPA), its allies and its support

base who have been disappointed with and critical of the government's

reticence to implement the National Common Minimum Programme (NCMP).

Employment, education, health, nutrition, drinking water, sanitation

and rural infrastructure, and the development of marginalised sections

such as SCs and STs, women, children and minorities all receive a

mention in the speech.

In many cases Chidambaram flags this recognition with specific numbers

reflecting increased allocations. Some of these numbers are indeed

significant, as is true in the case of the Sarva Shiksha Abhiyan which

gets a non-lapsable allocation of Rs.7,156 crore for 2005-06 as compared

with an actual expenditure of Rs.4753.63 crore in 2004-05. In other

cases even though the aggregate numbers are small, they reflect new

or enhanced allocations. For example, new allocations totalling Rs.980

crore for a horticulture mission and micro-irrigation have been provided.

And there are areas like the provision of drinking water too were

the increase in allocation is sizeable.

However, in many cases, and especially in the ''big areas'', neither

do the numbers quoted always reflect a budgetary initiative of the

Finance Minister, nor are they significant. Thus, to prove his commitment

to the welfare of the ‘common citizen' in rural India, the Finance

Minister refers to the fact that disbursement of credit to agriculture

would touch Rs.108,500 crore in 2004-05 as against the Rs.105,000

crore targeted for in the budget. What should be obvious is that this

is not a budgetary measure, but an off-budget initiative reflecting,

if true, the use of the lever of directed credit which the Finance

Minister wants to give up as part of the financial liberalisation

programme.

The other area where off-budget means are to be used to finance expenditures

is in closing the so-called ''infrastructure deficit''. The Finance

Minister intends to establish a Special Purpose Vehicle (SPV) which

would draw on borrowed rupee and foreign exchange resources to build

roads, ports, airports and tourism infrastructure. When spend you

must, but keep the fiscal deficit in check, the best way is to move

expenditures off the budget and claim to be fiscally ''prudent'',

whatever that may mean.

What about the budgetary allocations themselves? The Finance Minister

claims that on priority sectors and flagship programmes falling under

the NCMP, he proposes to provide an additional sum of Rs. 25,000 crore.

What the term ''additional'' means is quite unclear given the fact

that the total budgetary expenditure of the central government is

expected to rise to Rs. 514,343.80 crore or by just Rs.8,553 crore

relative to the revised expenditure estimate for 2004-05. In fact,

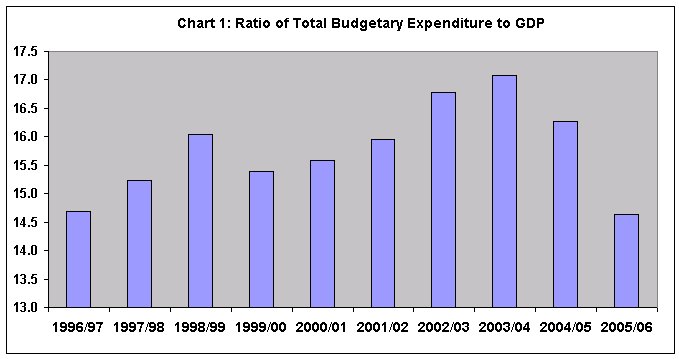

as Chart 1 shows the ratio of total budgetary expenditure to GDP,

which had declined from 17.1 to 16.3 percent between 2003-04 and 2004-05,

is expected to fall sharply to 14.6 per cent in 2005-06.

What

is most disappointing is the allocation for the National Food for

Work Programme (NFFWP) launched in November 2004, which the expenditure

budget document describes as ''a step towards the commitment to an

employment guarantee programme''. The expenditure budget document

indicates that a total sum of Rs.6,408 crore was spent on rural employment

during 2004-05. This is to be increased to Rs.9,000 crore in 2005-06,

including an allocation of Rs.5,400 crore for the NFFWP. However,

in his budget speech, the Finance Minister has indicated that because

of an allocation of 50 lakh metric tonnes of foodgrain, the total

allocation—comprising of cash and food components—for the NFFWP is

Rs.11,000 crore. This implies that the government is moving a significant

part of the expenditure on the NFFWP off the budget. Yet, the total

allocation for the programme is far short of estimates of the sums

required for effectively implementing this programme, which vary between

Rs.25,000 and Rs.45,000 crore.

In sum, while in some areas allocations have indeed been increased,

allocations for crucial initiatives such as a greater rural focus,

improved health and, above all, employment guarantee, are inadequate

or meagre. What is more, a substantial part of even these allocations

have been funded not through increased budgetary provisions but through

off-budget means.

Interestingly, even to finance the limited expenditure allocations

made in the budget for 2005-06, the Finance Ministry has had to make

extremely optimistic projections with regard to tax buoyancy. We must

note that the budget continues with tax ''reform'' policies that reduce

revenues and restrict the spending power of the government. In particular,

despite India's appallingly low tax-GDP ratio, the process of reducing

taxes to liberalise trade, provide incentives to the private sector

and spur domestic demand has been continued with. The Finance Minister

has reduced the peak rate of customs duty on non-agricultural products

from 20 to 15 per cent, reduced import duties on a host of imports,

especially capital goods, cut excise duties on polyester filament

yarn, tyres and air conditioners from 24 to 16 per cent, adjusted

other excise duty rates downwards, and provided major concessions

with regard to taxes on both corporate and personal incomes.

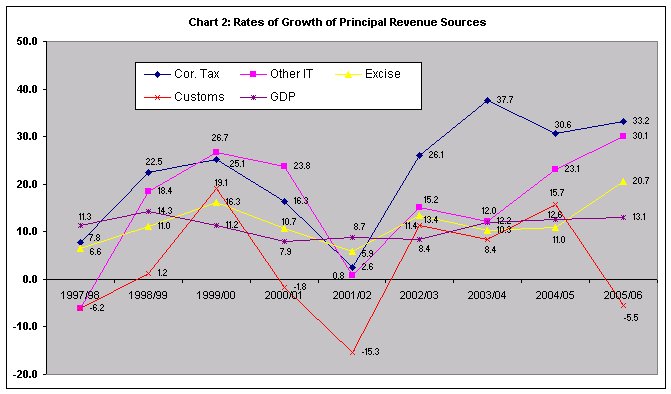

Despite this, the ratio of corporate and other taxes on income to

GDP are projected to rise substantially and that of excise duties

moderately, so as to raise the central gross tax revenue to GDP ratio

from 9.8 to 10.5 per cent. This requires assuming that revenues from

these taxes would rise by 33, 30 and 21 per cent respectively in a

year when nominal GDP is expected to rise by just 13 per cent (Chart

2). The presumption obviously is that tax concessions would lead to

both greater income buoyancy and substantially greater compliance.

Neither of these has been realised in practice in the past when taxes

have been cut. Nor are they likely to be realised in 2005-06.

It is true that to partly neutralise the impact of these concessions

on the revenue side of his budget the Finance Minister has resorted

to a set of new taxes. The two major tax initiatives are the Fringe

Benefits Tax on benefits provided individually or collectively to

employees by firms; and, a transactions tax of 0.1 per cent on cash

withdrawals of Rs.10,000 or more from banks in a single day. While,

the revenues to be generated from these measures are not provided,

the Finance Minister has already agreed to dilute the provisions of

the Fringe Benefits Tax and is likely to go back on the withdrawals

tax. They are therefore unlikely to be the sources of buoyancy of

the kind assumed.

Have these optimistic revenue projections proved adequate from the

point of view of ensuring ''fiscal prudence'' as defined by the FRBM

Act. The FRBM Act requires a reduction in the revenue and fiscal deficits,

respectively, of 0.5 and 0.3 percentage points every year. According

to the revised estimates for 2003-04, the revenue deficit was 3.6

percent and the fiscal deficit was 4.8 per cent of GDP. By bringing

down the former to 2.7 per cent in 2004-5, the Finance Minister claims

to have been able to deliver almost all of the reduction required

for two years in a single year. The fiscal deficit too has come down

by half of a percentage to 4.5 per cent of GDP. Thus, according to

Chidambaram, while faithfully attempting to implement the mandate

of the NCMP and still pursing economic reform, he has been able to

remain on the path of fiscal consolidation.

However, the reason the budget delivers this outcome is the misuse

of a clause in the Twelfth Finance Commission's recommendations that

provides states the option to borrow directly from the market rather

than from the central government to finance their plan expenditures.

Thus far this sum was provided as the loan component of the grant-cum-loan

transfers to be made by the centre to finance approved plan expenditures

of the states. The Twelfth Finance Commission has made a provision

for grants from the Centre to the states but left it to the states

to decide whether the loan component would come from the Centre or

directly from the market.

However, this is just an option that is now open to the states. If

the states exercise that option the deficit on their budgets would

rise. If they do not, borrowing to finance a part of plan funding

for the states would have to come out of the Centre's budget, increasing

the expenditure and the fiscal deficit of the centre. But, misusing

the option provided by the Finance Commission, the Finance Minister

in his budget speech states that ''Plan expenditure for 2005-06 is

estimated, on a like-to-like basis at Rs.172,500 crore. However, the

Budget shows Plan expenditure at Rs.143,497 crore, and the balance

amount of Rs.29,003 crore will be raised by the State Governments

directly, in accordance with the recommendations of the TFC.'' With

a single sentence the Finance Minister has removed an allocation of

more than Rs.29,000 crore or more than 0.8 per cent of GDP off the

budget.

Because of this manipulation, central assistance for State and UT

Plans, which stood at Rs.54,858 crore in 2004-05 (R.E.), is projected

at just Rs.33,112 crore in the budgetary estimates for 2005-06. This

''gain'' of Rs.21,746 crore amounts to more than three fourths of

the proposed increase in budgetary support for the central plan and

87 per cent of the increased allocation for implementing the NCMP.

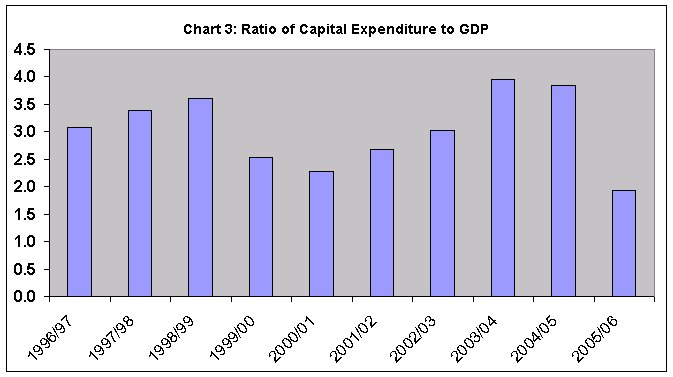

Further, as Chart 3 shows, the ratio of capital expenditure to GDP

in the central budget collapses by 2 percentage points for the coming

fiscal year, helping ease the fiscal strain.

The real difficulty faced by the Finance Minister was that, while providing for allocations for programmes incorporated in the NCMP, he was bent upon establishing that he is fiscally prudent. This is problematic since the government has now clearly defined the nature of such prudence in the form of targets incorporated in the Fiscal Responsibility Act, since the budget has provided major tax concessions, since all allocations cannot be increased off-budget and some must be shown in the budget and since the Twelfth Finance Commission (TFC) has increased the share of gross tax revenues to be transferred from the Centre to the States. Hence, the option before the Finance Minister was to call for a repeal of the straightjacket that the FRBM Act involves. Instead he has chosen to dress up the budget in ways that do not tally with the claim that the economic reform also implies more transparency.

©

MACROSCAN 2005