Themes > Features

12.06.2006

What Does the Upsurge in Global Capital Flows Indicate?

C.P. Chandrasekhar and

Jayati Ghosh

On

the face of it, global capital markets have never been so active, and

especially for flows related to developing countries. The past year witnessed

a massive and broad-based increase in capital flows to developing countries,

which reached a net level of $491 billion. This included increases in

all the major forms of capital flows: bank lending, issues of long-term

bonds of developing countries, foreign direct investment and portfolio

capital flows.

Recent increases in private capital flows have been associated with financial innovations in many ''emerging markets'', especially local-currency financing and structured financial instruments, such as credit default swaps and other derivatives. The explosive growth of hedge funds has been very much part of this expansion. Some argue that this is a positive feature because it has encouraged more capital flows to developing countries because of the improved ability of investors to manage their exposure to the risks associated with emerging market assets. Others see this as creating even more potential for volatility in developing country financial markets in future.

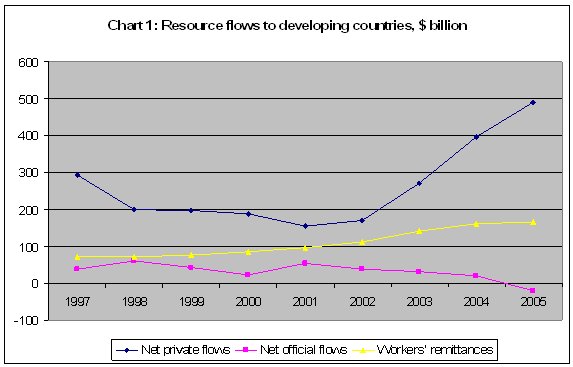

The World Bank's most recent report on Global Development Finance 2006 describes some contemporary trends. According to this report, there are three main tendencies of particular significance in the past five years, summarised in Chart 1.

Recent increases in private capital flows have been associated with financial innovations in many ''emerging markets'', especially local-currency financing and structured financial instruments, such as credit default swaps and other derivatives. The explosive growth of hedge funds has been very much part of this expansion. Some argue that this is a positive feature because it has encouraged more capital flows to developing countries because of the improved ability of investors to manage their exposure to the risks associated with emerging market assets. Others see this as creating even more potential for volatility in developing country financial markets in future.

The World Bank's most recent report on Global Development Finance 2006 describes some contemporary trends. According to this report, there are three main tendencies of particular significance in the past five years, summarised in Chart 1.

The

first is the substantial increase in net private flows (including both

debt and equity flows) especially after 2002. In the past year, long-term

bond flows (which increased by $19 billion over 2004), medium- and long-term

bank lending (up $28 billion), and portfolio equity (up $24 billion)

showed the strongest gains. Bonds and commercial bank lending were associated

with lower interest rates in emerging markets, as interest rates in

the US and other OECD countries remained low, and spreads on emerging

market sovereign bonds declined.

Local-currency bond markets in developing countries have recently emerged

as a major source of long-term development finance. They are now the

fastest-growing segment of emerging market debt, growing from $1.3 trillion

at the end of 1997 to $3.5 trillion in September 2005. These markets

tend to be driven largely by domestic institutional and individual investors,

and the positive feature is that they do allow major developing countries

to improve debt management by reducing currency and maturity mismatches.

It should be noted, however, that the actual size of the increase in

private assets is hard to judge, since it is calculated as a residual

and thus includes errors and omissions from elsewhere in the balance

of payments.

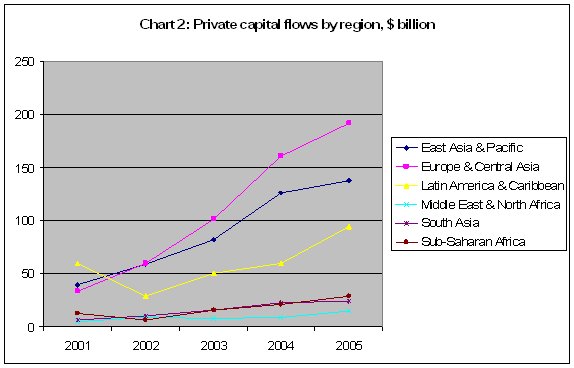

The recent increase in private capital flows has also been fairly widespread

in regional terms, with all of the major regions showing some increase.

In the very recent past, the most rapid rises have been experienced

by countries in Europe and Central Asia, which now accounts for the

largest share - nearly half - of all private capital flows. Most of

this was the form of FDI in this region - most of the large privatisation

and M&A deals announced in 2005 related to this region, and were

dominantly in the telecom and banking sectors.

While

there has been an increase in private capital flows to all the major

developing country regions, in general private capital flows remain

concentrated in just a few countries. In 2005 about 70 percent of bond

financing and syndicated lending went to ten countries. Similarly, only

three countries - China, India, and South Africa - accounted for nearly

two-thirds of all portfolio capital flows. Ironically, in these countries

such capital inflows were not ''necessary'' in macroeconomic terms of

bridging either savings or foreign exchange gaps, since all these countries

actually increased their already substantial holdings of reserves over

this period.

There has been some increase in bank lending to poor countries, especially

from oil surplus countries benefiting from the recent increase in world

oil prices and in low-income countries located geographically close

to major investors. However, this still remains not only a minuscule

fraction of the total of such flows, but far below the requirements

in these countries.

What is also worth noting - and will be considered in more detail below

- is that increasingly capital outflows from developing countries are

becoming regular features of international financial markets. Private

capital outflows have increased following external financial liberalisation

policies that have allowed the rich residents of the developing world

to export capital. This also means enhanced potential for instability

as periods of capital flight are associated not only with non-resident

exodus of capital but also capital export by domestic residents. In

addition, central banks of developing countries have increased their

holding of foreign exchange reserves and invested these in ''safe havens''

in developed countries.

The second very notable feature of the recent past is the general stagnation

and recent decline in net official flows. In 2005, net official flows

declined by nearly $20 billion, reflecting a combination of a slight

increase in bilateral aid grants from $50.3 billion in 2004 to $52.6

billion in 2005, and a very sharp decline in net official lending. Indeed,

judging from the quantitative reach of their activity alone, the major

multinational banks are rapidly becoming irrelevant for most developing

countries.

Net official lending came to -$71.4 billion in 2005, making this the

third consecutive year of net outflows from developing countries to

the multilateral banks. In the past three years, developing countries

have repaid $112 billion in loans to multilateral creditors. While World

Bank loans have declined, the really big negative shift comes from the

IMF. In 2005 net debt outflows from developing countries to the IMF

were as much as $41.1 billion, compared to a net debt inflow of $19.5

billion in 2001.

This implies a -$60.6 billion swing in net lending by the IMF over the

period between 2001 and 2005. Some of this reflects repayments of loans

by major borrowers, such as Indonesia, Russia, Argentina, Brazil, and

Turkey. But gross new lending by the IMF has also declined substantially,

from about $30 billion in 2002 to only $4 billion in 2005. The situation

is likely to get more dire for the IMF in the next few years, as there

are some large scheduled payments from Indonesia, Turkey and Uruguay.

So net lending by the IMF will probably decline further in the near

future.

While net disbursements of foreign aid or ODA by OECD members appear

to have increased dramatically in 2005, reaching $106.5 billion, most

of the increase of $27 billion in 2005 reflects debt relief provided

by Paris Club creditors to Iraq (nearly $14 billion) and Nigeria (over

$5 billion). Other debt relief - which incidentally does not imply any

fresh loans but simply a part write-off of some of the loans, usually

with very stringent conditions on policies - accounts for most of the

increase in so-called ''foreign aid''. So on balance, official flows

have become negative and do not contribute at all to resource transfers

to developing countries.

The third noteworthy feature of recent international resource flows

is the very substantial role played by workers' remittances, which have

increased to as much as $167 billion in 2005, and come to around one-third

of all form of capital flows and aid flows put together. This represents

a doubling of recorded remittance flows in the past five years. This

is a major reason why the current account balance of developing countries

as a group, and many individual developing countries, has been positive,

and in 2005 was as high as 2.6 per cent of GDP.

Such remittances are clearly valuable for developing countries, since

they are non-debt creating flows which do not require any future repayment.

They also tend to be counter-cyclical, which supports domestic stabilisation

processes. Short term labour migration which results in such remittances,

and can have poverty reduction effects, is obviously to be welcomed.

But it should not be lost sight of that recent very rapid increases

in such migration reflect conditions of extreme unemployment and agrarian

crisis in many parts of the developing world.

What exactly has all this explosion in global capital flows to developing

countries meant? Does it imply a genuine increase in resources available

for investment, such that we can now hope for higher investment rates

and therefore more economic growth in these countries? Interestingly,

the World Bank's report, which devotes so much space to capital flows

in to developing countries, does not go beyond simply mentioning the

very substantial flows out of developing countries, and certainly does

not examine either the causes of the implications of this growing phenomenon.

After all, international capital markets are supposedly all about financial

intermediation, between savers and investors, or between capital-rich

and capital-poor locations. So it is both expected and desirable to

find increasing capital flows into the developing world in general.

However, these inflows relate to gross resource flows, and the net picture

is rather different because of the large increase in outflows of both

public and private investment from the developing world into the developed

economies, and particularly the United States.

Indeed, if capital inflows into developing countries were actually serving

to close either foreign exchange or savings-investment gaps, this should

be revealed in the form of increased current deficits of developing

countries. Instead we find positive and increasing balances on the current

account, coming to as much as 2.6 per cent of the combined GDP of developing

countries, as previously noted. So the inflows are being counterbalanced

either by increasing official reserves or by capital outflows, mostly

by private agents in the developing world.

The latter is evident in IMF estimates quoted in Global Development

Finance 2006, which show such capital outflows by private entities in

developing countries to be highly volatile but still accelerating rapidly,

from less than $60 billion in 1995 to as much as $260 billion in 2005.

The opening of capital accounts in the developing world has increased

opportunities for capital outflows, enabling the rich residents of developing

countries to improve their investment returns and reduce their risks

through international diversification.

This in turn means that net private inflows into the developing world

are much less than the $490 billion suggested by the gross inflows,

and are only in the region of $230 billion for all developing countries

taken together.

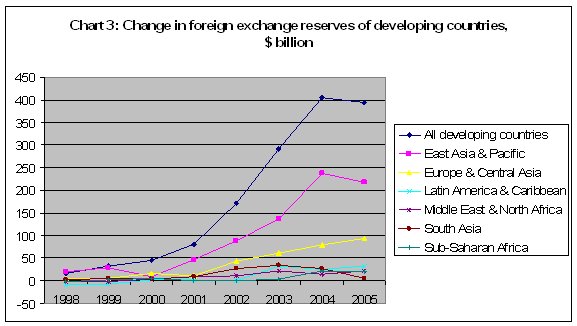

Now consider what developing countries are effectively doing even with

this $230 billion. The total external reserves held by all developing

countries are estimated to have increased by $392 billion in 2005. This

follows several years of such dramatic increase. Chart 3 indicates that

while the largest increases were to be found in East Asia, transition

Europe and Central Asia, every developing country regions has continued

to add to external reserves in 2005 as it has in the previous years.

So

what emerges is that developing countries increased their holding of

foreign exchange reserves by more than the amount of net capital inflows

of all kinds! This was true of 2005 just as it also applied to the previous

two years. They were able to do this because of trade surpluses (as

in the case of China and East Asia) or current account surpluses generated

by workers' remittances, or simply because the capital inflows were

not ''used'' for increasing domestic investment, but saved up to act

as a hedge against potential capital flight or to prevent currencies

from appreciating.

So,

despite the apparent explosion of global development finance in the

past year, there has actually been no effective transfer of resources

for investment to the developing world. Financial liberalisation explicitly

designed to increase access to resources for new investment has instead

been associated simply with much more circulation of finance around

the world, instead of creating a growth-oriented intermediation for

developing countries. Citizens of the developing world - apart from

the privileged few who can take advantage of the newly liberal regime

to transfer their wealth around the world to maximise their own returns

- may well ask whether the process of capital account liberalisation

has been worth it.

© MACROSCAN 2006