Themes > Features

26.07.2004

Fiscal Responsibility and Democratic Accountability

C.P.

Chandrasekhar and Jayati Ghosh

One

of the first legislative actions of the UPA government was to notify

the Fiscal Responsibility and Budget Management Act (henceforth FRBM

Act). This Act was notified on 2 July to come into force on 5 July

2004, only three days before the presentation of the Annual Budget,

thereby circumscribing the entire budgetary exercise from the start

of the new government’s tenure.

The

FRBM Act is apparently well-intentioned, designed to clean up public

finances and put them on a sustainable footing. Thus, it requires

the reduction of the fiscal deficit and the elimination of the revenue

deficit of the Central Government by 31 March 2008 (the deadline is

to be extended by a year). This would appear to be a way of forcing

the government to adhere to a discipline which would thereby allow

it to spend more on useful capital expenditure.

However, the actual implications of the working of the Act are much

more serious and potentially adverse, than is generally understood.

Some of the requirements of the FRBM Act and the associated rules

mentioned in the notification, are described in Table 1.

The Act requires the Central Government to reduce the fiscal deficit

by 0.3 per cent of GDP each year, and the revenue deficit by 0.5 per

cent each year, beginning with this financial year. If this is not

achieved through higher tax revenues, the necessary adjustment has

to be made by cutting expenditures..

Table

1: Requirements of FRBM |

|

FRBM

Act/FRBM

Rules |

|

Revenue

deficit |

|

Date

for elimination |

31-3-2008

(now 31-3 2009) |

Minimum

annual reduction |

0.5

% of GDP |

Fiscal

deficit |

|

Ceiling |

3

% of GDP by 31-03-2008 |

Minimum

annual reduction |

0.3

% of GDP |

Total

debt |

Increase

capped at 9 % of GDP in 2004-05 |

Annual

reduction |

1

% of GDP |

RBI

primary market purchases of GOI bonds |

To

cease on 1-4-2006 |

Further,

the Act prohibits the Central Government from borrowing from the

Reserve Bank of India (that is deficit financing, involving the

printing of money) to meet its deficit, except for temporary cash

advances. This effectively rules out a cheap source of borrowing

and forces the government to borrow at much higher rates, for no

evident reason. The RBI is even to be prohibited from making primary

market purchases of government bonds.

But the limitation on borrowing from the RBI, or deficit financing,

is not at all something that can be easily justified. The argument

that deficit financing causes inflation is not just simply wrong.

It is now widely acknowledged across the world to be ridiculous

and completely unwarranted, especially in the financially sophisticated

world we live in. Inflation control does not at all depend upon

controlling the central government’s borrowing directly from the

RBI.

So this directive does not serve any useful purpose. Instead, it

unnecessarily forces the government to pay much higher interest

on all its debt, instead of allowing for some low interest debt

to the RBI. This raises the interest cost of the government and

thereby the total revenue expenditure, perversely making it harder

to achieve the revenue deficit targets. It is hard to understand

why this portion of the Act has been retained even when earlier

discussion in Parliament pointed to the absurdity of this condition.

Furthermore, as can be seen from Table 1, the FRBM Act and Rules

require a continuous reduction in revenue and fiscal deficits over

the next four years, regardless of the prevailing macroeconomic

circumstances. This insensitivity even to more obvious patterns

such as the business cycle (which typically affects tax revenues

and therefore public deficits) makes the entire legislation excessively

rigid and ties the government’s hands even in terms of responding

to the needs of its citizens.

But the most worrying – and potentially undemocratic – part of the

FRBM Act relates to compliance conditions. The Act states that “whenever

there is a shortfall in revenue or excess of expenditure over the

pre-specified levels….the Central Government shall take appropriate

measures for increasing revenue or for reducing the expenditure

(including curtailing of the sums authorised to be paid and applied

for from and out of the Consolidated Fund of India under any Act

so as to provide for appropriation of such sums).”

The notification spells this out even more clearly: “In case the

outcome of the quarterly review of trend in receipts and expenditure…at

the end of any financial year… shows that

-

the total non-debt receipts are less than 40 per cent pf the Budget Estimates for that year; or

-

the fiscal deficit is higher than 45 per cent of the Budget Estimates for that year; or

-

the revenue deficit is higher than 45 per cent of the Budget Estimates for that year,

then…

the Central Government shall take appropriate corrective measures.”

This means that if any of these conditions holds (which is very

likely in most years) the government will in effect be forced to

cut expenditures even if they are essential for the economy, or

required to enforce its popular mandate or to deliver the socio-economic

rights of the citizens.

This is going to hit home much faster than many people realise.

The Budget 2004-05 contains what are widely recognised to be inflated

and highly optimistic revenue receipt projections. Also, the overwhelming

part of additional resource mobilisation in the budget is backloaded,

to be available only after September. In addition, the truant monsoon

is bound to depress revenues. By September, it is not just likely

but almost inevitable that the actual revenue receipts will fall

short of the Budget estimates by 40 per cent or more.

When that happens, by the Act that the government has just notified,

it will then be required to cut back on expenditure. This means

that even the low and inadequate provisions for employment, education

and other goals listed in the National Common Minimum Programme

will be further cut, and may not even increase at all.

Much of the opposition to the expenditures projected in the Budget

has focussed on the low additional outlays for critical and socially

necessary areas, which has been seen as a betrayal of the people’s

mandate. The total budgeted for these is only Rs. 10,000 crores,

but imagine the situation if even this small additional outlay is

not actually provided, because of the constraint posed by the FRBM

Act!

There may be even worse to come. The fearsome combination of heavy

floods and severe drought that is affecting different parts of the

country is bound to involve lower incomes and thus lower tax collections,

as already stated. But it should also require much larger outlays

to provide even the most minimal relief to the affected people who

are spread across India. Even such critical relief and rehabilitation

– including in the form of rural employment and other physical assistance

– may be under threat from the absurdly rigid fiscal discipline

imposed by the Act.

The problems with such fiscal responsibility legislation across

the world are now becoming more and more evident. The Gramm-Rudman-Hollings

legislation in the US, which was the international front runner

in this regard, is now really honoured only in the breach, through

shifting many expenditures of the US federal government to off-budget

heads. In the European Union, the Growth and Stability Pact which

provides similar constraints is coming under severe pressure, and

France and Germany are already seeking ways to make it effectively

meaningless and inapplicable to actual fiscal policy.

However, we in India seem to be blissfully unaware of the potential

problems in store. The Task Force appointed by the earlier government,

on Implementation of the Fiscal Responsibility and Budget Management

Act (hereafter Kelkar Task Force) has just submitted its report

in late July 2004. This Report is much more optimistic about meeting

the targets defined by the FRBM.

The Report correctly argues that fiscal consolidation should be

revenue-led, rather than requiring cuts in expenditure, and even

suggests that capital expenditure should be enhanced, in order to

balance the contractionary effects of fiscal consolidation. And

some of its suggestions for tax reform, such as widening the tax

base, enhancing the equity of the system, establishing an effective

compliance system, and simplifying the system by removing rebates,

are well-known and basically desirable.

However, the Kelkar Tax Force’s basic perception appears to be that

fewer and lower rates of taxation will lead to much greater compliance

and generate a lot of tax buoyancy. This Laffer Curve-type argument

has been repeatedly disproved in its country of origin (the US)

and there is absolutely no reason to believe that lower rates will

generate higher revenues without major changes in tax enforcement.

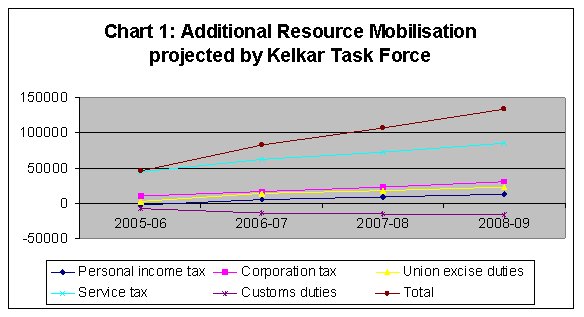

Nevertheless, the optimistic projections in the Report are based

on precisely such an argument. Chart 1 shows the valiant projections

of increasing tax revenues over the next four years, which are apparently

going to be achieved through lower and fewer rates and reform of

the tax administration by introducing VAT for all central and state

government goods and services taxes. Apparently, the reduction in

tax rates will not only encourage better voluntary compliance, but

will also generate much higher rates of economic growth, which will

obviously then mean more government revenues as well.

The

largest increase is projected for services taxes (which are projected

to increase by more than Rs. 45,000 crore from next year to more than

Rs. 85,000 crore by 2008-09), and the most significant decline is

for customs duties (which are slated to decline progressively, starting

from Rs. 8300 crore next year to more than Rs. 16,000 crore in 2008-09).

All this creates the astounding figure of an additional Rs. 134,062

crore of tax revenues just four years hence.

Associated with this, there are naturally very optimistic projections

regarding tax buoyancy. Table 2 indicates the extent of buoyancy which

is predicted, compared to the estimated buoyancy rates of the past

five years. Customs duties are the only category for which buoyancy

is projected to come down, largely because the Task Force proposes

very dramatic declines in such duties. For all other categories of

taxes, there are substantial increases projected for buoyancy, mostly

without adequate justification. The biggest such increase is for services

tax, which is apparently assumed to be relatively easy to collect

(a strong assumption in India where unorganised services dominate).

Table

2: Tax buoyancy projections of Kelkar Task Force |

||

Baseline |

With

proposed reforms |

|

Income

tax |

1.69

|

1.84 |

Corporation

tax |

1.98

|

2.19

|

Union

excise duty |

0.75

|

0.98

|

Customs |

0.54 |

0.06 |

Service

tax |

1.77

|

5.39

|

In

general, such an optimistic scenario appears to reflect the triumph

of hope over experience. It is certainly true that such increases

in tax revenues (and indeed even larger increases) can be achieved

– but this will require not just reduction of rates and simplification

of the tax system, but a much more aggressive attitude towards enforcement

and punishment of tax evaders.

What

has prevented this in the past is not practical difficulty but the

absence of political will. There is little to indicate that the political

economy of the ruling classes has changed so dramatically in the recent

past that such enforcement will be likely. And until that happens,

the unfortunate reality is that the burden of fiscal adjustment will

continue to be borne by the poor of the country, through reductions

in much-needed public expenditure.

©

MACROSCAN 2004