Portents

for the global economy are gloomy at best. And recent

events have already shown that the Indian economy

will be also be affected by adverse developments in

the rest of the world, whether through the impact

of mobile capital flows, or through exports being

dragged down by the recession in Europe and the economic

uncertainty in the US.

How resilient is the Indian economy at present, in

the face of these negative global forces? In terms

of domestic demand, it is certainly possible for the

government to think of ways of rejuvenating the economy,

ideally through more broad-based employment-led growth.

But externally, the recent pattern of growth has been

crucially related to India's greater global integration,

and therefore it has created patterns of dependence

on international markets and international capital.

This makes the economy significantly more vulnerable,

especially because the growth has been reliant on

capital inflows to generate domestic credit-driven

bubbles, rather than trade surpluses.

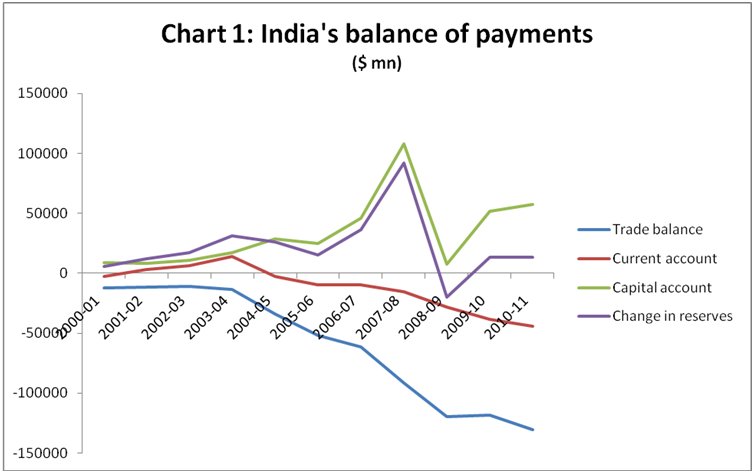

Chart 1 describes the main elements of India's balance

of payments. (All data in this and the following charts

are from the Reserve Bank of India's online statistical

database, accessed on 6 January 2012.) Several features

of importance emerge from this chart. First, the trade

balance has been negative and progressively worsened

over the course of the decade. Second, in the early

years of the decade, this impact could be kept in

check because remittance inflows and software exports

ensured that the current account was either in surplus

or ran small deficits. But in the second half of this

period, even large remittance inflows could not prevent

a substantial deterioration of the current account.

Third, despite this, external reserves have kept growing,

except for the crisis year 2008-09. Fourth, this was

entirely because of capital inflows, which increased

over the decade except in the crisis year, and the

capital account peaked in 2007-08 with more than $100

billion net inflow.

Chart

1 >>

(Click to Enlarge)

What this suggests is that India's external reserves

were effectively borrowed rather than earned, as they

were largely growing because of capital inflows that

were dominated by portfolio inflows and external commercial

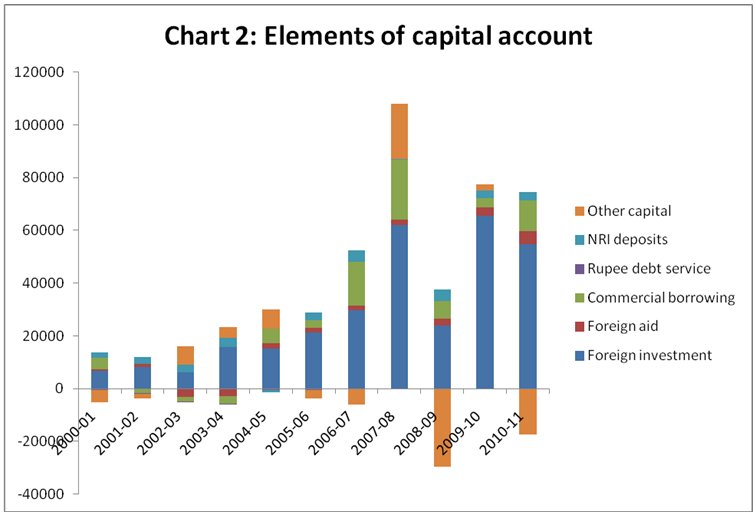

borrowing. This is confirmed by Chart 2, which shows

that – especially in the second half of the decade

– foreign investment and external commercial borrowing

were dominantly responsible for the inflows on capital

account.

In this context, another recent feature of foreign

investment is worth noting. In the past, it made a

lot of sense to separate portfolio inflows from direct

foreign investment, on the grounds that the former

are typically more short-term in orientation and more

likely to be volatile and therefore exit the country

in periods of downswing. However, the emergence of

private equity, especially after 2000, has changed

this considerably, since this is typically included

in FDI. Private equity is also essentially short term

in orientation, since it seeks to make relatively

rapid capital gains on the acquisition of domestic

assets. A significant proportion of inward FDI into

India in the recent past has been in the form of private

equity. As a result, a significant proportion of inward

FDI is also effectively short term, and cannot be

assumed to be in for the long haul, any more than

explicitly portfolio inflows.

Chart

2 >>

(Click to Enlarge)

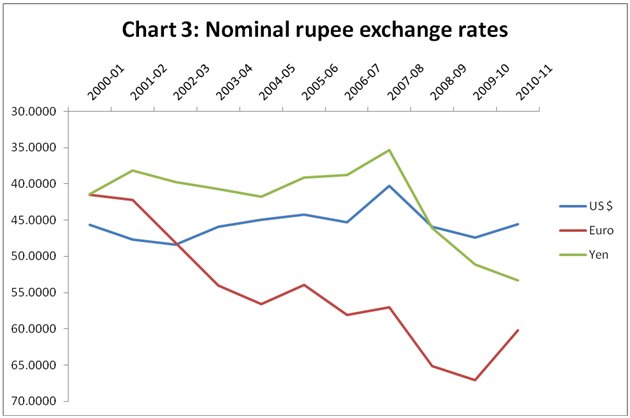

There is a widespread perception that the rupee has

depreciated significantly in recent times. Certainly,

in nominal terms vis-à-vis the major currencies,

there is evidence of substantial decline in value.

Chart 3 shows the rupee relative to the US dollar,

Euro and Japanese Yen. Nominal depreciation has been

particularly evident over much of 2011, which has

not been captured in this chart.

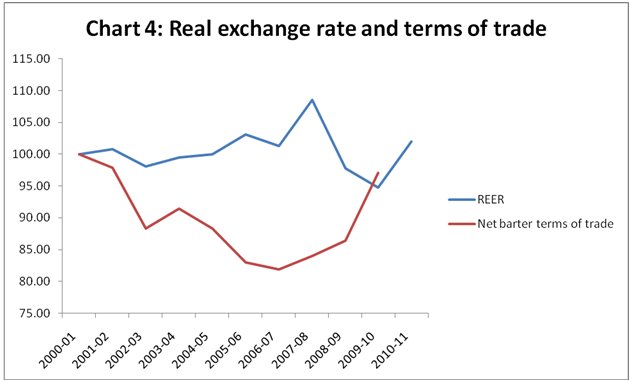

However, it should be noted that this was also a period

in which inflation in India was significantly higher

than in many if not most of its trading partners.

As a result, the real effective exchange rate, shown

in Chart 4, barely changed very much over the entire

course of the decade. The net barter terms of trade

declined until 2007, especially because of high world

oil prices, but then improved, so that even in terms

of this variable there was not much change by the

end of the decade.

Chart

3 >>

(Click to Enlarge)

Chart

4 >>

(Click to Enlarge)

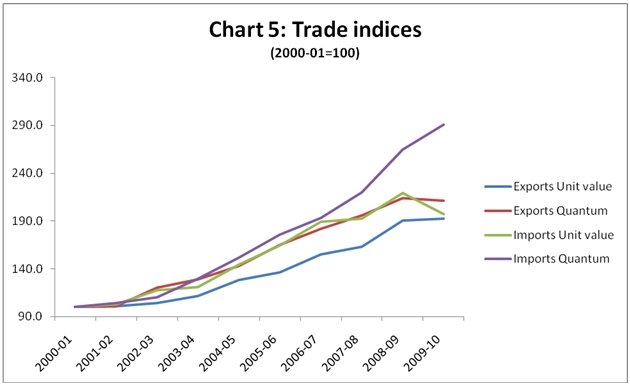

Chart

5 >>

(Click to Enlarge)

Chart 5 describes the indices of trade in terms of

quantum and unit value, separately for exports and

imports. This is an extremely significant chart, because

it highlights that the quantum index for imports moved

up much more rapidly than all the other indices. Further,

it does not seem to have been at all affected by the

global crisis. So it would be unwise to blame high

oil prices alone for the high and growing total import

bill – clearly import liberalisation has resulted

in a significantly increased propensity to import

within the economy.

This also has another implication: the domestic impact

is greater than would be evident from just the total

value of imports, since significantly greater quantities

of imports are entering the country. This has direct

effects on import-competing activities, on employment

and livelihood particularly of small producers. The

slow growth of non-agricultural employment despite

rapid aggregate GDP growth may be at least partly

related to the impact of substantially increased import

volumes of a wide range of manufactured commodities.

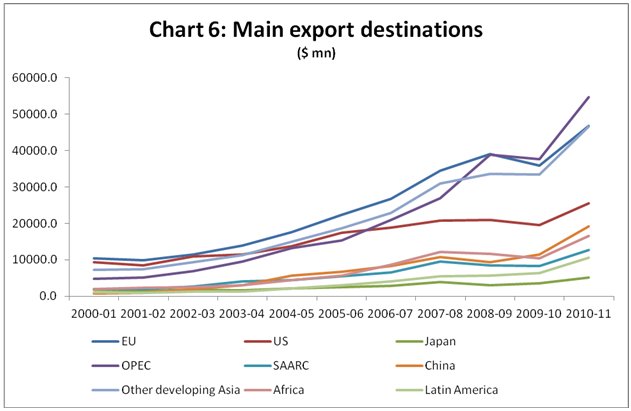

Chart

6 >>

(Click to Enlarge)

In terms of direction of trade, it is evident from

Chart 6 that the European Union remains an extremely

important destination for exports. This is bad news,

given the likely recession in Europe which is also

bound to affect their imports. OPEC as a group recently

overtook the EU in becoming the grouping to receive

the largest amount of India's exports (in value terms)

but it is worth noting that China and other developing

countries in Asia have become increasingly significant

as export markets for India.

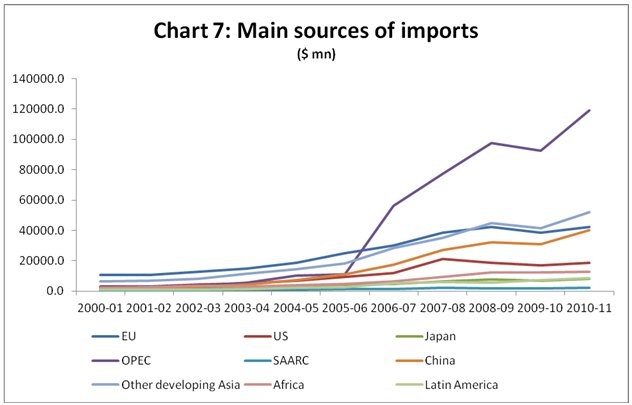

Chart 7 shows that in terms of imports, the global

increases in oil prices propelled OPEC countries dramatically

to the top of the groupings in terms of sources of

imports in the second half of the decade. But once

again, it is important to note that China and other

developing Asia have become major sources of imports,

exhibiting the fastest rate of growth for non-oil

imports.

Chart

7 >>

(Click to Enlarge)

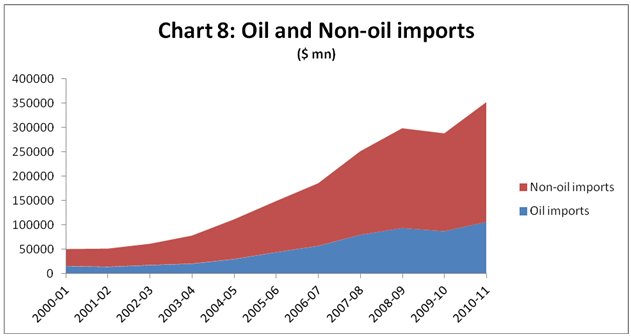

These non-oil imports have in fact been growing very

sharply. Chart 8 makes it clear that the recent increases

in the total import bill cannot be ascribed to oil

prices alone, because non-oil imports have been growing

much faster in value terms.

Chart

8 >>

(Click to Enlarge)

So recent trends in the external sector were already

cause for concern, even before the latest impact of

the ongoing global economic crisis can be felt. It

is not just high energy dependence which is a strategic

problem for India. The rapid expansion of non-oil

imports suggests an economy that (despite two decades

of liberalising ''reforms'') is becoming less externally

competitive and generating trade patterns that are

likely to continue to have adverse employment effects.

Most of all, a trajectory of growth based on capital

inflows that generate domestic finance-driven consumption,

including significantly high imports and worsening

trade balances, is obviously not sustainable. We do

not need a global crisis to recognise these danger

signals.

*This article was published

in the Business Line on January 9, 2012.