Introduction

The Indian economy has been under a severe and consistent

inflationary pressure for the past couple of years.

While the inflation rate (point to point, WPI) was

4.5 per cent in January 2008, it increased to 12.8

per cent by August 2008. It was followed by a period

of low inflation till October 2009. But from November

onwards prices were on an accelerating trend again

and by April 2010 inflation rate touched 11 per cent,

hovering thereabout since then. This is in sharp contrast

to most of the 2000-2005 period when inflation rate

hardly ever crossed 7 per cent, and the last time

inflation crossed double digit was in May 1995.**

Therefore, the recent increase in rate of inflation

is quite striking not only because of the peaks, but

also because it appears to be a consistent phenomenon.

As it has snowballed into a social crisis and a possible

election issue, there has been a flurry of writings

from various quarters over the last year or so regarding

the reasons behind it, the impacts, and possible policy

suggestions. It seems that the inflation during 2008-09

was quite different from the most recent one. While

the increase in inflation rate during 2008-09 undoubtedly

had a global link associated with rise in the prices

of mineral oils, metals, and food grains globally,

this time around, inflation does appear to be an India-specific

phenomenon, as there are no major global factors at

play. In addition, researchers have also argued that

instead of countering the global trends, our domestic

policies, especially those related to money supply,

had consolidated and stimulated the inflationary trends

during 2008 (Marjit, 2008), whereas the current phase

of rising inflation is in the face of tight money

policy. Moreover, though inflation is supposed to

weaken the purchasing power of a currency, recent

inflation in India has been accompanied by the rupee’s

relative strengthening against international currencies,

especially the US dollar. This suggests that current

inflation is more a structural problem arising from

supply side constraints both on the production as

well as distributional fronts, especially in food

commodities. It appears that factors like lack of

capital formation in agriculture, withdrawal of the

State from irrigation and extension activities, speculation

& commodity trading with a practically non-existent

Public Distribution System, have also contributed

to the crisis. Some economists have been consistently

pointing out that domestic policy lapses in these

areas are the main reason behind persistent and increasing

rates of prices (Chandrasekhar, 2008, 2010), but their

arguments seem to be falling on deaf ears.

While there has been no dearth of macroeconomic projections,

most of the analysis has been on the growth impact

of inflation and almost nothing on the distributional

impact (a notable exception has been Ghosh, 2009).

The present article focuses on this specific issue

of distributional impact of current inflation by quantifying

the differential impact of the current inflation on

different income groups of the society.

Trends in WPI and CPI Inflation Indices

Inflation rate in India is officially measured through

changes in the Wholesale Price Index (WPI). In addition,

effective inflation for consumers is measured through

changes in the Consumer Price Index (CPI). While most

analysis has been based on the aggregate WPI, we are

more concerned about price trends in different commodity

groups, especially those in the CPI. We therefore

look at inflation in three broad groups of commodities

- Food, Fuel, and Others.

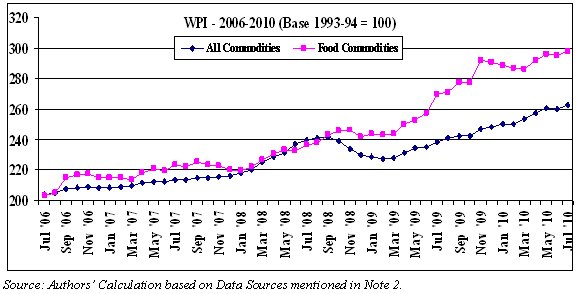

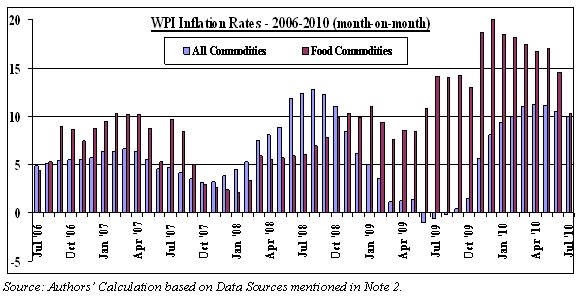

It is observed that the current bout of inflationary

pressure started roughly in December 2007, and WPI

Inflation, which had remained in the 4-6 per cent

band for a long period of 26 months – January 2006

to March 2008 –climbed up sharply to supra-10 figures,

first in June 2008, and then again in February 2010.

Food price inflation increased sharply during March-April

2008, crossed double-digit mark in June 2009, reached

a peak of 20 per cent in December 2009, and declined

marginally thereafter. The inflation rate for the

Fuel group was quite high during 2004-05, declined

till November 2007, and increased steeply thereafter.

It remained negative for most of 2009, but rose sharply

again during 2010. Inflation in the Non-Food–Non-Fuel

sector was initially low but is increasing and shadowing

the WPI inflation in recent past. The most recent

figures obtained from the Government of India put

the inflation rates at 10.0 per cent (WPI), 10.3 per

cent (Food), 14.3 per cent (Fuel), and 8.5 per cent

(Non-Food–Non-Fuel) for July 2010.

Chart

1 >> Click

to Enlarge

While

headline inflation has been much talked of, the man

on the street is more concerned about the price (s)he

pays for commodities. Rise in prices paid by the common

person is reflected by the CPI. Consumers in rural

areas are affected by movements in CPI for Agricultural

and Rural Labourers (CPIAL), while those in urban

areas are concerned with CPI for Industrial Workers

(CPIIW) and CPI for Urban Non-manual Employees (CPIUNME).

Inflation in CPI lagged behind the WPI and started

the current northward journey from January 2008 onwards.

However, unlike WPI which showed decelerating trend

in 2009, CPI Inflation has been significantly high

throughout the last four years and instead of slowing

down is on the rise over the last few months. This

is all the more disconcerting because the deceleration

in WPI over most of 2009 was associated with global

recession, which led to loss of jobs and decreased

income for a large part of Indian populace. Thus,

while most incomes remained stagnant, consumer prices

were on the rise. Even among the sectors, increase

in CPIAL has been greater than CPIIW or CPIUNME indicating

that prices in rural areas have increased at a faster

pace than those in the urban areas.

At a disaggregated level, rise in CPI for the Food

group has been higher than that in overall CPI, especially

in the most recent past, seemingly confirming our

earlier observation that the present inflation is

a supply side problem. CPI for Fuel showed a decelerating

trend till April 2008, and has been erratic throughout

the period, probably because of the administered prices

of fuel. Interestingly, fuel prices in rural areas

have increased at a much faster rate compared to those

in urban areas. This is due to the greater share of

Firewood in the calculation of CPIAL and also due

to the nature of the unregulated and unorganised fuel

market in rural areas. The recent shift in fuel price

policy to a market based regime is expected to be

reflected in a more systematic movement in Fuel price

inflation in line with global prices. Thus with global

crude prices firming up, the common man is going to

be hit harder.

Chart

2 >> Click

to Enlarge

What is significant is that inflation has been most

severe in the foodgrains group. Since a large part

of the consumption expenditure of the majority of

people is on food, which has a very low price elasticity,

the common man has been affected most severely. Also,

because of the low weight of the Food group in the

WPI, headline inflation has not revealed the true

misery of people.

If we look at the rates of price increase, we find

that over the last four years WPI has increased by

about 29 per cent (Table 1). Rise in CPI has been

substantially higher, with urban price indices rising

by around 40 per cent and rural prices increasing

by about 49 per cent. Prices of Food have increased

the most – more than 50 per cent – followed by Fuel

prices in rural areas. It thus transpires that the

purchasing power of common people has declined by

about 49 per cent in rural areas and more than 40

per cent in urban areas over the last four years.

However, this impact has not been uniform; the suffering

has been uncommon to some groups, which we explore

in the next section.

Table

1: Rates of Increase in Price Indices |

Indicator |

Weight |

Percentage

Increase During |

July

2006 –

July 2007 |

July

2007 –

July 008 |

July

2008 –

July 2009 |

July

2009 –

July 2010

|

July

2006 –

July 2010 |

WPI

All |

100.0 |

4.9 |

11.7 |

-0.1 |

10.0 |

28.7 |

Food |

15.4 |

8.7 |

6.3 |

14.9 |

10.3 |

46.5 |

Fuel |

14.2 |

-1.5 |

17.1 |

-10.3 |

14.3 |

18.2 |

Others |

70.4 |

5.4 |

11.8 |

-1.4 |

9.0 |

26.9 |

|

CPIAL

All |

100.0 |

8.6 |

9.4 |

12.9 |

11.0 |

48.9 |

Food |

66.7 |

9.6 |

10.7 |

9.9 |

15.6 |

54.1 |

Fuel |

7.9 |

6.5 |

8.5 |

9.0 |

14.1 |

48.9 |

Others |

25.4 |

6.7 |

6.2 |

21.9 |

14.1 |

35.3 |

|

CPIIW All |

100.0 |

6.1 |

8.3 |

11.9 |

13.7 |

40.4 |

Food |

46.2 |

8.4 |

11.8 |

14.7 |

17.3 |

48.9 |

Fuel |

6.4 |

7.4 |

6.2 |

2.1 |

3.4 |

19.2 |

Others |

47.4 |

3.6 |

5.3 |

10.5 |

11.6 |

34.9 |

|

CPIUNME-All |

100.0 |

6.4 |

7.4 |

13.0 |

14.1 |

41.2 |

Food |

46.2 |

9.4 |

10.0 |

15.3 |

9.7 |

52.1 |

Fuel |

6.4 |

7.0 |

6.2 |

2.1 |

5.4 |

22.3 |

Others |

47.4 |

3.4 |

5.0 |

12.3 |

19.6 |

33.0 |

|

Source:

Press Releases of Government of India, Various

Issues; Reports on Price Indices obtained from

Ministry of Statistics and Programme Implementation,

Various Issues. See Note 2. |

Table

1 >> Click to Enlarge

Distributional Impact: Who are the worst sufferers?

While everyone except speculators are adversely affected

by the current inflation, some groups are more so

than the rest. At a theoretical level, it has been

postulated that inflation favours the profit earners

(the rich, mostly) and robs the wage earners (the

middle and low income groups). While incomes of the

former group are mostly indexed to prices, incomes

of the latter groups follow prices only after a lag,

and even then they are often not compensated fully.

Apart from this textbook rendition of the distributional

impact of inflation, effective inflation faced by

different socio-economic groups would be different

also because of their different consumption patterns.

We try to quantify the impact of the recent inflation

on different income groups in India.

As price rises are not uniform across commodity groups,

effective inflation would depend on the consumption

pattern of families. Since the commodity baskets of

the lower income groups are different from those of

the high income groups, effective inflation rates

faced by them are also dissimilar.

Periodical surveys from National Sample Survey Office

(NSSO) provide data on the consumption pattern of

different economic groups. NSSO data divides the population

into Twelve Monthly Private Consumption Expenditure

(MPCE) classes and the shares of different commodity

groups in total expenditure are provided for each

of these classes separately. The bottom four MPCE

classes can be taken as the Low Income Group, while

the top four can be considered as the High Income

Group. The middle four MPCE classes can be taken to

represent the Middle Income Group.

Table

2: Consumption Pattern of Indian Households |

MPCE

Classes |

Average

MPCE

(Rs per capita)

|

Shares

of Commodity Groups in Total Expenditure (%) |

Food |

Fuel |

Others

|

Rural

– I |

195 |

68.3 |

13.6 |

18.1 |

Rural

– II |

256 |

67.2 |

13.4 |

19.4 |

Rural

– III |

298 |

61.9 |

11.3 |

26.8 |

Rural

– IV |

343 |

60.8 |

11.7 |

27.5 |

Rural

– V |

387 |

59.3 |

11.1 |

29.6 |

Rural

– VI |

433 |

60.1 |

10.8 |

29.1 |

Rural

– VII |

482 |

59.3 |

10.8 |

29.9 |

Rural

– VIII |

542 |

58.1 |

10.3 |

31.6 |

Rural

– IX |

631 |

55.8 |

10.2 |

34.0 |

Rural

– X |

775 |

53.4 |

9.7 |

36.9 |

Rural

– XI |

1003 |

49.8 |

9.1 |

41.1 |

Rural

– XII |

1743 |

33.7 |

5.9 |

60.4 |

|

|

|

|

|

Urban

– I |

283 |

64.9 |

14.3 |

20.8 |

Urban

– II |

368 |

63.0 |

13.3 |

23.6 |

Urban

– III |

444 |

56.7 |

12.3 |

31.0 |

Urban

– IV |

533 |

55.3 |

12.5 |

32.2 |

Urban

– V |

627 |

52.5 |

12.0 |

35.4 |

Urban

– VI |

732 |

50.4 |

11.8 |

37.8 |

Urban

– VII |

859 |

48.2 |

11.4 |

40.4 |

Urban

– VIII |

1010 |

45.9 |

10.7 |

43.4 |

Urban

– IX |

1227 |

42.4 |

10.1 |

47.5 |

Urban

– X |

1599 |

38.8 |

9.0 |

52.1 |

Urban

– XI |

2156 |

35.6 |

8.8 |

55.6 |

Urban

– XII |

3943 |

23.6 |

6.0 |

70.4 |

|

|

|

|

|

Rural

Low Income |

299 |

67.7 |

13.5 |

18.8 |

Rural

Middle Income |

468 |

61.5 |

11.4 |

27.0 |

Rural

High Income |

927 |

39.1 |

7.0 |

53.9 |

Rural

- All |

625 |

53.3 |

9.7 |

37.0 |

|

|

|

|

|

Urban

Low Income |

445 |

63.8 |

13.8 |

22.4 |

Urban

Middle Income |

813 |

49.7 |

11.5 |

38.8 |

Urban

High Income |

1985 |

27.6 |

6.9 |

65.4 |

Urban

- All |

1171 |

40.0 |

9.4 |

50.7 |

Source:

Authors’ calculations based on NSSO Report

No 523, Household Consumption Expenditure in

India 2005-06, GOI (2008) |

Table

2 >> Click to Enlarge

This enables us to derive the consumption basket of

the bottom, middle and top fractile income classes.

Using NSSO data for 2006-07, it is observed that Fuel

& Light has the lowest share in total expenditure

for all the three income groups (Table 2). For the

Low and Middle Income people, Food commodities constitute

the largest consumption expenditure group, while the

largest share of expenditure goes to Non-Food Non-Fuel

commodities for the High Income group consumers.

These shares of Food, Fuel and Others in the commodity

basket of different classes of people have been used

as weights to derive the effective inflation rates

faced by the different income groups from the commodity-group

CPIs. While CPIAL is used for rural sector, simple

average of CPIIW and CPIUNME has been used for the

urban sector. This provides us with the Effective

Consumer Inflation Rate for the six groups of people

considered (Table 3). Since essential items like Food

and Fuel feature more prominently in the basket of

the LIG people and these items have experienced relatively

higher price rise during the study period, effective

inflation rates are higher for the poorer section

of the people, both in the rural and the urban areas.

It also appears that the urban consumers have suffered

more erosion of purchasing power during 2009-2010,

mainly because of the inflation in Non-Food–Non-Fuel

commodities, which feature heavily in their consumption

basket. However, it is still price rise in food commodities

that hurts people most since these are basic to a

decent standard of living.

Table

3: Effective Inflation Rates Faced by Different

Economic Groups |

MPCE

Groups |

Percentage

Decrease in Purchasing Power During |

July

2006 –

July 007 |

July

2007 –

July 2008 |

July

2008 –

July 2009 |

July

2009 –

July 2010 |

July

2006 –

July 2010

|

Rural

Low Income |

8.6 |

9.6 |

12.1 |

12.1 |

49.9 |

Rural

Middle Income |

8.4 |

9.3 |

13.1 |

10.7 |

48.4 |

Rural

High Income |

7.8 |

8.1 |

16.3 |

6.1 |

43.6 |

|

|

|

|

|

|

Urban

Low Income |

7.5 |

8.9 |

12.4 |

13.7 |

42.7 |

Urban

Middle Income |

6.6 |

8.1 |

12.1 |

13.3 |

40.6 |

Urban

High Income |

5.3 |

6.8 |

11.8 |

14.1 |

37.6 |

Source:

Authors' Calculations. |

Table

3 >> Click to Enlarge

Over the last four years the impact has therefore

been hardest on the lower income people, especially

those in the rural areas. It is observed that the

purchasing power has declined by about 50 per cent

for the Rural Low Income Group people compared to

about 38 per cent for the Urban High Income Group

people. In addition, since a majority of the lower

income groups are wage earners and that too from the

unorganised sector, their incomes are not compensated

for the price rise. On the other hand, most of the

people in the highest income groups are either profit

earners or engaged in the organised sector. Therefore,

their incomes are frequently indexed to price rise

and they are somewhat compensated against the inflationary

trends.

If we consider the fact that per capita income has

increased by about 40 per cent over the last 4 years

(in nominal terms) and assuming (though unrealistically)

that this growth has been shared equally by all the

groups of people, we still arrive at a fall in real

income for five of the six groups considered by us.

Only the urban HIG people seem to have had a rise

in real income under such restrictive assumption.

If we now contemplate the reality that most of the

recent income growth have benefited the upper echelons

of the society we can easily comprehend the uncommon

immiseration of the already marginalized group that

has taken place, especially at the countryside.

This has wider socioeconomic implications since the

erosion in the purchasing power due to current inflation

has been biased against the poor, decreasing their

real per capita incomes disproportionately. This has

been worsening the already widespread economic inequality

in India and this is perhaps the most appalling impact

of current inflation. We hope that the present commentary

stirs up some thoughtful debate on the wider socioeconomic

impact of the distributional effects of the specific

type of inflation currently prevailing in India and

that appropriate policies are formulated before the

resultant inequality goes out of control.

* Authors are Associate

Professor and Reader respectively at the Department

of Economics, University of Burdwan, India. Authors

are grateful for valuable communications with Dipa

Mukherjee, Saikat Sinha Ray, and Pinaki Chakraborti.

Disclaimers apply. Correspondence: meriju@rediffmail.com.

** Note: Data used in this article

are obtained from – RBI Bulletin, various years, [available

at http://www.rbi.org,

accessed on 12/08/2010]; Reports on Consumer Price

Indices for Agricultural & Rural Labourers and

for Industrial Workers, Various Issues [available

from http://www.labourbureau.nic.in

accessed on 28/08/2010]; Reports on Wholesale Price

Indices and Consumer Price Indices for Urban Non-Manual

Employees, Various Issues [available from http://www.mospi.nic.in

accessed on 26/08/2010].

References

Chandrasekhar, C.P. (2008) ''Inflation: How Much and

Why'',

Macroscan,

17th April, 2008 [available from http://www.macroscan.org/cur/apr08/print/

prnt170408Inflation.htm,

accessed on

12/08/2010]

Chandrasekhar, C.P. (2010) ''Engineered Inflation'',

Macroscan,

2nd August, 2010 [available from http://www.macroscan.org/cur/aug10/print/

prnt020810Inflation.htm,

accessed on

12/08/2010]

Ghosh, Jayati (2009)

''Prices and Politics in India'', Macroscan,

24th

March, 2009 [available from http://www.macroscan.org/cur/mar09/print/

prnt240309Prices_Politics.htm,

accessed on 12/08/2010]

Marjit, Sugata (2008)

''Inflation and Public Policy:

Contemporary Dilemmas'', Economic and

Political Weekly, Vol. 43, No. 36

September 6, 2008.