Themes > Features

09.02.2012

Behind the Fear of Debt*

It began with the Reserve Bank of India's third quarter 2011-12 Review of Macroeconomic and Monetary Developments released on January 23, 2012. Its assessment of the situation in India's external sector noted that: ''Risk aversion in the global financial markets has slackened the pace of capital flows to India… If the pace of FDI inflows does not pick up once again and FII equity inflows revert to the decelerating trend, CAD (current account deficit) may have to be largely financed through debt creating flows in the coming quarters.'' It also underlined the fact that signs of a recent revival of FII inflows were largely on account of investment in debt instruments. A few days later, RBI Governor D. Subbarao, referring to the rise in debt flows, publicly emphasised that India has ''a preference for non-debt flows over debt flows'', and ''within non-debt flows, more of FDI''.

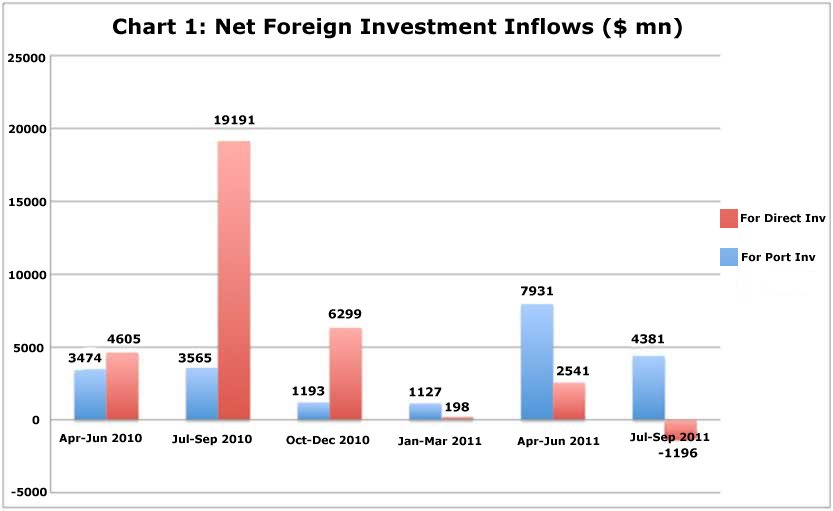

Along with the expression of such fears the government has been liberalising

foreign investment rules to attract equity inflows in lieu of debt.

The most recent such policy allows individual investors to invest in

equity. The justification provided for these fears and policies is the

evidence that investments in Indian equity have decelerated during the

first half of fiscal year 2011-12 when compared to the recent past (Chart

1). In particular, there has been a collapse of foreign portfolio investment

flows, leading to an overall fall in external investment in equity.

The RBI has released some preliminary figures for the third quarter

of 2011-12 (Table 1). These figures also point to a decline in monthly

average inflows of foreign equity investments during September to November

in the case of direct investment and September to December 2011 in the

case of portfolio investments. But the decline is by no means dramatic.

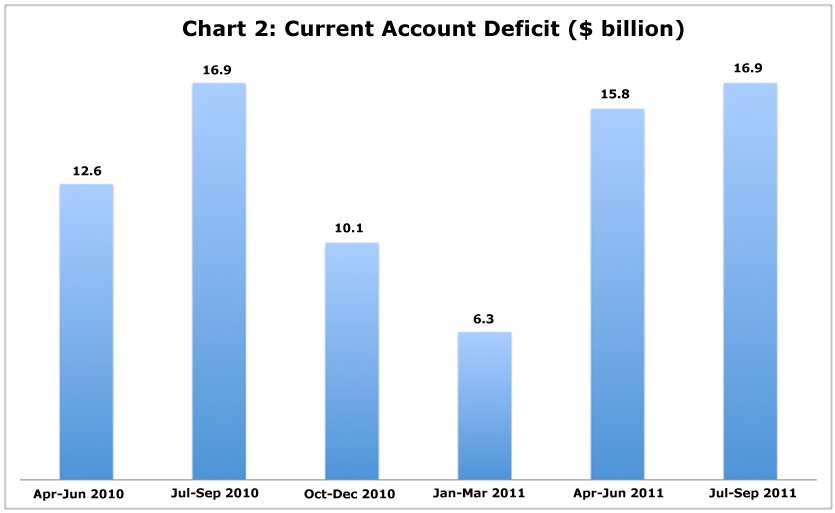

These changes have been occurring at a time when the external current

account deficit, which had fallen in the second half of fiscal 2010-11,

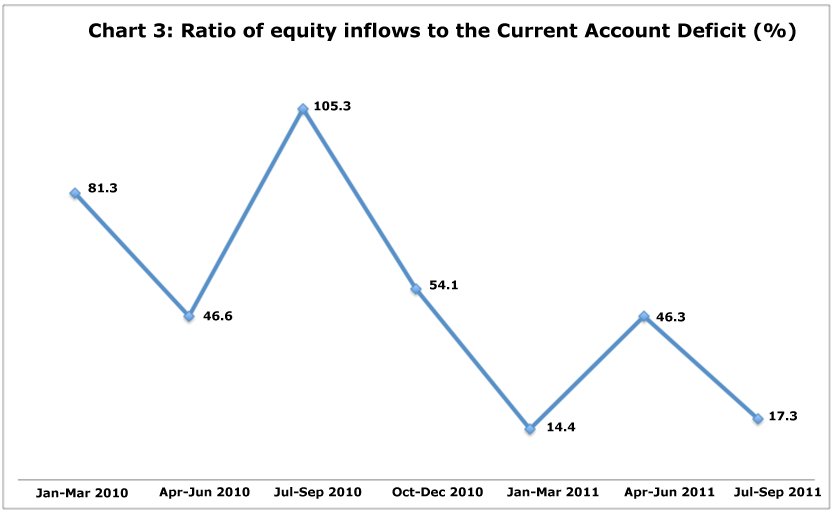

has risen significantly (Chart 2). As a result, a rising share of a

rising deficit is being financed with non-equity flows. The ratio of

direct and equity investment flows to the current account deficit in

India appears to have shifted downwards over a relatively short period

of time (Chart 3). The conclusion arrived at is that India has had to

increase its reliance on debt creating flows to finance its current

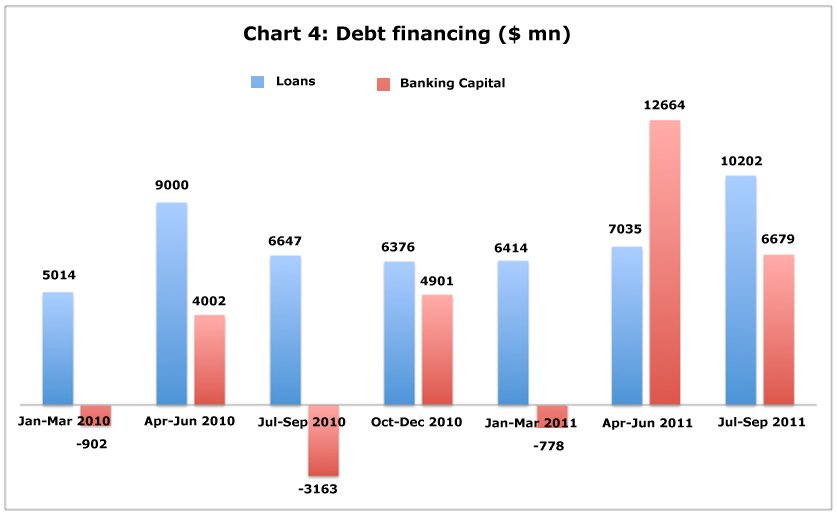

account deficit. Supporting that is the evidence that inflows in the

form of loans and banking capital have together risen quite sharply

during the first two quarters of this fiscal year (Chart 4).

Table

1: Capital Flows during 2011-12 ($ bn) |

||||

2011-12 |

2011-12

|

|||

(Apr.-Aug.) |

(Sep.-Dec.)

|

|||

(Monthly

Average)

|

||||

FDI

to India* |

4.9 |

3.2 |

||

FDI

by India |

1 |

0.8 |

||

FIIs

(net) |

0.4 |

0.1 |

||

ADRs/GDRs

|

0.1 |

0.1

|

||

ECB

Inflows (net) |

1.3 |

0.6 |

||

NRI

Deposits (net) |

0.5 |

1.2

|

||

* : April-November.

|

||||

Though fully collated figures for the period since September

2011 are yet to be released, there are reports that these tendencies

have only intensified more recently. According to one report (Indian

Express, January 30, 2012), during calendar year 2011 as a whole, foreign

debt inflows amounted to $8.65 billion, out of which as much as $4.18

billion came in the month of December. On the other hand, calendar 2011

is said to have recorded a net outflow of equity investments to the

tune of $357 million. Moreover, foreign debt inflows in January are

placed at $3.21 billion against a much smaller $1.7 billion of equity

inflows.

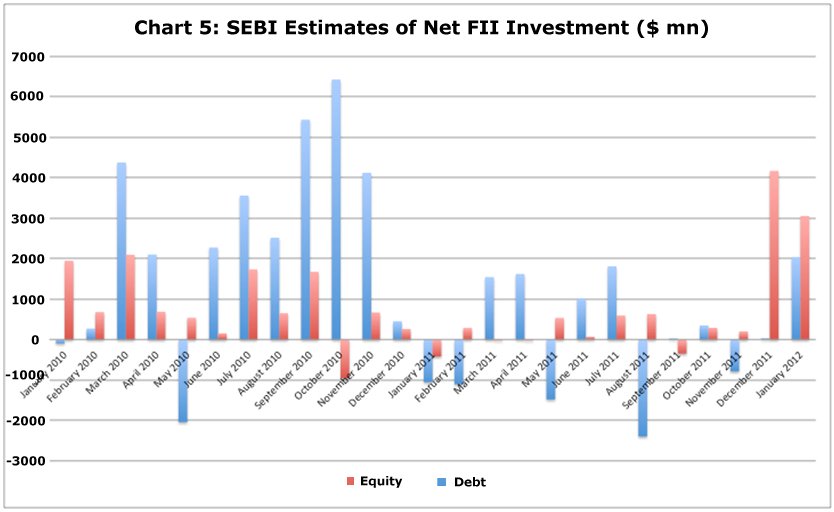

Finally, SEBI figures on net FII investment suggest that while FII investments

in equity have been low or negative for much of the past 14 months,

FII purchases of debt instruments have spiked during December 2011 and

January 2012.

What does this combination of figures say about the capita inflows into the country and their role in financing the current account deficit? To start with, they do point to the fact that, over the last year, inflows of equity investment have been less buoyant than they were prior to the financial crisis and during the post crisis recovery. Secondly, they indicate that one consequence of this has been an enhanced role for foreign debt in financing the current account deficit.

However, this does not mean that India is having any difficulty financing its current account deficit, nor that increased reliance on debt is driven purely by the need to finance the current account deficit. Rather large Indian firms are choosing to borrow abroad to benefit from the substantially lower interest rates in international markets as compared with India. Moreover, the government had in December deregulated interest rates on Non-Resident (External) rupee (NRE) deposits and Ordinary Non-Resident (NRO) Accounts, triggering a chase for non-resident deposits among Indian banks. According to reports, there has since been a surge in NRI deposits, encouraged by the opportunity to earn profits through arbitrage. This makes the volume of debt inflow much greater than needed to finance the current account gap. As a result, foreign exchange reserves have risen and remained at relatively high levels.

Despite these factors the government and the RBI appear to be using

the shift away from equity to debt inflows to liberalise the terms for

foreign equity investment inflows. Flagging this tendency was the announcement

on New Year's day 2012 that a new group of foreign investors identified

as Qualified Foreign Investors (QFIs) are to be permitted to invest

directly in India's equity markets. The definition of who ‘qualifies'

is rather broad: it covers any individual, group or association resident

in a foreign country that complies with the Financial Action Task Force's

(FATF) standards and is a signatory to the multilateral Memorandum of

Understanding of the International Organisation of Securities Commissions

(IOSCO), dealing with regulation of securities markets.

Measures such as these are partly explained by the UPA government's

desire to establish that it has not slowed down on reform and to counter

the view that a form of ''policy paralysis'' afflicts it. But they are

also driven by the need to reverse the slow down in inflows of foreign

portfolio investment. The decline in FII inflows has been attributed

to developments abroad, which required foreign institutional investors

to book profits in India and repatriate their funds to meet commitments

or cover losses at home. The presumption appears to be that individual

investors would not be affected by such compulsions. The government's

press release announcing the new QFI policy declares that the object

of the measure is to ''to widen the class of investors, attract more

foreign funds, and reduce market volatility''. In the last Budget these

investors had been allowed to invest in Indian Mutual Fund Schemes.

The recent announcement takes this a step further and treats them on

par with FIIs. The government's view that QFIs would make up for any

loss of FII inflows and that their investment would be characterised

by greater stability has to be tested. But the factors motivating its

decision are clear.

One danger is that the new measure allows direct access to equity markets

to entities not regulated in their home country. When India first began

permitting foreign investment in the equity market, the FII category

was created to ensure that only entities that were regulated in their

home countries would be permitted to register and trade in India. The

logic was clear. Since it is impossible for Indian regulators to fully

rein in these global players and impose conditions on their financing,

trading and accounting practices, controlling unbridled speculation

required them to be regulated at the point of origin.

But this kind of derivative regulatory control can apply, if at all,

only to institutional investors. Individual investors cannot be subject

to such rules even in their home country and allowing them to enter

amounts to giving up the requirement that only foreign entities subject

to some discipline and prudential regulation should be allowed to trade

in Indian markets. This is of relevance because individual investors

are unlikely to enter India and invest in equity to hold it with the

intention of earning dividend incomes. The exchange rate and other risks

would be deterrents to such long-term commitments. If such investors

do come it would be with the intent of reaping capital gains through

short-term trades. Thus, to the extent that the measure is successful

it would mark a transition towards allowing speculative players greater

presence in Indian markets. Defending that on the grounds that it would

help reduce dependence on debt is indeed questionable.

*This

article was published in the Business Line on January 9, 2012.

©

MACROSCAN 2012