Ever

since the global financial and economic crisis broke,

the International Labour Organisation (ILO) has been

regularly tracking its impact on the level and quality

of employment. In January 2009, the ILO (International

Labour Office 2009) indicated that, under alternate

scenarios, global unemployment could increase by between

18 million or 51 million people worldwide from 2007

to 2009. By June 2009 the range for 2009 had shifted

upwards, to an increase of between 29 million and

59 million unemployed over the period from 2007 to

2009.

The most recent estimates put out by the ILO suggest

that this range was broadly indicative, though the

outcome appears to be closer to its lower bound. In

its January 2010 update, the ILO estimates global

unemployment at 212 million in 2009, or around 34

million above its 2007 level, with most of the increase

having occurred during 2009. In sum, the impact of

the fiscal stimuli delivered by many governments does

not seem to be as yet adequate to stall, let alone

reverse the employment decline resulting from the

crisis. This increase in unemployment was unevenly

distributed, with Developed Economies and the European

Union, Central and South-Eastern Europe and CIS countries,

and Latin America and the Caribbean accounting for

more than two-thirds of the increase in the number

of unemployed during 2009. In other words, South-East

Asia and the Pacific, East Asia and South Asia were

much less affected.

It needs to be noted, however, that in most countries

unemployment figures do not tell the whole story.

With social protection inadequate or lacking altogether,

those in the working age groups need to take on some

form of employment or starve. Hence, recorded unemployment

rates tend to be low. Thus, what is more telling is

to look at a combination of the trends in aggregate

employment and more importantly in the quality of

that employment. According to the ILO, in 2009, employment

growth became negative in two regions (Developed Economies

and the European Union and Central and South-Eastern

Europe and CIS countries) while employment growth

in Latin America and the Caribbean dropped to near

zero. In all regions except South-East Asia and the

Pacific and the Middle East, employment growth declined

below the average annual growth in the first half

of the decade.

This is surprising, since it is to be expected that

countries that are more dependent on foreign trade

and investment flows, such as those in South-East

Asia, would have been more affected by the crisis.

The region experienced the sharpest reductions in

economic growth because of the crisis. Economic growth

in the region as a whole is expected to fall to 0.5

per cent in 2009, down from 4.4 per cent in 2008 and

from an average annual rate of more than 6 per cent

prior to the crisis. The countries that have experienced

the sharpest declines in growth in 2009 are Cambodia

(where growth fell to -2.7 per cent from 6.7 per cent

in 2008 and more than 10 per cent in the years leading

up to the crisis), Malaysia (-3.6 per cent growth

in 2009), Thailand (-3.5 per cent growth in 2009),

Singapore (-3.3 per cent) and Fiji (-2.5 per cent).

According to the ILO, the presence of a major economy

like Indonesia, which has a large domestic market

and is less dependent on trade has buffered the region

and unemployment in the ILO scenarios is projected

to increase by a moderate 1.2 million (with an upper

bound of 2 million and a lower bound of 0.5 per cent).

Overall, the presence of countries where growth is

largely based on the domestic market is seen as positive

from the point of view of the intensity of the downturn

and its effects on employment. In South Asia, the

fact that growth in the larger economies like India

and Pakistan is based more on the domestic market

than exports has blunted the impact of the crisis

on growth and employment.

That having been said there are four features of labour

market trends in the Asia-Pacific region that need

to be noted. First, there are many small disadvantaged

countries, including the small landlocked and island

economies in the region that have no domestic market

to speak of and therefore are perforce (and not just

by strategy), heavily dependent on exports. Second,

three decades of liberalisation have meant that all

regions and countries in the Asia-Pacific have increased

their dependence on exports, even if to differing

degrees. Third, in almost all countries there are

at least a few sectors (whether they be primary products,

manufacturing or informational technology services)

in each country where export dependence is high. And,

fourth there are routes other than an export slowdown

– domestic demand decline, reduced credit access,

etc. – through which the global downturn transmits

itself to developing countries, affecting employment

even in sectors and industries dependent on domestic

markets.

Chart

1 >> Click

to Enlarge

However,

underlying the better performance of this region in

terms of aggregate employment are certain disconcerting

trends. This comes through from an examination of

countries in South-East Asia and the Pacific for which

more recent data is available from labour force surveys.

Given the fact that unemployment is the exception

for individuals in countries without adequate or any

social protection, the impact of the reduction in

growth is felt more in terms of deterioration in the

quality of employment rather than a decline in its

volume. The ILO defines workers in vulnerable employment

as consisting of own-account workers and contributing

family workers, who are less likely to have formal

work arrangements, and are therefore more likely to

lack elements associated with decent employment such

as adequate social security and recourse to effective

social dialogue mechanisms. As a result, vulnerable

employment is often characterized by inadequate earnings,

low productivity and difficult conditions of work

that undermine workers' fundamental rights.

In some countries in South-East Asia, the impact of

crisis has been an increase in vulnerable employment

rather than in recorded unemployment. With job losses

in the export sector the proportion of workers in

vulnerable employment in export dependent countries

has tended to increase. According to the ILO: ''Both

the proportion and the number of workers in vulnerable

employment in South-East Asia and the Pacific have

risen since 2008, with the middle scenario providing

a projected increase of almost 5 million. This trend

is to be expected, as many workers who have lost their

job in export-oriented manufacturing cannot afford

to join the ranks of the unemployed and instead will

take up employment in the informal sector, perhaps

working in agricultural activities or in informal

services, such as street vending.''

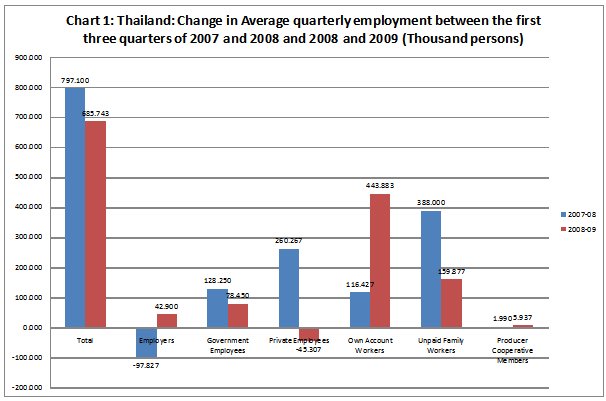

Consider, for example, a country like Thailand, for

which employment figures under different status categories

are available from the National Statistical Office

till as recently as September 2009. The figures show

that if we take average quarterly figures for the

first three quarters of 2007, 2008 and 2009, the increase

in overall employment fell from around 797,000 between

2007 and 2008 to 686,000 between 2008 and 2009. But

this was accompanied by significant changes in the

pattern of employment. The number of private employees,

which grew by 260,000 between 2007 and 2008, declined

by 45,000 between 2008 and 2009 because of the impact

of the crisis on the country's export industries.

Over the same periods the increase in the number of

own-account workers rose from 116,000 to 444,000 and

those in vulnerable employment as per the ILO's definition

rose from 504,000 to 604,000. Unable to obtain employment

in the export industries that had hitherto sustained

them, workers were seeking any form of employment

in order to survive.

Chart

2 >> Click

to Enlarge

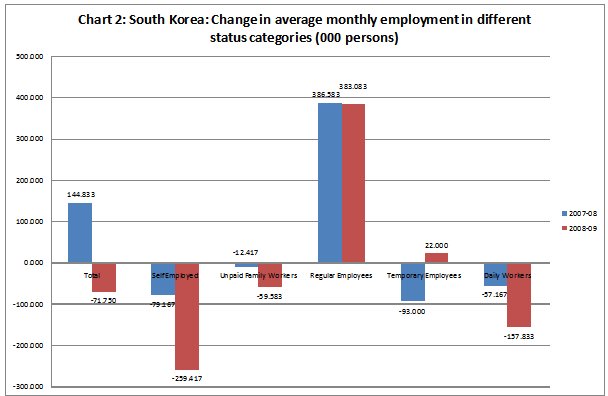

However, the experience differs across countries.

In South Korea, average monthly employment, which

rose by 144,833 between 2007 and 2008, fell by 71,750

between 2008 and 2009. What is remarkable was the

sharp rise in the number of jobs lost in the self-employed

(from 79,000 to 259,000), unpaid family worker (12,400

to 60,000) and daily worker (57,000 to 158,000) categories.

That is, there was a huge decline in vulnerable employment.

On the other hand, the absolute increase in the monthly

average number of regular employees remained more

or less constant in the 380,000 range. One explanation

for this very different experience could be that the

government's efforts at a stimulus kept regular jobs

rising, but the impact of the crisis damaged sectors

relying on self-employed or irregularly employed workers

for their survival.

Finally, there are specific groups that have been

affected particularly adversely. Besides marginalised

or disadvantaged sections, the impact of the crisis

was significant in the case of women and youth. Women

were affected not merely because of the all-prevalent

gender discrimination, but also because in many countries

there has been some degree of feminisation of export

employment, especially in the case of low value added,

labour intensive processing. And with unemployment

and underemployment on the rise, new entrants into

the labour market among the youth are bound to find

it difficult to find themselves decent work.

These trends in Asia are of significance because at

the time when the crisis was just beginning to unfold,

optimists pointed to Asia as the shock absorber that

would buffer the global downturn. A decoupled Asia,

it was argued, would through its own growth and the

demands that it would make on the world's output ensure

that the financial crisis that was largely a phenomenon

restricted to the developed countries would not have

as damaging an effect on global growth as the pessimists,

then in a minority, were predicting. That prognosis

has turned out to be only partially, and in some cases

marginally, correct.

What is more the recovery has been accompanied by

a return of inflation to commodity markets, with increases

in food and oil prices. This is seen as making the

current recovery driven by large-scale public spending

a source of danger inasmuch as it can once again trigger

commodity price buoyancy. And even as the world hesitantly

looks forward to recovery the fear that commodity

price inflation would threaten the process of adjustment

is on the increase.

This fear has created a situation where there is uncertainty

about the continued use of the most obvious tool for

combating a recession, viz. substantially increased

government spending to stimulate demand in the domestic

market. Since the adoption of programmes of economic

liberalisation (which included customs duty reductions,

indirect tax rationalisation and direct tax concessions),

countries have been faced with a reduction in their

sources of revenue and in the volume of taxes they

garner from traditional sources of revenue. Hence,

enhanced expenditures are often financed with larger

deficits, which go contrary to the tenets of fiscal

reform. On the grounds that such deficit-financed

spending would trigger inflation, especially in the

case of food items, it has been argued that governments,

especially governments in developing countries should

desist from relying excessively on deficit-financed

government stimuli to combat recessions and rising

unemployment. This could stall the incipient recovery

in output and employment in these countries.