Having

decided to import wheat in sequential lots to beef

up its reserve, the government finds that it is having

to pay continuously rising prices for the commodity.

According to reports, as compared with the weighted

average price of $205 per tonne paid for wheat imported

in 2006-07, the average price paid on tenders floated

on June 26, August 30 and November 12, 2007 was $326,

$389 and $400 per tonne respectively. This takes the

weighted average price paid so far this year to $372

per tonne or 80 per cent higher than in the previous

year. With one more tender floated on November 26

and more imports likely if an early election is planned,

this figure may rise even further.

It is undoubtedly true that with total imports contracted

thus far this year valued at a little more than $600

million, the foreign exchange burden imposed by these

imports is small change when compared to the $270

billion of reserves that India holds. However, the

high price of imports does imply the price paid for

imports is 1.5 to two times the procurement price

offered to domestic farmers. Since these imports are

being used to shore up stocks meant for the public

distribution system, this also means that the budgetary

subsidy for wheat would be that much higher, with

the subsidy being paid to international suppliers

in order to dampen domestic inflation.

While high international prices are the immediate

cause of these outcomes, they also reflect the failure

of the government to ensure adequate domestic procurement

and to assess global price trends. Operating on the

premise that international price would be pushed higher

if India chose to make large imports, the government

may have decided to import the commodity in smaller

lots. But global developments pushed up prices in

any case, making the sequential import strategy a

mistake.

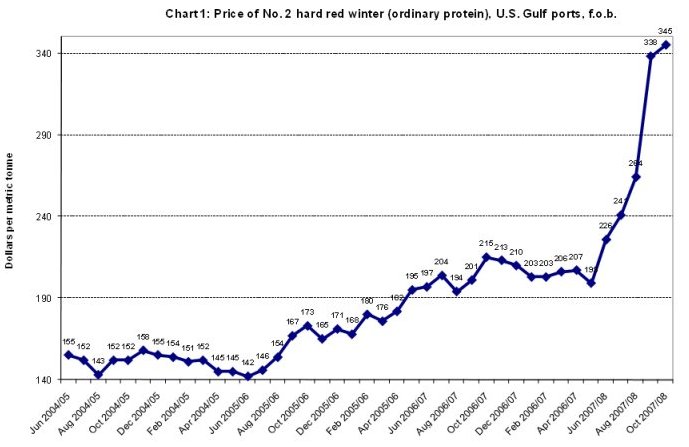

Across the world, food prices, especially those of

staples like grains, have been rising sharply in recent

months. Wheat, the staple used to make bread, pasta,

chapatti and much else, epitomises the trend. The

free-on-board price of US-exported "No. 2 hard

red winter wheat", which stood at $199 per metric

tonne in May of 2007, rose by 70 per cent to touch

$345 per metric tonne in October 2007.

The surge in prices of this globally consumed staple

has triggered widespread protests. Italian consumer

organisations even called on members to "sacrifice"

their (wheat-based) pasta consumption for a day to

register their dissent. Protest of this sort has set

policy makers in search of explanations for what investment-banking

firm Merill Lynch has reportedly termed "agflation".

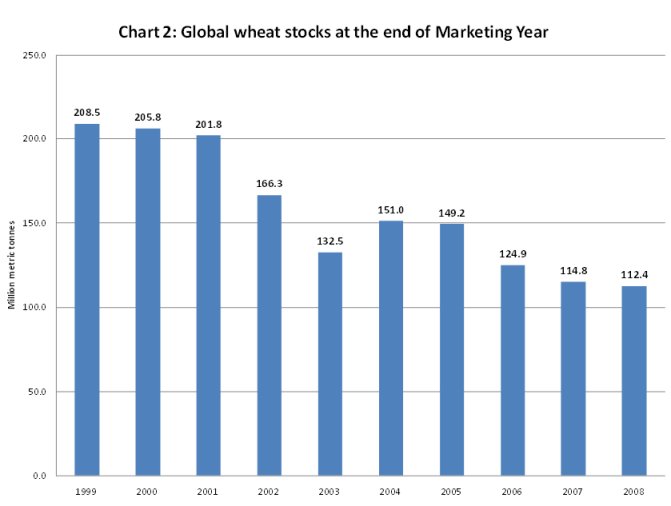

With agricultural prices conventionally seen as being

determined by the relative levels of demand and supply,

attention is focused on the US Department of Agriculture’s

(USDA) estimate this September that global stocks

of would touch wheat would touch 112.4 million tonnes

at the end of this marketing year (May 2008), their

lowest in 30 years. Year-end stocks have been declining

continuously since the end of marketing year 2003-04,

when they stood at 151 million metric tonnes. That

figure too was below the May 1999 high of 209 million

metric tonnes. Clearly consumption has been running

ahead of production over the long run, almost halving

year-end inventories over a decade

Chart

1 >> Click

to Enlarge

Given

this tendency, any short term changes either in consumption

or supply can result in imbalances that influence

price movements. Moreover, global surpluses are concentrated

with a few nations. World exports of wheat account

for around 18-20 per cent of world production. And,

six countries or groupings-Argentina (8.9%), EU (9.9%),

Russia (11.3%), Australia (12.2%), Canada (13.2%)

and the US (28.2%)-account for close to 85 per cent

of world exports. Given this context, the USDA blames

supply side developments in these countries for the

upward pressure on prices. For example, Canada’s wheat

output is expected to fall by roughly a fifth this

year because of bad weather. Weather-related factors

are also expected to reduce supplies from major exporters

such as the EU, Australia and Argentina, restricting

availability in global markets.

Chart

2 >> Click to Enlarge

Further, the increase in wheat prices this has triggered

is not reducing demand. Not only are big wheat buyers

such as Brazil and Egypt continuing to buy, but import

dependent countries like Japan and Taiwan have rushed

into the market early to secure their supplies. Moreover,

occasional buyers like India, have also been significant

purchasers in recent times. The net effect has been

a surge in prices, argue analysts.

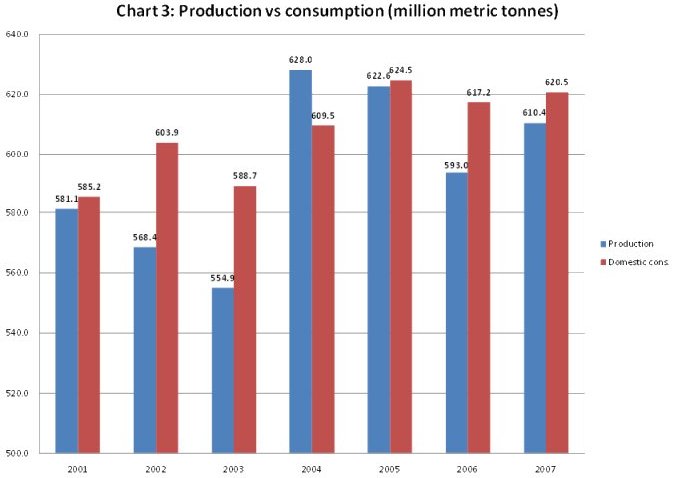

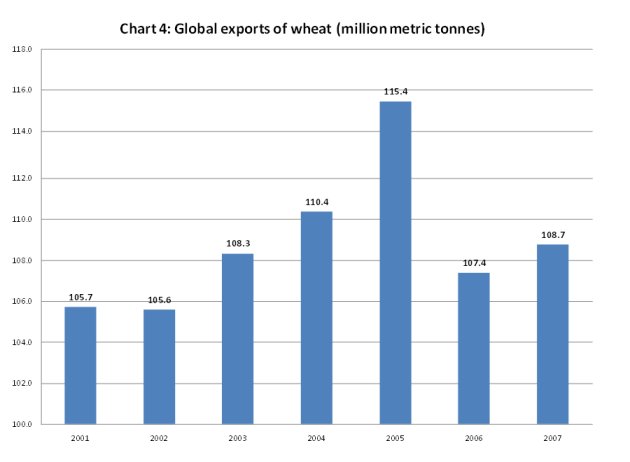

The data partly bears out these trends. The gap between

production and domestic consumption across nations

has been declining in recent years (Chart 3). So countries

have less to export (Chart 4).

However, even accounting for these factors, the extremely

sharp increase in prices in recent months is not easily

explained. Even though global stocks have been falling,

they are still at a comfortable 114.8 million metric

tonnes or 18.8 per cent of global production-a figure

roughly equivalent to the proportion of production

that is globally traded in a year. Taking into account

the fact that rising prices would encourage farmers

to plant more wheat, production can also be expected

to adjust, even if with a lag. For example, though

exports in 2007-08 from the EU and Canada are expected

to fall by 1 million tonnes each and that from Australia

by 1.5 million tonnes because of reduced crop prospects,

exports from Russia and the US are expected to rise

by 1 million tonnes each because of improved production

and the incentive created by higher prices. In the

circumstances the sudden and sharp rise in prices

seems difficult to explain based on demand and supply

alone.

Chart

3 >> Click

to Enlarge

Chart

4>> Click

to Enlarge

Fat and rising margins garnered by monopolistic processors

and retailers and speculation in futures markets are

seen by many to be playing a role. Protesting against

rising pasta prices outside the parliament in Rome,

Carlo Rienzi of the Codacons consumer association

is reported by the Financial Times to have berated

politicians, wholesalers, retailers and speculators-"everyone

but farmers and consumers". Their actions are

seen as having resulted in the accumulation of large

margins as wheat passes from the field to the supermarket

shelf.

The set of players whose trades are least transparent

and whose effect on prices least obvious are investors

in futures markets. When in September, a December

wheat contract traded at the Chicago Board of Trade

at a record $9.11¼ a bushel, it was unclear

whether traders were capturing the level at which

prices are likely to settle come December or influencing

the way prices would move in the weeks to December.

What is clear, however, is that financial investors

(who are speculators by design) see much gain in commodity,

including wheat, futures. Noting that financial investors

have been increasing their stake in these markets,

The Economist (September 6, 2007) recently reported:

"Trading in agricultural futures, once a backwater,

has boomed in recent years. In addition to agri-businesses,

more institutional investors-ranging from hedge funds

to pension funds-are investing. Last year nearly $3

trillion in grain futures was traded on the Chicago

Board of Trade (now part of CME Group), the world's

largest such market." And wheat is one of the

favoured commodities.

The Food and Agricultural Organization also reports

an increase in speculative activity in agricultural

commodity markets. In a recent assessment, the FAO

argued that market-oriented policies are creating

financial opportunities in agricultural markets at

a time when financial markets are awash with liquidity.

This abundance of liquidity has, in its view, "paved

the way for massive amounts of cash becoming available

for investment (by equity investors, funds, etc.)

in markets that use financial instruments linked to

the functioning of agricultural commodity markets

(e.g. future and option markets)." Among such

investors are speculators looking to such markets,

"as a way of spreading their risk and pursuing

of more lucrative returns. Such influx of liquidity

is likely to influence the underlying spot markets

to the extent that they affect the decisions of farmers,

traders and processors of agricultural commodities."

The extent to which these factors have actually contributed

to the recent price increase is yet to be ascertained.

But the fact that demand-supply imbalances and stockholding

levels cannot explain the recent price surge in wheat

and other agricultural commodities has strengthened

the suspicion that they have indeed had an effect.

India is partially insulated from the effects of these

global trends. Exports are not permitted and the minimum

support price rules well below import prices, so that

global "agflation" is not being imported

into the country. But the government’s decision to

allow private players, including large international

firms, a major role in domestic markets has created

a curious situation. According to reports, private

companies (such as ITC, Cargill, AWB India, Britannia,

Agricore, Delhi Flour Mills and Adani Enterprises)

picked up around 20 lakh tonnes of wheat during the

recent rabi marketing season (April-July). While this

may appear small relative to total production such

purchases can make a difference at the margin to prices.

In any case, they affect the ability of the government

to procure supplies to refurbish its reserves. Even

though production of wheat during 2006-07 is estimated

at close to 75 million tonnes as compared with 69

million tonnes in the previous year, procurement fell

short of expectations because the procurement price

of Rs. 8.5 a kg ruled well below market prices that

have ranged between Rs.10 and Rs.12 a kg. Though by

July 19 procurement was, at 11.1 million tonnes, higher

than the 9.2 million tonnes recorded in 2006-07, it

was way below the levels of 16.8 and 14.8 million

tonnes recorded in 2004-05 and 2005-06. With offtake

likely to remain high, this implies that buffer stocks

could fall below comfort levels. If low global stocks

are seen to trigger inflation, an inadequate buffer

stock generates similar fears domestically.

Faced with the prospect of an early election and the

evidence of inflation in global wheat markets, the

government that had earlier reversed a decision to

import wheat has now decided to import the grain,

but in small sequential lots. This, as noted earlier,

has proved costly. A recent clarification attributed

the cancellation of the earlier import decision to

the expectation that global prices would fall in the

wake of the harvest in major wheat producing countries

and the consequent view of the Integrated Finance

Division (IFD) of the Department of Food and Public

Distribution that "a very high benchmark price

would be established for future wheat imports."

With these expectations not being realised the government

has now decided to make the best of a bad situation

created by wrong decisions on domestic trade, procurement

and imports. As clarified by the Union Food and Agriculture

Minister Sharad Pawar, the Empowered Group of Ministers

took the recent import decision, "influenced

by the downward revision of the global wheat production,

apprehensions about some major wheat producing countries

placing restrictions on wheat exports and the Chicago

Board of Trade (CboT) futures showing an upward trend

of wheat prices for December 2007 and March 2008."

It was possibly the Indian decision that resulted

in the sharp rise in US export prices in August this

year. Unfortunately neither the Indian farmer nor

the Indian government is gaining from these trends.

And it is not clear how long the Indian consumer would

be even partially insulated from their effects. Maybe

Carlo Rienzi had got it right.