Themes > Features

27.12.2004

The Tired Old Subsidies Debate

The

National Common Minimum Programme of the UPA government promised many

things, and on some of the more crucial issues (such as on the Employment

Guarantee ACT) the current central government has shown itself to be

less than enthusiastic in terms of fulfilling the true spirit of its

promise. But on other matters which are more in tune with the basic

neo-liberal economic policy paradigm which the government continues

to uphold, it has acted with alacrity.

The

most recent example is in terms of the debate on subsidies provided

by the central government. The NCMP had promised that ''All subsidies

will be targeted sharply at the poor and the truly needy like small

and marginal farmers, farm labour and urban poor.'' However, the actual

analysis provided by the Finance Ministry in its recent Report prepared

with assistance from the National Institute of Public Finance and Policy

(''Central government subsidies in India: A report'', December 2004)

suggests that this is to be used as a justification for overall cutbacks

in subsidies, regardless of their effects on the poor and needy.

This discussion is not new, of course: the period since 1991 has been

characterised by a generalised distaste for subsidies among policy makers,

who have tended to blame them for virtually all fiscal problems, and

have used this smokescreen to divert attention from the inability to

raise tax revenues. And so declarations by the government as well as

explicit attempts to reduce direct subsidies on food and fertiliser

have been important parts of the economic reform programme since 1991.

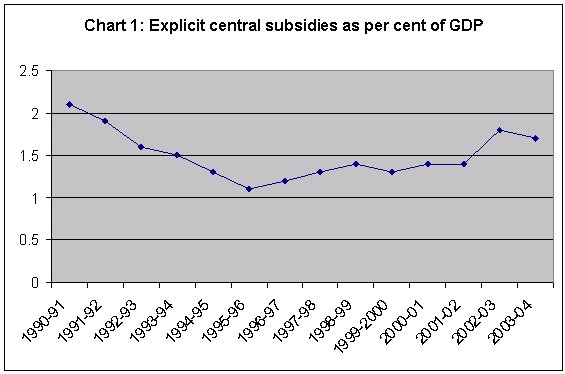

All this has been despite the fact that direct subsidies paid by the

central government amounted to a very small proportion of GDP over this

entire period. Chart 1 shows that since 1991, central government subsidies

have never crossed 2 per cent of GDP. Indeed, the ratio of all direct

subsidies paid by the central government to GDP has actually fallen

from around 1.85 per cent in the triennium beginning 1990-91 to 1.6

per cent in the triennium ending 2003-04.

This

is really a trivial amount not only in terms of the past, but also in

relation to international experience. In countries of western Europe,

for example, direct subsidies in the form of unemployment benefits and

social security can make up as much as half of the current spending

of governments.

Because direct subsidies are so low, the obsession with reducing them

has also necessarily required that the attention be shifted from direct

to ''indirect'' or implicit subsidies, calculated on the basis of working

out the excess of expenditure over receipts for all major items of government

expenditure. As early as 1997, a similar Discussion Paper released by

the then government (which contained many of the faces that are so prominent

today) concluded that total subsidies (including these implicit subsidies

reflecting low or non-existing user charges for public services) in

India were not only four to five times higher than explicit subsidies,

but constituted an unacceptable 14.4 per cent of GDP.

This estimate was arrived at from budget documents simply by calculating

the shortfall in public revenues (or "recovery" of expenditure

through charges) relative to the actual public expenditure incurred.

Using the notion of ''merit'' and ''non-merit'' subsidies, (that is,

those on goods and services with significant externalities in which

private and social valuations would therefore differ significantly,

and those without large externalities) it was argued that subsidies

accounting for 10.7 per cent of GDP were unwarranted.

It was posited that the distributive consequences of subsidies were

adverse since they were not properly targeted, quite obviously in cases

where the subsidy was administered through inputs (fertiliser, electricity,

diesel, irrigation, etc.) and even in cases where they applied to a

final good (food). As a result, it was proposed that most of these subsidies

were best done away with, and that the best way to do so was "through

phased increases in recovery charges".

Thus the 1997 paper argued that there was a strong case for an almost

across-the-board increase in user charges for services provided by the

central and state governments. This was then used to justify the increase

in fertiliser prices which had negative effects not only on fertiliser

consumption and farm productivity, but also on the viability of cultivation.

It was used to explain the completely ham-handed and ultimately counterproductive

attempt to reduce the food subsidy by raising issue prices of food grain

and ''targeting'' the poor. This led to reduced offtake and not only

a paradox of large publicly held food stocks in midst of hunger, but

also an actual increase in subsidies on holding of stocks, which were

then exported at prices even lower than earlier denied to the domestic

poor.

Several critiques of that paper comprehensively established that the

basic methodology of this exercise was invalid. The classification of

merit and non-merit subsidies emerged as being very subjective and often

bizarre. The principal failure of this methodology was that it recognised

only one reason (the presence of externalities) why the private valuation

of benefits could deviate from their social value to society. But subsidies

are essentially no more than negative taxes, so externalities cannot

be the only reason why societies choose to subsidise particular activities,

just as there are basic socio-political and income-distributional decisions

which determine the pattern of taxation. In fact, there can be many

cases where the fact that public expenditure exceeds cost recovery need

not be a problem but could in fact be socially desirable.

This is because market failure does not occur only at the microeconomic

level as is true in the case of externalities. Even at the macroeconomic

level, government expenditure plays a critical role in maintaining levels

of economic activity, and to characterise much of this as implicit ''subsidy''

is therefore highly misleading. In market-based systems where savings

and investment decisions are taken by atomistic decision-makers based

on their guesses and expectations of an uncertain future and of the

decisions to be taken by others, there is an inherent tendency towards

an unemployment equilibrium. Faced with this prospect, governments tend

to intervene with counter-cyclical demand management policies aimed

at dealing with the prospect of a recession, and in some cases they

attempt to mitigate the adverse consequences of unemployment through

mechanisms such as unemployment benefit.

In addition, market-based systems tend to be characterised by an unequal

distribution of assets and incomes, which reduces the ability of some

individuals to participate in the market and adequately finance their

basic needs. It is to deal with these features of the market economy

that the developed industrial nations have created an elaborate welfare

state, which has been dismantled only partially even in the current

"market-friendly" ideological environment, and why direct

subsidies continue to be such an important part of the expenditure of

such governments.

Given this background, it is disturbing to see the current Finance Ministry

producing almost the same false arguments of the earlier Paper, and

coming to even more unwarranted conclusions with respect to policy.

The only modification (which is not really of much signfiicance) is

the further segregation of ''merit'' subsidies into two categories based

on degree of merit. The methodology for calculating implicit subsidies

is the same, and yields a figure of 4.18 per cent of GDP for the year

2003-04.

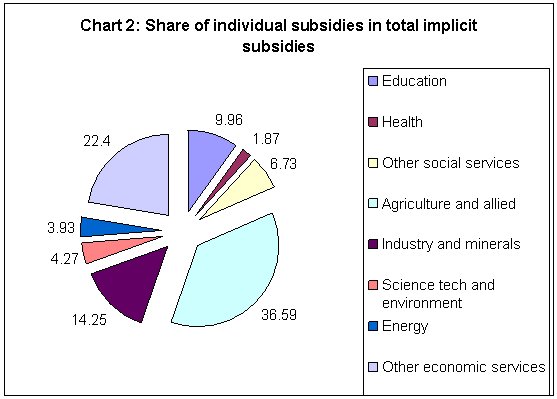

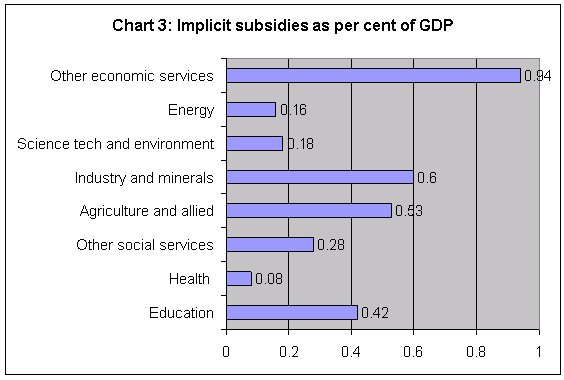

Even the calculations presented in the Paper indicate that these are mostly spent on critical areas such as agriculture, industry and education. Chart 2 shows the break-up of implicit subsidies as described in the Paper. And these individual implicit subsidies (which are already worked out on the basis of a problematic methodology) come to tiny percentages of GDP, so small that they are barely to be noticed in public finance terms. Chart 3 provides an estimate of these. In fact, if social services such as health and education as well as expendtiure for the development of agriculture and industry is to be provided in a socially optimal way and provided to all of those who are poor and/or deserving, then higher levels of implict subsidy are called for, not lower ones.

But this faulty calculation (which also throws up anomalies such as

the railways providing a negative subsidy, that is a net profit, for

the government) is then used to make very sweeping and even alarming

recommendations for cutting all subsidies. Based on the unjustified

axiom that even so-called ''merit'' subsidies should be reduced as much

as possible, the Report makes policy proposals that are not only wrong-headed

but also breathtaking in their insensitivity to the current economic

situation and problems of ordinary people.

Thus, it calls for reducing Minimum Support Prices for farmers at a

time of widespread agrarian crisis. It suggests that the present two-tier

system of prices in the Public Distribution System should be done away

with (presumably by revising the lower prices upwards) along with a

system of food coupons for BPL families. Fertiliser prices should be

raised. LPG and kerosene subsidies, which affect largely middle class

and poor households, are seen as objectionable and requiring further

reduction, notwithstanding the recent price hikes which have already

adversely affected the poor.

Economic services are to be priced to varying degrees, which essentially

means increasing user charges regardless of the merits and positive

externalities of the services in question. Even social services do not

escape the net: the Report argues that ''while humand development is

a necessary concern of the welfare state. It may be necessary to reassess

policies in this area at the micro level to temper this concern with

the equally legitimate concern of burgeoning public expenditures.''

(page 22).

The irony is that in fact public expenditures have not been burgeoning

- as a share of GDP, non-interest public expendiutre has actually been

falling in recent years, and this is part of the economic problem of

the country. This falling share of public expenditure has been associated

with much less infrastructure development, poor and declining public

services, and a collapse of employment generation. So the economic agenda

should really be to think of ways of increasing public expenditure,

not cutting it further.

The focus on reducing expenditure only comes about because of the failure

to raise tax revenues. And this has been an integral part of the fiscal

strategy associated with neo-liberal reform. The cuts in indirect and

direct tax rates have been associated with falling central tax to GDP

ratios, but the current Finance Ministry does not appear to see reversing

this trend as a priority. Instead, it has already simply given away

around Rs. 6,000 crores to stockbrokers as lost taxes, first by replacing

the capital gains tax with a turnover tax, and then by reducing that

proposed tax to a fraction of the original demand because of protests

on Dalal Street.

All fiscal measures have very strong implications for income distribution.

And they reflect very clearly the intentions of the government and which

sections of the people and the economy the government serves. If this

Paper is an accurate reflection of the curent thinking of the government

in the matter of subsidies, then it is bad news not only for the poor

and needy who require such subsidies for survival, but also for development

of the economy in general.

© MACROSCAN 2004