The

dollar is on the decline, with its value having fallen

by around 30 per cent relative to other major currencies

since 2002 and by close to 20 per cent in trade-weighted

terms. Yet, the US government feigns being unconcerned

with the problem. In the G-20 meeting held in the

second half of November, the US Treasury Secretary

reportedly refused to talk about the dollar's decline,

though he reiterated the Bush administration's public

commitment to halve the US government's budget deficit

during its second term and bring it below two per

cent of GDP.

The relevance of the budget deficit for the problem

at hand is obvious, given the connection between the

dollar's decline and the twin deficits in the US-the

balance of payments deficit amounting to 5.5 per cent

of GDP and the fiscal deficit to 4.2 per cent of GDP.

With savings rates close to zero on average, private

spending is high in the US. But a large part of the

demand this generates spills over into the international

market given the lack of competitiveness of US producers.

However, this has not resulted in a domestic recession

because the government has in recent years been pump-priming

the economy with deficit spending (though a part of

that too leaks out abroad). In the event, the US has

required the two deficits to sustain its reasonable

rate of growth by developed country standards.

These deficits have not proved a problem because of

capital inflows, including in the form of investment

of surpluses accumulated by foreign governments and

central banks in dollar denominated financial assets.

According to one source, in 2002, 2003 and the first

half of 2004, foreign governments financed $564bn

(43 per cent) of a cumulative current account deficit

of $1,318bn (£695bn). The problem recently has

been that both private wealthholders and foreign governments

have begun to fear that the unsustainable value of

the dollar spells a decline in the currency that could

sharply erode the value of their assets. The resulting

rearrangement of their portfolio away from dollar

assets in favour of other currencies is what explains

the dollar's decline.

At one level this decline appears to be a boon to

the US. It cheapens the foreign exchange value of

its exports and renders imports more expensive in

dollar terms, improving US competitiveness. If this

helps reduce the trade deficit, the size of the fiscal

deficit needed to keep growth going would be lower.

A process of self-correction seems to be providing

a solution to the twin deficit problem.

The difficulty, however, is that the dollar's decline

would also result in lower inflows into and larger

outflows into US capital markets, resulting in a fall

in financial asset prices that would reduce the wealth

position of US households and institutions. This would

reduce consumer spending and curtail demand. That

problem could be aggravated by a possible liquidity

crunch in the system, as banks and financial institutions

experiencing a depreciation of their asset values

turn cautious. Further, lower financial asset prices

imply higher interest rates that could affect investment

adversely as well. Thus a correction of the twin deficit

problem through a depreciation of the dollar could

also imply a recession in the US.

All this makes the dollar's decline a problem for

the rest of the world as well, especially countries

in Europe and in Asia, like China, that are heavily

dependent on the US market. Dollar depreciation increases

the dollar value of their exports to the US and undermines

their competitiveness and recessionary trends in the

US would squeeze an important market for their exports.

It is this global effect of the dollar's decline that

the US exploits to make the decline everybody's problem

and not just its own. In its view, the twin deficit

problem can be best resolved through increased net

exports (exports net of imports) from the US. This

would reduce the trade deficit, contribute to demand

for US goods and help reduce the fiscal deficit without

affecting growth adversely. So, Europe, Japan and

China must help raise net exports from the US.

The G-20 meeting in November saw the Europe and Japan

partly going along with the US on this count. ''The

Group of 20 leading rich and emerging market nations

have agreed on a co-ordinated effort to reduce global

trade imbalances by cutting the US fiscal deficit,

reforms to boost growth in Europe and Japan and increasing

exchange rate flexibility in Asia,'' reported the

Financial Times on November 22. That is, the reduction

of the US fiscal deficit was made contingent on reflation

in Europe and Japan which, hopefully, would expand

the market for US goods, and reduced currency intervention

by Asian governments aimed at pegging their currencies

to the dollar. The latter, by resulting in an appreciation

of Asian currencies vis-à-vis the dollar is

expected to increase the competitiveness of US exports

to these countries and therefore in an increase in

the volume of US exports.

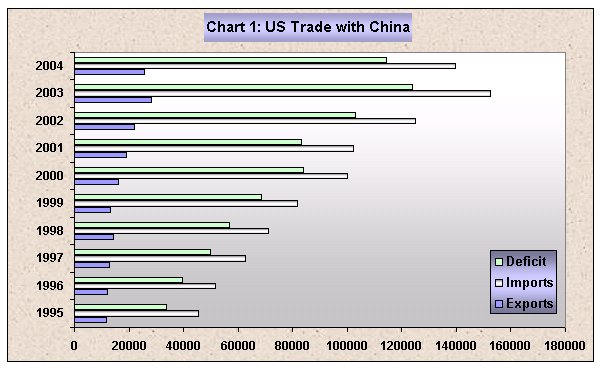

The country which would be most effected by the second

of these recommendations is China, which has pegged

the value of its currency the renminbi (yuan) at 8.27

to a dollar since 1997. China has been under pressure

for quite some time to revalue its currency and redress

the ''imbalance'' that its trade surplus ($124 billion

last year) with the US (Chart 1) and its large foreign

exchange reserves ($514.5 billion) ostensibly reflect.

That pressure has now increased, since Europe and

Japan would like to see China bearing a larger share

of the burden of global adjustment, by curtailing

its exports and increasing its imports with a flexible

and appreciating currency.

Chart

1 >> Click

to Enlarge

China's

fears on this count are not just related to its trading

position. It is more worried about the effects of

introducing a more flexible currency and allowing

the yuan to appreciate on its currency and financial

markets. A stronger yuan is bound to spur large capital

inflows, while capital account restrictions do not

permit money to flow out easily. This would increase

reserves further and drive the yuan even higher. And

once that happens, speculation on the value of the

yuan can increase capital inflows even more. Such

a spiral can be destabilising and weaken autonomy

in monetary policy.

Not surprisingly, China is not happy. In an interview

with the Financial Times, Li Ruogu, the deputy governor

of the People's Bank of China, warned the US not to

blame other countries for its economic difficulties.

''China's custom is that we never blame others for

our own problem,'' he reportedly said. ''For the past

26 years, we never put pressure or problems on to

the world. The US has the reverse attitude, whenever

they have a problem, they blame others.''

There were three unexceptional arguments that Li used

to justify his criticism. First, "The savings

rate in China is more than 40 per cent. In the US

it is less than 2 per cent. So the problem is that

they spend too much and save too little." Second,

there was a lack of correspondence between US wages

and productivity resulting from the tendency of the

government to protect low productivity jobs. US workers

enjoyed relatively high wages but remained excessively

engaged in low value-added industries such as textiles

and agriculture. Finally, US policies discriminate

against exports of goods that China needs. Restrictions

on exports of military and high-technology products

to China partly explains Beijing's huge trade surplus

with America, he argues.

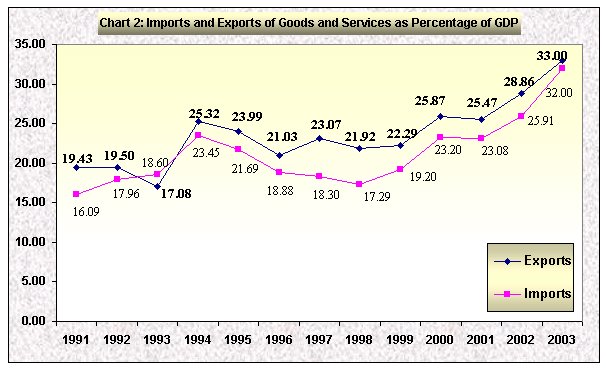

In fact, the evidence on China's trade does not support

the view that it adopts a mercantilist policy that

pushes exports and restricts imports. In 2003, while

exports of goods and services amounted to 33 per cent

of GDP, imports of goods and services stood at 32

per cent of GDP (Chart 2). At present, China records

an overall trade deficit, which is expected to touch

$40 billion in 2004. In the first four months of 2004,

China's exports amounted to $162.7 billion, up 33.5

per cent from a year ago. Imports on the other hand

rose 42.4 per cent to $173.5 billion, resulting in

an overall trade deficit of $10.8 billion. A negative

trade balance is sure proof that mercantilism does

not drive trade and economic policy.

Chart

2 >> Click

to Enlarge

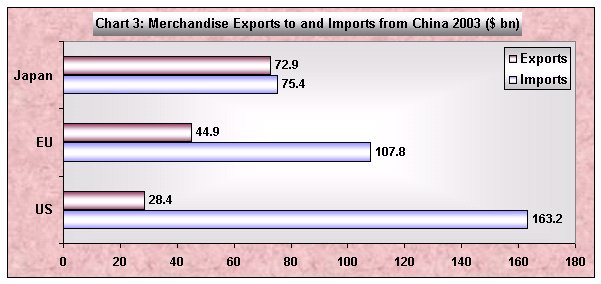

The reason why China is susceptible to international

pressure despite this trade record is the country-wise

distribution of its exports and imports. In 2003,

merchandise imports from China into the US amounted

to $163.2 billion, or 12.5 per cent of its total merchandise

imports. This figure had risen from 6.3 per cent in

1995. Imports into the European Union and Japan amounted

to $107.8 billion (3.7 per cent) and $75.4 billion

(19.7 per cent). Though relative to the total Japan

was a major importer, the US clearly dominated in

absolute magnitude. What is more, merchandise exports

to China in 2003 stood at $28.4 billion, $44.9 billion

and $72.5 billion respectively in the case of the

US, European Union and Japan. The US sucks in commodities

from China, but sends little back in return.

Chart

3 >> Click

to Enlarge

Finally, in recent years, China has provided space

for foreign firms in its domestic market. As Nicholas

Lardy, then of the Brookings Institution, wrote in

2002: At the turn of the twenty-first century in China,

''foreign manufacturers led by Motorola, Nokia and

Ericsson had captured 95 per cent of the market for

cellular phones. Coca-Cola was the dominant supplier

of carbonated beverages with a market share fifteen

times its closest domestic competitor. Its operations

in China have been profitable for more than a decade,

and Coca-Cola expects China to emerge as its largest

Asian market in 2002 or 2003. McDonald's and Kentucky

Fried Chicken, with almost 900 outlets between them,

dominated China's rapidly growing food market. Kodak

had captured half the market for film and photographic

paper. Volkswagen, through two separate joint ventures,

controlled more than half the domestic automobile

industry. Carrefour, the French company, had become

China's second largest retailer only five years after

entering the market. And, as unlikely as it might

have once seemed, Proctor and Gamble had more than

half of what is undoubtedly the world's biggest shampoo

market.''

Thus, the problem is not one of Chinese mercantilism,

but one of lack of competitiveness of the US. Not

surprisingly, the US has performed poorly despite

the fact that the yuan is pegged to the dollar. With

the dollar depreciating vis-à-vis the euro

and the yen, it is the EU and Japan that should lose

out in trade with China, not the US.

Despite all this evidence in its favour, China is

feeling the heat, as shown by Li Ruogu's response.

This is the result of China's reform-driven dependence

on exports in general and exports to the US in particular.

With exports amounting to 33 per cent of GDP and the

US accounting for 37 per cent of China's total merchandise

exports of $438.4 billion, the US market is too important

for China for US views to be ignored. Not surprisingly,

expectations are that China would soon loosen strings

on the yuan, which has since 1995 been allowed to

fluctuate only within a ultra-narrow 0.3 per cent

band around 8.28 yuan to the dollar. That band is

now expected to widen. But this is likely to be too

slow to satisfy the US because of what investment

banker Henry Liu sees as China's ''residual commitment

to socialist principles'', which makes it hope that

it can ''reap the euphoria of market fundamentalism

without succumbing to its narcotic addiction.'' The

US and the rest of the world will have to find some

other answer to the problem of the weakening dollar

generated by the twin deficits in the US.