Themes > Features

03.04.2012

Post-Crisis Reform: A lost opportunity?*

It

has been more than four years since the onset of the financial crisis

and the accompanying Great Recession in the US and much of the developed

world. Yet, the crisis is still with us. It has only spread geographically,

with its worst consequences now visible in the peripheral countries

of Europe rather than in the financial centres of the world where it

originated.

Early into the crisis, its severity had resulted in a near-consensus

on the need to re-regulate finance. The financial and real economy collapse

was too close to the experience of the 1930s to brook further delay

in rethinking the deregulation that is now widely seen as having contributed

to these developments. There was need for a response that equalled in

scope the Glass-Steagall Act of 1933. How much has been achieved in

the last four years and more? Not much in Europe, where despite the

de Larosière report, the focus remains on stalling and reversing

the ongoing crisis rather than on preventing future crises. If financial

reform has proceeded anywhere it is in the US. It began with the Obama

Statement of June 2009 on the way forward and culminated in the passage

of the Dodd Frank Act. As a result, efforts are now on to formulate

a set of rules regulating the varied sets of markets, institutions,

activities and instruments that constitute the complex financial structure

that evolved as a result of financial deregulation. Unfortunately, the

experience till now has been that, while much was promised, little progress

is being achieved.

From the very beginning it became clear that the discussion on reform

in the US was riven by the tension between those fighting to restrict

the response largely to bailing-out finance and those who were demanding

a return to strong regulation of the pre-1980s kind. A hint that the

actual regulatory package that would get implemented would include significant

compromises in favour of Finance Capital came early, with the Obama

package. While declaring that the economic downturn was the result of

''an unravelling of major financial institutions and the lack of adequate

regulatory structures to prevent abuse and excess,'' the Obama statement

did not blame the dismantling of the regulatory regime that was put

in place in the years starting 1933 for these developments. It attributed

them to the fact that ''a regulatory regime basically crafted in the

wake of a 20th century economic crisis-the Great Depression-was overwhelmed

by the speed, scope, and sophistication of a 21st century global economy.''

The problem was not that the Glass-Steagall Act was diluted and dismantled,

but that it had lost its relevance.

Implicit in this was the understanding that there was no question of

reversing the dismantling of the regulatory walls that separated different

segments of the financial sector or of restrictions set on institutions

and agents in individual segments, especially banking. Other ways, which

take account of the changes in the world of finance, had to be found

to rein in the tendency of the financial sector to proliferate risk

and create conditions for a systemic failure. Especially because of

the externalities involved for the functioning of the real economy,

which required using taxpayers' money to rescue the system.

Despite this moderation, there were a number of important regulatory

advances that the Obama package, released as a trial balloon, incorporated.

To start with, it recognised the role played by institutions-banks and

non-banks-that are too big to fail (TBTFs) in the events leading up

to and after the crisis, because they were systemically important financial

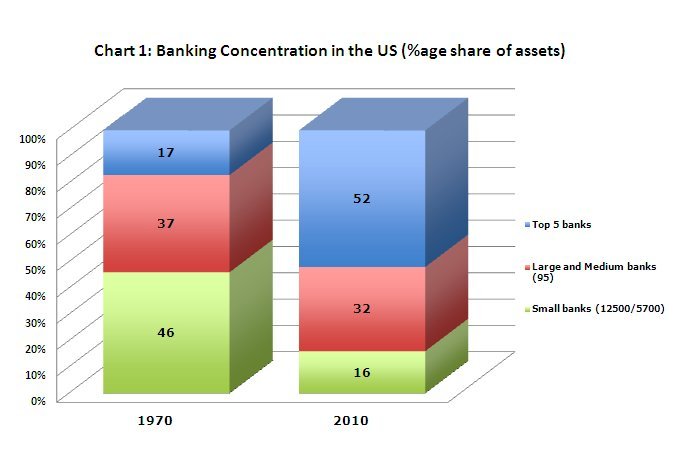

institutions (SIFIs). The top 5 banks, which accounted for just 17 per

cent of commercial banking assets in 1970, held 52 per cent of those

assets in 2010 (Chart 1).

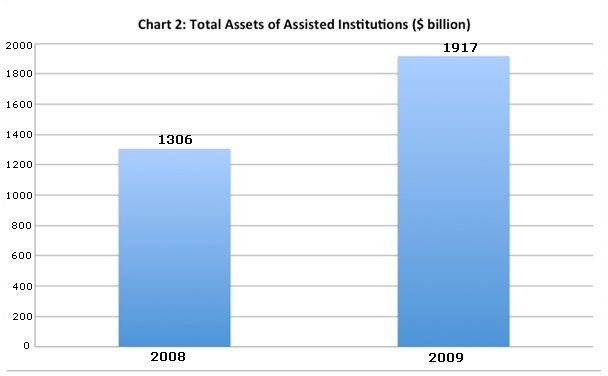

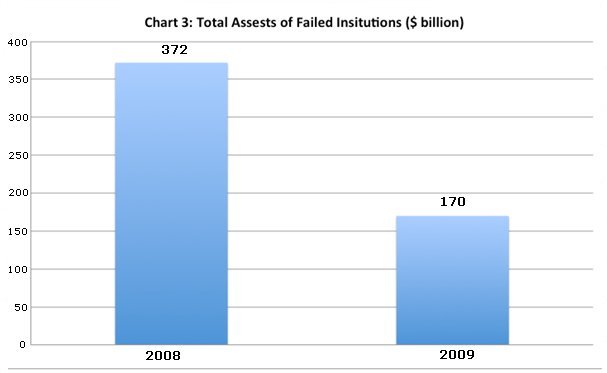

It hardly bears emphasising that these entities are not just large in size, but because the walls between different segments of the financial sector (conventional banking, investment banking, insurance, etc) were completely dismantled by 1999, they are diversified as well. Further, as the Dallas Fed's report notes, size was built not on equity but on leverage, leading to a combination of little capital, much debt and too much risk. Also with size came complexity, and with complexity came obfuscation. These consequences of the search for quick and large profits increased the importance of a few institutions as well as rendered them prone to failure. But their failure would have ripple effects across the financial sector and as a corollary impact adversely on the real economy. And since for this reason they could not be allowed to fail, the cost of ensuring their survival had to be transferred onto the taxpayer. This was what was done when the crisis occurred, with the state rushing to the assistance of most large financial firms. As Charts 2 and 3 show, the assets of institutions that were assisted to survive during 2008-09 amounted to $3.22 trillion, where many multiples of the assets of those that were allowed to fail, which stood at just $542 million. Much of the financial system was kept in place with aid from the state.

It must be noted that what is at issue here is not size per se. It is

the ''excessive'' size of privately owned institutions that was the

result of speculative practices aimed at garnering quick profits and

permitted and encouraged by deregulation. Large publicly owned banks

and specialised financial institutions would not be driven by the same

objectives and can exploit economies of scope to deliver important developmental

benefits.

However, the Dallas Federal Reserve is critical of size because (i)

the need to rescue them left most Americans with the impression that

''economic policy favours the big and well-connected'', which is not

good for the policy maker; and (ii) even this massive transfer of resources

has not recapitalised these institutions adequately and restored normal

credit provision by them. With banks holding back on providing credit,

the Fed's efforts at stimulating a recovery with a combination of quantitative

easing and low interest rates are not proving very successful. The irresponsibility

of the banks, argues the report, has undermined the efficacy of monetary

policy and therefore of the Federal Reserve.

Despite this partisan perspective, the Dallas Fed does underline the

fact that little is being done to address the problem that flows from

having privately managed TBTFs. The Obama package promised a new role

for the Federal Reserve in overseeing and regulating these entities

as well as measures to trim their size. Discussions on these and other

proposals, running parallel to investigations on the developments that

led up to the crisis in 2007, resulted in the bill introduced by senators

Barney Frank and Chris Dodd, and finally passed in revised form and

signed into law in July 2010. Since then a number of agencies such as

the Federal Reserve, the Treasury, the Federal Deposit Insurance Agency

and the SEC have been engaged in a long and slow process of converting

the provisions of the Act into implementable rules and regulations.

The results have thus far been disappointing.

The Dodd-Frank Act itself is on occasion disappointing as in the case

of TBTFs. Under the Act these institutions would be monitored and regulated

by a newly established Financial Stability Oversight Council, which

would ''bring together regulators from across markets to coordinate

and share information; to identify gaps in regulation; and to tackle

issues that don't fit neatly in an organisational chart.'' They would

also be subject to more stringent regulations with regard to capital

adequacy and liquidity. However, all this amounts to an effort to prevent

the emergence of institutions that are considered too important to fail,

but to prevent the failure of large firms without having to burden the

taxpayer. Since it is impossible to guarantee that this would work at

all times, an effort has been made to devise a system that would allow

firms to be unwound without damage to the system and excessive burdens

on the tax payer.

This, the Dallas Fed, feels is both unconvincing and unlikely to succeed,

and would not serve to restore faith in ''the system of market capitalism''

based on competition. It is, therefore, in favour of ''the ultimate

solution for TBTF-breaking up the nation's biggest banks into smaller

units.'' While this position is controversial, its source and content

reflect the more widespread perception that the opportunity for reform

is being lost. In fact, the too big to fail issue is not the only one

where disappointment is rife. Another, for example, is the need for

some form of structural regulation that seeks to limit or circumscribe

the activities of the all-too-important banking system. Under Glass-Steagall

this was essentially achieved by segmenting the financial sector into

(i) institutions that were depository institutions (accepting deposits

from the public at large), which were subject to membership of the deposit

insurance system and were eligible for liquidity support from the central

bank or the lender of last resort; and (ii) other institutions including

those which accepted investments from high net worth individuals that

were not insured and which were not eligible for central bank accommodation.

While for a number of reasons a return to this system was not seen as

advisable, the need to limit the activities of prime depository institutions

so as to keep them out of sensitive sectors involving speculative operations

was recognised by many. Over time those holding this view gravitated

to the ''Volcker rule'' as representing the minimum acceptable level

of separation of activities between institutions in the financial sector.

The stated objective of the Volcker rule is to ''generally prohibit

any banking entity from engaging in proprietary trading or from acquiring

or retaining an ownership interest in, sponsoring, or having certain

relationships with a hedge fund or private equity fund (''covered fund''),

subject to certain exemptions.'' Proprietary trading involved engaging

as the principal for any account used to take positions in securities

with the intention of selling it in the near-term for profit. Implicit

in it was the idea that while separation of activity could not be complete,

since it allowed banks to serve as agent, broker or custodian for an

unaffiliated third party, banks should not be allowed to use their own

funds, especially those obtained from depositors, to trade in securities.

Besides restricting banks from engaging in risky activities using depositors'

monies, the proposal was addressing the moral hazard that arises when

bank managers were allowed freedom in a context where deposits were

insured and there was an implicit guarantee against failure.

This is one area where the Fed, FDIC and SEC have sat together and attempted

to formulate the guidelines to implement the version of it incorporated

in the Dodd-Frank Bill (DFB). What is striking is the number of exemptions

that have been made with regard to the proscription on proprietary trading

by bank holding companies (BHCs). The first major set of exemptions

relates to the activities of underwriting or market making. The rule

now permits banks to continue with the activity of underwriting share

issues for clients, even though that would result in the bank acquiring

equity in instances where under-subscription leads to shares devolving

on the underwriter. Similarly, by serving as a market maker who stands

by with a bid and an ask price for equities, a bank may find itself

in a situation where it is acquiring stocks that it cannot find an immediate

buyer for, but in time makes a profit selling it at a significantly

higher price. To distinguish between these activities and proprietary

trading is to draw a fine line, which can be erased when banks choose

to circumvent the rule. Implementing the rule in practice would, therefore,

prove difficult.

A similar approach is adopted with regard to ''permitted risk-mitigating

hedging activities''. In particular, by focusing on reining in short-term

trading and implicitly permitting longer-term arbitrage, the rules as

framed may be leaving the door open for the rogue trade. Finally, the

Volcker Rule provides for ''permitted trading on behalf of customers.''

To that end it identifies ''categories of transactions that, while they

may involve a banking entity acting as principal for certain purposes,

appear to be on behalf of customers within the purpose and meaning of

the statute.'' In sum, the proposed rules are ambiguous enough to allow

banks to circumvent the law and engage in proprietary trading in some

form.

This too is an example of how, as ideas get translated into implementable

decisions, through the rough-and-tumble of debate and politics, we are

ending up with limited progress on addressing the failure of regulation

that resulted in the outbreak of the 2007 crisis with its damaging external

effects on the real economy. The Dallas Fed is also pointing to that

danger.

*This

article was originally published in the Business Line on 2nd April,

2012

©

MACROSCAN 2012