Themes > Features

15.04.2010

The Travails of the Rupee

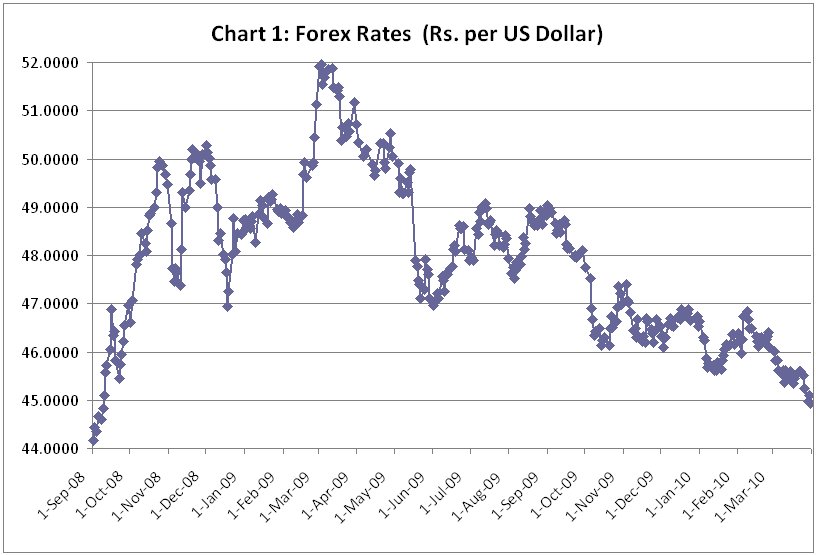

The Indian rupee stood at a robust Rs. 44.4 to the dollar at the beginning of the second week of April. At that level the rupee had appreciated by more than 13 percent vis-a-vis the dollar over the preceding 13 months (Chart 1). This suggests that the Reserve Bank of India has not intervened in the market and bought up surplus foreign exchange to the extent required to relax the upward pressure on the value of the rupee and stall its appreciation. This reluctance could partly be because, given the relatively high level of already accumulated foreign exchange reserves, the central bank is finding it difficult to match the surge in capital inflows with new purchases.

The surge in capital inflows is explained largely by developments on

the supply side, with India being chosen as one of the favoured destinations

by financial investors seeking to exploit the cheap liquidity that developed

country governments have pumped into the system in response to the financial

crisis. Further, like many other emerging markets, India is becoming

a victim of the dollar carry trade, in which international players borrow

in dollar markets, where liquidity is ample and interest rates are low

because of anti-crisis measures, and invest in equity, debt and real

estate in emerging markets, where returns are much higher, in order

to profit from the differential between the cost of debt and the return

on investment. This is a game that seems to especially attract international

financial firms seeking to quickly recoup the losses they suffered in

the recent recession.

That this kind of game is currently popular with respect to India as

well is clear from the fact that the rupee's appreciation is associated

with a boom in equity markets driven largely by foreign institutional

investment, as a result of which the Sensex is courting the 18,000 level

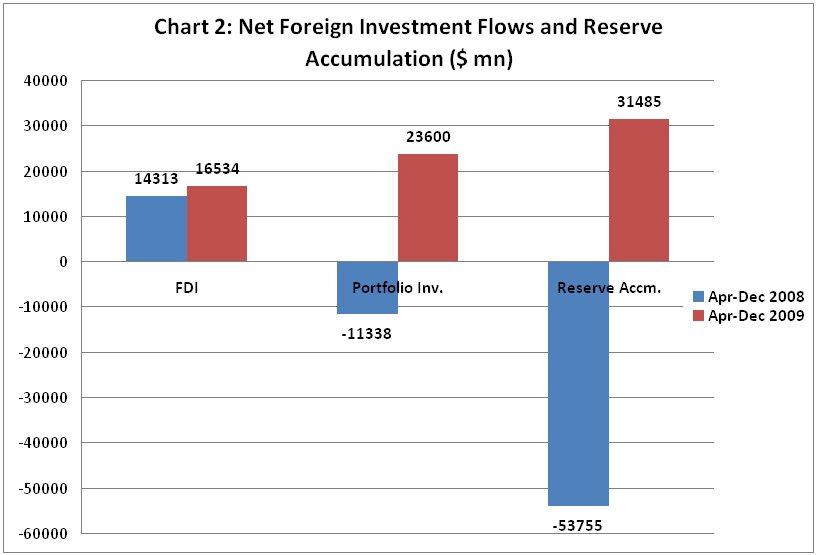

once again. Balance of payments data recently released by the Reserve

Bank of India indicate that net portfolio investment inflow during April-December

2009 amounted to $23.6 billion, as compared with an outflow of 11.3

billion during the crisis months of April-December 2008 (Chart 2). The

accumulation of reserves during the April-December 2009 period amounted

to $31.5 billion. While valuation changes contributed to an increase

in dollar reserve figures, the importance of portfolio inflows and central

bank intervention in currency markets cannot be denied.

This process has since continued. According to figures from the Securities

and Exchange Board of India, as of April 11, net investments by FIIs

in debt and equity markets amounted to an additional $10.1 billion,

during 2010. Seen in this light, the reluctance of the RBI to intervene

adequately to absorb these inflows is understandable.

This trend reflective of the dollar-carry trade feeds on itself for two reasons. First, it is well known that despite post-liberalisation buoyancy the Indian stock market is still both narrow and shallow. Narrow because there are relatively few listed companies whose stocks are actively traded. And shallow because the proportion of ''free-floating'' shares in these companies not held by promoters and available for regular trading is limited. As a result whenever there is even a minor surge in foreign institutional investment flowing into these markets, the demand they generate at the margin is enough to drive stock prices up quite quickly, widening the differential between the cost of borrowing and the return on investment and attracting further investments. This tends to generate a self-reinforcing and often speculative spiral of investment.

Secondly, the expected return to the investor is even higher than this

differential because as and when she decides to sell financial assets

to book profits and repatriate capital to clear debts incurred at home,

the appreciation of the rupee yields more dollars than would have been

the case at the exchange rate when the investment was first made. This

provides an additional return that justifies even more the speculative

spiral and leads to further appreciation of the rupee.

The corollary of such rupee appreciation is of course a weakening of

India's export competitiveness because the dollar values of the country's

exports rise as the rupee appreciates. It is to prevent or moderate

that outcome that central banks have to manage the exchange rate through

open market operations, involving in this case the purchase of dollars

and an increase in reserves. But if this increase in the assets of the

central bank is not neutralised or sterilised through the sale of government

securities, for example, then money supply to the economy increases.

In the past the Reserve Bank of India had resorted to this option to

retain its control over the pace of expansion of money supply. But with

the inflow of capital having risen sharply and been quite high in most

years of this decade, its ability to do so depended on rebuilding its

depleted stock of government securities through special schemes like

the Market Stabilisation Scheme which create their own problems. So

the reluctance to intervene may be because of a decision to retain some

degree of control over the monetary lever ignoring (at least for some

time) the fall out for the rupee.

Whatever be the explanation for that reluctance, it is material only

because as of now dealing with the source of the problem, which is the

embarrassingly large and unneeded inflow of foreign capital for what

are speculative investments, is not an option for the government and

the central bank. Some other countries, like Brazil, have sought to

deal with the recent surge with measures, however limited, that are

directed at curbing speculative inflows. Since this would go against

the grain of the ideology influencing economic reform, which includes

the belief that maintaining a freer and more open capital account is

the best option, the Reserve Bank of India that wants control over the

monetary lever and is faced with a surge in capital inflows would have

to tolerate rupee appreciation.

But it is clear that the central bank cannot continue with this stance

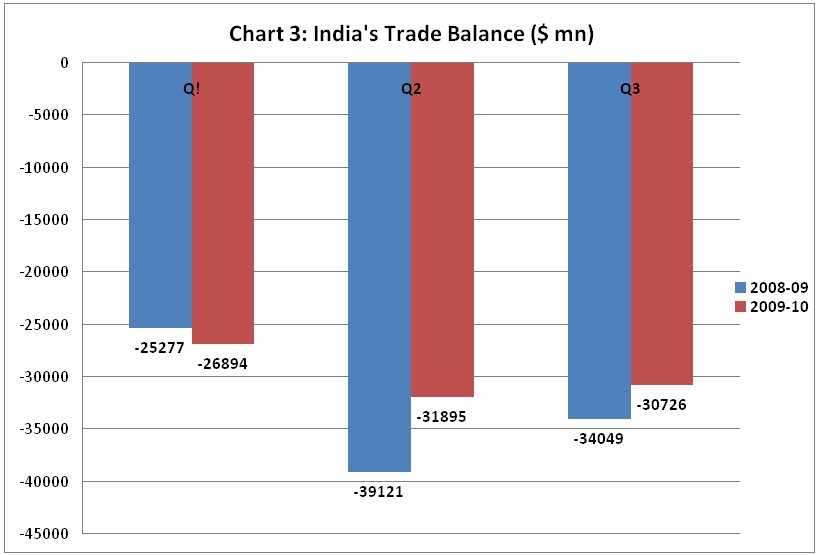

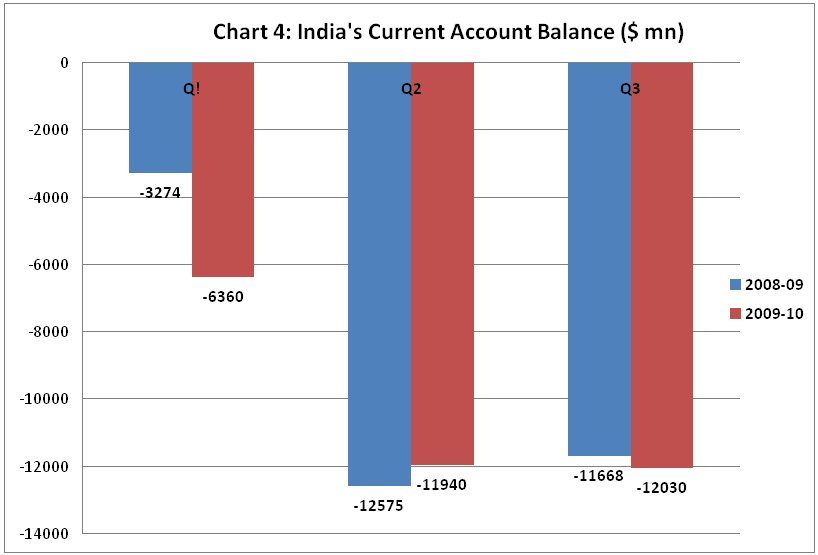

for long. India's balance of payments statistics point to high and persisting

trade and current account deficits in recent quarters (Chart 3 and 4),

and those deficits would only widen if international oil prices continue

to rise. In these circumstances, even if the protests of exporters are

dismissed, a process that renders exports more expensive in dollar terms

and imports cheaper in rupee terms cannot be ignored. That is ''success''

on the capital account of the balance of payments cannot beyond a point

be at the expense of a weakening of the current account and the domestic

economy.

Further, rising inflation is forcing the Reserve Bank of India to turn

its attention to what has always been its primary brief: using the monetary

level to moderate price increases. One way in which it is expected to

do this is by raising interest rates and reducing offtake of credit

to cool an overheating system. But raising domestic interest rates would

only encourage further those investors exploiting international interest

rate differentials and engaging in the carry trade. Being relevant on

the price management front may make the central bank an even greater

failure with regard to exchange rate management.

The real option is, therefore, one of dealing with the source of the

problem and using measures to control the inflow of financial capital,

especially speculative capital. There are many policy options at hand

to achieve this end. What is required is that a government that had

perceived the surge in capital inflows and the accumulation of reserves

as being indicators of economic success admits that even in its own

framework this is proving to be too much of a good thing.

©

MACROSCAN 2010