Themes > Features

16.04.2008

Global Inflation and India

With

the annual rate of inflation in India having touched 7 per cent on a point-to-point

basis during the week-ending 22 March 2008, the search for policies to

combat the price rise has begun. One factor seen as making that search

difficult is the ostensible role of "imported inflation" in

driving the rise in domestic prices. There is an obvious reason why such

an argument arises. Among the products primarily responsible for the current

inflation are food products of different kinds including cereals, intermediates

like metals and the universal intermediate, oil.

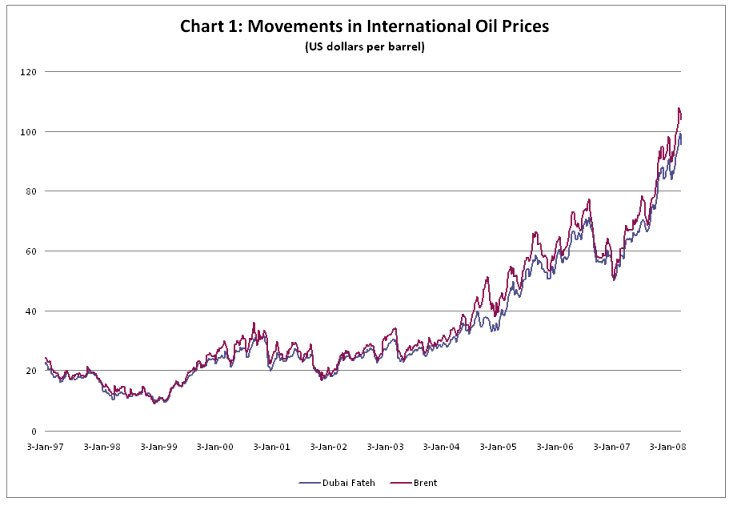

Of these, the difficulties that high and rising levels of oil prices pose have been known for some time now. Price movements for the two varieties of crude that enter India’s import basket (Graph 1) show that since May 2003 international prices have, despite fluctuations, been on a continuous rise. In the event the prices per barrel of these varieties have moved from less than $25 in May 2003 to close to or well above $100 today.

Second, there is the impact of both oil prices and government policies in the US, Europe, Brazil and elsewhere that have promoted bio-fuels as an alternative to petroleum. This has led to significant shifts in acreage as well as use of certain grains. For example, in 2006 the US diverted more than 20 per cent of its maize production to the production of ethanol; Brazil used half of its sugar cane production to make bio-fuel, and the European Union used the greater part of its vegetable oil production as well as imported vegetable oils, to make bio-fuel. This has naturally reduced the available land for producing food.

Third, the impact of policy neglect of agriculture over the past two decades is finally being felt. The prolonged agrarian crisis in many parts of the developing world; the shifts in acreage from food crops to cash crops relying on purchased inputs; the excessive use of ground water and inadequate attention to preserving or regenerating land and soil quality; the lack of attention to relevant agricultural research and extension; the over-use of chemical inputs that have long run implications for both safety and productivity; the ecological implications of both pollution and climate change, including desertification and loss of cultivable land: all these are issues that have been highlighted by analysts but largely ignored by policy makers in most countries. Reversing these processes is possible but will take time and substantial public investment, so until then global supply conditions will remain problematic.

Fourth, there is the impact of changes in market structure, which allow for greater international speculation in commodities. It is often assumed that rising food prices automatically benefit farmers, but this is far from the case, especially as the global food trade has become more concentrated and vertically integrated. A small number of agribusiness companies worldwide increasingly control all aspects of cultivation and distribution, from supplying inputs to farmers to buying crops and even in some cases to retail food distribution. This means that marketing margins are large and increasing, so that direct producers do not get the benefits of increases expect with a time lag and even then not to the full extent. This concentration also enables greater speculation in food, with more centralised storage.

Finally, primary commodity markets are also attracting financial speculators. As the global financial system remains fragile with the continuing implosion of the US housing finance market, commodity speculation is increasingly emerging as an important alternative investment market. Such speculation by large banks and financial companies is in both agricultural and non-agricultural commodities, and explains at least partly why the very recent period has seen such sharp hikes in price.

Commodity speculation has also affected the minerals and metals sector. For these commodities, it is evident that recent price increases have been largely the result of increased demand, especially from China and other rapidly growing developing countries, but also from the US and European Union. A positive fallout of the recent growth in demand and diversification of sources of demand is that it has allowed primary metals producing countries, especially in Africa, to benefit from competition to extract better prices and conditions for their mined products. But there is also the unfortunate reality that higher mineral prices have rarely if ever translated into better incomes and living conditions of the local people, even if they may benefit the aggregate economy of the country concerned.

At any rate, metal prices are high and likely to remain high because of the growing imbalance between world supply and demand. A reduction in global output growth rates would definitely have some dampening effect on prices from their current highs, but the basic imbalance is likely to continue for some time. This is also because there has been a neglect of investment in this sector as well, so that building up new capacity will take time given the long gestation period involved in investments for metal production.

So the medium term outlook for global commodity prices, while uncertain, is that they are likely to remain high even if the world economy slows down in terms of output growth. What does this mean for India? Until the 1990s, both producers and consumers in India were relatively sheltered from the impact of such global tendencies because of a complex system of trade restrictions, public procurement and distribution and policy emphasis on at least food self-sufficiency.

The liberalising policies that began in the early 1990s have rendered all of that history, since one explicit aim of the reform strategy was to bring Indian prices closer in line to world prices. Countries like India seeking to manage this effect of global speculation on the prices of a universal intermediate like oil have to decide how important it is to insulate the domestic economy and the domestic consumer from its effect. Given the huge revenues being derived from duties on oil products, one way this can be done is to forego duty while holding oil prices. This would require compensating for revenue losses with taxes in other areas which a growing economy can contemplate. But the government appears unwilling to take this route, increasing pressure to hike oil prices further and aggravate an inflationary tendency that is already proving to be economically and politically damaging.

This reticence till recently to proactively insulate the domestic economy has meant, that both producers and consumers are now more or less directly affected adversely by global trends. The government’s response to the domestic price rise, which is already creating panic in official corridors in an election year, has been to reduce or eliminate import duties on several food items such as edible oils, so as to allow imports to bring the price down. But that is a short-sighted and probably ineffective strategy. It provides direct competition to Indian farmers producing oilseeds, even as they suffer rapidly rising costs. It sends confused signals not only to farmers for the next sowing season, but also to consumers, and leaves the field open for domestic speculators as well because the imports are not under public supervision but left to private traders.

Most of all, given the tendency of international commodity prices noted here, it will not solve the basic problem of rising inflation in such commodities. Instead, it will make the Indian economy even more prone to the volatility and inflationary pressure of world markets. In fact, the increases in prices in India have not been as sharp for some commodities largely because of the vestiges of the intervention era. Thus, prices of some commodities, like rice for example, have gone up less than world prices only because exports have been prohibited. This does suggest that the Indian economy cannot hope to remain insulated from these global trends without much more proactive policies that rely substantially on government intervention in several areas. In the case of food, this essentially requires a more determined effort to increase the viability of food cultivation, to improve the productivity of agriculture through public measures, and to expand and strengthen the public system of procurement and distribution. For other commodities too, it is now evident that a lassez faire system is simply not good enough, and public intervention and regulation of markets is essential.

Of these, the difficulties that high and rising levels of oil prices pose have been known for some time now. Price movements for the two varieties of crude that enter India’s import basket (Graph 1) show that since May 2003 international prices have, despite fluctuations, been on a continuous rise. In the event the prices per barrel of these varieties have moved from less than $25 in May 2003 to close to or well above $100 today.

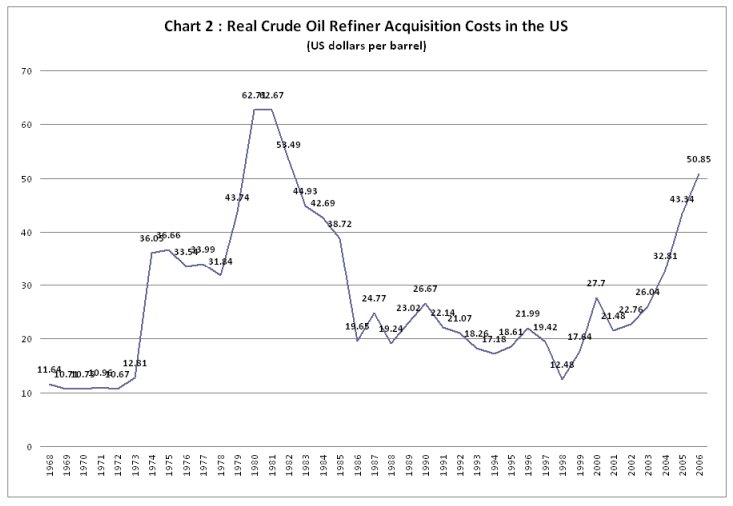

This has changed one feature of the oil price scenario that held during much of the last two decades. During those years, despite high nominal prices, the real price of oil (adjusted for increases in the general price level) was far lower than that which prevailed during the 1970s. As Chart 2 shows, when measured by the price-deflated refiner acquisition cost of imported oil in the US, in the years since 1974 the real price of oil was higher than that in 2006 only during a brief period between 1980 and 1982. Since 2006, nominal oil prices having risen further at rates much higher than the average level of prices. As a result, oil producers are regaining the real price benefits they garnered during the 1979-81 shock. According to one estimate, in terms of current prices the late 1970s-early 1980s peak in oil prices works out to $100-110 a barrel. That is a figure that we are fast approaching.

Underlying

the buoyancy in prices is the closing gap between global petroleum demand

and supply at a time when the spare capacity is more or less fully utilised.

Much of the increase in demand is coming from China, but that is affecting

stockpiles everywhere. This trend, combined with the uncertainty in

West Asia resulting from the occupation of Iraq and the standoff in

Iran, has created a situation where any destabilising influence—such

as political uncertainty and attacks on the oil supply chain in Nigeria—triggers

a sharp rise in prices.

What needs noting, however, is that prices are where they are because

speculators have exploited these fundamentals. It is known that energy

markets have attracted substantial financial investor interest since

2004, but especially after the recent decline in stock markets and in

the value of the dollar. Investors in search of new investment targets

have moved into speculative investments in commodities in general and

oil in particular. The Organisation of the Petroleum Exporting Countries

(OPEC), which is normally held responsible for all oil price increases,

has repeatedly asserted that oil has crossed the $100-a-barrel mark

not because of a shortage of supply but because of financial speculation.

Views similar to those from OPEC have been expressed by more disinterested

sources as well. As far back as April 29, 2006 the New York Times had

reported that: "In the latest round of furious buying, hedge funds

and other investors have helped propel crude oil prices from around

$50 a barrel at the end of 2005 to a record of $75.17 on the New York

Mercantile Exchange." According to that report, oil contracts held

mostly by hedge funds had risen to twice the amount held five years

ago. Such transactions are clearly speculative in nature.

While the disruption caused by the US occupation of Iraq, other geopolitical

factors and the speculation that followed has played a role in the case

of oil, what explains the recent increase in other global commodity

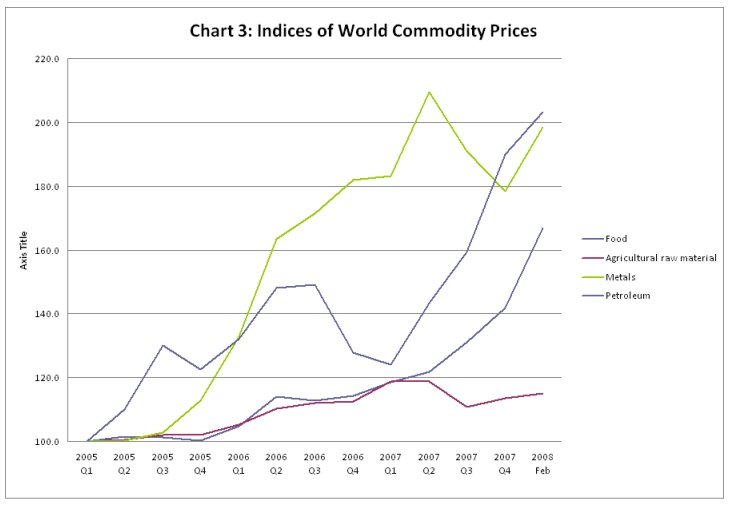

prices, especially food articles and metals? Chart 3 (based on IMF data)

shows that, except for agricultural raw materials whose prices have

increased very little, all the other commodity groups have shown sharp

rises in price. The rise in price levels for metals was the earliest

in the recent surge, with the weighted average of metals prices increasing

sharply from the last quarter of 2005, and almost doubling in the two-year

period to February 2008. Coal prices more than doubled last year, thereby

showing a faster rise than even the oil price. Food prices, like agricultural

raw materials, had shown only a modest increase until early 2007. But

since then they have zoomed, such that the IMF data show more than 40

per cent increase in world food prices over 2007. The FAO food price

index, which includes national prices as well as those in cross-border

trade, suggests that the average index for 2007 was nearly 25 per cent

above the average for 2006. Apart from sugar, nearly every other food

crop has shown very significant increases in price in world trade over

2007, and the latest evidence suggests that this trend has continued

and even accelerated in the first few months of 2008. The net result

is that globally the prices of many basic commodities have been rising

faster than they ever did during the last three decades.

It has been argued that these developments are largely demand driven,

being the result of several years of rapid global growth and the voracious

demand from some fast-growing countries such as China. Certainly there

is some element of truth in this. And to the extent that this is true,

it implies that the world economy is heading back to the late-1960s

and early-1970s scenario wherein rapid and prolonged growth came up

against an inflationary barrier. Capitalism’s success over the last

two decades was its ability to prevent such an outcome political economy

processes that restrained the wage and income demands of workers and

primary producers. But clearly there are limits to such a process, and

these limits are now being reached.

If this were the only cause of the recent commodity price inflation,

it would not necessarily be of such concern to policy makers, because

it could then be expected that a slowing down of overall growth would

simultaneously reduce inflation. It would also reflect some recovery

of the drastically reduced bargaining power of workers and primary producers.

But there are other, more worrying tendencies in operation, that suggest

that the current global inflationary process has other factors pushing

it which will not be so easily controlled.

To understand this, it is necessary to examine the forces behind the

prices rises for different commodities. In the case of food, there are

more than just demand forces at work, although it is certainly true

that rising incomes in Asia and other parts of the developing world

have led to increased demand for food. Five major aspects affecting

supply conditions have been crucial in changing global market conditions

for food crops.

Second, there is the impact of both oil prices and government policies in the US, Europe, Brazil and elsewhere that have promoted bio-fuels as an alternative to petroleum. This has led to significant shifts in acreage as well as use of certain grains. For example, in 2006 the US diverted more than 20 per cent of its maize production to the production of ethanol; Brazil used half of its sugar cane production to make bio-fuel, and the European Union used the greater part of its vegetable oil production as well as imported vegetable oils, to make bio-fuel. This has naturally reduced the available land for producing food.

Third, the impact of policy neglect of agriculture over the past two decades is finally being felt. The prolonged agrarian crisis in many parts of the developing world; the shifts in acreage from food crops to cash crops relying on purchased inputs; the excessive use of ground water and inadequate attention to preserving or regenerating land and soil quality; the lack of attention to relevant agricultural research and extension; the over-use of chemical inputs that have long run implications for both safety and productivity; the ecological implications of both pollution and climate change, including desertification and loss of cultivable land: all these are issues that have been highlighted by analysts but largely ignored by policy makers in most countries. Reversing these processes is possible but will take time and substantial public investment, so until then global supply conditions will remain problematic.

Fourth, there is the impact of changes in market structure, which allow for greater international speculation in commodities. It is often assumed that rising food prices automatically benefit farmers, but this is far from the case, especially as the global food trade has become more concentrated and vertically integrated. A small number of agribusiness companies worldwide increasingly control all aspects of cultivation and distribution, from supplying inputs to farmers to buying crops and even in some cases to retail food distribution. This means that marketing margins are large and increasing, so that direct producers do not get the benefits of increases expect with a time lag and even then not to the full extent. This concentration also enables greater speculation in food, with more centralised storage.

Finally, primary commodity markets are also attracting financial speculators. As the global financial system remains fragile with the continuing implosion of the US housing finance market, commodity speculation is increasingly emerging as an important alternative investment market. Such speculation by large banks and financial companies is in both agricultural and non-agricultural commodities, and explains at least partly why the very recent period has seen such sharp hikes in price.

Commodity speculation has also affected the minerals and metals sector. For these commodities, it is evident that recent price increases have been largely the result of increased demand, especially from China and other rapidly growing developing countries, but also from the US and European Union. A positive fallout of the recent growth in demand and diversification of sources of demand is that it has allowed primary metals producing countries, especially in Africa, to benefit from competition to extract better prices and conditions for their mined products. But there is also the unfortunate reality that higher mineral prices have rarely if ever translated into better incomes and living conditions of the local people, even if they may benefit the aggregate economy of the country concerned.

At any rate, metal prices are high and likely to remain high because of the growing imbalance between world supply and demand. A reduction in global output growth rates would definitely have some dampening effect on prices from their current highs, but the basic imbalance is likely to continue for some time. This is also because there has been a neglect of investment in this sector as well, so that building up new capacity will take time given the long gestation period involved in investments for metal production.

So the medium term outlook for global commodity prices, while uncertain, is that they are likely to remain high even if the world economy slows down in terms of output growth. What does this mean for India? Until the 1990s, both producers and consumers in India were relatively sheltered from the impact of such global tendencies because of a complex system of trade restrictions, public procurement and distribution and policy emphasis on at least food self-sufficiency.

The liberalising policies that began in the early 1990s have rendered all of that history, since one explicit aim of the reform strategy was to bring Indian prices closer in line to world prices. Countries like India seeking to manage this effect of global speculation on the prices of a universal intermediate like oil have to decide how important it is to insulate the domestic economy and the domestic consumer from its effect. Given the huge revenues being derived from duties on oil products, one way this can be done is to forego duty while holding oil prices. This would require compensating for revenue losses with taxes in other areas which a growing economy can contemplate. But the government appears unwilling to take this route, increasing pressure to hike oil prices further and aggravate an inflationary tendency that is already proving to be economically and politically damaging.

This reticence till recently to proactively insulate the domestic economy has meant, that both producers and consumers are now more or less directly affected adversely by global trends. The government’s response to the domestic price rise, which is already creating panic in official corridors in an election year, has been to reduce or eliminate import duties on several food items such as edible oils, so as to allow imports to bring the price down. But that is a short-sighted and probably ineffective strategy. It provides direct competition to Indian farmers producing oilseeds, even as they suffer rapidly rising costs. It sends confused signals not only to farmers for the next sowing season, but also to consumers, and leaves the field open for domestic speculators as well because the imports are not under public supervision but left to private traders.

Most of all, given the tendency of international commodity prices noted here, it will not solve the basic problem of rising inflation in such commodities. Instead, it will make the Indian economy even more prone to the volatility and inflationary pressure of world markets. In fact, the increases in prices in India have not been as sharp for some commodities largely because of the vestiges of the intervention era. Thus, prices of some commodities, like rice for example, have gone up less than world prices only because exports have been prohibited. This does suggest that the Indian economy cannot hope to remain insulated from these global trends without much more proactive policies that rely substantially on government intervention in several areas. In the case of food, this essentially requires a more determined effort to increase the viability of food cultivation, to improve the productivity of agriculture through public measures, and to expand and strengthen the public system of procurement and distribution. For other commodities too, it is now evident that a lassez faire system is simply not good enough, and public intervention and regulation of markets is essential.

©

MACROSCAN 2008