With

the annual rate of inflation in India having touched

7 per cent on a point-to-point basis during the week-ending

22 March 2008, the search for policies to combat the

price rise has begun. One factor seen as making that

search difficult is the ostensible role of "imported

inflation" in driving the rise in domestic prices.

There is an obvious reason why such an argument arises.

Among the products primarily responsible for the current

inflation are food products of different kinds including

cereals, intermediates like metals and the universal

intermediate, oil.

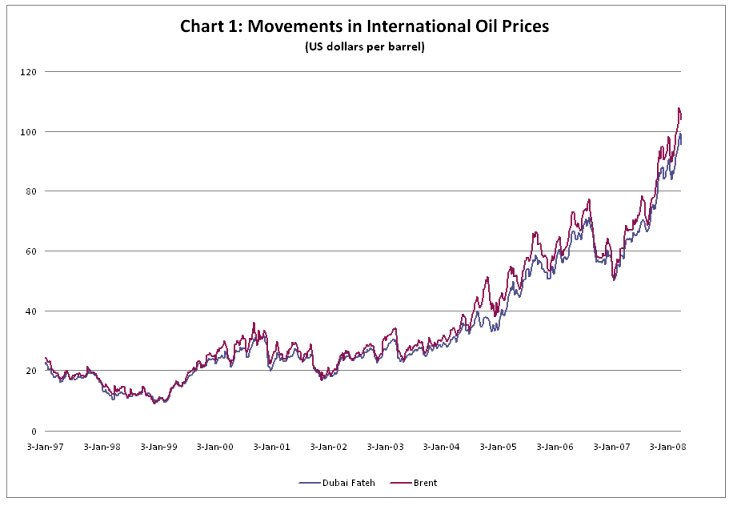

Of these, the difficulties that high and rising levels

of oil prices pose have been known for some time now.

Price movements for the two varieties of crude that

enter India’s import basket (Graph 1) show that since

May 2003 international prices have, despite fluctuations,

been on a continuous rise. In the event the prices

per barrel of these varieties have moved from less

than $25 in May 2003 to close to or well above $100

today.

Chart

1 >> Click

to Enlarge

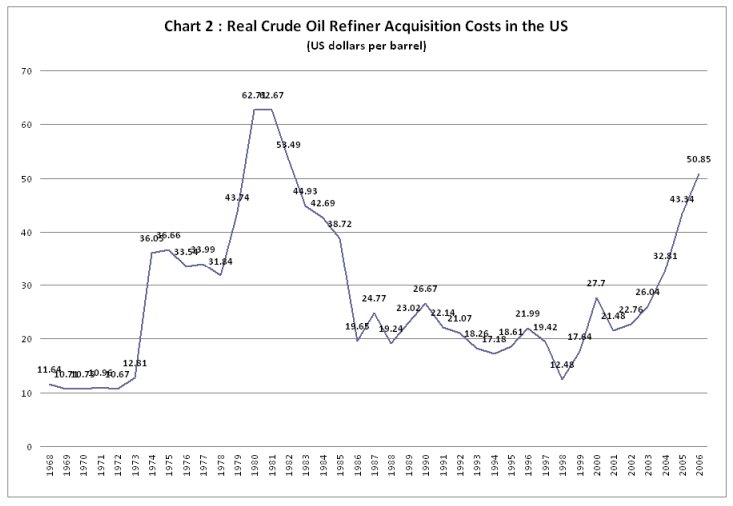

This has changed one feature of the oil price scenario

that held during much of the last two decades. During

those years, despite high nominal prices, the real

price of oil (adjusted for increases in the general

price level) was far lower than that which prevailed

during the 1970s. As Chart 2 shows, when measured

by the price-deflated refiner acquisition cost of

imported oil in the US, in the years since 1974 the

real price of oil was higher than that in 2006 only

during a brief period between 1980 and 1982. Since

2006, nominal oil prices having risen further at rates

much higher than the average level of prices. As a

result, oil producers are regaining the real price

benefits they garnered during the 1979-81 shock. According

to one estimate, in terms of current prices the late

1970s-early 1980s peak in oil prices works out to

$100-110 a barrel. That is a figure that we are fast

approaching.

Chart

2 >> Click

to Enlarge

Underlying the buoyancy

in prices is the closing gap between global petroleum

demand and supply at a time when the spare capacity

is more or less fully utilised. Much of the increase

in demand is coming from China, but that is affecting

stockpiles everywhere. This trend, combined with the

uncertainty in West Asia resulting from the occupation

of Iraq and the standoff in Iran, has created a situation

where any destabilising influence—such as political

uncertainty and attacks on the oil supply chain in

Nigeria—triggers a sharp rise in prices.

What needs noting, however, is that prices are where

they are because speculators have exploited these

fundamentals. It is known that energy markets have

attracted substantial financial investor interest

since 2004, but especially after the recent decline

in stock markets and in the value of the dollar. Investors

in search of new investment targets have moved into

speculative investments in commodities in general

and oil in particular. The Organisation of the Petroleum

Exporting Countries (OPEC), which is normally held

responsible for all oil price increases, has repeatedly

asserted that oil has crossed the $100-a-barrel mark

not because of a shortage of supply but because of

financial speculation.

Views similar to those from OPEC have been expressed

by more disinterested sources as well. As far back

as April 29, 2006 the New York Times had reported

that: "In the latest round of furious buying,

hedge funds and other investors have helped propel

crude oil prices from around $50 a barrel at the end

of 2005 to a record of $75.17 on the New York Mercantile

Exchange." According to that report, oil contracts

held mostly by hedge funds had risen to twice the

amount held five years ago. Such transactions are

clearly speculative in nature.

While the disruption caused by the US occupation of

Iraq, other geopolitical factors and the speculation

that followed has played a role in the case of oil,

what explains the recent increase in other global

commodity prices, especially food articles and metals?

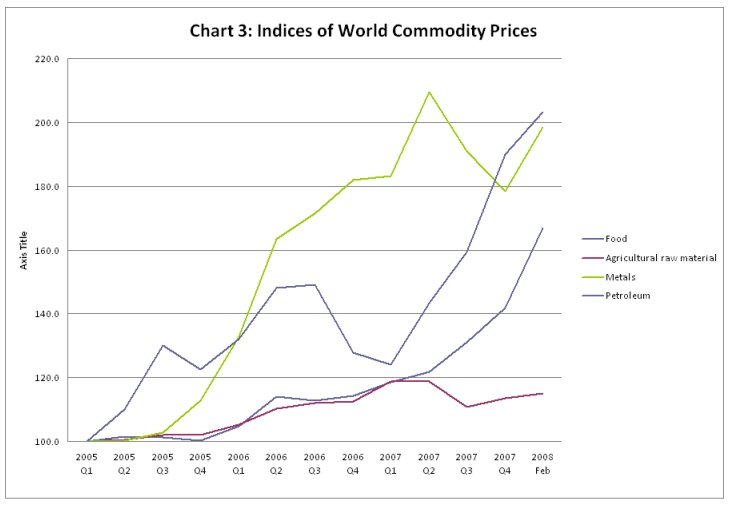

Chart 3 (based on IMF data) shows that, except for

agricultural raw materials whose prices have increased

very little, all the other commodity groups have shown

sharp rises in price. The rise in price levels for

metals was the earliest in the recent surge, with

the weighted average of metals prices increasing sharply

from the last quarter of 2005, and almost doubling

in the two-year period to February 2008. Coal prices

more than doubled last year, thereby showing a faster

rise than even the oil price. Food prices, like agricultural

raw materials, had shown only a modest increase until

early 2007. But since then they have zoomed, such

that the IMF data show more than 40 per cent increase

in world food prices over 2007. The FAO food price

index, which includes national prices as well as those

in cross-border trade, suggests that the average index

for 2007 was nearly 25 per cent above the average

for 2006. Apart from sugar, nearly every other food

crop has shown very significant increases in price

in world trade over 2007, and the latest evidence

suggests that this trend has continued and even accelerated

in the first few months of 2008. The net result is

that globally the prices of many basic commodities

have been rising faster than they ever did during

the last three decades.

It has been argued that these developments are largely

demand driven, being the result of several years of

rapid global growth and the voracious demand from

some fast-growing countries such as China. Certainly

there is some element of truth in this. And to the

extent that this is true, it implies that the world

economy is heading back to the late-1960s and early-1970s

scenario wherein rapid and prolonged growth came up

against an inflationary barrier. Capitalism’s success

over the last two decades was its ability to prevent

such an outcome political economy processes that restrained

the wage and income demands of workers and primary

producers. But clearly there are limits to such a

process, and these limits are now being reached.

If this were the only cause of the recent commodity

price inflation, it would not necessarily be of such

concern to policy makers, because it could then be

expected that a slowing down of overall growth would

simultaneously reduce inflation. It would also reflect

some recovery of the drastically reduced bargaining

power of workers and primary producers. But there

are other, more worrying tendencies in operation,

that suggest that the current global inflationary

process has other factors pushing it which will not

be so easily controlled.

To understand this, it is necessary to examine the

forces behind the prices rises for different commodities.

In the case of food, there are more than just demand

forces at work, although it is certainly true that

rising incomes in Asia and other parts of the developing

world have led to increased demand for food. Five

major aspects affecting supply conditions have been

crucial in changing global market conditions for food

crops.

Chart

3 >> Click

to Enlarge

First, there is the impact of high oil prices, which

affect agricultural costs directly because of the

significance of energy as an input in the cultivation

process itself (through fertiliser and irrigation

costs) as well as in transporting food. Across the

world, governments have reduced protection and subsidies

on agriculture, which means that high costs of energy

directly translate into higher costs of cultivation,

and therefore higher prices of output.

Second, there is the impact of both oil prices and

government policies in the US, Europe, Brazil and

elsewhere that have promoted bio-fuels as an alternative

to petroleum. This has led to significant shifts in

acreage as well as use of certain grains. For example,

in 2006 the US diverted more than 20 per cent of its

maize production to the production of ethanol; Brazil

used half of its sugar cane production to make bio-fuel,

and the European Union used the greater part of its

vegetable oil production as well as imported vegetable

oils, to make bio-fuel. This has naturally reduced

the available land for producing food.

Third, the impact of policy neglect of agriculture

over the past two decades is finally being felt. The

prolonged agrarian crisis in many parts of the developing

world; the shifts in acreage from food crops to cash

crops relying on purchased inputs; the excessive use

of ground water and inadequate attention to preserving

or regenerating land and soil quality; the lack of

attention to relevant agricultural research and extension;

the over-use of chemical inputs that have long run

implications for both safety and productivity; the

ecological implications of both pollution and climate

change, including desertification and loss of cultivable

land: all these are issues that have been highlighted

by analysts but largely ignored by policy makers in

most countries. Reversing these processes is possible

but will take time and substantial public investment,

so until then global supply conditions will remain

problematic.

Fourth, there is the impact of changes in market structure,

which allow for greater international speculation

in commodities. It is often assumed that rising food

prices automatically benefit farmers, but this is

far from the case, especially as the global food trade

has become more concentrated and vertically integrated.

A small number of agribusiness companies worldwide

increasingly control all aspects of cultivation and

distribution, from supplying inputs to farmers to

buying crops and even in some cases to retail food

distribution. This means that marketing margins are

large and increasing, so that direct producers do

not get the benefits of increases expect with a time

lag and even then not to the full extent. This concentration

also enables greater speculation in food, with more

centralised storage.

Finally, primary commodity markets are also attracting

financial speculators. As the global financial system

remains fragile with the continuing implosion of the

US housing finance market, commodity speculation is

increasingly emerging as an important alternative

investment market. Such speculation by large banks

and financial companies is in both agricultural and

non-agricultural commodities, and explains at least

partly why the very recent period has seen such sharp

hikes in price.

Commodity speculation has also affected the minerals

and metals sector. For these commodities, it is evident

that recent price increases have been largely the

result of increased demand, especially from China

and other rapidly growing developing countries, but

also from the US and European Union. A positive fallout

of the recent growth in demand and diversification

of sources of demand is that it has allowed primary

metals producing countries, especially in Africa,

to benefit from competition to extract better prices

and conditions for their mined products. But there

is also the unfortunate reality that higher mineral

prices have rarely if ever translated into better

incomes and living conditions of the local people,

even if they may benefit the aggregate economy of

the country concerned.

At any rate, metal prices are high and likely to remain

high because of the growing imbalance between world

supply and demand. A reduction in global output growth

rates would definitely have some dampening effect

on prices from their current highs, but the basic

imbalance is likely to continue for some time. This

is also because there has been a neglect of investment

in this sector as well, so that building up new capacity

will take time given the long gestation period involved

in investments for metal production.

So the medium term outlook for global commodity prices,

while uncertain, is that they are likely to remain

high even if the world economy slows down in terms

of output growth. What does this mean for India? Until

the 1990s, both producers and consumers in India were

relatively sheltered from the impact of such global

tendencies because of a complex system of trade restrictions,

public procurement and distribution and policy emphasis

on at least food self-sufficiency.

The liberalising policies that began in the early

1990s have rendered all of that history, since one

explicit aim of the reform strategy was to bring Indian

prices closer in line to world prices. Countries like

India seeking to manage this effect of global speculation

on the prices of a universal intermediate like oil

have to decide how important it is to insulate the

domestic economy and the domestic consumer from its

effect. Given the huge revenues being derived from

duties on oil products, one way this can be done is

to forego duty while holding oil prices. This would

require compensating for revenue losses with taxes

in other areas which a growing economy can contemplate.

But the government appears unwilling to take this

route, increasing pressure to hike oil prices further

and aggravate an inflationary tendency that is already

proving to be economically and politically damaging.

This reticence till recently to proactively insulate

the domestic economy has meant, that both producers

and consumers are now more or less directly affected

adversely by global trends. The government’s response

to the domestic price rise, which is already creating

panic in official corridors in an election year, has

been to reduce or eliminate import duties on several

food items such as edible oils, so as to allow imports

to bring the price down. But that is a short-sighted

and probably ineffective strategy. It provides direct

competition to Indian farmers producing oilseeds,

even as they suffer rapidly rising costs. It sends

confused signals not only to farmers for the next

sowing season, but also to consumers, and leaves the

field open for domestic speculators as well because

the imports are not under public supervision but left

to private traders.

Most of all, given the tendency of international commodity

prices noted here, it will not solve the basic problem

of rising inflation in such commodities. Instead,

it will make the Indian economy even more prone to

the volatility and inflationary pressure of world

markets. In fact, the increases in prices in India

have not been as sharp for some commodities largely

because of the vestiges of the intervention era. Thus,

prices of some commodities, like rice for example,

have gone up less than world prices only because exports

have been prohibited. This does suggest that the Indian

economy cannot hope to remain insulated from these

global trends without much more proactive policies

that rely substantially on government intervention

in several areas. In the case of food, this essentially

requires a more determined effort to increase the

viability of food cultivation, to improve the productivity

of agriculture through public measures, and to expand

and strengthen the public system of procurement and

distribution. For other commodities too, it is now

evident that a lassez faire system is simply not good

enough, and public intervention and regulation of

markets is essential.