The unprecedented bull run

on the Bombay stock exchange which took the Sensex

beyond consecutive 1000-point hurdles in a matter

of days rather than weeks or months has little to

do with economic fundamentals. Rather, huge foreign

capital inflows over a short period of time have pushed

up equity valuations to levels that would normally

be considered unsustainable. Between August 21 and

October 29, the price earnings ratio for the 50 S&P

CNX Nifty stocks had risen from 18.4 to 26.4 or by

more than 40 per cent. Such a sharp rise to unusually

high levels over a two-month period can hardly be

attributed to improved earnings expectations. Thus,

the RBI has had to admit in its recently released

Report on the Trend and Progress of Banking in India

that: “Although the macroeconomic fundamentals are

strong as also the corporate earnings, large demand

by FIIs given the limited supply of domestic assets,

is putting pressure on the equity valuations.” For

the record, net FII inflows during the first 10 months

of 2007 had touched $18.9 billion as compared with

the $10.9 billion it had touched in 2003-04, the maximum

for any full financial year.

While fundamentals cannot explain stock market buoyancy,

the role of foreign capital inflows in explaining

such buoyancy can work against fundamentals. Huge

capital inflows have resulted in an appreciation of

the rupee, from its Rs. 46-to-the-dollar level in

mid-September 2006 to Rs.39.3 on November 1, 2007.

The damage this has wrought on the exporting sectors

is only being assessed as yet. Such appreciation has

occurred despite the central bank’s intervention aimed

at stalling the currency’s rise. While intervention

has failed to fully realize its objective, it has

resulted in the continuous accumulation of foreign

exchange reserve assets with the central bank. This

makes it difficult for the RBI to manage money supply

and use the monetary lever to pursue other objectives.

A strait-jacketed central back is hardly good for

the economy. Finally, in its effort to balance the

accumulation of foreign exchange assets by retrenching

government securities deposited with it by the central

government (under the Market Stabilization Scheme),

the RBI has taken on deposits of such securities to

the tune of more than Rs.180,000 crore. Since the

interest due on those securities has to be met from

the central budget, the Centre may be burdened by

as much as Rs.12,500 crore over a full financial year.

This would make fiscal management difficult as well.

The outcome may be a further cutback in capital and

social expenditures.

Given these consequences of the FII surge, justifying

the open door policy towards foreign financial investors

has become increasingly difficult for the government

and for non-government advocates of such a policy.

The one argument that still sounds credible is that

such flows help finance the investment boom that underlies

India’s growth acceleration. There does seem to be

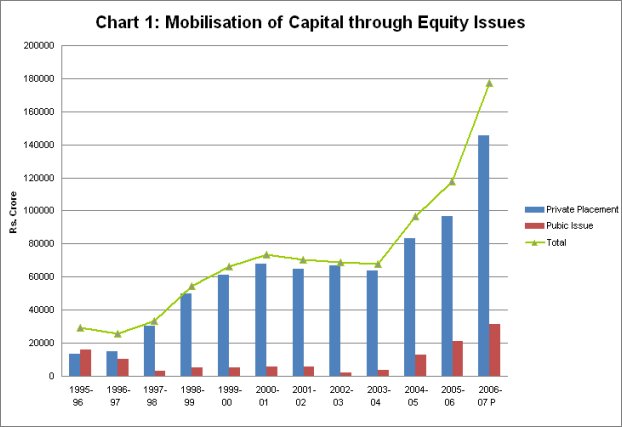

a semblance of truth to this argument. Between 2003-04

and 2006-07, which was a period when FII inflows rose

significantly and stock markets were buoyant most

of the time, equity capital mobilized by the Indian

corporate sector rose from Rs.67,622 crore to Rs.177,170

crore (Chart 1).

Chart

1 >> Click

to Enlarge

Not all of this was raised through equity issued in

the stock market. In fact a predominant and rapidly

growing share amounting to a whopping Rs.145,571 crore

in 2006-07 was raised in the private placement market

involving negotiated sales of chunks of new equity

in firms not listed in the stock market to financial

investors of various kinds such as merchant banks,

hedge funds and private equity firms. While not directly

a part of the stock market boom, such sales were encouraged

by the high valuations generated by that boom and

were as in the case of stock markets made substantially

to foreign financial investors.

The dominance of private placement in new equity issues

is to be expected since a substantial number of firms

in India are still not listed in the stock market.

On the other hand, free-floating (as opposed to promoter-held)

shares are a small proportion of total shareholding

in the case of many listed firms. If therefore there

is a sudden surge of capital inflows into the equity

market, the rise in stock valuations would result

in capital flowing out of the organized stock market

in search of equity supplied by unlisted firms. The

only constraint to such spillover is the cap on foreign

equity investment placed by the foreign investment

policy of the government. Thus, as per the original

September 1992 policy permitting foreign institutional

investment, registered FIIs could individually invest

in a maximum of 5 per cent of a company’s issued capital

and all FIIs together up to a maximum of 24 per cent.

But much relaxations has occurred since. The 5 per

cent individual-FII limit was raised to 10 per cent

in June 1998. Further, as of March 2001, FIIs as a

group were allowed to invest in excess of 24 per cent

and up to 40 per cent of the paid up capital of a

company with the approval of the general body of the

shareholders granted through a special resolution.

This aggregate FII limit was raised to the sectoral

cap for foreign investment in the concerned sector

as of September 2001. These changes obviously substantially

expanded the role that foreign financial investors

could play in the market for corporate equity.

Even in sectors where the restrictions on foreign

investment or constraints on foreign investor rights

are severe, as in the print media and banking, investors

have evinced unusual interest. This is because the

process of liberalization keeps alive expectations

that the caps on foreign direct investment would be

relaxed over time, providing the basis for foreign

control. Thus, acquisition of shares through the FII

route today paves the way for the sale of those shares

to foreign players interested in acquiring companies

as and when FDI norms are relaxed.

One obvious consequence of FII investments in stock

markets is that the possibility of take over by foreign

entities of Indian firms has increased substantially.

This possibility of transfer of ownership from Indian

to foreign individuals or entities has increased with

the private placement boom, which is not restrained

by the extent of free-floating shares available for

trading in stock markets. Private equity firms can

seek out appropriate investment targets and persuade

domestic firms to part with a significant share of

equity using valuations that would be substantial

by domestic wealth standards and may not be so by

international standards. Since private equity expects

to make its returns in the medium term, it can then

wait till policies on foreign ownership are adequately

relaxed and an international firm is interested in

an acquisition in the area concerned. The rapid expansion

of private equity in India suggests that this is the

route the private equity business is seeking given

the fact that the potential for such activity in the

developed countries is reaching saturation levels.

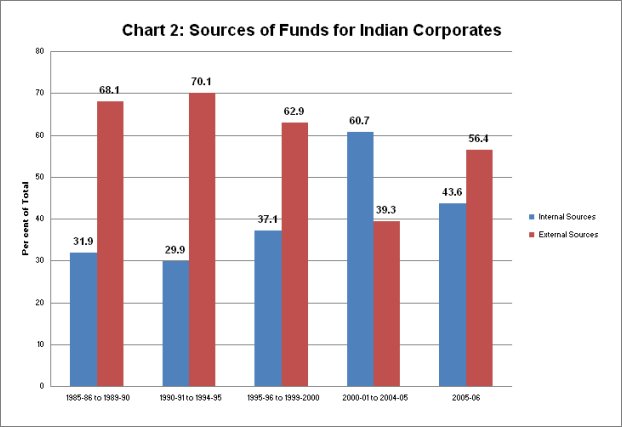

The point to note, however, is that these trends notwithstanding,

equity does not account for a significant share of

total corporate finance in the country. In fact, internal

sources such as retained profits and depreciation

reserves have accounted for a much higher share of

corporate finance during the equity boom of the first

half of this. According to RBI figures (Chart 2),

internal sources of finance which accounted for about

30 per cent of total corporate financing during the

second half of the 1980s and the first half of the

1990s, rose to 37 per cent during the second half

of the 1990s and a record 61 per cent during 2000-01

to 2004-05. Though that figure fell during 2005-06,

which is the last year for which the RBI studies of

company finances are as yet available, it still stood

at a relatively high 56 per cent.

Among the factors explaining the new dominance of

internal sources of finance, three are of importance.

First, increased corporate surpluses resulting from

enhanced sales and a combination of rising productivity

and stagnant real wages. Second, a lower interest

burden resulting from the sharp decline in nominal

interest rates, when compared to the 1980s and early

1990s. And third, reduced tax deductions because of

tax concessions and loop holes. These factors have

combined to leave more cash in the hands of corporations

for expansion and modernization.

Chart

2>> Click

to Enlarge

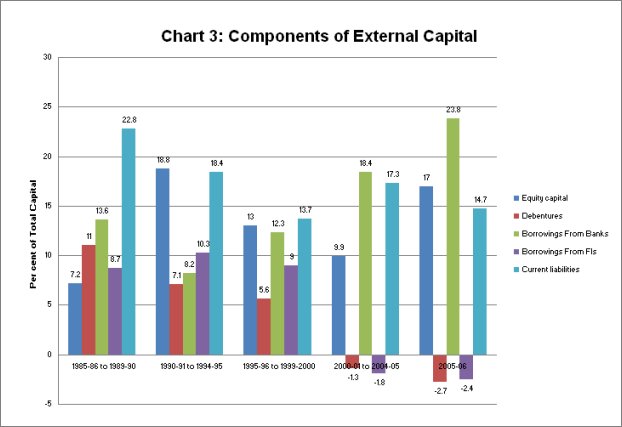

Along with the increased role for internally generated

funds in corporate financing in recent years, the

share of equity in all forms of external finance has

also been declining. An examination of the composition

of external financing (measured relative to total

financing) shows that the share of equity capital

in total financing that had risen from 7 to 19 per

cent between the second half of the 1980s and the

first half of the 1990s, subsequently declined 13

and 10 per cent respectively during the second half

of the 1990s and the first half of this decade. There,

however, appears to be a revival to 17 per cent of

equity financing in 2005-06, possibly as a result

of the private placement boom of recent times.

What is noteworthy is that, with the decline of development

banking and therefore of the provision of finance

by the financial institutions (which have been converted

into banks), the role of commercial banks in financing

the corporate sector has risen sharply to touch 24

per cent of the total in 2003-04. In sum, internal

resources and bank finance dominate corporate financing

and not equity, which receives all the attention because

of the surge in foreign institutional investment and

the media’s obsession with stock market buoyancy.

Thus, the surge in foreign financial investment, which

is unrelated to fundamentals and in fact weakens them,

is important more because of the impact that it has

on the pattern of ownership of the corporate sector

rather than the contribution it makes to corporate

finance. This challenges the defence of the open door

policy to foreign financial investment on the grounds

that it helps mobilize resources for investment. It

also reveals another danger associate with such a

policy: the threat of widespread foreign take over.

Many argue that this is inevitable in a globalizing

world and that ownership per se does not matter so

long as the assets are maintained and operated in

the country. But there is no guarantee that this would

be the case once domestic assets become parts of the

international operations of transnational firms with

transnational strategies. Those assets may at some

point be kept dormant and even be retrenched. What

is more, the ability of domestic forces and the domestic

State to influence the pattern and pace of growth

of domestic economic activity would have been substantially

eroded.

Chart

3>> Click

to Enlarge