With

the Sensex defying all laws of economic gravity, the

disconnect between India’s booming financial sector

and its real economy has only worsened. Few would

argue that the performance of the real economy can

explain the recent exuberance in the stock markets.

So, this may be a good time to look to the real economy

to introduce an element of moderation into assessments

of economic performance.

It hardly bears repeating that going by GDP estimates

(that are still subject to revision) the Indian economy

has moved on to a higher growth trajectory over the

last four years with growth averaging over 8 per cent

per annum. But what has been more welcome is the evidence

that high growth is no longer confined only to services,

but characterizes the manufacturing sector as well.

While agriculture still performs poorly, there appears

to be at least one segment of the commodity producing

economy that has begun to reflect the dynamism that

services have displayed thus far. And this trend is

continuing.

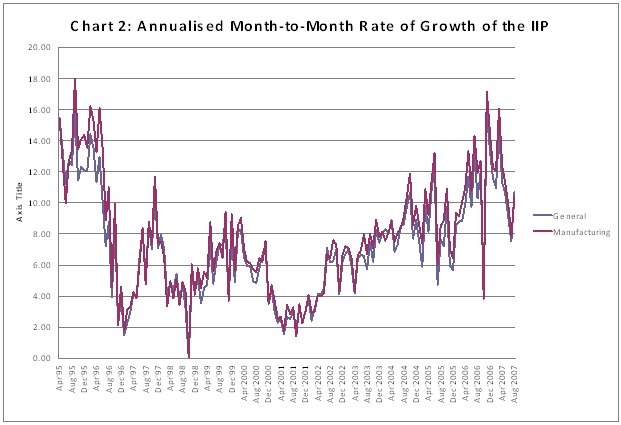

On October 12, the Central Statistical Organization

(CSO) released the provisional Index of Industrial

Production (IIP with 1999-2000 base) for the month

of August. This gave some cause to celebrate. Not

only was the annual month-to-month rate of growth

of the IIP (at 10.7 per cent) marginally better than

it was a year earlier, but it appears to have recovered

from a downturn in June and July this year, when industrial

growth lost some of its momentum and fell to 7.5 per

cent. These signs of the persistence of high industrial

and manufacturing growth are reassuring, since past

experience under liberalization suggests that high

industrial growth has not been the rule and periods

of high growth have been short-lived.

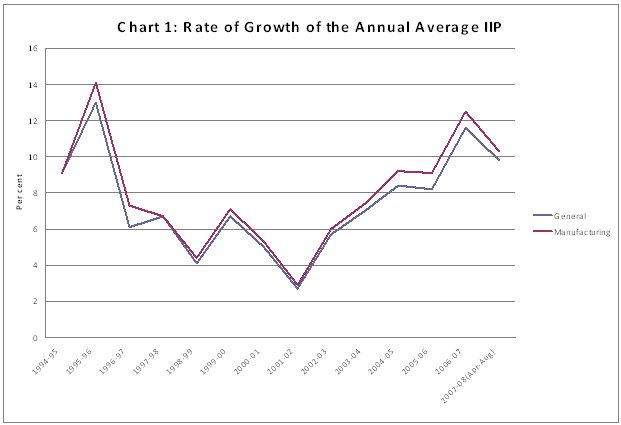

Taking a long view, we find that industrial growth

as captured by the IIP, which averaged 9 per cent

in the second half of the 1980s, slumped immediately

after the balance of payments crisis of 1991. However,

a recovery followed, with manufacturing growth rising

to a peak of 14.1 per cent over the three-year period

1993-94 to 1995-96. This led many to argue that liberalization

had begun to deliver in terms of industrial growth.

But the boom proved short-lived, and industry entered

a relatively long period of much slower growth, with

fears of an industrial recession being expressed by

2001-02.

Since then the industrial sector has once again recovered,

with rates of growth touching the high level s of

the mid-1990s by 2004-05. Even though the peak of

1995-96 has not been equaled, growth has been creditable

and sustained for more than three years now. But given

the mid-1990s experience every sign of a possible

downturn, as that in July this year, is received with

some apprehension.

Chart

1 >> Click

to Enlarge

One

cause for comfort is that there are significant differences

between the mini-boom of the mid-1990s and what is

occurring now. As has been argued before in this column,

the 1993-1995 “mini-boom” was the result of a combination

of several once-for-all influences. Principal among

these was the release after liberalization of the

pent-up demand for a host of import-intensive manufactures,

which (because of liberalization) could be serviced

through domestic assembly or production using imported

inputs and components. Once that demand had been satisfied,

further growth had to be based on an expansion of

the domestic market or a surge in exports. Since neither

of these conditions was realized, industry entered

a phase of slow growth.

What was surprising, in fact, was that growth was

not even lower. Economic liberalization and fiscal

reform were bound to adversely affect manufacturing

growth. To start with, import liberalization resulted

in some displacement of existing domestic production

directly by imports and indirectly by new products

assembled domestically from imported inputs. Second,

the reduction in customs duties resorted to as part

of the import liberalization package and the direct

and indirect tax concessions that were provided to

the private sector to stimulate investment, led to

a decline in the tax-GDP ratio at the Centre by anywhere

between 1.5 to 2 percentage points of GDP. This implied

that so long as deficit-spending by the government

did not increase, the demand stimulus associated with

government expenditure would be lower than would have

otherwise been the case. Third, after 1993-94 the

government also chose to significantly curtail the

fiscal deficit as part of fiscal reform, so that the

stimulus provided to industrial growth by state expenditure

was substantially smaller than was the case in the

1980s.

Chart

2>> Click

to Enlarge

If

all this did not result in an even steeper decline

in industrial growth it was partly because increases

in consumer credit facilitated by financial liberalization

kept the demand for consumption goods at above average

levels in many years. Further, the ‘windfall gains’

registered by a significant number of central and

state government employees as a result of the payment

of arrears following of the implementation of the

Fifth Pay Commission’s recommendations also contributed

to an increase in the number having the wherewithal

to contribute to such demand.

Compared with that experience there are elements of

both continuity and change in the more recent boom

in manufacturing. The element of continuity stems

from the extremely important role that credit-financed

consumption and investment play in keeping industrial

demand at high levels. Credit has been an important

stimulus to industrial demand in three areas. First,

it has financed a boom in investment in housing and

real estate and spurred the growth in demand for construction

materials. Second, it has financed purchases of automobiles

and triggered an automobile boom. Finally it has contributed

to the expansion in demand for consumer durables.

The point to note is that compared to the mid-1990s

the growth of credit has been explosive, facilitated

in part by the liquidity injected into the system

by the large inflows of foreign financial capital

in the form of equity and debt. In the wake of this

increase in liquidity, expansion in credit provision

has been accompanied by an increase in the exposure

of the banking sector to the retail loan segment.

The share of personal loans in total bank credit has

almost doubled in recent years rising from 12.2 per

cent in 2001 to 22.2 per cent in 2005. Much of this

has been concentrated in housing finance, with housing

loans accounting for 53 per cent of retail loans in

2005. But purchasers of automobiles and consumer durables

have also received a fair share of credit. The importance

of credit-financed private consumption and investment

for growth has been flagged in recent times by the

Finance Ministry. Despite being an ardent votary of

financial liberalization and being committed to a

policy of minimal government intervention, it has

chosen to hector public sector banks into reducing

interest rates every time there is any sign of a slowing

of credit growth. It is not non-intervention that

the new breed of liberalization involves, but a form

of intervention that uses the financial sector as

means of stimulating the demand needed to keep private

sector growth going.

The element of change in the factors contributing

to industrial growth during the current boom as opposed

to that in the mid-1990s is the stimulus provided

by exports. In the early and mid-1990s high growth

was accompanied by high imports, with exports growing,

if at all, in areas where India was traditionally

strong. In recent years, the share of India’s traditional

manufactured exports such as textiles, gems and jewelry

and leather in the total exports of manufactures has

declined, while that of chemicals and engineering

goods has gone up significantly. This would have stimulated

growth. While exports are by no means the principal

drivers of manufacturing production, they play a part

in sectors like automobile parts and chemicals and

pharmaceuticals where Indian firms are increasingly

successful in global markets.

All this suggests that Indian industry has been experiencing

a transition. While during the first four decades

of development industrial growth was almost solely

dependent on the stimulus offered by government expenditure

and the support provided by public investment in infrastructure,

there are signs that other sources of demand such

as private consumption demand and exports are playing

an important role in recent times. Further, the current

industrial buoyancy suggests that these new stimuli

have, unlike during much of the 1990s, neutralized

the adverse effects that import liberalization and

fiscal contraction had on industrial growth. But with

just three years of high growth so far, the question

remains whether this is a sustainable trajectory or

merely another mini-boom awaiting its inevitable end.

The latter is a possibility if the growth in credit-financed

consumption or in exports is tenuous. To the extent

that the expansion in credit is dependent on the liquidity

generated by inflows of foreign capital, sustaining

the process requires the persistence of such inflows.

In the past a surge in capital flows has inevitably

been followed by a reversal, making this a real possibility.

Moreover, credit expansion has resulted in excess

exposure of Indian banks to the housing and real estate

sector, forcing the Reserve Bank of India to issue

periodic warnings. Defaults resulting from such exposure

would not only freeze credit flow, but could adversely

affect investor confidence resulting in an exit of

foreign investors.

Exports too are under threat because of the effect

that the surge in capital flows is having on the value

of the rupee. Exporters have been complaining for

long that rupee appreciation driven by capital inflows

is undermining their competitiveness making it most

unlikely that they would meet targets. But unwilling

to limit or curb capital inflows, the government has

offered to compensate them in other ways to neutralize

the effects of the appreciation. If it is not successful

in this effort the export stimulus may weaken too.

In sum, while there are important differences between

the mid-1990s industrial mini-boom and the boom that

is currently underway, which make this episode of

growth robust, the danger of a downturn still lurks.

This is a challenge the government must face up to.

That, however, may require shifting from credit to

state expenditure as a stimulus to growth and limiting

capital flows to stabilize the rupee.