An

appreciating exchange rate, stock market volatility

and global pessimism are yet to affect India’s growth

story. Figures released by the Central Statistical

Organisation at the end of August indicate that GDP

grew by 9.3 per cent during the first quarter (April-June)

of 2007-08 when compared with the corresponding quarter

of 2006-07. This is the sixth of the last seven quarters

in which the annualized rate of growth of GDP has

exceeded 9 per cent, the exception being the third

quarter of 2007 when growth fell short of that target

by just 0.3 percentage points.

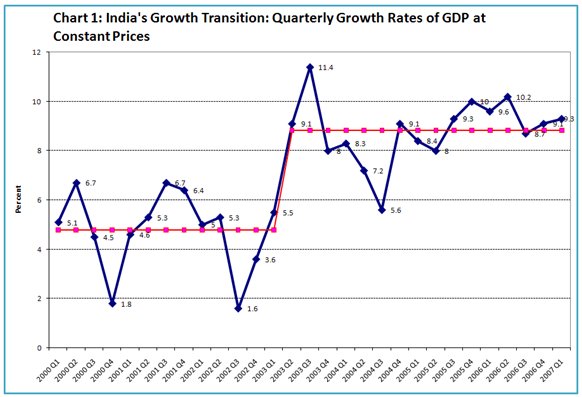

The quarter-on-quarter annual GDP growth rate first

crossed the 9 per cent mark in the second quarter

of 2003-04, and has remained above that level in 10

of the 16 quarters since then. Restricting the analysis

to the current series of national income statistics

with 1999-2000 as base, we find that in the 13 quarters

prior to that (starting with the first quarter of

2000-01), the GDP growth rate never crossed the 6.7

per cent mark and stood below 5 per cent in five of

those annual comparisons. In the event, if we make

a crude comparison of averages of quarterly growth

rates for the two sub-periods starting with the first

quarter of financial year 2000-01 and the second quarter

of 2003-04 respectively, India appears to have traversed

from a rate of growth averaging 4.8 per cent to a

rate of growth of 8.8 per cent (Chart 1). In sum,

the country seems to have experienced a sudden boost

in the middle of 2003 that resulted in a more than

80 per cent increase in its average quarter-on-quarter

GDP growth rate.

Chart

1 >> Click

to Enlarge

While

celebration over this remarkable transition to a new

growth trajectory continues, convincing explanations

of this statistical trend are difficult to come by.

One route to follow to arrive at such an explanation,

however tentative, is to search for sectoral drivers

of growth in overall GDP.

There are a number of features of the sectoral composition

of growth that needs noting. To start with, the widely

held perception that the agricultural sector (broadly

defined to include forestry and fishing) has not been

part of India’s growth transition is corroborated

by the data. Agriculture has languished at a time

when the trend rate of growth has been rising. The

divergence in growth rates of overall and agricultural

GDP has persisted and even widened after the 2003

breakpoint, even though the volatility in agricultural

growth rates has fallen since then. While agriculture’s

share in aggregate GDP averaged more than 21 per cent

during this decade, its contribution to the quarter-on-quarter

absolute increase in GDP has remained below 10 per

cent in most recent quarters.

The second much-noted feature is that services seem

to have played an important part in India’s growth

story. Services GDP has grown faster than aggregate

GDP for most of the period since 2000. What is more

there appears to have been acceleration in the growth

of services GDP during the second of the two sub-periods

being discussed. In most quarters since 2003, services

have contributed between 50 and 65 per cent of the

quarter-on-quarter increment in GDP.

However, a disaggregated analysis suggests that it

is only one component of the services sector—Financing,

Insurance, Real Estate and Business Services—that

appears to have contributed to the acceleration in

GDP growth. The rate of growth of this segment of

services has been accelerating since the middle of

2002. On the other hand, the rate of growth of the

other important segment of services—Trade, Hotels,

Transport and Communications—though higher on average

in the second sub-period, has shown no signs of any

significant acceleration.

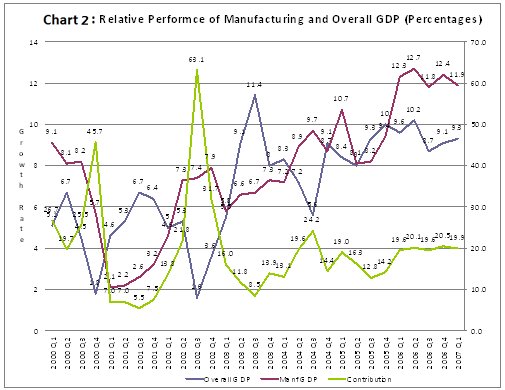

Fourth, in a less noticed development, the sector

that appears to have contributed significantly to

the growth transition is manufacturing, which has

seen a sharp acceleration in annual rates of growth

between the first and second periods. It has also

registered a significant and consistent increase in

its contribution to the annual quarter-on-quarter

increment in GDP. This less-recognized aspect of the

growth story signifies a shift away from the excessive

dependence on services to generate increases in India’s

GDP growth.

Overall, therefore, the evidence seems to suggest

that financial, real estate and business services

and manufacturing are the two sectors that have driven

India’s transition to a higher growth trajectory.

Four questions arise. What has been the relative importance

of exports and domestic demand in explaining the transition?

Is the simultaneous role of finance and manufacturing

as growth drivers coincidental or related? If related,

what is the mechanism by which their interaction translates

into higher growth? And, if this mechanism did trigger

the transition, why did it come into operation when

it did?

Export revenues have unquestionably contributed to

the expansion of the business services sector, which

includes software and IT-enabled services. But manufactured

exports have also played a significant role. The average

rate of growth of the dollar value of merchandise

exports from India rose from 13.2 per cent during

2000-01 to 2002-03 to 25 per cent during 2003-04 to

2005-06. Sectors under manufacturing that have contributed

to this recovery include Chemicals (17 to 25 per cent),

Manufacture of metals (15.2 to 31.4), Machinery and

instruments (19.7 to 33.7) and Transport equipment

(18.7 to 50.9). However, while this step up in export

growth would have has contributed to the acceleration

in manufacturing growth rates, the small share of

exports in manufacturing production still gives domestic

demand an important role in explaining the growth

recovery.

Chart

2>> Click

to Enlarge

Domestically,

the simultaneous boom in finance and real estate on

the one hand and manufacturing on the other is not

fortuitous. The financial boom is based on an increase

in liquidity in the system that has permitted a sharp

increase in credit provision and ensured a relatively

low interest rate regime. This has, in turn, triggered

a boom in the real estate sector, driven by a sharp

increase in housing finance and lending to and investment

in the real estate sector. Thus, within the Finance

and Real Estate sub-sector there are internal linkages

that deliver a rapid increase in GDP based on easy

finance.

But easy finance impacts on manufacturing too in two

ways. First, it results in a credit-financed housing

and consumption boom that significantly steps up manufacturing

demand. And, second, the profits derived from the

credit financed manufacturing boom are much higher

than would have otherwise been the case because of

much lower interest costs. Higher profits in manufacturing

trigger, in turn, an investment-led boom in that sector.

Thus, the Indian economy’s sudden transition in mid-2003

to a higher growth trajectory, while influenced by

a revival in exports, was driven in the final analysis

by a financial boom that eased credit availability,

reduced interest rates and encouraged debt-financed

consumption and investment. But why did this financial

spur occur when it did? The timing was influenced

by factors external to the Indian economy that resulted

in a surge in inflows of foreign capital into developing

countries since around 2003. India benefited disproportionately

from those flows both because of her liberalised investment

environment, relatively good economic performance

and also because of the concessions offered to foreign

investors in India, including the abolition of the

long-term capital gains tax in the Budget for 2003-04.

The liquidity overhang that the surge in capital flows

resulted in created the environment that facilitated

the growth transition.

However, this role of capital inflows in placing India

on a new growth trajectory also make that growth process

fragile for reasons that are becoming clear in recent

months. One source of such fragility is the continued

appreciation of the exchange rate of the rupee despite

the efforts of the Reserve Bank of India to stall

such appreciation. Signs are that rupee appreciation

is reducing the competitiveness of India’s exports

and weakening the export stimulus that contributed

to an improvement in both services and manufacturing

growth.

The other potential source of fragility is the threat

of a liquidity crunch because of an outflow of foreign

capital for reasons unrelated to India’s economic

performance. Dependence on foreign capital flows has

made India vulnerable to the contagion effects of

financial crises elsewhere, such as the sub-prime

crisis in the US. One consequence of that crisis has

been a tendency for foreign investors to sell out

assets acquired in India and repatriate the receipts

so as to cover losses and meet commitments in the

US and elsewhere. That prospect is resulting in a

degree of uncertainty in India’s real estate market

where foreign investors have been important players

in recent times. Their exit could slow or stall the

expansion of real estate sector. The exit of foreign

investors could also absorb much of the liquidity

in the system, adversely affecting credit availability

in the Indian market and pushing up interest rates.

If that happens the spur to growth provided by easy

finance would also be weakened, slowing growth. These

tendencies, though visible, have yet to substantially

slow India’s rapid growth. But if they gather strength

the impact on growth could be adverse. This is the

inevitable outcome of India’s indirect dependence

on foreign capital inflows to ensure its transition

to a new growth trajectory.