Themes > Current Issues

14.07.2007

Banking on Home Builders

C.P. Chandrasekhar

Banking

in India is changing face, looking to the mortgage market and personal

debt as the route to profit. Having been permitted, in fact encouraged,

to chase profits in markets that were restricted earlier and with instruments

that were rare or non-existent, banks are choosing to change their portfolios

rather sharply. This occurs at a time when the appetite and ability

of banks to create credit has increased significantly.

The ability of banks to lend has expanded because the Indian economy

is awash with liquidity as a result of massive inflows of foreign capital.

Excess liquidity has encouraged them to seek out potential borrowers

and persuade them to increase their portfolio of debt. In the event,

at a time when GDP growth has been accelerating, credit has grown at

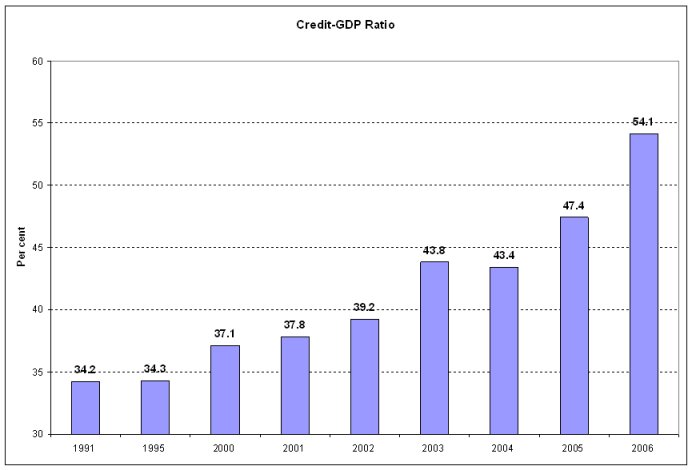

an even faster rate. According to the Reserve Bank of India’s Report

on Currency and Finance 2006-07, the credit-GDP ratio in the country

which rose from 34.2 per cent in 1991 (when the reforms began) to 43.4

per cent in 2004, has risen to 54.1 per cent over the subsequent two

years. Banks are at the centre of this credit splurge accounting for

close to 80 per cent of credit provided by the end of March 2006.

It could be argued that since GDP is growing rapidly, credit growth

would be high as well. But the rise in the credit to GDP ratio indicates

that there is more to the matter. Credit is growing even faster than

warranted by higher growth. This appears to be true of all the major

sectors-agriculture, industry and services-of the economy, in each of

which the rate of growth of credit has been in excess of the rate of

growth of sectoral GDP. As a result "credit intensity", defined

as the ratio of credit offtake to sectoral GDP, has risen in all of

these sectors.

But

focusing on the relative rate of growth of credit with respect to GDP

in individual sectors can be misleading. The trend may be the result

of the slow growth of production rather than a fast growth of credit,

as appears true in an area like agriculture where GDP growth has been

poor over a long period of time. A better index, therefore, would be

the share of different sectors in outstanding credit, which would show

whether one or more sectors are responsible for the spike in credit

growth.

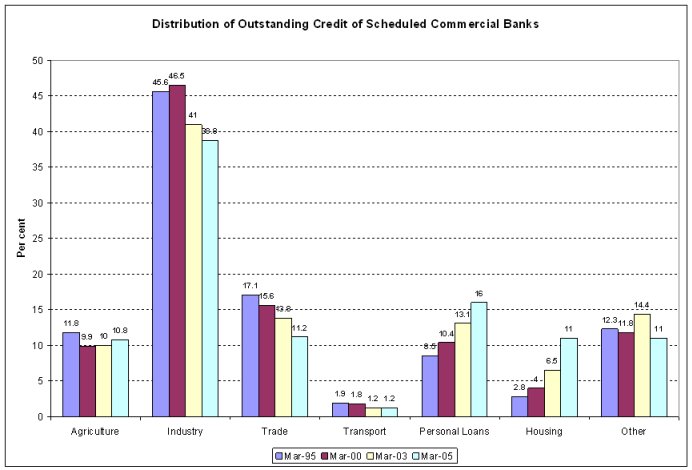

Thus, if we examine the share of outstanding credit of the scheduled

commercial banks accruing to different categories of borrowers, we find

that the share of agriculture fell sharply from 16 per cent at the end

of March 1990 to 10 per cent at the end of March 2003, with the figure

rising marginally to 10.8 per cent by end-March 2005. The trend seems

to be the same in industry where the decline has been continuous from

48.7 to 38.8 between 1990 and 2005. In trade too, the decline has been

sharp from 17.1 in 1995 to 11.2 per cent in 2005.

These trends point to a diversification of bank credit away from the

commodity producing sectors and even trade. The loss in share of these

sectors seems to be almost completely counterbalanced by loans to individuals

and professionals (Personal Loans and Professional Services), whose

share rose from 9.4 per cent to 16.8 per cent between end-March 1990

and end-March 2002, and then shot up to 27 per cent by end-March 2005.

This is the direction in which credit is moving, and these are the sectors

accounting for a substantial part of excess credit growth.

While

a number of sub-categories such as loans for purchases of automobiles

and consumer durables, especially the former, have gained in terms of

growth in credit provision, there is one sector that has absorbed the

bulk of the increase even here: loans for housing. The share of housing

loans in scheduled bank credit rose from 2.4 per cent in 1990 to 5 per

cent in 2002 and then to 11 per cent by 2005.

From the point of view of the scheduled banks’ lending portfolio this

has implied two outcomes. First, the exposure of the banking sector

to the retail loan segment has increased substantially. The share of

personal loans in total bank credit has almost doubled in recent years

rising from 12.2 per cent in 2001 to 22.2 per cent in 2005. Second,

retail loan exposure has been concentrated in housing finance, with

housing loans accounting for 53 per cent of retail loans in 2005.

One factor accounting for these outcomes, noted by the RBI’s Report

on Currency and Finance, is the decline in demand for bank credit from

industry. With profits soaring in recent times, retained profits and

reserves have proven to be major sources of finance for the corporate

sector. Three among non-bank sources of finance for industry have registered

significant or dramatic increases in recent years. To start with, resources

raised through new capital issues increased from Rs. 2422 crore in 2003-04

to Rs.13,781 crore in 2005-06. Reports have it that sums raised through

this route would exceed Rs.1,00,000 crore in 2007 (Business Standard,

23 June 2007). Second, the contribution of retained earnings rose from

Rs.15,645 crore to an estimated Rs.48,402 crore over these three years.

And, finally, borrowing from abroad, rose from Rs.16,098 crore to Rs.45,708

crore. In sum, own or cheaper sources of domestic finance have substituted

for borrowing in aggregate corporate finance. But to the extent that

firms’ appetite for investment has increased, necessitating borrowing

for investment, they prefer to borrow from cheaper sources abroad than

from the domestic banking system.

Deprived of credit demand from their conventional blue chip clients,

banks would have been forced to turn elsewhere. The retail market, with

a preference for housing finance, seems to have been the chosen option.

But it would be wrong to presume that banks turned to the retail segment

only because of the "push" out of the corporate credit market.

Loans to the retail segment are lucrative. Since they are distributed

across a large number of borrowers the risks involved in such lending

are hedged. Lending to the housing sector creates its own collateral

in the form of the mortgaged property. And, finally, banks in India,

like their counterparts in the developed countries, are increasingly

securitising retail debt. Mortgage loans to different segments are bundled

together and securitised, with the securities thus created being sold

to financial institutions, insurance companies and mutual funds. Credit

created by the banks disappears from their balance sheets and appears

in the investment portfolios of investors and funds. This permits banks

to transfer some of the risk associated with retail lending, reducing

the risk they carry as a result of their high exposure to these markets.

The craving for housing finance created by these features is also resulting

in a shift away from what are considered safe investments. For example,

in the latter half of the 1990s banks invested in government securities

to an extent far in excess of that needed to meet the liquidity stipulations

set by the RBI through its statutory liquidity ratio (SLR) guidelines.

But more recently banks have been unwinding their excess holdings of

SLR securities, to generate resources that can help finance incremental

credit. Banks have also shown a tendency to resort to overseas borrowing

to augment capital needed to finance the demand for credit from the

retail market.

But with exposure growing rapidly in a single area, the risks are now

clearly rising. While lending to home owners may be a more secure form

of credit, for the reasons noted above, a rapid increase in such credit

inevitably involves features that spell risk. Finding a growing number

of new borrowers to ensure credit offtake inevitably requires relaxing

income criteria for those applying for loans or lending to those whose

income stream is not guaranteed or secure. It may also involve lending

without adequate scrutiny of income documents. The result would be an

increase in the proportion of risky borrowers in a situation of rising

credit provision and increased exposure to the housing market. Defaults

and foreclosures could increase with adverse consequences for bank profitability

and even viability.

This possible outcome can be worsened by the effects of speculation.

An immediate consequence of a credit-financed spike in housing acquisitions

is a rise in real estate prices. India has been experiencing such a

rise in recent years, which in turn has encouraged real estate speculation.

The implies that many borrowers are not financing homes they plan to

live in, but those they plan to sell for profit at an appropriate time.

If this leads to a glut in housing in certain brackets, or if changes,

such as an increase in interest rates, affect speculators’ expectations

adversely, a collapse of the housing boom could ensue. Those who resorted

to credit hoping to close their deals well before maturity might find

it difficult to meet their credit obligations, and banks may find themselves

saddled with foreclosed property worth much less in the market than

the loan provided. What is more, with securitisation having gained ground

in India, the ripple effects of this would be felt in other segments

of the financial sector to which the risk has been transferred.

Recognising these risks the central bank has been warning banks against

increasing their exposure to the housing market any further and requiring

them to be more stringent when scrutinising loan applications. Whether

banks are heeding these warnings is unclear. There are signs of a dampening

of the growth of housing credit in recent months; but that could be

more the result of the recent hardening of interest rates rather than

of increased bank caution. Banks need to lend when loaded with deposits;

and that can be a problem if prime borrowers in the commodity-producing

sectors, industrial firms, are reluctant to turn to the banks for credit.

But the recent trends in Indian banking suggest that they have gone

even further than warranted by this development. It is time to hold

back. And it is also time to think of ways of diversifying portfolios,

even if returns are not as attractive.

© MACROSCAN 2007