The

Wall Street Journal is to many a venerable institution,

reflecting all that is best in American capitalism.

So much so that many are concerned about the implications

for the paper's integrity of Rupert Murdoch-owned

Newscorp's bid to acquire Dow Jones, which owns the

Journal. Murdoch's $5 billion take-over offer involved

a price of $60-a-share. Since that implied a 65 per

cent premium on the then prevailing share price and

amounted to 40 per cent of earnings for a company

losing revenues, the offer seemed too good to refuse.

But, given the purported conflict between the Journal's

well-cultivated image of journalistic integrity and

Murdoch's reputation for sacrificing professionalism

at the altar of profits, speculation was rife that

the Bancroft family, which controls 64 per cent of

the stake through myriad trusts controlled by as many

as 35 family members, would reject the offer. But

sections of the Bancroft's relented, after an initial

refusal to sell in May this year, and are now trying

to push through the sale. At the time of writing,

when final discussions among Bancroft family members

are under way, indications are that Mr. Murdoch would

have the last laugh.

What is surprising is not Murdoch's generous offer,

for the likes of which he is now famous. It is the

ability to paint a picture that the Wall Street Journal

is too pristine an institution to be owned by a tycoon

like him. In fact, to bolster that image, the newspaper's

management had launched on a major editorial restructuring

aimed at aligning better its print and internet editions

before and during discussions on the offer, which

was taken to imply that it did not need support from

Mr. Murdoch.

But is all the piety, displayed by those who have

focused on Murdoch's suitability as owner of the paper

rather than the price he has to offer, justified?

After all, the Journal has promoted the changes in

American capitalism that have paved the way, inter

alia, for the merger and acquisitions wave that has

come to dominate the dynamic of the system. One consequence

of that trend has been the conversion of media empires

into typical corporations that are as much the targets

of take-over and seekers of financial gain as any

other. Another recent financial media mega merger

was the 8.7 billion pounds sterling acquisition of

Reuters by Thomson Financial.

The corporate-led, profit-driven dynamic underlying

this trend, promoted vigorously by the media itself,

is not without implications for questions of integrity,

especially of the financial media across the world.

Media businesses, with some notable exceptions, are

now as keen on State policies that cushion and increase

profits and permit flexibility in ownership and operations

that promote private gains at the expense of the public

interest. One consequence has been the sharp increase

in inequalities that underlie contemporary economic

growth. The media have become the means to manufacture

consent in favour of such policies, often based on

the manipulation of selectively chosen information

rather than the impartial dissemination of the news

as it is. This has made the media the principal instrument

for promoting such policies with an obvious conflict

between the media's role as a pillar of democracy

geared to informing and even educating the citizen

and its role as an agency that serves to shift the

distribution of the gains of growth in favour of capitalists

and the rich.

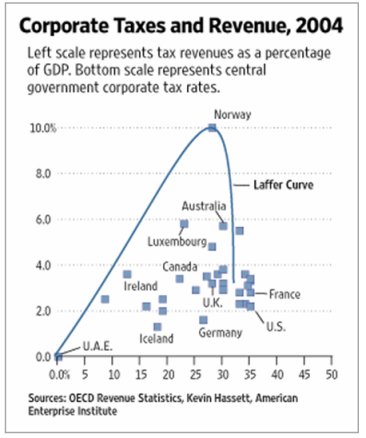

One striking example of the kind of policies favoured

by the corporate media in its new financial avatar,

is the concerted effort to get governments to substantially

reduce taxes on profits or offer concessions or leave

loopholes that have the same effective result. A typical

example of the use of wrong theory and empirical manipulation

to realize this end is the promotion of the idea of

the "Laffer curve". The idea of such a curve

with particular characteristics has been used since

the mid 1970s to promote tax cuts for the rich, on

the ground that this would result in an increase in

tax revenues for the government. The curve reflects

the view that when tax rates rise, initially revenues

gained from such rates would rise, but beyond some

maximal point any further increase in taxes would

in fact reduce revenues either because individuals

would work less rather than earn more and have it

taxed away or because they would find ingenious ways

of avoiding tax payments. In sum, any country which

is to the right of the maximum would gain by reducing

tax rates either because it would have the supply

side effect of encouraging more work and output and

therefore generating more taxes or would ensure greater

tax compliance and therefore increase tax revenues.

In practice a whole host of factors including a nation's

per capita income, the extent of income inequality,

perceptions of what the government does with tax revenues,

the nature and efficacy of the tax administration

and the justice implicit in the tax system go to determine

the revenue (relative to GDP) generated by a given

structure of taxes. This implies that what is the

optimal maximum tax rate is impossible to specify,

unless a lot of variables are taken as given and their

effects are presumed to be understood. Yet, sections

of the rich who have always believed that any prevailing

tax rate is too high have pushed this view consistently,

even if not through the medium of a formal curve.

Economists inclined to advance that view have also

used the notion in various ways.

The idea of a curve with theoretical and empirical

substance gained currency during the Reaganite years

of indiscriminate tax cuts, with the idea reportedly

attributed by Wall Street Journal correspondent Jude

Wanniski to Arthur Laffer, a subsequent member of

Reagan's Economic Policy Advisory Board, who is supposed

to have drawn the curve for her education on a napkin.

Popularity, of course, invites attention. And innumerable

economists have spent time and energy to show that

the concept is theoretically hollow and empirically

unsubstantiated. This seems to have influenced even

the US Congress with the US Congressional Budget Office

questioning it validity in a 2005 paper.

But given the interest behind promoting the idea and

the support of influential media of the kind that

the Wall Street Journal represents, the idea has just

not gone away. Since the rise of the Laffer curve

idea in the 1970s taxes have been cut many times over

across the world. Yet it is routinely invoked to justify

further cuts in taxes. The point is that even today

influential newspapers like the Wall Street Journal

promote the idea, based on obviously mistaken reasoning.

Consider for example a recent report in the Wall Street

Journal titled "We're Number One, Alas"

(13 July, 2007). Lamenting that the US is not among

the 25 developed nations that have opted for "Reaganite

corporate tax cuts" since 2001, the newspaper

provides two reasons why the US government should

follow the path adopted by these countries and others

such as Vietnam. First, it makes the country a more

attractive site for foreign investment. This, however,

is unlikely to attract a country which without much

effort draws on the world's capital to finance its

huge trade and current account deficit. But there

is a second reason, according to the Journal: "Lower

corporate tax rates with fewer loopholes can lead

to more, not less, tax revenue from business. … Tax

receipts tend to fall below their optimum potential

when corporate tax rates are so high that they lead

to the creation of loopholes and the incentive to

move income to countries with a lower tax rate."

Note the subtle shift in argument. Reduce corporate

tax rates to prevent incomes from moving out of the

country in search of relative tax havens. If every

country begins to do this, the race to the bottom

can take corporate tax rates to near zero. The call

is not for international agreements that prevent such

tax evasion, but to reduce taxes on fat corporate

profits in a world where intra-country inequality

is clearly rising. What is shocking is that this line

of reasoning is backed up with the accompanying graph

that ostensible delivers a smooth Laffer-type curve

from cross-country data. To any student with simple,

school-level graphing skills it should be clear that

using the low tax UAE and a median-tax outlier like

Norway to draw the curve is a basic error, since all

other points do not match its trajectory.

Yet using that graph the Journal approvingly quotes

an "expert", Kevin Hassett, an economist

at the American Enterprise Institute whose view as

expected is that the U.S. "appears to be a nation

on the wrong side of the Laffer Curve: We could collect

more revenues with a lower corporate tax rate."

Chart

1 >> Click

to Enlarge

Reports

of this kind, precisely at a time when the Journal's

take-over is being discussed, make nonsense of the

counterposition of the Journal's integrity with Murdoch's

greed. From a social point of view they reflect the

same disturbing trend in today's world.

Democracy presumes accountability. But not all its

pillars are as accountable as the others, if at all.

An area of concern has been the media, owned privately

most often and zealously guarding its independence

on the basis of the fundamental right of freedom of

expression. Media monopoly, reflected in cross-media

ownership across concentrated media markets, combined

with corporate interests outside of the media business,

have long been seen as a dangerous blend. Especially

since there is no adequate countervailing power against

such corporate influence in modern democracies. For

long this aspect of the media, while much analyzed,

was underplayed, because of a focus on the dangers

of a state controlled media, as opposed to a competitive

private media environment, where the battle for eyes

and ears was expected to ensure a high degree of integrity.

More recently the danger of the misuse of media power

has increased because of two tendencies. First, the

direct entry of media moguls into the political arena,

illustrated by Silvio Berlusconi in Italy and Thaksin

Shinwatra in Thailand. This allows political power

to be pursued by utilizing the power of a media protected

by the democratic commitment to freedom of expression.

The second, and more pervasive, is the coalescence

of corporate and financial interests with media interests.

One reason is that the competitive media business

often warrants concentration, on the one hand, and

mobilizing funds for expansion and modernization from

the capital markets, on the other. What is happening

to the Wall Street Journal is just a reflection of

this trend. We may grieve for democracy. But that

is not the same as grieving for the Journal.