For

nearly three decades now, the economy of Bangladesh

has been growing at slightly more than 4 per cent,

and per capita income growth even accelerated in the

1990s compared to the previous decades. In the 1980s,

per capita GDP had grown slowly at the rate of about

1.6 per cent per annum. In the first half of the 1990s,

the growth rate accelerated to 2.4 per cent and further

to 3.6 per cent in the second half of the decade.

Of

course this increase in the per capita growth was

mainly because of the demographic transition involving

declines in rates of population growth (from 2.1 per

cent in 1990 to only 1.6 per cent in 2000), since

there was no apparent break in the trend rate of growth

of around 4 per cent over the entire period. However,

there was clearly greater macroeconomic stability

in terms of reduced rates of inflation (from an average

of 9.9. per cent per annum in the early 1980s to an

average of 5.6 per cent per annum by the end of the

1990s).

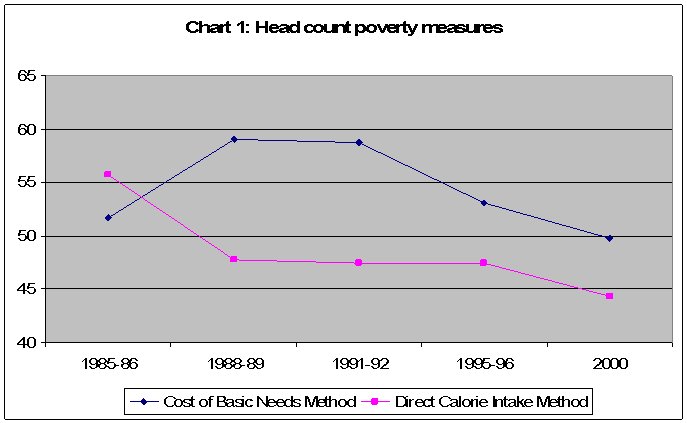

However, it is notable that this aggregate economic

expansion has had less apparent direct impact on poverty

reduction. It is certainly the case that the long-term

trends in poverty show notable progress since Independence,

from 71 per cent in 1973-74 to around 45 per cent

in 2000.

Chart

1 >> Click

to Enlarge

Chart 1 provides estimates of poverty

according to two different methods: in terms of a

poverty line derived from the cost of basic needs,

and in terms of direct calorie intake. While some

reduction in the incidence of poverty is evident,

this is actually less rapid than occurred during the

1980s. Clearly, the reduction in poverty has not been

commensurate with the expectations generated by the

macroeconomic pattern of relatively stable and non-inflationary

growth.

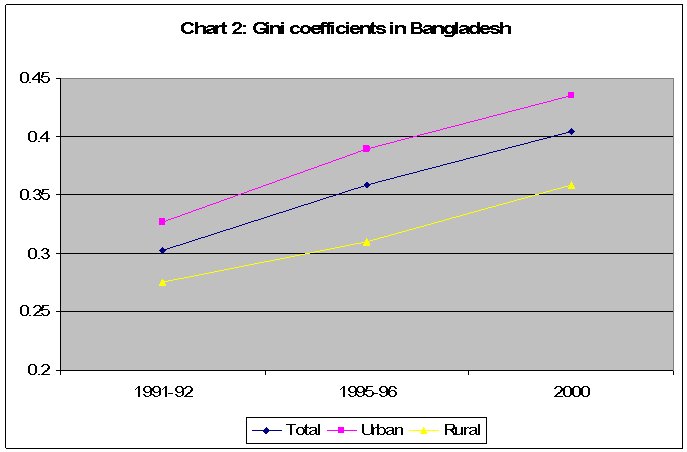

Some of the reason for this is probably the substantial

increase in inequality over this period, as evident

from Chart 2. The main source of increasing inequality

was the increasingly unequal distribution of both

non-farm income and remittance income.

Chart

2 >> Click

to Enlarge

The outward-looking macroeconomic policy pursued by

Bangladesh in the recent past did succeed in stimulating

some parts of the economy, especially readymade garments

and fisheries which were the most rapidly growing

activities in the 1990s. But these activities still

have a relatively low weight in the economy, and most

(at least two-thirds) of the incremental growth in

the 1990s originated from the non-tradable sectors

- mainly, services, construction and small-scale industry.

The demand stimulus for this came from three major

sources - the increase in crop production in the late

1980s, accelerated flow of workers' remittance from

abroad and incomes generated by the readymade garments

industry.

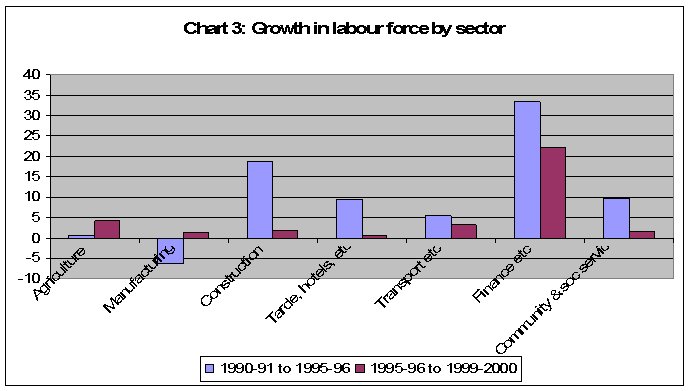

However, these sectoral contributions of changing

GDP were not exactly matched by changes in employment

patterns. Chart 3 show the extent of growth of labour

force in different sectors over the two halves of

the decade of the 1990s. The most rapid growth has

been in financial services, but these still constitute

a very small part of total employment. Manufacturing

employment has grown only marginally, after falling

in the previous decade. While the new export sector

of ready made garments has provided an important source

of new employment (especially for women) total employment

in aggregate manufacturing has actually declined,

in both relative and absolute terms. There has been

significant de-industrialisation, particularly in

the traditional sectors, which have suffered from

import penetration.

However, agriculture has shown substantial increase

in employment generation to around 4 per cent per

annum in the second half of the decade, reflecting

the impact of various policy measure offering more

incentives to cultivators from the mid-1980s onwards.

While construction increased its share of GDP rapidly,

the rate of employment generation decelerated in this

sector. Other services sectors also showed decelerating

employment growth in the second half of the 1990s.

Chart

3 >> Click

to Enlarge

In the early 1990s there was a marked improvement

in the government's budgetary position along with

an equally marked increase in the domestic saving

rate. However, the increase in the saving rate was

not matched by a commensurate response from private

investment, at least in the early 1990s. However,

in the second half of the 1990s, while public investment

rates remained broadly the same, private investment

increased causing the aggregate rate to increase to

more than 21 per cent.

The sectoral allocation pattern of development spending

has undergone some significant changes in the last

two decades, reflecting the changing role of the government

under the economic reforms. Allocations have fallen

appreciably for a number of directly productive sectors

- most notably, manufacturing industry, water resources,

and energy, and agriculture, and increased for transport

and communication, rural development, education and

health.

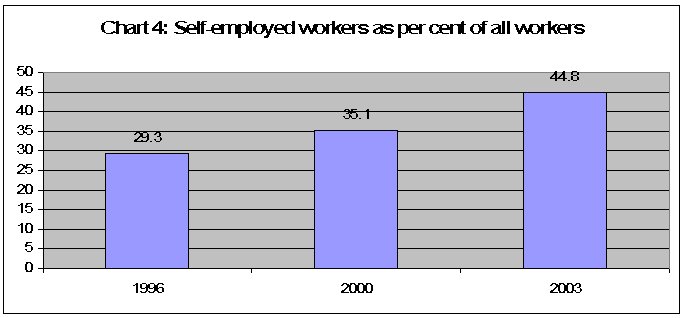

Open unemployment rose risen from 1.8 per cent of

the labour force to as much as 4.9 per cent, and was

as high for women as for men, while underemployment

in 2000 was estimated to be very high at around 31

per cent. What is also of concern is the dramatic

increase in the ratio of self-employed to total workers,

as indicated in Chart 4. In general the shift to self-employment

in non-agriculture tends to be less rewarding in income

terms for the poor, than the shift to regular work.

However, there has been only a very slight, almost

negligible increase in the share of regular employment.

So it is apparent that one crucial link to ensure

more rapid poverty reduction - the generation of productive

employment - has simply not been operating in a way

that would show more effective results. rather, employment

elasticities of output growth have been low or falling

in most sectors, and the persistence of large-scale

underemployment implies the continued proliferation

of low productivity jobs, most typically now in the

services sector.

Chart

4 >> Click

to Enlarge

There is a common perception that the high presence

of micro-credit delivery systems in Bangladesh has

operated to provide a cushion for poor households

in case of shocks such as crop failures, floods and

other natural disasters, etc. It has also helped to

improve the relative position of women. However, the

basic features of micro-credit (short-term, relatively

small amounts, groups lending pressure for prompt

repayment) mean that it has not contributed much to

asset creation among the poor, or to sustained employment

generation.

In fact, the poverty reduction that has occurred may

be related more to other forms of public expenditure.

The expansion of public transport infrastructure,

especially roads networks in the 1980s, may have contributed

to subsequent rural development which in turn assisted

some of the reduction of poverty in that later period.

However, trade liberalisation had the counter effect

of reducing the viability of many small producers,

so the net effect of all the policy changes over the

period is not clear. It is likely that some of the

effects of openness were positive (as in the garments

industry) others were adverse for livelihood and therefore

poverty, and these were to some extent mitigated by

the spread of public transport networks and the availability

of micro-credit.