The

past months have witnessed soaring oil prices in international

markets, which have come on top of increases in the

previous three years. In the third week of August

world trade prices of crude oil nearly touched $50

per barrel before settling somewhat lower. But further

increases are not ruled out in the near future.

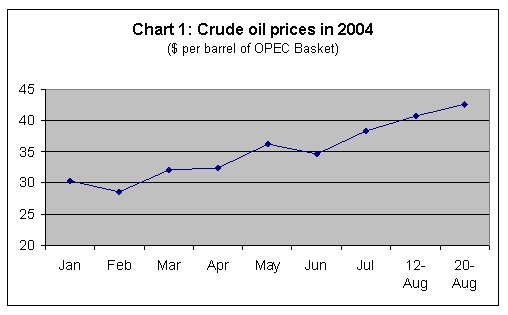

While

crude oil prices have been rising since March this

year, thus far the month of August has seen the most

rapid increase, as Chart 1 shows. The most recent

increases have been driven by a number of factors.

The most important factor, of course, is the continued

resistance of the Iraqi people to the US military

occupation. The inability thus far of the US army

to contain the armed struggle of the militia of Muqtada

al Sadr and others despite using blatant violence

even against civilians, along with the growing sabotage

of oil facilities and destruction of oil pipelines

in Iraq, has reduced exports and led to expectations

of uncertain future supplies from that country.

Chart

1 >> Click

to Enlarge

In addition, the threats of terrorist attacks in the

world's largest oil producer, Saudi Arabia, are growing

and also have been increasingly realised in recent

months. The nervousness this has created in world

markets has not been neutralised by OPEC's promises

of boosting production. More recently, the travails

of the giant Russian oil company Yukos have also contributed

to rising oil prices.

Normally, some of this supply uncertainty would be

considered as inevitable and would have only a marginal

effect on markets. At present, however, these factors,

as well as other potential issues such as instability

in Venezuela or strikes in Norway, or indeed any changes

in any oil-producing country, can have substantial

effects on prices at the margin and cause sudden price

spikes. This is because world demand for oil rules

very high at present. In consequence, current oil

production is extremely close to current capacity,

and there is little margin for major increases in

supply in the near future.

World demand for oil has been fuelled not only by

growth in the US, but also by strong demand from other

countries. China's imports of crude oil have increased

by more than 40 per cent since the beginning of 2004.

This is not all for current consumption - rather it

reflects stockpiling by the Chinese government, a

shift from holding excess dollar reserves to holding

oil reserves.

Even the US government is continuing to add to its

Strategic Petroleum Reserve, rather than depleting

it in order to reduce oil prices. The Bush administration

has made it clear it would not intervene to release

any of these stocks unless the oil prices goes to

levels of $55-60 per barrel before the November elections.

Market analysts do predict that the current high levels

of OPEC production (which was 29.8 million barrels

per day in July, only 0.5 million barrels below total

OPEC crude oil production capacity) are likely to

push prices below $40 per barrel by the last quarter

of 2004. Nevertheless, it is unlikely that 2005 will

witness a sharp decline in crude oil prices, simply

because world demand is expected to continue to grow

and keep inventories tight. Global oil demand is currently

projected by the US Department of Energy to exceed

2 million barrels per day this year as well as in

2005.

So if oil prices do continue to rise, what are the

implications? Some observers have already sounded

the alarm bells. OPEC itself has predicted that the

global economic recovery could be in jeopardy in prices

remain at current levels (around $40 per barrel) for

the next two years. An OPEC report projects that this

would reduce growth in Europe and the US by between

0.2 and 0.4 percentage points.

Asian economists have been even more pessimistic.

Kim Hak-Su, the Executive Secretary of UN-ESCAP (the

United Nation's Economic and Social Commission for

Asia and the Pacific) has suggested that oil prices

of around $40 per barrel would mean a 0.5 percentage

point reduction of growth in the region, and $50 per

barrel would mean a 1 percentage point reduction.

Such projections usually hinge around the perceived

trade-off between growth and inflation, and are predicated

on the assumption that oil prices increases will lead

to more general inflation. Governments attempting

to combat inflation will then embark upon contractionary

fiscal and monetary policies, which will bring down

inflation but also imply lower rates of aggregate

economic growth.

It is correct to assume that governments across the

world remain obsessed with inflation control, because

the political economy configurations that have led

to the domination of finance still persist. However,

the prior assumption, that oil price hikes necessarily

lead to higher inflation, may not be so valid any

more.

Certainly it is true that for a very long period -

in fact almost the whole of the second half of the

20th century - oil prices showed a strong relationship

to aggregate inflation rates in the world economy.

Between 1970 and 2000, for example, world trade prices

and oil prices were strongly positively correlated

and in the largest economy, the US, the Consumer Price

Index inflation tracked movements in world oil prices.

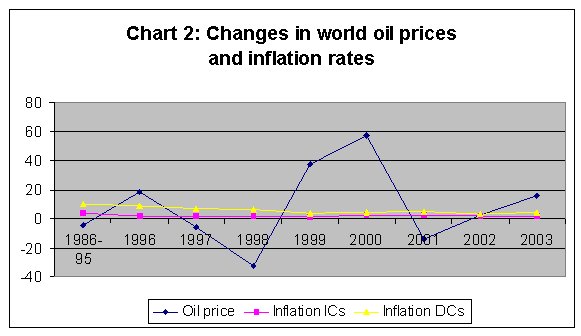

However, there is evidence that such a relationship

may be changing. Chart 2 indicates the annual percentage

changes in world oil prices and average inflation

rates in industrial and developing countries, especially

since 1996.

Chart

2 >> Click

to Enlarge

Two things stand out quite sharply in this chart.

The first is that oil prices were exceptionally volatile

over this period, rising and falling dramatically.

The second is that such fluctuations appear to have

had little impact on aggregate inflation rates in

either developed or developing countries. Rather,

such inflation rates have been relatively stable and

even fallen slightly compared to the earlier decade.

So what has changed in the world economy to cause

such an apparently established relationship to break

down? To begin with, it is worth remembering that

even the currently ''high'' oil prices are still well

below their real levels in the 1970s, when the oil

price shocks generated stagflation. But there are

other forces which have reduced the responsiveness

of the general price level to energy prices.

The first important factor is the reduced dependence

of the industrial economies upon oil imports, at least

in quantitative terms. For the group of industrial

countries in the OECD, net oil imports accounted for

2.4 per cent of GDP in 1978, but have since fallen

continuously, to amount to only 0.9 per cent of GDP

in 2002.

But the second factor may be even more significant.

This is a distributional shift, whereby the burden

of adjustment to higher oil prices is essentially

borne by workers across the world and non-oil primary

commodity producers in the developing countries. This

means that even though energy is a universal intermediate

good, its price rise does not cause prices of many

other commodities - and especially the money wage

- to increase accordingly. This in turn enables aggregate

inflation levels to remain low even though oil prices

may be increasing.

It is well-known that the period since the early 1990s

has been once of a substantial decline in the bargaining

power of workers vis-à-vis capital in most

of the world, and this has been reflected in declining

wage shares of national income and real wages that

are either stagnant or growing well below productivity

increases. This provides a significant amount of slack

in terms of the ability of employers to bear other

input cost increases. In addition, this disempowerment

of workers also means that such input cost increases

can be passed on without attracting demands for commensurate

increases in money wages in the current period.

Along with the working class, the peasantry and other

non-oil primary commodity producers have also been

adversely affected and been forced to take on some

of the burden of adjustment. Indeed, even manufacturing

producers from developing countries have been forced

in a situation where intense competitive pressure

has ensured that they cannot pass on all their input

cost increases.

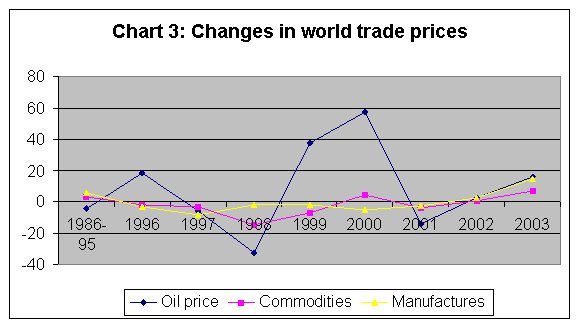

Chart 3 indicates the annual changes in the world

trade prices of oil, non-oil primary commodities and

manufactured goods. It is evident that the prices

of other primary commodities have generally been more

depressed, falling between 1995 and 1999, and barely

increasing even in years when world oil prices rose

sharply. Similarly manufactured goods prices also

have hardly increased, and have also been falling

in absolute terms over much of this period. Only in

the period since 2001 is there some evidence of all

three sets of prices moving together.

Chart

3 >> Click

to Enlarge

So does this mean that the oil price is no longer

an issue of concern for those interested in the aggregate

growth of the world economy? Not at all; in fact,

such a conclusion would not only be unwarranted, it

could also be extremely misleading.

It is clear from the preceding argument that the adverse

impact of oil prices upon inflation can only be contained

by suppressing and reducing the incomes of workers

everywhere and peasants in the developing world. But

there are limits to the extent to which such incomes

can continue to be reduced, since such a process has

already been under way for some years, and it cannot

be intensified in most countries without causing social

unrest and political instability.

This means that continuing high prices of oil are

likely to place governments across the world in a

dilemma. If they continue with the practices of the

recent past of forcing the majority of the people

to bear the burden, they risk losing legitimacy with

the people. In any case these policies have become

so unpopular and are meeting with more and more distrust

and resistance. This is of special significance in

those developed countries (including the US and UK)

where elections are due in the near future. But it

is also true of some developing countries (including

India) where the balance of political forces may be

shifting in some small degree in favour of the working

class and peasantry after more than a decade of extreme

tilt in the opposite direction.

So this particular strategy has its limits. However,

the alternative strategy, of using contractionary

monetary policies to bring down aggregate inflation,

would also be extremely unpopular since it would add

to unemployment and material insecurity which are

already at high levels.

It appears that if governments are to take into account

this requirement of popular legitimacy, they must

be prepared to live with higher inflation in the medium

term. How far this is compatible with the domination

of international finance capital is something that

remains to be seen.