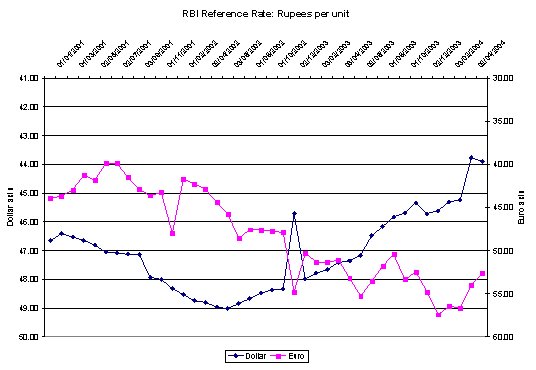

The

Indian rupee is on the rise. While its appreciation

vis-à-vis the dollar began in June 2002, when

it had touched a low of more than Rs. 49 to the dollar,

it has been rising vis-à-vis the Euro as well

over the last four months. During these periods of

ascent, it has appreciated by close to 12 per cent

vis-à-vis the dollar in 22 months and by a

significant 9 per cent vis-à-vis the Euro in

a short period of 4 months. Not surprisingly, exporters

have begun to get restive; since a loss of 10 per

cent in the rupee price of their exports can shave

off margins on past fixed-price dollar/euro contracts

and make it difficult to win new orders.

The rise of the rupee is partly attributable to the

depreciation of the other currencies, especially the

dollar against those of its competitors. That this

was true for some time is reflected in the fact that

while the rupee was appreciating against the dollar

for close to two years, it was depreciating vis-à-vis

the euro for much of this period. This is, however,

only small cause for comfort, since most export contracts

are denominated in dollar terms. Moreover, in recent

months, as noted above, the rupee has been appreciating

against the euro as well.

Two factors have influenced this rise of the rupee

vis-à-vis various currencies. First, the excess

supply of foreign currency, relative to demand for

current and capital account transactions from resident

individuals, agencies and institutions, other than

the Reserve Bank of India. Second, the willingness

of the central bank to buy foreign currencies to add

to its reserves and, thereby, increase the demand

for these currencies in the market. The role of market

demand and supply in determining exchange rates and

the consequent shift to market mediated intervention

by the central bank has been the natural outcome of

the adoption of a liberalised exchange rate system

over the 1990s.

The pressure on the rupee leading to its appreciation,

which is affecting export competitiveness adversely,

arises because India, which has recorded a current

account surplus since financial year 2001-02, has

encouraged and attracted large inflows on its capital

account. India's current account surplus, we must

note, is not a reflection of its strong trade performance.

Rather, it is because, net inflows under what is called

the ''invisibles'' head of the current account of

the balance of payments has been more than adequate

to finance a large and recently rising merchandise

trade deficit.

The principal sources of current account inflows have

been buoyant remittance flows and inflows under the

''software services'' head. That is, transfers made

by Indian workers abroad, either on short or long-term

contracts, have helped overcome the adverse balance

of payments consequences of India's lack of competitiveness

reflected in a large trade deficit. Inflows on account

of software services rose from $5.75 billion in 2000-01

to $6.88 billion in 2001-02, $8.86 billion in 2002-03

and $9.09 billion over the first nine months of 2003-04,

while private transfers (mainly remittances) touched

$14.81 billion in 2002-03 and $14.49 billion during

April-December 2003, after having fallen from $12.8

billion to $12.13 billion between 2000-01 and 2001-02.

In an intensification of this trend, during the first

nine months of the recently ended financial year 2003-04,

net inflows on account of invisibles stood at $18.22

billion, well above the $15 billion deficit on the

trade account.

Even while India's current account was relatively

healthy on account of the foreign exchange largesse

of Indian workers abroad, the country's liberalised

capital markets have attracted large inflows of capital

amounting to a net sum of $10.57 billion in 2001-02,

$12.11 billion in 2002-03 and a massive $17.31 billion

during the first nine months of 2003-04. Expectations

are that, because of the huge portfolio capital inflows

during the last three months of 2003-04 encouraged

by the government's privatisation drive, net capital

account inflows during 2003-04 will be in excess of

$20 billion.

There are two issues that arise in this context. The

first relates to the nature of the capital inflows

during these years. The second to the implications

of these inflows for the value of the rupee under

India's liberalised exchange rate management system.

Three kinds of inflows have dominated the capital

account. An early and important source of inflow during

the years of financial liberalisation has been in

the form of NRI deposits in lucrative, repatriable

foreign currency accounts. On a net basis, such inflows

accounted for $2.32 billion, $2.75 billion, $2.98

billion and $3.5 billion respectively in 2000-01,

2000-02, 2002-03 and April-December 2003 respectively.

They reflect the attempt by richer non-residents to

exploit arbitrage opportunities offered by the higher

(relative to international rates) interest rates on

repatriable, non-resident, foreign exchange accounts,

to earn relatively easy surpluses.

A second important source of capital inflows has been

portfolio capital flows, reflecting investments by

foreign bodies, especially foreign institutional investors,

in India's stock and debt markets, encouraged more

recently by the disinvestment of shares in profitable

public sector undertakings. On a net basis, such inflows

had fallen from $2.59 billion in 2000-01 to $1.95

billion in 2001-02 and just $944 million in 2002-03,

but rose sharply to $7.62 billion in the first nine

months of 2003-04. As compared with this, net foreign

direct investment has been relatively stable, at $3.27

billion in 2000-01, $4.74 billion in 2001-02, $3.61

billion in 2002-03 and $2.51 billion during April-December

2003.

The third important source of capital inflows was

a financial liberalisation-induced increase in the

net liabilities of commercial banks (other than in

the form of NRI deposits), which rose from a negative

$1.43 billion in 2000-01 to $2.63 billion in 2001-02,

$5.15 billion in 2002-03 and $2.56 billion during

April-December 2003. This is possibly explained by

the expansion of the operations of international banks

in the country.

In sum, capital inflows that create new capacities

either in manufacturing or in the infrastructural

sectors have been limited. Much of the capital inflow

has consisted of financial investments that expect

to earn higher annual returns than available in international

markets or obtain windfall gains from the appreciation

of the value of such investments, as has recently

been witnessed in India's stock markets.

Given the determination of the exchange rate of the

rupee by supply and demand conditions in the market,

this large inflow of foreign capital in the context

of a current account surplus was bound to exert an

upward pressure on the rupee. When inflows contribute

to an appreciation of the rupee, foreign investors

also gain from the larger pay off in foreign currency

that any given return in rupees involves. This tends

to increase the volume of inflows. The real losers

are exporters, on the one hand, who find that the

foreign exchange prices of their products are rising,

eroding their competitiveness, and domestic producers,

on the other, who find that the prices of competing

imports are falling or rising less that their own

costs of production.

However, this potential loss of competitiveness on

account of surging capital inflows was stalled for

long by the intervention of the central bank. By purchasing

foreign currency from the domestic market and adding

it to its reserves, the Reserve Bank of India increased

the demand for foreign currency and dampened the rise

of the rupee. The foreign exchange assets of the central

bank rose sharply, from $42.3 billion at the end of

March 2001 to 54.1 billion at the end of March 2002,

$75.4 billion at the end of March 2003 and $113 billion

at the end of March 2004. This implies that even after

discounting for the increase in reserves resulting

from the appreciation of the dollar value of the RBI's

Sterling, Yen and Euro reserves, the foreign exchange

assets of the central bank were rising by around $980

million a month in 2001-02, $1.4 billion a month in

2002-03 and $2.5 billion a month during 2003-04. Further,

because of inflows on account of the sale of equity

in companies such as ONGC and ICICI bank, foreign

exchange assets rose to $116.1 billion during the

first nine days of 2004, or by a whopping $3.1 billion.

These magnitudes have two implications. First, they

suggest that the RBI has had to sustain a rapidly

rising rate of acquisition of foreign currency in

order to dampen the rise of the rupee and preserve

export competitiveness. Second, that despite this

sharp rise in the foreign exchange assets of the central

bank the task of managing the rupee's exchange rate

is proving increasingly difficult leading to a rise

in its value.

The task of managing the rupee is daunting because,

when the central bank increases its foreign currency

assets to hold down the value of the local currency,

there would be a corresponding matching increase in

the liabilities of the central bank, amounting to

the rupee resources it releases within the domestic

economy to acquire the foreign exchange assets. If

forced to continuously acquire such assets, the resulting

release of rupee resources would lead to a sharp increase

in money supply, undermining the monetary policy objectives

of the central bank. Since financial liberalisation

implies abjuring direct measures of intervention to

curb credit and money supply increases, the central

bank has sought to neutralise the effects of reserve

accumulation on its asset position, by divesting itself

of domestic securities through sale of government

securities it holds.

This process of ''sterilising'' the effects of foreign

capital inflows through sale of government securities

has, however, proceeded too far. The volume of rupee

securities (including treasury bills) held by the

RBI has fallen from Rs. 150,000 crore at the end of

March 2001 to Rs.140,000 crore at the end of March

2002 and Rs. 115,000 crore at the end of March 2003,

before collapsing to less than Rs.30,000 crore by

the end of March 2004. The possibility of using its

stock of government securities to sterilise the effects

of capital flows on money supply has almost been exhausted.

Foreign investors have made a complete mockery of

the much-trumpeted ''autonomy'' of the central bank

won by curbing the government's borrowing from the

RBI.

In the current context, there are only two options

available with the government for preventing a capital

flow-induced appreciation of the rupee that could

not just reduce India's exports but also deindustrialise

the economy and devastate agriculture by cheapening

imports that are now free. The first is to resort

to measures that could reduce the volume of inflows.

A feeble effort in that direction has been the gradual

reduction in the differential between interest rates

paid on non-resident foreign exchange deposits and

those prevailing in the international market, as reflected

by the LIBOR. The ceiling on interest on non-resident

external deposits had earlier been linked to the LIBOR

and set at 0.25 per cent above it. Now the ceiling

has been set at the LIBOR itself.

But NRI inflows during April-December 2003-04 only

accounted for around a fifth of net capital inflows

into the country, and that ratio is likely to be much

smaller in the subsequent months. Managing the rupee

by controlling capital inflows requires targeting

portfolio flows. That is the signal that the rising

rupee sends out. Unwilling to heed that signal, the

government has decided to encourage outflows on the

current and capital account by removing the few import

controls that remain, reducing duties, easing access

to foreign exchange for current account transactions

like travel, education and health and, most important,

relaxing outflows on the capital account by permitting

firms and individuals to transfer money abroad for

investment purposes.

The dangers of blowing up in this manner the foreign

exchange obtained in the form of volatile capital

flows should be obvious. What is more, it is unclear

whether this would resolve the problem. The process

of liberalisation may, in the short run, make India

an even more favoured destination for foreign investors.

The rupee could appreciate further. Exports could

shrink. Further liberalisation aimed at increasing

foreign exchange outflows could damage the domestic

production system. All of which could finally encourage

investors to walk out on India, in the perennial search

of markets that have not yet been destabilised. That

would deliver an economic scenario that no one would

want to conjure for this country.

Chart

>> Click

to Enlarge